Author’s Note - Please excuse the delayed post, I have recently returned from my Honeymoon. Shout-out to for bringing GOOS 0.00%↑ to my attention and for his own excellent write up (linked at the bottom of this post).

GOOS 0.00%↑ Metrics (at time of publication)

Market Cap - $1.22B

EV = $1.65B

FCF = $17.5M

EBIT =$159.3M

Summary Ratios -

P/S = 1.37

EV/EBIT = 10.36

FCF Yield = 1.4%

Debt/Equity = 104%

Return on Equity = 9.01%

5 Year CAGR = 7.94%

Intro

Canada Goose (GOOS) is a company that has a lot going for it; a luxury brand, celebrity endorsements, healthy gross margins, owner operated and 33% revenue CAGR over 22 years. With so many positive traits you would be expect GOOS to be a market darling.

In reality the stock is down 75% in 5 years and 31% since the IPO in 2017! Revenue growth has slowed over the past 12 months and the share price has suffered. Canada Goose is listed on the Toronto Stock Exchange and a quarter of the shares are short.

History

GOOS is a company with a 67-year history. Initially launched in 1957 under the name Metro Sportswear, this evolved into Snow Goose before finally adopting the name Canada Goose in the late 90s.

The origins Canada Goose trace back to the current CEO’s maternal grandfather, Sam Tick, a Holocaust survivor who immigrated after World War II and found work cutting fabric in a Toronto factory.

By 1957, Tick established his own business, crafting wool vests, raincoats, and snowsuits. In the mid-1980s, Tick sold the business to his son-in-law David Reiss, who transformed production by automating the labour-intensive task of filling jackets with down feathers.

In 2001, after four years with the company, Dani Reiss assumed the CEO role at the age of 27, succeeding his father. Under Reiss’s leadership, the company has experience considerable growth, expanding revenues from a $2M to $1.269B.

The brand gained prominence when it featured in the 2004 film "Day After Tomorrow" and was later worn by celebrities including Meg Ryan, Nicole Kidman, Drake, Hugh Jackman and Kate Upton. By 2013, sales had exceeded $100 million.

In December 2013, Reiss sold 70% of the company to Bain Capital, in anticipation of the IPO in 2017.

Products

Canada Goose products were originally developed for Antarctic explorers. The company still uses the same technology and design to lock in warmth. The longest-running products are its parkas. The coats been worn by researchers in the United States Antarctic Program and in dogsledding events such as the Iditarod and the Yukon Quest.

GOOS has Cold Rooms in select stores that simulate freezing conditions for jacket testing, with some items designed to withstand -22 degrees Fahrenheit. Canada Goose has developed a TEI (Therma Experience Indicator) rating, which outlines the different levels of warmth and best uses.

The coats are filled with goose down, the layer of fine feathers found under the tougher exterior feathers. Canada Goose uses down sourced from Canadian Hutterite farmers. The company announced it would stop using coyote fur by end of 2022 on the trim of the parka jackets.

GOOS jackets come with a lifetime warranty, which protects against defects in material and workmanship for the lifetime of the product.

Beyond the jackets, GOOS manufactures outerwear, apparel, knitwear, hats, gloves and footwear. GOOS have expanded their product range from 20 to 200 items. Most customers are unlikely to ever wear the products in such extremes. It’s a status symbol, similar to how a Ferrari customer is unlikely to ever drive on a race track, or Jordan shoe wearer will play in the NBA.

The quality of the product and lifetime guarantee do not lend themselves to recurring revenue products, However, 30% of FY23 customers were repeat purchasers.

The Canada Goose Black Label collection is designed as fashion focused and quickly sells out. The HyBridge Knit products introduced a range of gilets and hoodies. These range between $495 - $695. Knitwear is one of our leading segments within apparel.

In 2018, the company acquired the bootmaker Baffin. In November 2021, Canada Goose launched its first-ever footwear collection, designed for conditions as cold as -22 degrees Fahrenheit. The boots cost between $750 and $1,295. The Journey is the more fashion-forward of the boots, with an oversized silhouette similar to that of Balenciaga footwear. The Glacier Trail Sneakers retail for $395.

GOOS controls the end to end supply chain, from raw material sourcing through to product warehousing. The company owns and runs the factories that produce the products, with 75% manufactured in Canada.

Business Model

Canada Goose has 65 stores globally and is aiming to more than double its store count by 2028, to between 130-150.

The company is growing using three strategic pillars; consumer-focused growth, building a direct to consumer (DTC) network and product expansion. Since 2017 GOOS has shifted from 29% wholesale, to 70% DTC, with annual DTC revenue increasing from $115M to $800M.

