DIS 0.00%↑ Key metrics

Market Cap = $165B

EV = $200B

FCF = $1.06B

FCF Yield = 0.64%

ROIC = 3.1%

EBIT = $7.02B

EV/EBIT = 28.49

Intro

The word “Disney” is synonymous with imagination, happiness and entertainment. Disney was founded on October 16, 1923. It feels appropriate to review the company in the year of its centenary.

Disney holds a special place in the hearts of generations of fans and families. The company retains an undefinable magic that resonates with all age groups.

Walt Disney was famous for pushing the boundaries. The studio launched with Mickey Mouse, followed by Snow White and the Seven Dwarfs, Pinocchio and Fantasia.

Disneyland Californian opened in 1955, before opening by Magic Kingdom Florida in 1971. The first international park, Tokyo Disneyland, was followed by Paris, Hong Kong and Shanghai. After Walt’s death in 1966, the company entered a downward spiral.

Michael Eisner’s appointment as CEO in 1984 helped to turn things around. He famously completed the $19B acquisition of Capital Cities/ABC. Capital Cities owned 80% of ESPN, a platform which remains key to this day.

Under Eisner’s tenure the company entered the second golden generation of animation with the release of The Lion King in 1994, Pocahontas in 1995, the Hunchback of Notre Dame in 1996, Hercules in 1997 and Mulan in 1998.

Following a downturn in the company’s fortunes at the turn of the millennium, Eisner was replaced with Bob Iger in 2005. Iger is credited with rejuvenating the business. He oversaw the acquisitions Pixar, Marvel, Lucas Film, 21st Centaury Fox and launched Disney+, whilst expanding the international presence of Disney parks.

The current investment narrative appears to be that Disney is in trouble. The share price has more that halved since the 2021 high and missed the bounce that most of the S&P has experienced since October 2022. The introduction of Disney+ has lead to additional expenditure in a platform which is currently losing subscribers.

Having retired in 2020, Iger, has returned to streamline the company. Is he too late and has Disney lost its magic?

https://insidethemagic.net/2023/02/disney-guests-losing-disney-magic-bwb1/

Overview

In the most recent earnings call, Iger stated that -

“We are targeting $5.5 billion of cost savings across the company.”

With the world reopening, Disney is enjoying increases in customers at both international and domestic parks. However, gross and operating margin are below pre-pandemic levels and Disney+ subscriber growth is stagnating.

Quarter ended 1st April 23

Income Statement -

Revenues for the quarter grew 13% to $21.81B for the quarter.

Disney Media and Entertainment Distribution grew 3% to $14.0B

-Linear Networks declined by 7% to $6.6B.

-Direct to consumer grew 12% to $5.5B.

-Content Sales, Licensing & Other grew 18% to $2.2B.

Disney Parks, Experiences and Products

-Parks & Experiences grew 24.3% to $7.76B

-Consumer Products declined 14% to $1.02B

Segment margin was 15%

-Parks, Experiences & Products had a 28% adjusted margin.

-Media & Entertainment had an 8% adjusted margin.

Operating margin of 10%.

EPS (non-GAAP) was $0.93.

EPS from continuing operations for the six months ended April 1, 2023 increased to $1.39 from $0.89 in the year prior.

Excluding certain items, diluted EPS for the six months ended April 1, 2023 decreased to $1.91 from $2.14 in the prior-year period.

Cash flow -

Operating cash flow was $3.2B, up from $1.77B 12 months prior.

Free cash flow was $1.99B, up from $0.67B 12 months prior.

Balance sheet -

Cash, cash equivalent was $10.40, a decrease from 6 months prior of $11.66B.

Total assets were $204.9B, an increase of $203.3B from October 2022.

Long-term debt was $45B down from $45.3B.

The Business

Disney management segments the business into three core sections; Disney Entertainment, ESPN and Disney Parks, Experiences and Products.

