DEO 0.00%↑ Key Metrics

Market Cap = $103.55B

EV = $121.55B

FCF = $2.08B

FCF Yield = 2%

ROIC = 13.9%

EBIT = $5.378B

EV/EBIT = 44.25

5 Year Rev CAGR =5%

10 Year Rev CAGR =3%

Thesis

The dominant company in the global spirits and beer industry.

Largest distribution network, allowing them to secure and deliver the best pricing.

Portfolio of diversified brands, appealing to almost any alcohol consumer.

Trade in an industry that is almost as old as human history. Unlikely to face significant disruption in the the short to medium term.

Intro

Diageo is the world's largest beer and spirit producer. The company owns over 200 brands and retails in more than 180 countries. The portfolio includes leading brands such as Johnnie Walker, Guinness and Smirnoff.

Diageo’s history is a long and interesting one. Distillers Company LTD (DCL) was formed in 1877 by the conglomeration of Menzies, Barnard & Craig, John Bald, Haig & Co, MacNab Bros, Robert Mowbray and Macfarlane & Co.

DCL went on to merge with John Walker & Son and Buchanan-Dewar in 1925.

After these acquisitions, DCL controlled 80% of the domestic Scotch whisky market and 75% of the global Scotch whisky market. The company was acquired by Guinness in 1986 and renamed United Distillers.

The modern day Diageo was formed in 1997 after the controversial merger between Guinness and Grand Metropolitan. The combined business sold-off food and hospitality ventures, including Burger King and Pilsbury, to focus on alcohol.

Diageo is in the business of acquisitions. Outside of its own brands, Diageo holds a 34% stake in Moet Hennessy. Hennessy and Moet are the world’s best selling Cognac and Champagne brands respectively. It was reported in 2009 that Diageo were exploring a potential acquisition of the remaining 66% from LVMH.

More recent acquisitions include Aviation Gin, Casamigos Tequila and Don Papa Rum. Management has stated that “(It is their) strategy to acquire high growth brands with attractive margins that support premiumisation.”

Business Segments

Diageo’s products are sold in over 180 countries. The global distribution network allows well-known brands to dominate categories. Many of the products are centuries old. The diversified portfolio has created pricing and flavour profiles for any occasion or consumer.

The company is focused on building and nurturing brands, particularly in the premium sector. In recent years acquisitions have consisted of young, competitor brands, mitigating any threats.

Acquisitions

Diageo is a company founded on acquisitions and mergers. Sales stagnation in several segments has forced the company to purchase growth.

Recent acquisitions have focused on premium to super-premium brands. This was justified in 2022’s results, with luxury brands growing 31% and contributing 27% of reported net sales. It’s clear that Diageo views long term profits in the premium segment of the market, anticipating key growth in India and China.

Recent buyouts have focused on brands including Don Julio in 2015, Casamigos in 2017, Aviation American Gin in 2020 and 21Seeds flavoured tequila in 2022.

The company finances Distill Venters, a start-up drinks accelerator, which allows Diageo to invest in and often acquire young alcohol brands.

Scotch - 24% of Sales

Scotch Whisky, colloquially referred to a ‘Scotch’, is a geographically protected whisky that is distilled and matured in Scotland.

Malt Whisky is produced using only malted barley, yeast and water. Grain Whisky uses wheat or rye, in place of the barley. Blended Whiskies are a mix of both grain and malt whisky.

Most cask types hold around 200-500L of bulk spirit. Scotch is aged in oak barrels for a minimum of 3 years after distillation. To be classed as scotch, the spirit has to remain above 40% abv. Spirit can be matured in several cask finishes, including bourbon, sherry, rum and mezcal.

Scotch generates 24% of Diageo’s reported revenue, making it the largest earner. The jewel in Diageo’s crown are their Scottish distilleries and reserves. Diageo operates 28 malt distilleries in Scotland. Each produces whisky with varying characteristics based on the fermentation, distillation, still type and maturation process.