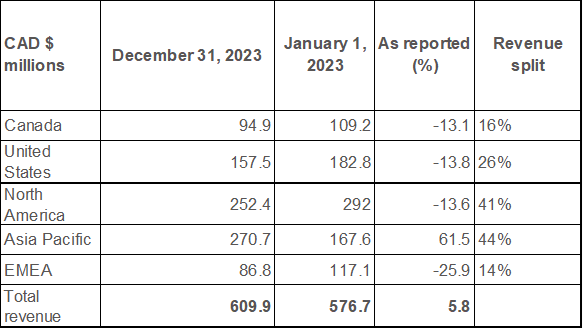

The Asia Pacific region is responsible for 41% of GOOS sales and achieved growth of 61.5% YoY. The brand is reliant on Asia to help maintain sales. The company's efforts to engage with a broad consumer base, including Gen Z, and the introduction of culturally relevant products have been key to its success within the region.

In the most recent quarter, sales were down YoY in every geographic region except Asia. GOOS blamed the decline on e-commerce and wholesale revenue. CEO Dani Reiss called it "globally challenging consumer environment." Carrie Baker, President of GOOS, criticised the mild winter weather in Europe, resulting in lower consumers motivation to purchase winter jackets.

GOOS are withdrawing from wholesale markets, with segment revenue decreasing in the most recent quarter by 28%.

The company plans to reach $3 billion in revenue by 2028, a CAGR of 19.8% from FY2023, with growth expected to be driven predominantly by its DTC channels and product category expansion. The growth will be achieved through commercial initiatives, store productivity, ecommerce and wholesale.

Using their luxury position, GOOS aims to pull four growth levers; Annual Price Increases, Vertically Integrated Supply Chain, Controlled Distribution and Iconic Products. The company anticipates this will drive pricing expansion, increased units, improved conversion and opening of new stores.

A $1.8B leap in 5 years is undoubtedly ambitious. The ongoing store openings and improvements in productivity should drive DTC revenue.

GOOS currently generates around $12-13M in revenue per store. 150 stores would achieve annual sales of around $1.875B from the segment. Pairing this with larger average basket, a diversified product range, increased year round transactions and higher repeat custom could achieve closer to $2B from DTC.

66% of GOOS sales are currently generated from Heavyweight jackets. GOOS are targeting a quarter of revenue from lightweight down jackets by 2028 (3X increase) and 10% from apparel (4X increase).

GOOS is still anticipating 2X growth in wholesale by 2028 - a sector the company appears to be actively withdrawing from. Whether wholesale revenue of 2X is realistic is questionable.

Asia is the focus, with targeted growth of 4X in the region by 2028, with China, Japan & Korea all contributing. Europe is targeted with a tripling sales followed by a doubling of revenue in North America.

Sales Channels

GOOS operates a range of stores. The company’s ‘sweet spot’ is 3,000 square feet, with revenue of around $4,000 per square foot.

The capex allocation is ~$1,000 per square foot, or a total of $3M in per new store. GOOS targets 40% operating margin per store with an anticipated payback of 12 months. With around $12.5M generated per store, each premises should achieve an operating margin of around $5M per annum, reaching profitably within the first year of trading.

The company offers a resale channel in Generations. The platform allows customers to trade in their jackets and GOOS to re-sell the items. The authorized re-sale ensures the Canada Goose products remain in circulation. This provides the customer confidence that second-hand product they are purchasing is authentic. The recipient receives payment in a Canada Goose gift card, ensuring they remain within the brand ecosystem.

The Brand & Marketing

GOOS describe themselves as a bold luxury brand that controls its own destiny. From Drake to the Kardashians, through to James Bond, GOOS has been worn by an abundance of celebrities.

The ‘made in Canada’ tag is important for the integrity of the brand and product. Reiss is adamant Canada Goose will continue to be manufactured on Canadian soil.