Over the past century Disney has created a wealth of characters, stories and the associated worlds. Successful movies and TV shows create IP which is incorporated into the theme parks, cruises and merchandise. Disney’s IP is arguably the most valuable in the world.

In 2021 the company was the top global licensor with $56B in revenue generated from associated merchandise. Disney IP and characters have become part of popular culture. Consider how many people you know with Disney, Star Wars or Marvel tattoos. In turn this drives new generations of fans. The flywheel effect creates consumers in gaming, music and toys.

Walt Disney drew out the design of the original flywheel in 1957. To this day, Disney operates an almost identical model, with updated technology.

Because of the power of its flywheel, consumers pay Disney to market to them whenever they buy a movie ticket, subscribe to Disney+ or enter one of the theme parks.

Owning Disney merchandise builds a deeper affinity with the brand and encourages consumers engage with movies and media. The company builds theme park rides and attractions using the same IP. Guests then purchase merchandise when they visit the parks. Super fans build their lives around a regular pilgrimage to Florida.

Disney Parks, Experiences and Products

Disney resorts consists of several parks, hotels, spas, golf courses and more.

Disneyland Resort - California - opened 1955.

Walt Disney World - Florida - opened 1971 - Includes Epcot, Hollywood Studios, Animal Kingdom and water parks Typhoon Lagoon and Blizzard Beach.

Tokyo Disney Resort - opened 1983 - Expanded with Tokyo DisneySea. Owned and operated by The Oriental Land Company and licensed by The Walt Disney Company.

Disneyland Paris - opened 1992 - Includes two theme parks, Disneyland Park & Walt Disney Studios.

Hong Kong Disneyland resort - opened 2005 - Owned and operated by Hong Kong International Theme Parks, a joint venture between the Hong Kong Government and Walt Disney Company.

Shanghai Disney Resort - opened 2009 - Disney owns 43% of the property, and the state, controlled Shanghai Shendi Group, owns the remaining 57%.

Disney does not publish visitor numbers or revenue per park. It was reported that Walt Disney World Resort welcomes more than 50 million guests annually. Approximately 21 million of those guests visit the Magic Kingdom in Florida, making it the most visited theme park in the world.

Post pandemic, Disney parks are enjoying year-over-year growth driven by higher attendance which has resulted in stronger financial results at Shanghai Disney Resort, Disneyland Paris and Hong Kong Disneyland Resort.

The average visitor spends $132 on a single day ticket and $69 on souvenirs. With 50 million guests spending over $200, Walt Disney World Resort generates $10 billion annually, not including accommodation or refreshments.

To remain relevant with current and future guests, Disney has to re-invest in rides and entertainment. For the management, it’s key that they blend modern popularity with assets that will stand the test of time. This avoids high investment costs whilst continuing to incentivise new and recurring customers. Despite being over 50 years old, the likes of the Haunted Mansion and Pirates of the Caribbean remain some of the most popular rides with visitors.

Disney announced that Avatar is coming to Disneyland Resort in the first earnings call of 2023. Iger is “very, very bullish” on the future of Disney’s theme parks.

“We have learned that when we invest in increasing capacity, with Star Wars: Galaxy’s Edge being a good example of that and Pandora a great example of that, we can grow our business.”

Iger indicated that the results of Pandora, The World of Avatar (built in Disney’s Animal Kingdom), that year-on-year growth numbers have been “stunning.”

The Avengers Campus opened in the Californian and Paris parks in 2021. Interestingly, due to a 1994 agreement between Marvel and Universal, Disney is prohibited from using ‘Marvel’ and core characters in the US and Japan based parks. The company has instead focused on the secondary characters, such as the Guardians of the Galaxy, to create attractions.

Future attractions include the World of Frozen and Kingdom of Arendelle, opening at Hong Kong, Paris and Tokyo parks from the second half of 2023.

In recent years the company has been criticised for gouging customers by constantly raising prices. Guests have complained of rising costs and wait times, which has lead to detrimental experiences.

