$CUERVO Metrics (at time of writing)

Market Cap = $6.72B

EV = $7.75B

FCF = -$451M

FCF Yield = N/A

ROIC = 7.46%

EBIT = $466M

EV/EBIT =16.63

5 Year Revenue CAGR = 11.75%

Introduction

Tequila was once the shot of choice for college and university students. It was a cheap and cheerful spirt. In recent decades, the growth has been explosive and led to mass market premiumisation.

The proliferation in the sector has led to a mass of new brands, with celebrities including George Clooney, Dwayne Johnson and Kendall Jenner launching products.

The market leader is Jose Cuervo, whose parent company, Becle, is the world’s largest tequila producer. Based in Mexico, the company trades on the Mexican stock exchange under the ticker $CUERVO.

Becle is a family owned business in the 11th generation of Cuervo family. The business produces, markets and distributes over 30 spirits, ready-to-drink cocktails and non-alcoholic brands in over 85 countries. Almost two thirds of sales are generated by tequila.

The company is facing the headwinds of inflation and the challenges of increased competition. The share price was down more that 18% after October’s poorly received results, the largest single day decline since it began trading six years ago.

History

The company was founded over 250 years ago by Don José María Guadalupe de Cuervo y Montaño’s. Becle has remained in the family for over 11 generations and the La Rojeña distillery is the world’s oldest tequila distillery.

The Beckmann’s are one of Mexico's wealthiest families who trace their lineage back to the original founder. Juan Domingo Beckmann Legorreta & family are direct descendants of Jose Cuervo and own around 87% of the company. Only 13% of shares are available to the public. The current CEO is Juan Domingo Beckmann Legorreta.

Most Recent Quarter

With over 75% of sales generated outside of Mexico, the stronger Peso negatively impacted earnings. The company’s foreign income, in particular US dollars, was devalued by gains in the Peso, which strengthened 14% against the dollar over the year ending 30th Sep.

When removing the effects of foreign exchange, the company anticipated annual sales should still grow by a high-single digit percentage. However, slowing sales and higher costs are clearly impacting the business.

Third quarter 2023 highlights -

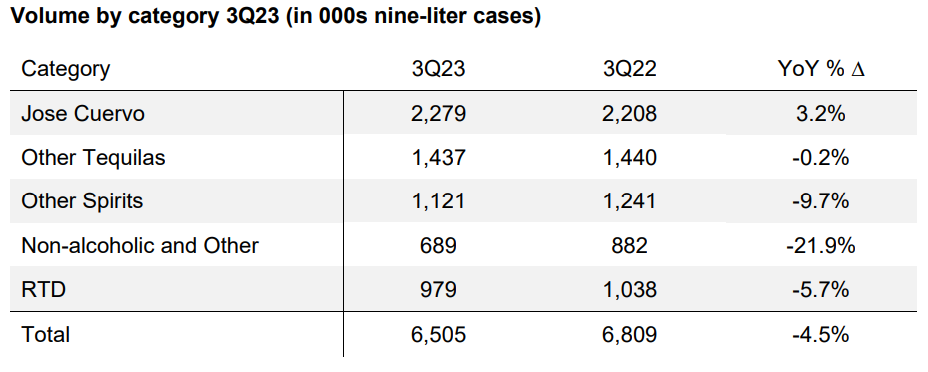

Volume decreased 4.5% to 6.5 million nine-litre cases.

Net sales increased 4.3% in constant currency on a like-for-like basis (-8.5% reported).

Gross profit decreased 18.7% to P$5,068 million pesos.

Gross margin was 48.1%, a decrease of 6.0 percentage points YoY.

EBITDA decreased 58.8% to P$1,159 million pesos.

EBITDA margin was 11.0%, a decrease of 13.4 percentage points YoY.

Consolidated net income decreased 88% to P$207 million pesos.

Net margin was 2.0%, a decrease of 12.9 percentage point YoY.

Earnings per share were P$0.06 pesos.

The Business

Tequila

Becle has successfully navigated the wave of tequila growth. The market has grown by almost 350% in the past two decades. Becle owns two of the top 5 largest selling tequila brands with Jose Cuervo and 1800.

Jose Cuervo is the brand that has allowed the company to thrive. Launched in 1785, the distillery is the oldest in the world. In 2022, Jose Cuervo was the world’s top selling brand, with over 9.2m 9L case sales. Jose Cuervo generates over third of company revenue. The brand is three times larger than nearest competitor, Bacardi owned Patron. With such market dominance, it’s unlikely that competitors can offer a real challenge in the near future.