There are an estimated 22 million scotch casks resting in Scotland, of which Diageo owns a reported 17 million. Factoring in the cost of the spirit and the wood, a cask of new-make (whisky under 3 years) is valued at around £250 to £500. Casks vary in price depending on the age and distillery. In 2022, a cask from Ardbeg Distillery was sold for £16m. Typically, the older and more unique, the more valuable.

The value of Diageo’s cask holdings can be estimated anywhere between a conservative £5B to north of £20B. The 2022 balance sheet reported inventories of only £7B.

Diageo’s ownership of 77% of the Scotch Whisky stock demonstrates a clear monopoly in a geographically protected market.

Johnnie Walker is the world’s largest blended whisky brand. The walking-man logo is recognised globally. The signature label, angled at a tilt of 24 degrees, comes in several varieties.

Red Label is the world’s best selling Blended Scotch Whisky, with a price point that appeals to the mainstream market (£20 / $25). At the opposite end of the spectrum, Blue Label incorporates some of Scotland’s rarest Scotch, targeting a premium demographic with a price point of £200 / $200.

2022’s results demonstrated a 34% increase in Johnnie Walker sales, with Scotch sales rising 29%. The brand retailed 21 million cases for the first time.

According to the Spirits Business, Johnnie Walker is the world's 10th most valuable spirits brand.

Beer - 16% of Sales

Guinness is Diageo's second largest brand and one of the oldest and most recognised. The beer is available in more than 100 countries worldwide and is brewed in almost 50.

The brand is in a state of recovery after the closure of bars and pubs during Covid-19. In 2022 organic net sales grew 32%.

In comparison to the rest of Diageo’s categories, Guinness produces notably lower margins than spirits. About 50% of Diageo’s beer sales are generated in the African continent, a remnant of the British Empire. Nigeria overtook Ireland as the world’s second biggest Guinness market around 2007.

Tequila - 10% of Sales

Tequila continues to drive growth for Diageo, with Don Julio and Casamigos growing 26% and 29% in 2022, respectively.

Don Julio’s sales remain well behind market leaders Jose Cuervo and Bacardi’s Patron. Jose Cuervo sold 11.7 million cases in 2021, more than double Diageo's total 5.1 million cases. Diageo previously distributed Jose Cuervo until 2013.

Diageo acquired Don Julio from Becle, in a 2015 swap deal for Bushmills Irish Whiskey. This was followed in 2017 with a purchase of George Clooney’s Casamigos for $1 billion.

Casamigos reportedly sold 100,000 of 9L cases in the same year it was purchased. Sales increased to 1 million cases in 2021.

Diageo had previously purchased DeLeon Tequila in 2013, in partnership with P Diddy (who also part owns Ciroc).

Vodka - 10% of Sales

Diageo’s most recognised vodka brand is Smirnoff, which is the world’s best-selling. In 2021 Smirnoff sold 26.5m cases, more than double their closest rival Absolut, with 11m. Smirnoff’s branding allowed it to expand into the alcopops, flavoured-vodka and ready-to-drink markets. In 2018 the company entered the Hard Seltzer sector, to challenge the likes of White Claw.

Diageo part-owns the world’s tenth best selling vodka, Ketel One , in partnership with the Netherlands based Nolet family. Other vodka brands include Ciroc and the recently acquired Chase Distillery.

2022’s results demonstrated that Smirnoff’s net sales grew 11%, whilst other brands, including Ketel One and Ciroc, declined by 11% and 34% respectively.

Rum - 5% of Sales

Captain Morgan is one of the world’s most recognised rums. In Europe, versions of Captain Morgan are typically classed as a ‘premium spirit’ rather than rum, due to the 35% ABV. Diageo acquired the Captain Morgan brand from Seagram in 2001.

In 2022 Captain Morgan sold 12.7m cases, up 6% on the previous year. The brand sits well behind the Bacardi range, which is the world’s most popular.

Diageo announced it would acquire Philippines producer Don Papa Rum, for €260 million in early 2023. Don Papa adds a premium element to the portfolio, allowing the company to compete with aged rum producers, including Havana Club.

Gin - 5% of Sales

Diageo owns the two world's largest selling gin brands, Gordon’s and Tanqueray.

