An Amazon Analysis

Inside Bezos’ Death Star

AMZN 0.00%↑ stats

Market Cap = $1.62T

EV = $1.63T

FCF = -$14.72B

FCF Yield = N/A

EBIT = $24.94B

EV/EBIT = 65.4

ROIC = 12.6%

Amazon needs no introduction. It’s the global behemoth you and I use daily. Each second, Amazon generates $4,722 of revenue, that’s $283,000 per minute or $17 million an hour.

There is a popular investing anecdote that goes ‘if you bought Amazon in 199X it would now be worth Y.’ It’s easy to forget that there have been several drawdowns, including a 90% drop between 1999 and 2001. Let’s be honest, unless you were Bill Miller, you were selling.

The share price has been relatively flat for the past 21 months, despite earnings trebling over the past 3 years. The announcement of a 20-1 stock split and $10 billion buyback in March saw shares jump 10%.

The introduction of Amazon Web Services (AWS) in 2006 has grown revenue and helped fund re-investment in moonshots. Amazon is relentlessly focused on long-term growth, rather than short-term profits. They only reached profitability in 2013, despite continuous revenue growth since 1996.

Amazon is a monster, it’s bigger than the next 14 US retailers combined. Online Stores remain the largest source of revenue, but several other business segments combine to drive their flywheel. Matthew Ball describes it as “a series of interconnected elements that are internally reinforcing and competitively exclusionary,”

Amazon’s diversified segments have been the key to their 28% CAGR of revenue over the past two decades. The segments are spread across online retail, cloud, advertising, digital payments, physical retail, streaming, hardware….the list goes on.

With a 15% drawdown from ATHs and Bezos flying off (literally) into the sunset, will 2022 be one of those years that’s remembered as ‘if you bought Amazon at $3100, your returns would be’ or is their monumental track record about to stall?

The Business

Founded by Jeff Bezos in 1994 as an online book store, the story goes that he wrote the business plan whilst driving cross country from New York to Seattle.

Amazon is a business everyone is familiar with. It’s estimated that 44% of customers start their shopping search on website. This cuts out third parties such as Google, Facebook and Apple.

Amazon is an entity that is driven by four key principles:

Customer obsession rather than competitor focus.

Passion for invention,

Commitment to operational excellence

Long-term thinking.

Revenue is generated through six main streams:

Online retail - 48%

Third party sellers - 22%

Amazon Web Services - 13%

Advertising Revenue - 7%

Prime & Subscriptions (including Audible & Kindle Books) - 6%

Physical retail (Including Whole Foods) - 4%

Retail Business

The segment of the business that makes everything tick. Amazon holds an inventory of around 12 million items (add in third party sellers this number increases to 350 million).

Amazon purchases directly from the manufacturers and producers. Purchasing on a global scale means that they can aggressively negotiate. The obsessive focus on low prices with fast and free delivery is the reason they are a $1.6 trillion company, 45 times larger than the likes of eBay.

Amazon has 185 fulfilment centres globally, which occupy nearly 160 million square feet. Artificial intelligence is the secret sauce. It powers the recommendation algorithm, whilst helping logistics monitor the efficiency of its workers and fulfilment.

The infrastructure means they have built a near insurmountable advantage, making them almost impossible to catch. Shopify often claims to ‘arming the rebels’ against Bezos’ Empire, but with only 1% of the revenue, they are going to need a lot more ammunition. Amazon benefits from a network effect and scale advantage. Their enormous scale ensures they secure the best pricing on the market and make more deliveries to increase the efficiency of their fulfilment network.

Third Party Sellers & Advertising

Amazon is the most successful retailer in history. They host over nine million third party sellers, which generated $80 billion of fees in 2021.

The platform allows sellers to list products and reach customers. Sellers can fulfil the products or take advantage of the Fulfilled by Amazon (FBA) programme that utilises the Amazon shipping and fulfilment network. Amazon earns a fixed fee as a percentage of the sale. The next time you purchase a product, keep an eye on the ‘Sold by’ title, just below the ‘Buy’ button.