Disney Cruise Lines

The Disney Cruise Line fleet consists of 5 ships. The Magical Cruise Company is the subsidiary that operates; Disney Magic, Disney Wonder, Disney Dream, Disney Fantasy, and Disney Wish. Three ships will join the fleet across 2024 and 2025.

Magical Cruise Company LTD is domiciled in the UK. In the pre-pandemic accounts the subsidiary generated revenues of £1.6B and £406m of net income. 2020 and 2021 resulted in back to back losses of -(£255)m and -(£629)m.

The average cost per person for a seven-night Disney cruise is $2,950 (£2,058), based on two adults sharing a room with a veranda. A 4 night Bahamian Cruise from Fort Lauderdale starts at £2,313 for two adults and rises to £6,375 for the Concierge package.

Disney Cruise Line also owns Castaway Cay, a private island in the Bahamas designed as an exclusive port for Disney ships. A second private destination, Lighthouse Point, a 700-acre property on Eleuthera, Bahamas will open in June, 2024.

Merchandising

According to License Global, Disney’s consumer segment repeatedly tops the list of top licensors, with $56.2 billion in retail sales of merchandise sold worldwide in 2021.

Disney takes a percentage of sales, which acts as cost free income. Licensees include Hasbro, Mattel, Mad Engine, the LEGO Group, Jay Franco, Kimberly Clark, Funko and Procter & Gamble.

Disney Media and Entertainment Distribution

Walt Disney Studios

Walt Disney Studios oversees a collection of studios, including Disney, Walt Disney Animation Studios, Pixar Animation Studios, Lucasfilm, Marvel Studios, Searchlight Pictures and 20th Century Studios.

The original studio launched in 1923. The studio and media it has produced over the past century are the beating heart of the corporation, with hits incorporated into parks and merchandise.

Beyond the studios listed previously, the company owns of the following, among others: -

Touchstone pictures (including the 14 film library of Dreamworks from 2011-2016).

The Muppets Studio

Hollywood Pictures

Buena Vista International

Star Distribution

Disney+

Disney+ has 157.8 million subscribers globally as of June 2023.

That is a drop of 4 million subscribers from the previous quarter.

Disney+ global average monthly revenue per paid subscriber is $4.44, an increase of $0.51 from the previous quarter.

Disney+ has an ARPU of $5.95 in the US and Canada.

Disney+ reached an audience of 130 million subscribers in less than 3 years, bolstered by pandemic streamers. Digital TV Research expects Disney+ and Netflix to reach 271 million and 275 million by 2026 respectively, before Disney+ eventually overtakes in 2027.

However, this prediction my be overly optimistic. SVOD growth largely plateaued in 2022. Disney+ suffered a second quarterly decline during the first three months of 2023, losing 4 million subscribers. This loss included 300,000 customers across North America. It came after a 2.4 million drop during the final quarter of 2022. Most of the cancellations came from the Disney+ Hotstar offering in India, after it lost streaming rights to Indian Premier League cricket matches.

Iger remains optimistic, having commented in the most recent earnings release that “Disney+ will hit profitability by the end of fiscal 2024 and achieving that remains our goal.”

The company is attempting to find the optimal length of time before bringing cinema releases to Disney+. It’s a fine balancing act, with the need to maximise movie theatre profits, whilst maintaining subscribers. Fans had to wait slightly longer to watch Ant-Man 3 than normal, and there's a strong chance that the trend will continue for Phase 5 Marvel projects.

To mitigate losses, Disney introduced advertising in December 2022 and plans to roll out an ad supported tier in Europe by the end 2023, with a higher price point to go ad-free. The company's other streaming services, Hulu and ESPN+, already have commercials. The company has a reported 5000 advertisers across the combined streaming platforms.

Disney+ subscribers pay $7.99 per month (ad supported) vs Netflix ($6.99) and Prime ($8.99). To incentivise new subscribers, Disney bundles Disney+, Hulu and ESPN+ into a single package starting at $12.99 per month. 40% of US subscribers access media through the package, equating to 18 million Disney+ subscribers.