After being introduced in 2017, Gordon’s Pink Gin was the top selling in the UK in 2021.

In 2020, it was announced that Diageo would acquire Ryan Reynolds Aviation Gin, through the purchase of Davos Brands, for an initial payment of $335 million and a further potential consideration of up to $275.

The acquisition of Chase Distillery adds to their portfolio of gins. Chase produce several gins and flavoured liqueurs (plus vodka, mentioned previously).

Liqueurs - 5% of Sales

Bailey’s is the driving force behind Diageo’s liqueur category. In the most recent 6 months, Baileys net sales declined 4%.

Launched in 1974, Baileys reached 1 billion bottle sales in December 2007, surpassing 2 billion in 2015.

Despite bumper 2021 sales, the liqueur sales have remained stagnant over the past decade.

In an effort to modernise the brand, Diageo introduced Baileys Almande, a vegan almond-based alternative in 2017. Alongside the dairy-free versions, Baileys introduced several additional flavours which include Eton Mess and Salted Caramel.

The Numbers

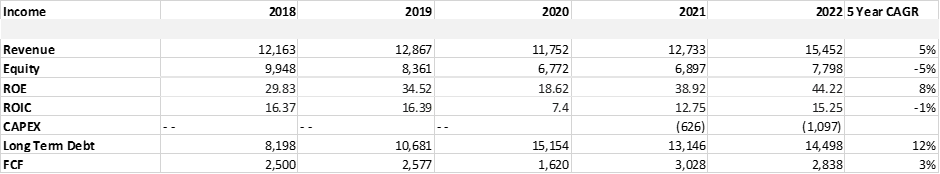

Diageo’s growth has slowed to a crawl in the past decade, with 2022 the exception. More concerningly, as revenue has slowed, long term debt has increased at a rate of 12% annually.

The company has spent more than $1 billion on acquisitions over the past 5 years.

It’s not yet clear if 2022’s improvements are the result of the acquisitions, or the world reopening from the pandemic.

Diageo displays a healthy gross margin of over 60% and operating margin of 30%.

Over the past 5 years, the company has averaged an ROE of 33.% and and ROIC of 13.6%.

The increase in long term debt has driven Debt/Equity from 82% in 2018 to 186% in 2022. Diageo enjoys some of the highest profitability in the industry with a free cash flow margin of almost 20%.

Bear case

Lack of skin in the game

Diageo is a typical blue chip. Ivan Menezes, who plans to retire in June 2023, has performed unwaveringly since being appointed as CEO in 2012. Revenues have increased by 43.5%, whilst the share price has achieved an almost 100% gain.

The 11 members of the management team own less than 1% of shares outstanding. Despite this, 2022’s annual report contains 25 pages discussing management remuneration. This excessive communication demonstrates where the board’s priorities lie.

Revenue Stagnation

2022 earnings appear to be riding the wave of a world recovering from repeat lockdowns.

Scotch and Tequila have made significant revenue gains. According to the IWSR total alcohol sales grew by +3% in 2021, after losses of -6% the year prior.

Despite the latest results, the company’s revenue have been flat for the past decade, with a 3% 10-Year CAGR. Over several years, the company has acquired brands to mitigate the slow down. Recent acquisitions have been questionable. Diageo paid up to $1 billion for Casamigos in 2017. Casamigos had only sold 120,000 cases in 2016, with revenues of around $40-50 million. Diageo paid 20x sales, despite purchasing super-premium tequila brand, Don Julio, in 2015.

Diageo was linked with a move to purchase Jose Cuervo in 2011, the world’s top selling tequila brand, for $3 billion. This appears to have been a missed opportunity, instead overpaying for two competing category brands.

Cost of goods

With inflation at the highest level in almost 30 years, smaller spirits companies are feeling the squeeze. British Honey recently filed for administration whilst Distil PLC shares are down 85% since 2021 highs.

Diageo will be more resilient than smaller organisations, but is unlikely to be completely impervious to increasing costs and price-sensitive consumers.