Amazon’s advertising tool allows sellers to purchase sponsored, display, and video advertising. The 2021 annual report revealed and enormous $31.2 billion was generated through advertising revenue.

Advertising creates a huge positive feedback loop in a closed ecosystem. A Seller spends on Amazon > they sell more products > they advertise further.

Amazon takes a fee in each segment of the advertising flywheel. With little fixed costs, advertising growth creates exponential profit opportunity and cuts out third party advertisers, such as Google & Facebook.

AWS - Amazon Web Services

AWS - Amazon Web Services - provides on demand cloud computing storage. It allows companies and organisations to store digital data on a pay as you go server.

Prior to AWS, companies hosted data on their own or rented server. This process was expensive, time consuming and left individual servers vulnerable. The introduction of AWS ensured it was much easier for companies, organisations and individuals to build online.

AWS origins date back to 2000, when Amazon wanted to launch an ecommerce service for third party retailers. AWS launched in 2006 with the mission of allowing any organisation, company or developer to run their technology applications on top of Amazon’s infrastructure. The foundational services offered by AWS include compute, storage, networking, database, identity & access management. In the final quarter of 2021, AWS added more revenue year-over-year than in any quarter in its history.

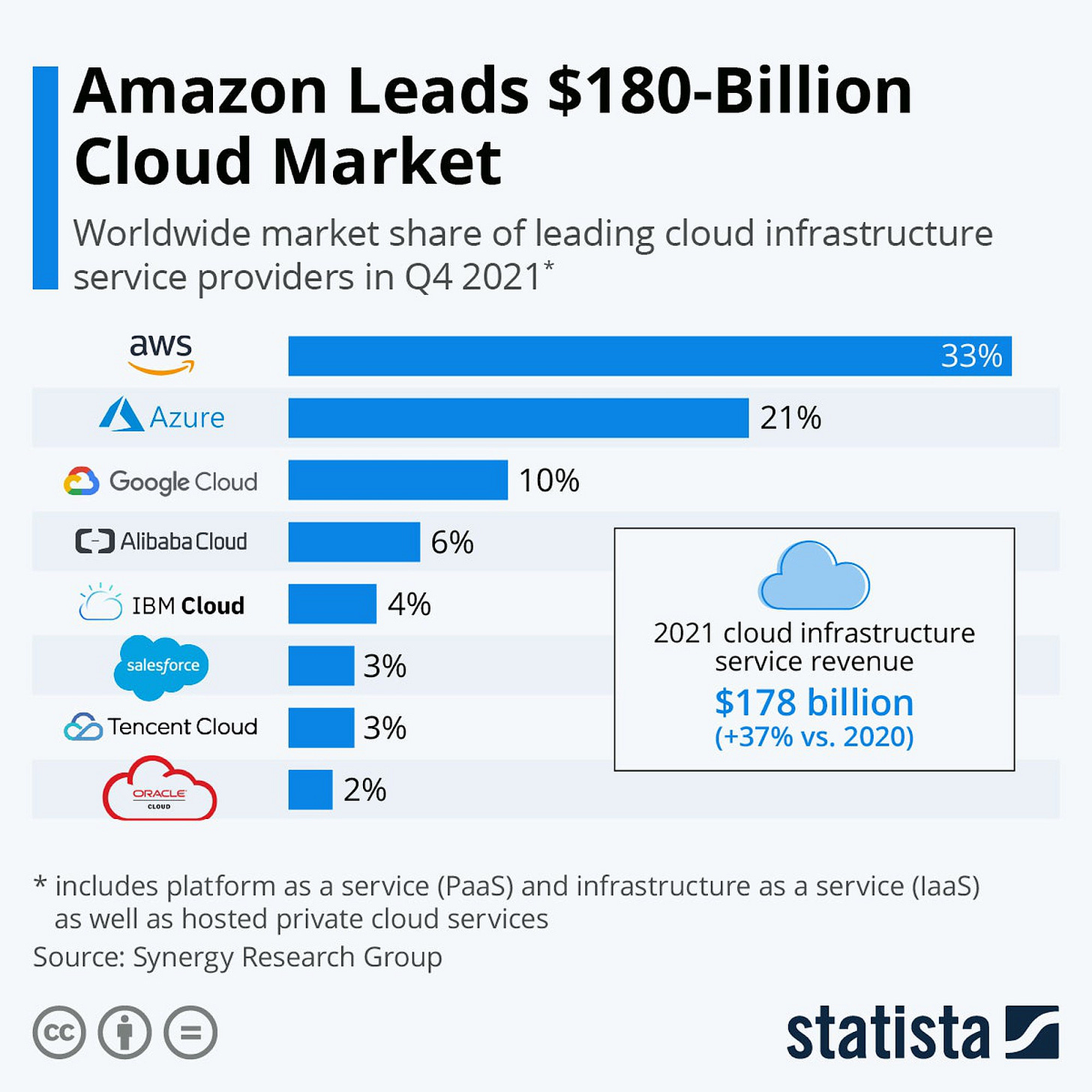

In 2021, the cloud infrastructure market grew by 37% to £131 billion, according to Synergy Research data. Although AWS maintains its market dominance of 33%, Microsoft Azure is gaining quickly.

AWS has 200 data centres globally and epitomises a first-mover advantage. In 2021, AWS sales accelerated, reversing a previous slow down.

AWS is growing faster than the market average, with a 39% growth rate in Q4 2021. However, their market share has remained fixed at 33% for several years, with Microsoft Azure and Google Cloud demonstrating noticeable higher growth rates of 45%.

Data Gravity, a term coined by Dave McCrory in a 2010 blog post, describes the effort of moving larger volumes of data becoming incrementally more challenging and expensive. For this reason, the more a customer stores with a cloud provider, the more difficult it is for them to leave. AWS, Azure and Google Cloud can raise prices and keep customers locked in.