What is clear is that the SVOD marketplace will not accommodate several streaming services per household. The market place has plateaued since the end of the pandemic.

Total streaming video on demand (SVOD) viewership among Netflix, Hulu, and Amazon Prime Video was up less than 1% in 2022, compared to 2021. The total number of hours watched in 2022 totalled 116 billion, an increase of 0.6% compared to 115 billion hours in 2021.

In the United States, Amazon Prime Video had the largest content catalogue of movies and TV shows with over five thousand movies and around 2,300 television shows as of January 2023. By contrast, Disney+ provides about 1,100 movies and 783 TV shows

With several other options outside of the top 3 services, the incumbents face aggressive competition. Customers also have the choice of HBO Max, Paramount+, among others.

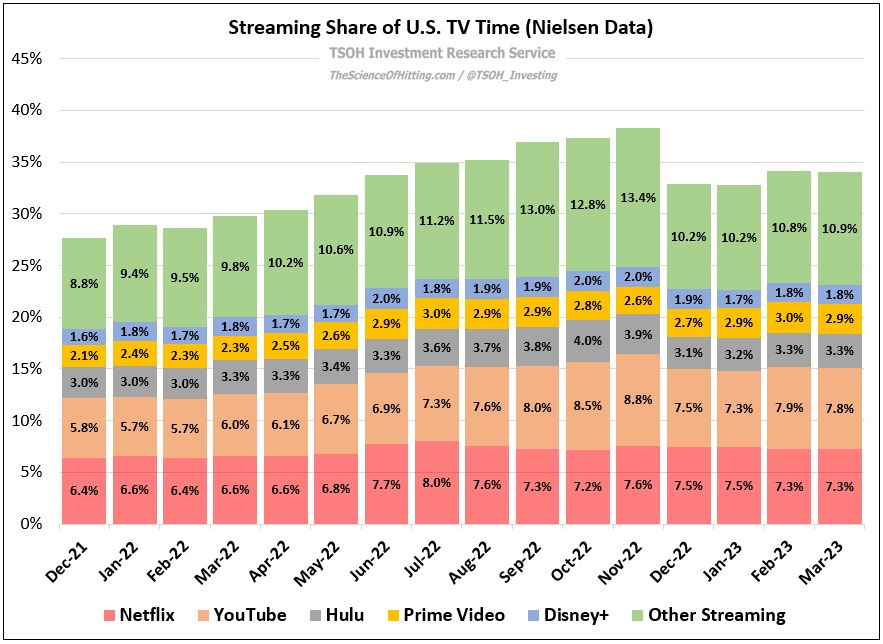

TSOH Investment Research Service highlighted in April that Disney+ had achieved less than 2% market penetration.

Netflix accounted for ~7.3% of TV time in March 2023, up from ~6.6% in March 2022 (helped by share shift to streaming generally). Today, Netflix and YouTube are in a league of their own: each service (individually) accounts for a larger share of U.S. TV time than Prime Video, Disney+, HBO Max, and Peacock collectively

Netflix has invested aggressively in original content for almost a decade, focusing on growth rather than profitability. Americans Spend $48 per month on Video Streaming Services.

As we enter a more challenging macro climate, Disney+ is more likely to be cancelled than Netflix. According to the latest data from Kantar, Disney+ has seen its churn rate (percentage of customers who unsubscribe) triple in the past quarter to 12%. The research has demonstrated that customers are less likely to unsubscribe from Netflix, with a churn of around 3%.

ESPN

ESPN is a multinational sports media service that primarily focuses on live sports, news and entertainment. Disney owns a controlling 80% stake and Hearst Communications owns the remaining 20%.

The ESPN+ subscription service streams live football (soccer), MLB, NFL, NBA plus more. Launched in 2018, it surpassed 25 million subscribers as of April 2023.

