Before we get into this write-up, this is a thank you for all your support throughout 2023. I look forward to exploring more investable companies with you in 2024. Have a wonderful festival period. 🎅

-Sonny

DG 0.00%↑ Metrics

Market Cap = $28.70B

EV = $46.33B

FCF = $0.455B

EBIT = $2.79B

EV/EBIT = 16.61

P/S = 0.74

5 year revenue CAGR =11%

Efficiency Ratios (TTM)-

Debt/Equity = 1.16

ROIC = 10.42%

Dividend Yield = 1.77%

FCF Yield = 1.58%

Gross Margin = 30.64%

Operating Margin = 7.17%

Introduction

Founded in 1939, Dollar General (DG) is the largest discount retailer in the US. The low-cost convenience store operates 19,725 locations across the US and Mexico. The chain consists of Dollar General, DG Market, DGX and pOpshelf across the United States and Mi Súper Dollar General stores in Mexico. DG has opened 622 net-new stores in 2023 to date.

The share price is down more that 50% over the past 12 months. Earnings are expected to decline between 22%-34% in 2023, down from the 8% decrease forecast just three months ago.

Operating profit for the second quarter of 2023 decreased 24.2% to $692.3 million, compared to $913.4M in 2022. Is the company is going through a temporary blip or a permanent downward spiral?

The Business

Approximately 80% of Dollar General stores serve communities of 20,000 or fewer, with 75% of Americans already living within 5 miles of a DG. Many Americans, especially in rural areas, rely on the retailer for their everyday and household essentials.

DG targets low population areas and avoids competition with Walmart. The small stores are approximately 7,400 square feet, with 11,000 SKUs on shelves and 6-7 members of staff.

The chain has as a track record of growth. DG has grown store numbers for 29 consecutive years. Since 2007 there has been a 5% expansion rate. The business aims to open a further 5,000 stores across the US, targeting 25,000 outlets.

Dollar General has over 20 own-label brands, which include Clover Valley, true living, DG Home, Studio Selection, Believe Beauty, DG Health, Comfort Bay, Smart and Simple, Gentle Steps, Rexall, Forever Pals amongst others. Introduced in 2009, Clover Valley has grown to include approximately 600 items and debuted more than 100 in 2023.

The launch of Dollar General Fresh allows the chain to act as a one-stop shop for fresh produce including milk, eggs and vegetables. DG currently offers ‘Fresh’ produce in more than 4,400 stores and aims to expand to more than 5,000 by January 2024. This is a key opportunity, as less than a third of the stores are serviced by DG Fresh. This results in a nutritional wasteland where finding real, whole, fresh food is difficult for customers.

Operations

DG utilises 18 distribution facilities across the US and has added 10 DG Fresh distribution centres which allow the delivery of fresh produce.

In August this year, Dollar General opened its first dual strategy distribution centre, a mix of the company’s traditional combined with DG Fresh supply chain model. The new centre covers approximately 1 million square feet and is located in Blair, Nebraska. The hub will support more than 1,000 Dollar General stores when at full capacity.

DG has announced automation plans for the distribution centre in South Carolina, with plans for a nationwide roll-out to follow. This effort will automate the delivery of goods to individual stores in an effort to mitigate supply chain issues.

The automation efforts are part of the retailer’s strategy to streamline the way it transports merchandise. Dollar General plans to roll out automation technology to new sites, and expand its in-house truck fleet (from 1,800 to 2,000) by the end of 2023.

Network

DG focuses on rural markets that are often too small for a Walmart. An example of Walmart’s inability to succeed in the small box space, was the closure of 41 ‘Walmart Express’ stores that Dollar General purchased. The 41 former Walmart Express outlets were located across 11 states and replaced with 40 relocated DG stores.

DG offers a Preferred Developer Programme which enlists independent, favoured developers who locate, permit and build new stores. Dollar General agrees a 15 year lease which is sold on to a REIT. Dollar General is attractive for landlords as it offers more aggressive, longer leases, in comparison Family Dollar that only offers a 10-year lease.

Competition

Dollar General is struggling with inventory, supply chain management and greater competition. Competition comes from other discount retailers including Walmart, Dollar Tree and Family Dollar Stores. (Dollar Tree and Family Dollar operate as separate brands but are owned by the same company). In comparison to DG, Walmart offers bigger-ticket items and caters to a higher-income consumer.