The $71 billion dollars generated by AWS makes up 13% of total revenue and essentially acts as a charge on the internet. Major AWS customers include Facebook, Netflix and Nasdaq. The fact that Nasdaq are planning to migrate US market data to AWS, whilst Facebook trusts them with data from their family of apps, demonstrates how truly reliant western tech is on AWS.

Despite AWS’s market dominance, it means that commerce competitors, such as Walmart, opt for cloud competitors which hinders growth. There’s an argument that AWS should be spun out to avoid future conflicts of interest.

Prime

Prime is Amazon’s subscription service that provides users with free delivery plus access to Video, Gaming, Reading and more. The service is reported to have 200 million members globally.

Prime helps to attract and retain customers who spend more with Amazon, generating recurring and higher margin revenue. Prime’s same day / next day service is the key differentiator from competition and is only possible due to Amazon’s decades of infrastructure investment.

Prime membership ensures customers are exceptionally sticky. Members are reported to spend over $1,500 annually, roughly four times more than non-Prime shoppers. As a Prime subscriber I placed a total of 52 orders in 2021 (a fact I was not aware of until I researched it)!

Prime’s churn rate is reported to be around 4%, the second best in the SVOD industry, behind Netflix’s 2.5%. 70% of Prime members are reported to be under the age of 50, ensuring Amazon has a shopping audience locked-in for decades to come.

Prime’s low churn rate ensures the service carries pricing power which allows Amazon to raise prices without fear of losing subscribers. Prime’s previous fee rise was in 2014 and 2018 in the UK and US respectively. The company announced in February that the monthly membership fee in the US will increase by 17%, from $12.99 to $14.99 monthly and $119 to $139 annually.

Outside of Video, Prime offers several additional subscriptions including;

Kindle Unlimited - $9.99 / per month - reported 3-5 million members

Audible - $14.95 / per month

Amazon Music - up to $9.99/ per month - reported 55 million subscribers in 2020

Amazon does not release individual subscription numbers, however their 2021 revenue for their combined subscriptions, including Prime membership, audiobook, e-book, digital video, digital music, and other subscription services totalled $31.77 billion.