The majority of Jose Cuervo sales are driven by the Gold and Especial editions. Newer, higher-end expressions include Reserva de la Familia and Tradicional.

The 1800 brand was the first premium sipping tequila when launched in 1975. 1800 Tequila takes its name from the first year that Tequila was aged in oak casks. The brand is now the world’s fifth best selling, with sales increasing 22.5% between 2021 and 2022 to 2.5m case sales.

Beyond these two prominent brands, the company also produces several other tequila and mezcal brands including Jaja, Gran Coramino and Creyente.

Other Spirits

‘Other Spirits’ brands represented 17.2% of total volume in the period and experienced a 9.7% decrease in volume compared to the third quarter of 2022.

Becle has strategically diversified into Irish Whiskey, Rum, Vodka and Gin. In 2014 it was announced that Diageo had traded the Bushmills brand in exchange for the 50% of the Don Julio owned by Becle, plus $408 million in cash. Bushmills Whiskey was founded in 1784 and has been continuously produced since 1885.

Whiskey

The Bushmills brand broke the one million nine litre case sales mark in 2022, up 9.7% from the prior year. This made it the world’s third best selling Irish Whiskey, behind Jameson and Tullamore Dew. Bushmills sales were 4.33% of company revenue in 2022.

In April 2023, Becle unveiled a new £37 million Causeway Distillery, part of a £60 million investment in the Irish brand.

In 2018, Becle completed the acquisition of premium Canadian whisky Pendleton. Becle purchased the brand for $212.8 million million. Pendleton Whisky was launched in 2003 and had achieved annual sales of more than 250,000 nine litre cases at the time of acquisition. With Pendleton cases likely retailing around $100-120, puts the cost of acquisition between 8-10x sales. The 2022 annual report reports Pendleton sales at 447,253 cases, almost double since the acquisition.

Launched in 2018, Proper No. Twelve is a blended Irish whiskey created by former UFC champion, Conor McGregor. Proper No. Twelve is reportedly the worlds fourth best selling Irish whisky brand. Having previously invested, Becle purchased the remainder of Proper No. Twelve for a reported $150 million, in a deal that valued the brand at up to $600 million. Since its launch, Proper No. Twelve had reportedly achieved ‘record-breaking growth’, shipping more than 500,000 nine-litre cases. This puts the cost of acquisition at between 10-15x sales.

Rum and Other Spirits

Kraken Rum is a Caribbean dark spiced rum that launched in 2010. The bottle is recognisable, with its distinct hooked flagon style. Kraken sales were 4.09% of company revenue for 2022.

Becle reported that Kraken had achieved sales of 1,075,310 9L cases, up 13% on 2021. This puts Kraken close to the top 10 best selling rums but means it is still only a small fraction of the likes of Tanduay, Bacardi and Captain Morgan.

Ready-to-drink products were 8.01% of company sales in 2022. Within the ready-to-drink category, products include canned cocktails; Jose Cuervo Authentic Margarita, Jose Cuervo Especial Paloma, Kraken Cola, and Jose Cuervo Golden Margaritas. The segment was down 5.35% on a volume basis and 12.3% on a value basis between 2021 and 2022.

Non-Alcoholic Beverages

Becle produces a range of non-alcoholic products that contributed 2.68% of total revenue. The non-alcoholic segment includes brands such as b:oost, Jose Cuervo Margarita Mix, and Sangrita Viuda de Sánchez.

Between 2021 and 2022, the non-alcoholic segment faced a decline. The volume of non-alcoholic product sales decreased by 7.7% and 11.4% by value, highlighting the obvious challenges in this sector.

Operations

Becle operates two tequila distilleries, Los Camichines and La Rojeña. La Rojeña is the oldest distillery in Mexico and exclusively focuses on crafting 100% agave tequila. It has an annual production capacity of 17.6 million litres. Los Camichines is the largest distillery in Mexico and boasts an impressive annual production capacity of 47 million litres. The company is in the process of building a third tequila distillery, the 1800 Distillery, to support demand.

In the US, Becle operates three whiskey distilleries (one in Colorado and two in New York) plus two bottling facilities in Colorado and Indiana. The company also secured the Northern Irish based Bushmills distillery and bottling facility.