Walmart's scale provides leverage when negotiating with suppliers and vendors. As the world's biggest retailer, Walmart was able to absorbed higher wholesale prices or pass them along to its customers.

Walmart and DG have vastly different customer bases. This is obvious in the revenue per square foot Walmart ($537.37) vs DG ($273). At the end of Q3, Walmart sales were up 5.2% YoY whilst operating income grew by 3%.

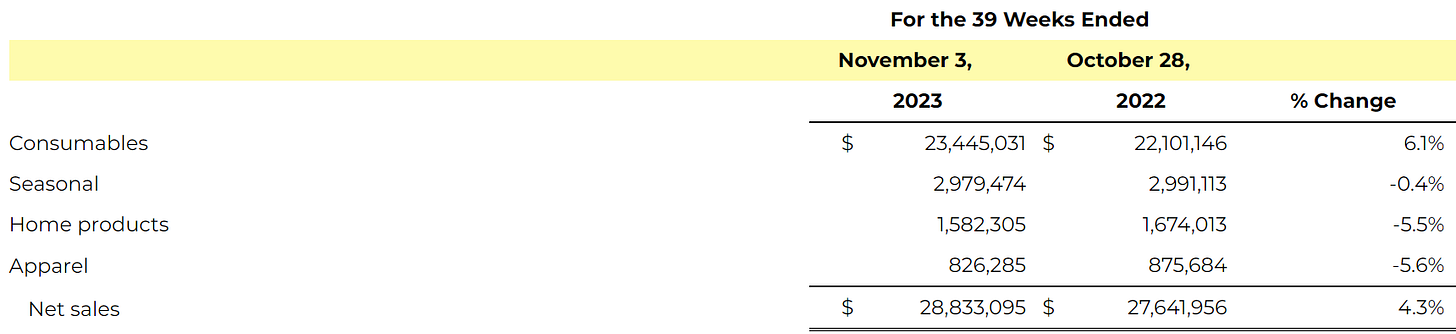

Customers are struggling with higher costs in a challenging macro climate, but inflation is hurting Dollar General's customers more. On average, DG shoppers earn less than $40,000 per year. After paying increased prices for groceries, gas and utilities, there's little to nothing left for any discretionary spending that Dollar General had once catered. This clear in the decreased revenue in both Home Products and Apparel. However, CFO, John Rainey highlighted the fact that the company's stores are drawing more higher-income consumers in the higher inflation environment.

Dollar General does enjoy relationships with suppliers that allow its stores to offer custom-size and priced, name-brand goods. However, it's around one-tenth the size of Walmart's U.S. operation, providing less leverage to negotiate supplier price hikes. Walmart’s Days Inventory (38.81) is less than half of DG (97.74) and highlights the difference in operating efficiency. Walmart can receive goods in and sell them within the credit period of the supplier.

Dollar Tree named Rick Dreiling as CEO in Jan 23. Dreiling was Dollar General’s CEO and chairman of the board from 2008 to 2015. He architected the expansion in DG stores by 66% and more than doubled revenue. At 66 Dreiling still has time to make significant improvements at Dollar Tree and turn the rival chain into a serious competitor. DG already lacks Dollar Tree in efficiency ratios, particularly days inventory. Dreiling is likely to further improve operating metrics.

Financials

DG revenue has more that doubled in the past decade, whilst income has increased by more than 200%. Earnings per share increased from $1.05 in FY 2009 to $10.73 in FY 2022. This is a 10X increase at approximately 20% CAGR over the decade.

Dollar General has implemented three strategies to achieve this growth.

Store Growth

Same store sales growth

Share repurchases

Since 2011, DG’s total outstanding shares reduced by 36%, from 340M to 219.5M. a This is a 3.8% CAGR in share reduction.

On August 24, 2022, the Board authorized a $2.0 billion increase to the existing common stock repurchase program, bringing the cumulative total to $16.0 billion authorized under the program since its inception in 2012

Most Recent Quarter - 3 Nov 2023

Results to November 3, 2023.

Net Sales Increased 2.4% to $9.7 Billion

Same-Store Sales decreased 1.3%

Operating Profit decreased 41.1% to $433.5 Million

Diluted EPS decreased 45.9% to $1.26

Year-to-Date Cash Flows From Operations of $1.4 Billion

Board of Directors Declares Quarterly Cash Dividend of $0.59 Per Share

The company’s revised expectations in Q2 decimated the share price. The most recent earnings have done nothing to taper the market’s pessimism.