The average monthly revenue per paid subscriber for ESPN+ grew by two per cent annually. This was said to be driven by a lower mix of annual subscribers and an increase in retail pricing. In August 2022, ESPN+ raised its monthly subscription fee by $3 to $9.99.

It’s likely that Disney is attempting to force subscribers to purchase the three-tiered bundle.

Hulu

Hulu is an American based streaming service predominately focused at adults. In 2011 Hulu began to produce its own original content. The first production released was the web series The Morning After. In 2012, Hulu announced that it would begin airing its first original scripted program, Battleground.

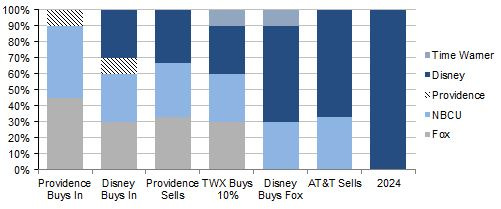

Disney owns the controlling 66% stake in Hulu, with the other 33% belonging to Comcast. Comcast has no operational control over the business and are open to selling in 2024.

Hulu ended Disney’s fiscal second quarter with 48.2 million subscribers. Hulu's annual revenue was valued at $10.7 billion in 2022, up from $9.6 billion in 2021.

Hulu pricing starts at $7.99 for the ad-supported tier and is only available in the US.

Acquisitions

The cornerstone of Iger’s success has been strategic acquisitions. The business implemented an ‘acquire and unlock’ strategy. Management has purchased underutilised back catalogues of IP, in the case of Marvel & Star Wars, and gone on to fully unlock the revenue potential.

Using the same blueprint with each acquisition the company has created media and experiences beyond primary characters, tapping into secondary and tertiary characters and the associated worlds.

Household names like the Guardians of the Galaxy were previously unknown by anyone but the most hardcore fans. The Guardians trilogy has now generated nearly $2.5B in box office revenue. Whilst the ride GOTG, Cosmic Rewind launched in 2022 in Epcot.

Marvel - $4.4B Acquisition

Marvel is the highest grossing cinematic universe of all time. When Robert Downey Jnr graced the screen in 2008 as Tony Stark, no one could have predicted the success that would follow. Marvel was acquired by Disney the following year.

To date, the franchise has churned out 44 movies and generated almost $30 billion of box office revenue.

Disney’s universe have been truly remarkable. Marvel’s success has been based in a long-term road map, sourcing the right directors and contracting their biggest starts.

For example, competitors such as D.C, haven’t come close to Marvel despite their arguable more recognisable assets in Batman and Superman. Recent D.C releases such as Wonder Woman 1984, Shazam! Fury of the Gods and The Suicide Squad have been failures both critically and commercially.

The real challenge for Marvel now is remaining relevant with a new generation who haven’t had the enjoyment of growing up with the previous four phases of films, without the big names of Iron Man and Captain America.

Lucas Film - $4.05B Acquisition

Disney acquired Lucas Film, the owner of Star Wars, in 2012. Unlike Marvel, Star Wars movies have remained relatively fixed within trilogies, with only two stand alone films released since the acquisition. Disney has unlocked Star Wars IP through direct to Disney+ shows and in the theme parks.

The success of the Mandalorian on Disney+ has been the shining light for Lucas Film’s IP. The show was one of the headline shows, launching with the platform in 2019 and was partially responsible for the early success.

In the Disney parks, Star Wars: Rise of the Resistance is the most popular ride at Disney Land. The exclusive Star Wars: Galactic Starcruiser, a fully immersive hotel, is being closed down after only opening it’s doors in March 2022.

Lucasfilm will also released Indiana Jones and the Dial of Destiny in June 2023, the first in the series since Disney made the acquisition. The movie features an 80 year old Harrison Ford. Dial of Destiny opened underwhelmingly, with $60 million at the first weekend box office.