Amazon’s digital subscription services have high gross margins and network effects, for every new subscriber the revenue goes directly to the bottom line.

Prime Video

Since 2018, Prime Video has tripled the number of Amazon Originals. Amazon is targeting Disney+ and Netflix. In March, Amazon acquired MGM studios for $8.45 billion. This September the Lord of the Rings - The Rings of Power will be released, with a reported cost of $1 billion.

With an almost unlimited budget, competitors should be wary. Prime has exclusive sporting tie-ins, having agreed to pay around $1 billion a year to air NFL Thursday Night. In 2021, Prime renewed their £90m deal with the English Premier League to show 20 games per season until 2025.

When it comes to content and live sports, Amazon is not afraid to spend. The investment in the Lord of the Rings series makes up 6% of Netflix’s total 2021 budget.

Hardware

Amazon’s main hardware range consist of Alexa, Kindle, Fire Tablet, Fire TV, Echo and Ring.

At their 2021 Hardware event they introduced 10 new products. These included a Ring Drone, Astro (the at home robot), upgraded Halo wearables and a smart thermostat, among other devices.

Amazon is building tomorrow's hardware infrastructure. Not every new piece of hardware will stick; however, their constant innovation does deliver some winners.

Amazon investors are largely in the dark about the investment and returns on hardware as numbers have never been made public. The Wall Street Journal called their Hardware the ‘ultimate black box’.

The company’s Echo range sells more than 35 million devices annually and has a 30% share of the smart speaker category, according to Canalys.

Amazon’s long term ambition does not appear to be a hardware player, but to break-even on technology and integrate their subscription services across the devices. Kindle was the foundation of the e-book market and is reported to generate more than $1 billion in annual revenue in the US alone. Echo speakers have propelled Amazon Music to over 680 million subscribers, generating approximately $5.4 billion in annual revenue.

Bear Case

Stagnation in Online Sales

Q4 2021 results were largely propped up by AWS, Advertising and other growth. Online sales were flat on the previous year. The company experienced a massive tailwind due to the covid pandemic and it’s yet to be seen how the world reopening will affect online revenue growth.

Operationally Leveraged with Fixed Assets

Unlike other FAANGs, Amazon has higher fixed costs. 30% of capex, around $18 billion, was spent on the fulfilment centres in 2021; whilst a further $15 billion was invested in transportation.

The comb heavily investing in fixed assets. With inflation reported to be anywhere between 7-14%, CFO, Brian Olsavsky, reported that ‘Amazon saw more than $4 billion in costs from “inflationary pressures” and lost productivity in operations’ than the previous quarter.

In an environment with rising costs and disrupted supply lines, this could be the precursor to more serious increases.

Employees Unionising

At the start of April, employees in the New York Amazon warehouse voted to unisonse. This is the first time in Amazon’s history it has been forced to recognise an employee union.

The company had previously resisted employee efforts to unionise. In an environment with rising labour costs, Amazons boasts 1.3 million employees, ten times more than Google, twenty times more than Facebook. This could be an area of worry for Amazon.

In the Bessemer, Alabama, fulfilment centre, labour groups are pushing a separate union drive. The successful New York effort, gives the Amazon Labour Union the right to negotiate contracts for the 8,000 workers at the Staten Island warehouse. Although a win for employees, this could lead to rising employment costs and be the first domino of many.

Global Exposure

The ongoing conflict in Ukraine has seen an exodus of western countries from Russia. Amazon does not operate dedicated fulfilment centres in Russia, but residents can buy products via Germany. AWS suspended all sales in Russia, with the company stating that ‘it has no data centres, infrastructure, or offices in Russia’ and reaffirming its long-standing policy of not doing business with the Russian government.

Despite this conflict largely acting as a warning shot, it demonstrates how a world that begins to de-globalize could have serious complications for Amazon’s long term strategy.

Moonshots Crashing

Amazon has been investing in moonshots and infrastructure for decades. This has famously allowed the company to reduce profitability for the sake of future gains. AWS has been widely successful, but what happens if AWS was a one-off?