Net income for the quarter ending Nov 23 was down a staggering 47% in comparison to the previous year. Despite higher store numbers, same store sales decreased.

The reduction in sales has been made worse by increasing cost of goods, soaring wages and significant headwinds from inventory shrink.

As customers become more conciseness around purchases, they have focused on required consumables and reduced purchases of the higher margin home and apparel products.

Our seasonal and home products categories typically account for the highest gross profit margins, and the consumables category typically accounts for the lowest gross profit margin.

Despite multiple challenges, including an average transaction amount decrease, customer traffic was positive for the first time in four quarters.

Management

Todd Vasos, who acted as Dollar General CEO from 2015 to 2022, has returned to replace Jeff Owen, who was CEO for less than a year. Similarly to how Iger has returned to the helm at Disney, DG have returned control to a safe pair of hands who led the business through one of the most impactful periods in its history.

Under Vasos’ previous tenure the company hit several milestones, including the addition of 7,000 stores, creation of 60,000 new jobs, increase in revenue by more than 80% and doubling of market cap.

The company is struggling post pandemic and was moving in the wrong direction under Owen. It’s key that Vasos improves operating inefficiencies quickly.

Bull Case 🐂

Brand Power- With almost 20,000 stores, the DG brand is recognised across the US. The network creates social proof. Customers understand the service and goods, which in turn drives more revenue. Consumers trust the brand, enjoy convenience and low prices, shop more and strengthen the brand further. The company was named to Fortune Magazine’s World’s Most Admired Companies List in 2020 and 2022

The introduction of DG own branded labels increases gross margin, in a similar way that Kirkland does for Costco, or Aldi and Lidl have done so effectively.

Network density - DG has more outlets across the US than McDonalds. The chain displays a network effect and can drop more goods per delivery making logistics cheaper. This ensures perishables are delivered faster, results in less waste and achieves a higher gross margin.

By delivering more pallets per visit, fewer trips are required to multiple stores. The network, logistics and buying power will continue to strengthen as more stores are added (particularly for selling online or click & collect).

Preferred developer programme - DG uses a network of contractors who build each store to spec. There is little risk to DG, as the business does not have to cover the cost of building stores and can open them at a rate competitors cannot compete with. Stores cost approximately $250,000 to open and the investment is repaid within 2 years. DG does not own the stores, ensuring cash is not tied up. This generates scale, leverage and productivity at speed.

Counter positioning - DG ultimately serves markets that Walmart cannot. DG opens stores in areas under served due to size, typically with populations of 20,000 or less.

Bear Case 🐻

Higher debt rates - DG has increased debt as they have grown. In 2023, long term debt was $6.44B compared to $4.5B pre-pandemic. This has been primarily driven by higher average borrowings and increasing interest rates. The debt-to-equity ration is now 1.16, near all time highs for the decade.

Risk of legislation - Not all press surrounding DG is positive. The company has been called a ‘cancer’ who puts Mom & Pop grocery stores out of business. Dollar General has racked up more than $21 million in fines from the federal Occupational Safety and Health Administration for having blocked fire exits and dangerous levels of clutter. In Spring, shareholders voted for a resolution that called for an independent, third-party audit into worker safety, a move that the company opposed.

Employee Challenges - DG runs a lean number of staff, with only 6-7 employees per store. Typically, these roles are low paid and demanding. DG store employees are paid an average around $11 per hour. This leads to over-worked, despondent staff. Employees have told Insider that one cause for the disorganised stores is that Dollar General hasn't allocated enough worker hours to maintaining them.

In the current inflationary environment, employees are demanding higher pay. Raising the federal minimum wage to $15 an hour is a policy goal for many lawmakers. With over 170,000 employees, a 36% increase in wages would be challenging to navigate.

Mismanagement of Inventory - Operating more than 19,000 dispersed stores in rural areas are stretching DG’s operating capacity. Such high numbers mean it's difficult to monitor and manage.

This is clear when you compare 2023 TTM Days Inventory and Days Payables, both of which currently sit at 97.74 and 52.43 respectively. Prior to the pandemic, each metric was below 80 and 40 days respectively.