Pixar - $7.4B Acquisition

Originally a spin out from Lucas Film, Pixar was acquired by Steve Jobs after he was ousted from Apple.

Unlike Marvel & Lucas Film, Pixar was relatively early in it’s journey when Iger proposed the acquisition. Pixar’s acquisition was as much about solving Disney’s own studio problems as tapping into the IP.

Ed Catmull’s 2014, ‘Creativity Inc’, provides a deep insight into the problems at Disney and the Animation Studios during the transition between Eisner and Iger.

The recent successes of Frozen, Moana and Encanto (Disney Animation) and indifferent responses to Elemental, Lightyear and Turning Red (Pixar) highlight that it may soon be Pixar that requires support.

21st Century Fox - $71B acquisition

The Walt Disney Company completed the largest acquisition with the $71 billion purchase of 21st Century Fox in 2019.

The 1st Century Fox assets included National Geographic, “The Simpsons” and the movie studio. The acquisition provided Disney with an instant content library of thousands of titles to plug into Disney+.

Some of the most prominent assets included: -

The Simpsons

Family Guy

Marvel Characters - Deadpool, X-men, Fantastic 4

Avatar franchise

The Simpsons and Family Guy back catalogues contain over 1000 episodes combined, whilst the first Avatar was the highest grossing film ever making $2.92B at the box office. The Way of the Water generated $2.32B and James Cameron plans to release a further 3 movies across the next 5 years.

The acquisitions sets the Disney+ up creatively. Shows such as The Simpsons, Family Guy and The Kardashians act as lynchpins for core subscribers. Fans have religiously watched these shows for decades.

Prior to the acquisition, Fox spun off the Fox Corporation which included the Fox Broadcasting Company, Fox Television Stations and Fox News Channel. A full acquisition was illegal due to Disney’s ownership of ABC.

Sky PLC was not included in the deal but the later sale proceeds went to Disney. Comcast for purchased Sky for £29.7B, with Disney receiving around $15B for Fox’s stake.

Bob Iger highlighted that the acquisition was predicated on the introduction of Disney+, after the 2017 purchase of BAMTech, a New York-based streaming media company. As part of the acquisition, Disney secured Fox’s 30% stake in Hulu, making them the controlling party of the service.

In addition to the assets, it was reported that Disney assumed nearly $14 billion in Fox debt.

Bear Case 🐻

Losing the Streaming Wars

Netflix employs a robust strategy to produce high quality content whilst minimising user churn. They have been in the streaming business since 2007. To stand any chance of success, it’s imperative that Disney+ reaches profitability, ensuring the service is self sustaining.

There’s room for more than one streaming service per household, but not by much. As of 2022, the average UK household has 2.6 subscription services, 2 SVOD services and 0.6 pay for TV options.

Disney doesn’t need to win, but it does need to come second. Amazon Prime currently sits behind Netflix, piggy backing off the delivery service. Disney+ is lagging in third.

Competition in SVOD will only intensify. Under the remit to streamline costs, the service is experiencing a reduction in investment and loss of subscribers. Disney risks cannibalising traditional theatre goers by releasing content too early or frustrating subscribers by releasing it too late. It will be essential that the service optimises for the best balance.

Employee Overheads

Disney employs 75,000 workers in the state of Florida and around 220,000 worldwide. Employees are members of several unions who have demanded improved salaries as the cost of living increases.

32,000 workers at Disney World will secure pay increase of $3 an hour by the end of 2023 and around a 37% increase of current employee pay, by 2026.

In February, Iger announced that the company would be cutting 7,000 jobs from its global workforce, around 3% of staff.

The Magic Disappears

At what point does the IP become stagnate? Marvel has delivered 44 films since the first Iron Man, plus several spinoff series. BBC podcast The Inquiry highlighted how the jump in lockdown subscribers put pressure on producers to create more content at a faster pace, hindering creativity and quality.

Marvel’s Phase 5 is releasing new media almost once per month, reducing the urgency to watch for part-time fans. In comparison, the six Phase 1 movies (Iron Man to the Avengers) were released over 4 years.