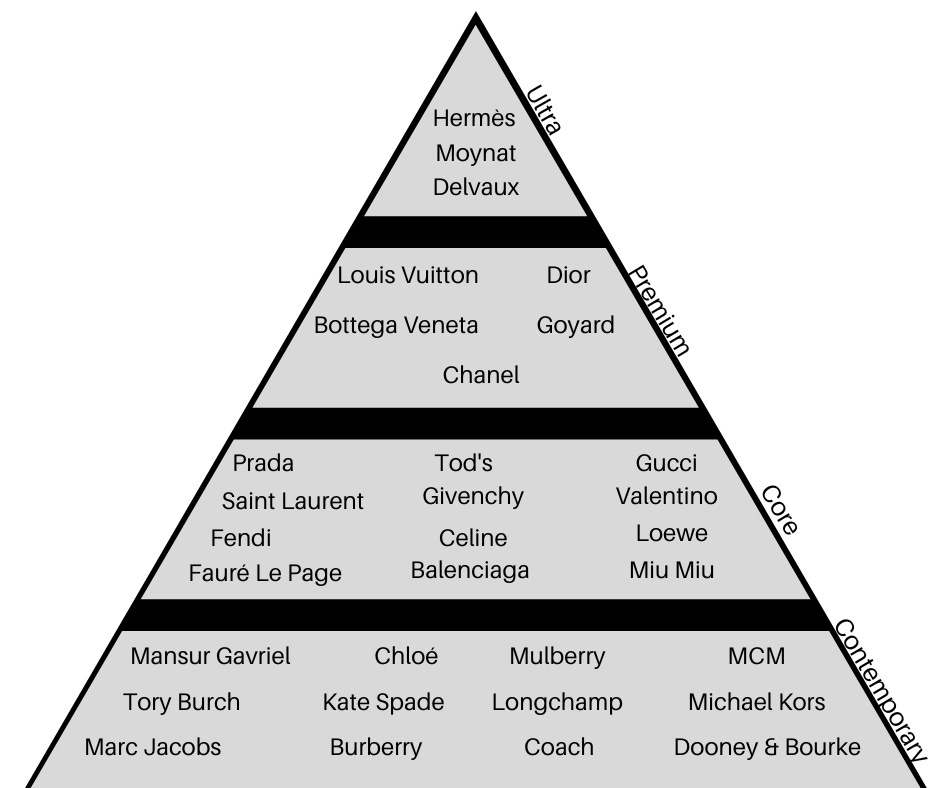

GOOS falls into the Luxury Pyramid between the Core and Contemporary segments. The brand is what allows GOOS to charge a premium in comparison to competitors. As the company scales it encounters the paradox of increasing scarcity whilst increase desire. It’s important that the company maintains the quality and exclusivity. Luxury brands that flood the marketplace with product are quicky de-valued.

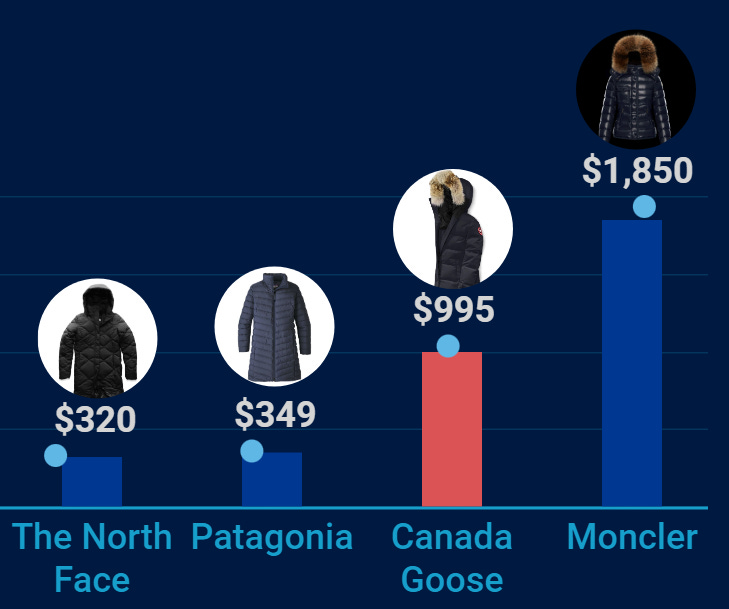

As a product, GOOS shares the same category with the North Face, Patagonia, Moncler and Stone Island.

The GOOS product is one of the best on the market. The lifetime warranty is a seal of confidence for the customer, a feature which is not available from competitors, except for Patagonia, (who service a different price point).

GOOS jackets retail for almost the same price of a Moncler, but fall short of the Italian brand’s fashion-forward designs. Despite Moncler’s origins as an expedition-tested brand, New York dry-cleaners Maurice, found that Canada Goose is more weatherproof and durable than the more expensive competitor.

GOOS has collaborated with Drake’s OVO (October’s Very Own) for more than a decade. The Canada Goose Chilliwack Bomber retails for $1,495 on OVO’s site.

In 2021, GOOS announced a multiyear partnership with the NBA. The NBA designs have been described as bold, bright and expressive - ideal for expanding the fashion appeal of the brand. GOOS teams up with designers and brands as part of the NBA partnership, including Kid Super and RHUDE. Oklahoma City Thunder point guard, Shai Gilgeous-Alexander, became a brand ambassador in 2024.