"The state of some Dollar General stores over the course of this year has been unhelpful to converting new shoppers into bigger spenders and to increasing basket size more generally," - Neil Saunders, managing director of GlobalData Retail

Inventory levels grew 3.4% YoY last quarter. It's possible that sales were lost because merchandise was in a stockroom, waiting in a warehouse or on a truck, rather than on a store shelf. During Q2, former CEO Owen, highlighted that DG faced $95 million hit to operating profits from markdowns, related to clearing inventory, mainly in non-consumable categories.

Increased Competition

Dreiling, DG’s modern-day architect and CEO from 2008 to 2015, became Dollar Tree’s CEO earlier this year. DG is already behind Walmart and Dollar Tree in key efficiency ratios. Dreiling is a turnaround CEO and improvements to Dollar Tree will likely follow.

Further risks comes from an over-saturated marketplace, in particular online competitors, such as Amazon, moving further into the grocery space for home delivery, or from Walmart’s online expansion. 15% of Walmart sales are now online and growing 15% YoY.

Low Income Demographic

DG’s primary customer base are lower-income households. When government stimulus stopped and inflation began to bite, customers tightened their spend. Lower income households are typically the worst affected during economic downturns. This is clear based on DG’s decrease in same store sales, whilst it has also been highlighted that rising theft costs are hitting the bottom line.

Conclusion

DG has fallen out of favour with the market. The share price is down 50% from 2022 highs. DG lags competitors in key efficiency ratios. However, with a trailing P/E of 15, DG trades at a discount to Dollar Tree (24.7) and Walmart (25.6).

For the first time since Todd Vasos took charge in 2015 the company will post operating margins of less than 8%, historically operating margin has sat around the 7-9% for the past decade.

The macro head-winds have significantly affected the lower-income demographic that DG services. As consumers feel the pinch, they are less willing to splash out on higher margin items such as Apparel and Home Products, which has affected DG’s gross margin.

Inventory shift was one of main reasons for missed earnings earlier this year. The retailer has taken action by marking down inventory and using special teams of employees to clean up stores. It’s essential that disorganised stores are resolved promptly. Untidy stores could be a turn-off for middle-income shoppers who have historically become a key customer base during economic downturns.

The return of Vasos as CEO offers investors reasons to be positive. With almost 20,000 establishments, a target of 25,000 outlets does not appear to be unrealistic.

The chain still opens stores faster and cheaper than competitors. It’s higher network density ensures is can drop more pallets per area.

The yellow Dollar General sign is widely recognised across the US and trusted by the consumer. The further expansion of DG Fresh will cater to more customers and increase basket size. The expansion and automation of distribution centres should increase operations whilst mitigating recent stock inefficiencies.

Recommend company reads on

:: :Further Reading & Sources

https://www.joincolossus.com/episodes/93129089/fuss-breaking-down-the-food-ecosystem?tab=transcript

https://investor.dollargeneral.com/websites/dollargeneral/English/2120/us-press-release.html?airportNewsID=ec5a2e95-ebd2-4022-8c97-dc5f0896c38b

https://money.yahoo.com/why-dollar-general-analyst-turning-195628496.html

https://seekingalpha.com/article/4377768-dollar-general-local-monopoly-generates-big-returns

https://cgbuchalter.com/case_study/dollar-general-preferred-development-program-multi-state/

https://www.businessinsider.com/dollar-general-low-price-strategy-2018-8?r=US&IR=T

https://www.theguardian.com/business/2018/aug/13/dollar-general-walmart-buhler-haven-kansas

https://www.mashed.com/216286/the-untold-truth-of-dollar-general/

https://docs.google.com/document/d/1lfgpU2v2_-BnOsrfmVaZAMLnzrKecv0eMykoZUjG-Pc/edit

https://www.businesswire.com/news/home/20230824709851/en/Dollar-Tree-Inc.-Reports-Results-for-the-Second-Quarter-Fiscal-2023%C2%A0

https://www.retaildive.com/news/dollar-general-opens-dual-distribution-center/691546/

DG is very compelling at this price point. It's hard to see more downside considering its more than 50% off the lows, and with future interest rates going down as well as inflation getting better I think the debt and inventory problems have reasonable solutions ahead. I've been long since the stock price capitulation and plan to stay long.