Tequila Production

Agave is the pineapple-like plant used to produce tequila through the distillation of agave juice. As the largest tequila producer in the world Becle possess the scale to secure competitive prices for raw materials.

The company’s 2022 annual report states that they “believe that we currently have the largest Agave Azul plantation in Mexico within the “tequila” Appellation of Origin region.” As demand for tequila has soared, the price of agave has followed. Having ownership of the estate ensures product quality and consistency as well as control of supply. Becle owns a reported 38,500 hectares of agave fields with over 15 million agave plants.

The cost of agave was about 5-7 Mexican pesos ($0.27-$0.37) per kilo for most of the past two decades but has been edging up in recent years and hit 31 pesos ($1.72) at the end of 2022.

As a plantation owner, Becle is likely insulated, but not immune from rising prices. It has been reported that Becle’s plantations can support 60 million litres per year. In 2022 they sold approximately 95 million litres. The company maintains relationships with independent agave producers to source additional required materials.

Distribution - Proximo Spirits

Proximo Spirits was formed in by the Beckmann family in response to Diageo withdrawing from distributing Jose Cuervo. In 2011, Diageo, was in talks to acquire Jose Cuervo from the Beckmann family for in excess of $3 billion. Following Diageo's failed attempt to buy the brand the Beckmann family took over distribution of Jose Cuervo in 2013. Proximo is now responsible for the distribution of all Becle brands globally.

Proximo Spirits has offices in the U.S, Canada, Ireland, the United Kingdom and Australia and sells products to wholesalers across the globe.

Although originally separate, in 2016, the company's shareholders approved the merger between Becle and Sunrise Holdings (of which Proximo is a subsidiary).

Proximo is the tenth largest distributor of spirits per retail volume in the United States according to IWSR. In the USA and Canada, Proximo exclusively distributes Becle products through subsidiaries.

Bear Case🐻

Foreign Exchange Backlash

Part of the reason for the recent share price decline was due to foreign exchange headwinds. Almost two thirds (57.3%) of Becle’s sales come from the US.

Most of the cash flow of the Company is generated in foreign currency. In the scenario that the Peso strengthens further against the Dollar, the company will suffer addition adverse results.

Changes in Consumer Habits

Younger consumers are changing their drinking habits. Gen Z drink 20 percent less per capita than Millennials. Millennials are drinking less than both Gen X and Baby Boomers.

Tequila has been partially insulated from this fallout, considered as a healthier alternative to dark spirits. The spirit has gained a reputation as a low calorie, clean spirit with health conscious customers. However, with younger consumers going completely teetotal, this trend could cause future challenges.

Reliance on Tequila

Becle is a Tequila company. Despite efforts to diversify, the spirit makes up 57% of sales. Tequila has experienced a huge resurgence over the past two decades, but is that growth beginning to slow?

Like Diageo, the company is pursuing the premium sector, enabling Becle to outperform the overall sector. Tequila has likely protected the company from the worst of the downturn in other spirits.

With such strong links to a single spirit, risk factors include wipe out of Agave through disease or natural disaster, changes around the geographic protections of tequila or changing consumer preferences.

Family Ownership - (Bull & Bear)

The Beckmann family owns 87% of the company and has the power to appoint the majority of the the board of directors. Karen Virginia Beckmann Legorreta owns 35.61% whilst JDBL y Compañía, S.A. de C.V. owns 51.6%. Mr. Juan Domingo Beckmann, is the current CEO and is the majority shareholder of JDBL y Compañía, S.A. de C.V.

With such dominance the interests of the family may differ from public shareholders. Any spats or fallouts could result in family conflicts that lead to damage or a breakup of the company.

However, it should not be overlooked that the Beckmann family and their ancestors have shepherded the company for 11 generations. The public float allows shareholders to invest alongside a family who have significant incentives to scale their resilient business.

The stewardship has been evident in how management has expanded the company in recent decades, making considered acquisitions or capturing direct distribution by launching Proximo Spirits.

The company’s heritage and experience gives it an automatic edge over new entrants. Becel has been able to build a moat over two and a half centuries.

In many scenarios management have little share in the company. In this case the family has the majority of their wealth in equity, ensuring a significant alignment with the shareholders.