Shifting Consumer Consumption

As consumers, particularly millennials and Gen Z, become more health conscious, there’s the question regarding how Diageo remains relevant.

Diageo is an alcohol company first and foremost. Less alcohol being consumed is bad for business. Diageo have recognised this trend and are investing in premium and non-alcoholic spirits to combat it.

CEO Menezes stated in the most recent earnings “we are building the brand at the high end of the luxury market."

Challenges lay ahead for the company with Berenberg Research highlighting that Gen Z drinks 20 percent less per capita than Millennials. Millennials are drinking less than both Gen X and Baby Boomers.

In 2019, Diageo acquired a majority shareholding in Seedlip, the world’s first distilled non-alcoholic spirit. Seedlip was launched in 2015 with a mission to solve the dilemma of ‘what to drink when you’re not drinking.’

Bull Case

Geographic Protections

Both Scotch and Tequila are geographically protected properties. Scotch possesses global desirability which creates demand over rivals including Japanese and Irish Whiskey. In 2022, Scotch Whisky exports were worth £6.2 billion.

The Scotch Whisky Association (SWA) is the governing body that dictates the rules and laws regarding Scotch. Diageo CEO, Ivan Menezes, is also the chair of the SWA.

With ownership of 70% of maturing Scotch whisky casks and owner of 29 of 143 distilleries, Diageo has an untouchable Scotch monopoly.

Global Brands

Diageo’s scale and network allow it to guarantee fast and effective supply almost anywhere in the world. Some brands have over 200 years of heritage, creating generations of loyalty consumers and fans. Similar to Coke, a consumer can purchase a Diageo branded product anywhere in the world with guaranteed quality. The company spend a reported £2.72 billion on advertising in 2022.

Ivan Mendes highlighted that consumers are drinking better, and thus looking for quality over quantity.

The quality association, marketing investment and leading pricing, creates fast and reliable sales for vendors, ensuring Diageo brands remain staple products.

Scale Advantages

The spirits market is a globally addressable market. Diageo’s diversified product range appeals to several segments, from hyper-premium to economy. The company can sell to the lower end of the market without devaluing premium brands.

The size and scale allows it to guarantee prompt and predictable sales, making Diageo an essential partner for retailers unwilling or unable to partner with unproven products.

The company reported in the most recent earnings update that -

“Price increases and supply productivity savings more than offset the impact of absolute cost inflation on gross margin.”

Diageo has built a global distribution network over decades. This network includes key partnerships with retailers, wholesalers and distributors.

With over 27,000 employees, it would be almost impossible for market entrants to replicate the scale. The size ensures the company can deliver products quickly and efficiently around the world. The reach allows brands to expand across geographies and enables new and acquired products in reaching a new audience.

As the largest producer of in the industry, Diageo can command the most effective pricing on raw materials, delivering economies of scale, highlighted by the 61% gross margin.

Conclusion

Diageo enjoys several competitive advantages, including a large portfolio of premium brands, the industry's largest global manufacturing and distribution system and a major presence in the world's emerging economies.

A 61% gross margin and 28% operating margin are impressive for any consumer brand. The products are some of the most recognisable spirits in the world. The scale advantages make them almost untouchable. Diageo acquires any challenger brands that pose a threat.

The market leading dynamics ensure the company can raise their prices inline with inflation. Recent growth in Scotch, particularly Johnnie Walker, has been promising. However, growth has slowed.

As an alcohol only conglomerate, the company is limited to growth within the addressable market. This focus creates challenges around health, wellness and future teetotal generations. It won’t happen overnight, but consumers are drinking less.

Diageo appears to be preparing for this by shifting focus to premium brands, targeting consumers who drink less but spend more.

Single digit sales growth is concerning, particularly when shares are priced at a lofty EV/EBIT of 44.25. The share price has more than doubled in comparison to the fundamentals in recent years.

With such high expectations, does Ivan Menezes retirement signal a new lease of life; or leaders abandoning a company in a time of need? With most of the spirits market already conquered, it’s difficult to see where the next stage of growth will come from.

Solid essay here. Won a place in the next issue of Market Talk!