Historically, companies have returned excess cash to shareholders in the form of buybacks or dividends. Amazon investors do not receive such luxuries. The management is investing for the future, with no guarantee the investments will pay off.

Writing Down Losses on Rivian

Amazon’s fourth quarter results were driven by an investment gain of $11.8 billion on Rivian Automotive stock.

Earnings were propped up by their 18% ownership. Since the release of the Q4 results, Rivian’s market cap has decreased by 40%. Accounting regulations could force Amazon to write-down as much as $10 billion.

Rivian looks set to suffer further as it struggles to acquire much needed microchips for production, resulting in lower vehicle production and revenue.

Government Regulation

The US government has been looking to crackdown on the power of incumbent tech companies for a number of years. In 2020 a report by the House of Representatives found Amazon abused its dominant market position to hurt its competitors, including third-party sellers.

Offences included taking data from its marketplace to locate top-selling items and creating its own competing products.

In recent years, Amazon has been investigated by several government bodies, including the Federal Trade Commission, attorney generals and the European Union.

It’s not clear what the outcome of these investigations will be, but findings could be damaging.

Bull Case

Diversity of Business Model

Unlike a their FAANG counterparts, Netflix and Facebook, who are heavily reliant on one source of revenue, Amazon has at least two significant moats and generates revenue from several sources. As management continues to invest in new areas of the business, new streams come online, whilst existing streams out-spend and out-compete the rest of the market.

Revenue growth of AWS and other parts of the business should support any slowdown in post-covid online retail sales.

Massive (growing) Infrastructure

Amazon is so far ahead of the competition that it is difficult to comprehend. They make up almost 50% of the online retail market. Their revenue is 100x larger than Shopify.

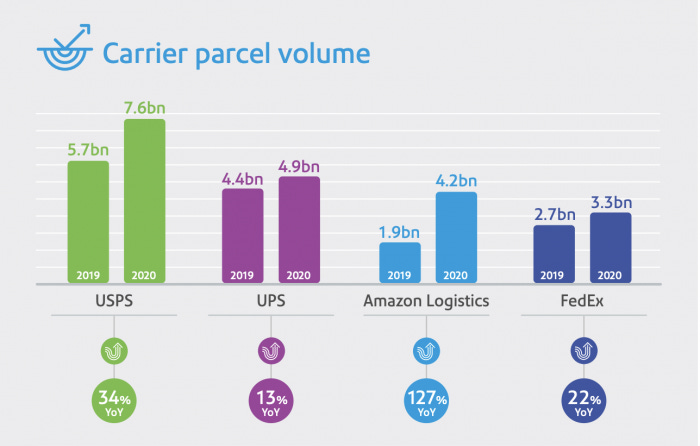

Amazon Logistics is a business within itself. It is no longer a marginal threat to the market leaders. It grew 21% in 2020, putting the parcel volume ahead of FedEx and just behind UPS.

The company continues to invest enormous sums to enhance and expand tomorrow’s infrastructure.

AWS

The first mover advantage of AWS gives it an almost unassailable lead. Data Gravity ensures the more data a customer has on AWS, the more difficult it will be to transition away. Grand View Research expects the cloud computing market to grow by 16% annually between 2022 and 2030. If Amazon can maintain its 33% share, it will generate an enormous $220 billion in cloud within 8 years.

Conclusion

Tobias Lütke is arming the rebels. Make no mistake, Amazon is the Empire, but their Death Star doesn’t have a thermal exhaust port.

It’s difficult to see a scenario in which Amazon is not the market leader a decade from now. As a retailer they are utterly dominant. Their 185 fulfilment centres, logistics network and software would take hundreds billions of dollars and decades to get close to.

On a fundamental basis, Amazon is not cheap. Management is heavily investing in the future and have done so successfully for the past two decades.

In the developing world, Alibaba and JD are the obvious competition, there’s always a risk of stagnation from online sales or Azure catching AWS. In the short term, the company may suffer from inflationary pressures or a Rivian write-off, but it’s very difficult to see a scenario in which Amazon does not conquer the galaxy.