Pixar’s most recent releases have missed the commercial and critical mark. The on-going live action remakes demonstrate a lack of imagination that consumers demand from Disney. It can be argued that there is more competition, with Iger praising the Mario Movie in the most recent earnings update.

Disney VS DeSantis

Florida’s governor is reportedly ‘at war’ with Disney. The feud began in 2022 when he signed the controversial law dubbed, 'Don't Say Gay.' This banned school teachers from discussing LGBTQ and gender identity with pupils between kindergarten and third grade.

Bob Iger criticised the instatement of the law and DeSantis responded by attempting to revoke Disney’s self-governing and tax privileges in Florida. In April, Disney set about suing DeSantis.

The fall out has led Disney to cancel a new $1B office complex that would have created more than 2,000 jobs, with the company making it clear that a $17B planned investment in Walt Disney World is at risk over the next decade.

Unlike an office complex or factory, Walt Disney World cannot be re-located. A lack of investment in the Florida infrastructure will hurt guest experiences.

The fallout between the company and the state of Florida could have ramifications for decades to come, especially if DeSantis wins the Presidency in 2024.

Bull Case 🐂

A Century of Infrastructure Building

A century on from the company’s founding, Walt’s flywheel remains in full motion. Disney owns the infrastructure. The introduction of Disney+ delivers media directly to consumers and removes a reliance on movie theatres and distributors. The service allows producers and creatives to build stories and spinoffs that would not have previously fit with the movie theatre distribution model.

In addition, it provides the company with user insights and keeps it relevant within a changing technology landscape.

Library of IP

Disney’s IP underpins the entire business. The savvy acquisitions bolstered the library. The IP plugs into the infrastructure and is used across media, merchandise and parks.

Good animation lasts for decades. Snow White and the Seven Dwarfs premiered in 1937 but sold 10 million VHS tapes in the first week when it was released in 1994!

The ongoing release of live action remakes are a prime example of exploiting the back-catalogue. Disney profits from stories and characters established several decades prior, whilst introducing them to a new generation of potential customers.

The Acquisition Blueprint

Iger has made his mark on the company through several acquisitions. Marvel has been the standout success, with $4 billion purchase achieving $30B cumulatively in box office revenue, alone. The acquisition of Fox has created an instant back-catalogue for Disney+ and Star Wars IP is drawing new fans to the parks.

Conclusion

At 100 years old, Disney is a global institution. The brand is as recognisable as McDonalds or Coca Cola. It holds a special place in the hearts of generations who have grown up watching the movies and cartoons.

Bob Iger is one of the best CEOs of this generations, but the company has grown reliant on his leadership. He needs to navigate a shift in the business model whilst implementing a succession plan.

Since the world has re-opened, park visitors have surged, whilst streaming subscribers have slowed. Disney+ has added unforeseen costs but ensures the technology remains relevant. The streaming service returns control, shifting away from competitor services who were using the content to strengthen their own positions.

It brings Disney into completion with Netflix, who have been streaming for almost two decades, whilst potentially cannibalising theatre revenue. The company is sacrificing short term returns to focus on its the future. This should offer hope to long term orientated investors.

Iger has highlighted that Disney+ is on track to reach profitably by 2024, but annalists remain sceptical. Streaming will require continuous investment and ongoing hits to attract new viewers.

The key to success could the number of subscribers who sign up to the combined Disney+/ESPN/Hulu bundle. In this, Disney offers a medium that other services cannot compete with.

Disney has made several acquisitions using leverage. As interest rates increase, the company will be forced to re-finance at higher rates. With a debt to equity ratio of 44%, the days of leverage funded acquisitions appear to be over.

100 years on, the company has surpassed anything Walt could have imagined. It’s yet to be seen how it will fair in harsher economic conditions. Based on the track record it’s a case of when, rather than if, the magic will return for shareholders.