Bull Case 🐂

Brand Power

Becle has 250 years of expertise of distilling, production and brand building. Jose Cuervo and 1800 are two worldwide leaders in the tequila market, with Bushmills third in Irish whiskey sector. Centuries of heritage has resulted in globally recognised brands (margaritas were invented using Jose Cuervo tequila).

Jose Cuervo and the other globally distributed brands are instantly recognisable worldwide. A consumer can purchase a Becel branded product anywhere in the world with guaranteed quality.

Distribution & Scale

Becle owns the oldest and largest tequila distilleries in Mexico. Tequila produced by the company accounted for 28.5% and 20.4% of the global tequila volumes and retail sales, respectively, in 2021.

The company is a full stack producer, from growing agave through to product distribution - even Diageo cannot make this claim (as they purchase the malt for their whisky distilleries).

Proximo is in charge of distributing products across the United States, Canada, Australia, the United Kingdom and the Republic of Ireland. This ensures the company is not reliant on secondary distributors and can gain direct feedback from customers.

Geographic Protections

The term Tequila has been protected in Mexico since 1974. The Appellation of Origin of Tequila is protected in 55 countries.

The territory of the Appellation of Origin includes the entire state of Jalisco and some border municipalities of the neighbouring states of Guanajuato, Nayarit and Michoacán as well as some municipalities in the state of Tamaulipas. The Appellation of Origin imposes strict standards for the cultivation of Agave Azul within its regions and the production of Tequila.

Spirit titled ‘100% tequila' must be bottled within the Appellation of Origin. This provides Becle with a unique advantage through the production chain.

The fact that the regulation forbids tequila production outside the territory, plus Becle’s ownership of agave plantations, provides the company with competitive advantages over new entrants.

Conclusion

In the most recent earnings Becle experienced a “perfect storm" of currency, volumes and cost challenges. This resulted in the one of the lowest quarterly net income since the IPO.

Tequila is - and likely will always be - the driving force behind this business. The spirit remains a growth segment and Jose Cuervo is dominant in the marketplace.

The Beckmann family have stewarded the business for 250 years. The current leadership have made proactive acquisitions and diversified the company to compete in a growing markets. The introduction of Proximo Spirits removed any reliance on Diageo and created self-sufficient distribution.

There are questions whether the acquisitions have been effective use of capital. Pendleton Whisky was acquired for 10-times sales and Proper No.12 for even more. However, compare this to Diageo, who paid 20x sales for Casamigos.

As tequila has grown in popularity, this has driven competition. Casamigos has grown to become the fourth largest selling brand in the world, after being founded in only 2013. The Diageo subsidiary grew by a massive 42.5% between 2021 and 2022. Mr Cuervo should be looking over his shoulder.

The influx of celebrities clamouring to create their own tequila brands shows no signs of slowing. Brands backed by influencers with strong social media followings will only dilute the market further. However, a rising tide floats all boats. These celebrity endorsements will increase public awareness and engagement with the spirit. As the market leader, Jose Cuervo stands to benefit.

With a heritage of 250 years and an almost untouchable production chain, from agave cultivation through to bottling, Jose Cuervo is the dominant player in a growing market. Whether acquisitions add value or detract from the business focus is yet to been seen. The one certainty is that as long as there is demand for tequila around the world, customers will drink Jose Cuervo.

Sources and further reading

https://www.ircuervo.com/documents/informes-anuales/2022/Becles%202022%20Annual%20Report%20(English).pdf

https://www.cuervo.com.mx/documents/informes-anuales/2022/Becles%202022%20Integrated%20Annual%20Report.pdf

https://cuervo.com.mx/documents/ratings/2022/Fitch%20Ratings%20on%20Becle%202022.pdf

https://www.ircuervo.com/documents/informes-anuales/2021/Annual%20Report%20Becle%202021.pdf

https://www.thespiritsbusiness.com/2023/06/top-10-biggest-selling-tequila-brands/

https://www.libertyliquors.com.au/blog/agave-shortage-increasing-price-of-tequila/

https://thelistwire.usatoday.com/lists/top-5-irish-whiskey-jameson-tullamore-dew/

https://artsandculture.google.com/story/CAXheiIrH7UB8g?hl=en

https://inpractise.com/articles/becle-de-sab-agave-price-trends-crt-inventory-and-possible-remedies

https://www.businesswire.com/news/home/20171213006257/en/Becle-S.A.B.-de-C.V.-to-Acquire-Pendleton-Whisky-Brands