In the most recent quarter, the company launched six collaborations; with BAPE, Concepts, OVO, The Shoe Surgeon, Pyer Moss and with Masai Ujiri’s Giants of Africa organization.

It’s essential that GOOS maintains the integrity of the brand which has been curated over the past three decades. The company must prevent counterfeit products at the risk becoming ‘too common’. Stone Island has been embraced by football/soccer hooligan culture whilst Burberry hats were the uniform of British delinquents. Gangs in the UK are reportedly targeting GOOS wearers. The brand can only maintain a luxury status by distancing itself from ‘gang culture’.

Financials

Product sales have slowed across 2024. GOOS generates almost half of annual revenue (48%) in Q3 which includes the months of October to December making up the majority of winter sales.

The company is anticipating annual revenue between $1.285b - $1.305b for 2024, up from $1.217b in 2023. This is an increase of only 5 to 7%. To achieve the headline revenue target of $3B by 2028, the GOOS needs to return a CAGR of 23.25% in 4 years, which appears unrealistic.

Many underlying metrics are moving in the right direction. Gross margin in the most recent quarter expanded from 72.2% to 73.7% YoY, largely based on increased product pricing. Gross margins are 770 basis points higher than 5 years ago.

SG&A (Sales, General & Administrative) represented 55.9% of revenue in FY2023. SG&A spending increases are primarily due to the expansion of the retail network.

At what point does GOOS reach SG&A reach escape velocity? Nike’s SG&A costs are only 8% of revenue. GOOS is targeting a reduction to 40% of SG&A of revenue by 2028. In comparison to FY2023, 40% SGA would have added $210m in earnings to bottom line.

The company are opting to purchase shares rather than pay down debt, repurchasing approximately 10% outstanding shares since the IPO. It raises the question why an aggressive growth company is re-purchasing shares, instead of investing in expansion?

Bear Case 🐻

Reliance on Asia

It’s worth noting that the luxury market is generally reliant on the Asia and the growing middleclass. Asia (excl. Japan) generates 47% of Hermes revenues and 31% LVMH revenues - the largest of any geographic region for either company.

GOOS has 22 permanent locations in China, one third of total stores. In Q3 DTC revenue increased by 14% over last year, reaching $514 million. This increase was primarily driven by DTC performance in Asia Pacific, specifically Greater China.

There are obvious challenges faced with dealing with the China and the government as western based company. Many Chinese consumers are now opting for homegrown champions, partly at the urging of the government. As a comparable example, Nike is losing market share to Chinese companies Anta and Li Ning.

Unethical Stigma

One of the largest criticisms Canada Goose has faced has been the ‘unethical’ sourcing of coyote fur for fur-lined hoods. PETA regularly protests against the brand. This association is not acceptable to a key demographic for the company, Gen Z, a consumer segment that will represent 30% of the luxury market by 2030.

Canada Goose argues that its use of coyote fur was a by-product of population control and ethically sourced. The brand went ‘fur free’ at the end of 2022, but despite the shift the stigma remains.

In November 2021, Canada Goose certified the brand under the Responsible Down Standard (RDS). The RDS association prohibits live-plucking or force-feeding in the supply chain of goose feathers and stipulates that all RDS down is a by-product of the poultry industry.

De-Worsify

A balance must be struck between scaling the company and maintaining the luxury integrity and quality associated with the products. As the company enters new categories, including eyewear, luggage and home, the new lines must meet the high quality consumers associate with the brand.

If GOOS floods the market with product, it removes the scarcity and desire associated with a luxury brand.

Reiss has stated that “We’re not a company that just puts logos on products and don’t have any license deals [with outside manufacturers].”

Debt

GOOS has multiple debt sources including a revolving credit facility, long term loan facility plus funding in Japan and China.

As of April 2, 2023, net debt was $468.1m compared to $333.8m on April 3, 2022. The increase of $134.3m was driven by borrowings plus an $84.1m in lease liabilities. Debt will naturally increase with lease liabilities linked to the opening of new stores.

Net debt as of April 2, 2023 was 1.7 times adjusted EBITDA. GOOS currently has a Debt/Equity ratio of 104%.

Increased debt exposes the company to the risk of an uncertain rate environment. Interest payments are not well covered by earnings and further rate increases could harm the company and risk defaulting.

Bull Case 🐂

Owner Operator

CEO, Dani Reiss has effectively worked at the company his entire life. He took control aged just 27. He is the individual that has scaled revenues 63,350% across 2 decades.

Reiss owns 20% of the company, but the majority of his shares have 10-to-1 voting rights. Bain Capital and Reiss hold approximately 90.6% of the voting power (35.7% Reiss and 54.8% Bain Capital).

Challenges could arise if Reiss was to fall out with Bain Capital and be removed. Based on his track record, its clear that GOOS needs Reiss at the helm.

Brand

Few winter-wear brands boast the same name or logo recognition as Canada Goose, the logo is synonymous with the quality offered. The company claims it has achieved 57% global awareness as of 2024.

As luxury brand the company can maintain pricing ahead of inflation and achieve comfortable 7-8% growth per year, with increases alone.

On the most recent earnings call, GOOS highlighted that further price increases were on the table. The company anticipates larger price tags on the heavy-weight jackets north of $2,000.

DTC Shift

GOOS has gone from two stores on the date of the IPO to 65 today. The company is targeting 130 - 150 stores by 2028. DTC generates 78.5% gross margin in comparison to the 53.4% of wholesale, highlighting the reasoning behind the strategy.

Stores are profitable within the first 12 months. The target is not without challenges and requires considerable investment in both physical and digital presence. GOOS recently had issues with conversion rate in e-commerce and does not have the same e-commerce experience as other online retailers.

Control over the sales channels will make GOOS a vertically integrated retailer. This will provide full control, from manufacturing through to sales, removing any middlemen and associated costs.

High Quality Product

GOOS products were originally designed to function in extreme conditions. The brand is known for creating unparalleled insulation against cold temperatures.

The stitching, fabric and water repellence have been manufactured to last for many years. Canada Goose jackets come with a lifetime warranty, which protects "against defects in material and workmanship for the lifetime of the product.”

The commitment to Canadian manufacturing, through their owned and operated factories, provides integrity that entirely-outsourced clothing companies cannot guarantee.

Conclusion

Canada Goose in a business is undergoing a transition. The company will continue to invest heavily to pursue $3B in revenue from 150 global stores. With $3M in CAPEX costs per store, the strategy is not without risk.

Whether the company can achieve $3B in 4 years seems unlikely with the recent revenue stagnation. With a harsher macro economic climate the market appears to be sceptical, there’s a lot of negatives factored into the price.

If GOOS can deify market expectations and return to double digit growth, this is as good an opportunity as any to invest. GOOS is cheap in comparison to competitors. Moncler trades at an EV/EBIT of 23.45 vs GOOS’s 10.36.

In a continuously warming world, GOOS has to shift to year-round apparel. The most recent European winter demonstrated that sales decrease in milder weather. The company is attempting to become ‘all-seasonally relevant’ with product expansion that appears to be working, with Reiss claiming “the Fleece is standout performer.”

Ultimately, the company and has to remain relevant as a luxury brand. From an awareness perspective, GOOS is hitting all the right notes. Drake, James Bond and the NBA are key cultural icons.

Anecdotally, within the UK, there’s a real risk that the company becomes associated with the nefarious segment of society which could result on missing out on the luxury consumers.

The company appears to be in a slump, but over the past 30 years Dani Reiss has demonstrated an ability to continuously drive the brand forward. With $3B in his sights and a quarter of the market betting against him, GOOS may be down but not out.

Sources and Further Reading

https://investor.canadagoose.com/files/doc_presentations/2023/Canada-Goose-Investor-Day-February-7-2023-FINAL.pdf

https://roic.ai/quote/GOOS:CN/transcripts

https://www.retaildive.com/news/canada-goose-to-double-physical-footprint-over-the-next-5-years/642269/

https://www.forbes.com/sites/brinsnelling/2023/08/16/the-profitable-path-canada-gooses-unique-journey-in-the-direct-to-consumer-landscape/

https://investor.canadagoose.com/files/doc_financials/2024/q3/Press-release-Q3-2024-SEDAR.pdf

https://hbr.org/2019/09/the-ceo-of-canada-goose-on-creating-a-homegrown-luxury-brand

https://en.wikipedia.org/wiki/Canada_Goose_(clothing)#:~:text=Canada%20Goose%20manufactures%20outerwear%20and,wearer%20warm%20in%20freezing%20temperatures.

https://www.forbes.com/sites/laurendebter/2019/04/18/how-dani-reiss-became-a-billionaire-turning-canada-goose-into-a-luxury-brand-powerhouse/?sh=5938feab4041

https://www.meurice.nyc/journal/2018/11/5/moncler-vs-canadagoose

https://www.elle.com/fashion/trend-reports/a42698228/canada-goose-sustainability/