Author’s Note - Please note that I am a shareholder in Fever-Tree at the time of writing and publication. Anecdotally, I was recently served a G&T with a competitor’s product and was unable to drink it. With that in mind, let's investigate the extent of the company's competitive edge.

£FEVR Stats

Market Cap = £901.79M

EV = £849.49M

Gross Margin =

FCF = -£13.4M

FCF Yield = N/A

5 Year Rev CAGR = 11.04%

EBIT = £22.8M

EV/EBIT = 37.26

ROIC = 9.73%

Introduction

I’m of the opinion that Fever-Tree’s results get so much coverage due to the pun opportunities with the headlines. The tonic maker’s half year results were released on 12th September. Shares slumped 11.6% on the day and fell to 2016 levels. The company delivered revenue of £172.9m for the first half of 2024, down 2% for the year. The performance was reportedly impacted by unseasonable weather in the second quarter.

If you are not familiar with the Fever-Tree, the company is the world’s leading premium carbonated mixer. Having dominated the UK market since it launched, the brand is now gaining traction in the US and rest of the world.

When I first wrote about the business over 2 years ago, the market cap was £1.25B. The stock price has never recovered from the pre-pandemic highs of almost £40 a share. At 2.5 price/sales, this ratio is now the lowest it has been since the IPO.

For a number of years, Fever-Tree shares were everything an investor wanted - fonder operated, a first mover advantage and riding the gin wave. The recent decline raises the question whether the premium brand remains a good investment.

Despite challenges in the UK and Rest of the World, the company has maintained growth in the US, extending market share and reaching the number one position in Tonic Water and Ginger Beer categories.

Tim Warrillow is one of the cofounders of the business and the current CEO. He originally launched the brand 20 years ago alongside Charles Rolls and retains a 4.78% ownership stake.

Product Mix

Fever-Tree has continued to develop the product portfolio, focusing on the global market with high quality mixers that can be used with both premium spirits and non-alcoholic alternatives. The products include ingredients sourced from unique locations across the globe, including quinine from the Democratic Republic of Congo, Sicilian Lemons and Ginger from the Ivory Coast, India and Nigeria.

The company places an emphasis on sourcing the finest ingredients from around the world to ensure exceptional flavour in each bottle.

Fever-Tree’s range includes;

Tonics: A variety of flavoured and Indian tonics, which still represent the majority of sales.

Other Soft Drinks: Includes products like Lemonade, Ginger Beer, Cola and Ginger Ales.

Adult Soft Drinks: Includes Cloudy British Apple, Sicilian Lemonade and Sparkling Mexican Lime.

Sodas: Premium sodas, crafted to pair with a range of spirits including gin, tequila, vermouth and Italian liqueurs.

Cocktail mixers: Fever-Tree cocktail mixers include Margarita, Light Margarita, Mojito, Bloody Mary and Espresso Martini.

The continued diversification of Fever-Tree’s range has seen growth in non-tonic products, which now make up over 40% of the company’s global revenues. Ginger Beer achieved a 19% year-on-year sales growth, which is 14% ahead of the nearest competitor. This growth highlights the rising popularity of Ginger Beer, not only as a mixer but as an adult soft drink.

In 2023, Fever-Tree launched a new range of cocktail mixers, designed to simplify the process of making quality cocktails at home. Options included the Margarita, Bloody Mary and Espresso Martin. The company reported that the mixers have been well-received by both on-trade and off-trade customers.

The business has continued to expand on existing product formats, with the 150ml can range growing at 50% year-over-year.

The introduction of the Adult Soft Drinks made the range more relevant to a variety of drinking occasions. The introduction of Pink Grapefruit and Ginger Beer in 250ml cans in regions including Benelux and Switzerland are examples of this expansion.

Fever-Tree remains ahead of the competition through diversified product offerings and ongoing innovations. The variety of Fever-Tree's portfolio ensures that the products cater to a diverse demographic and geography, delivering the right product for the right occasion.

Sales

Results for the first half of 2024 follow a similar trend from 2023. The US is now the company’s largest market, with revenues growing by 22.4% to £117 million in 2023, whilst the UK and Europe are stagnating.

For the first half of 2024, US sales grew by 7% to £60.3 million. UK sales declined by almost 6%. Despite this, Fever-Tree remains the top mixer brand in the UK, with 90% of premium mixer sales in the Off-Trade channel and a 45% value share. This is double that of the closest competitor, Schweppes. The company reported that adverse weather during the summer and a soft gin market were the main reasons for poor UK sales.

European sales also experienced a sharper decline, with revenues down almost 17%. The Rest of the World achieved a bounce, with sales up almost 55% YoY. This growth was linked to the inventory buy-back in Australia and a transition to a new subsidiary, which opened in the territory in 2023.

Globally, Fever-Tree is now in over 90 markets and building distribution routes in key regions including Japan, Canada and Australia. In Canada, the brand increased household penetration by 30% year-on-year, with strong gains in both the Tonic and Ginger Beer categories. Fever-Tree has continued to grow ahead of the competition and now has more than 30% value share in both Tonic and Ginger Beer categories in the Canadian market.

The company's non-tonic product categories also demonstrated growth, increasing sales by 10% and diversifying the overall portfolio.

Fever-Tree continues to focus on premiumisation, tapping into partnerships with tequila and luxury brands and targeting growth opportunities in markets including India and China.

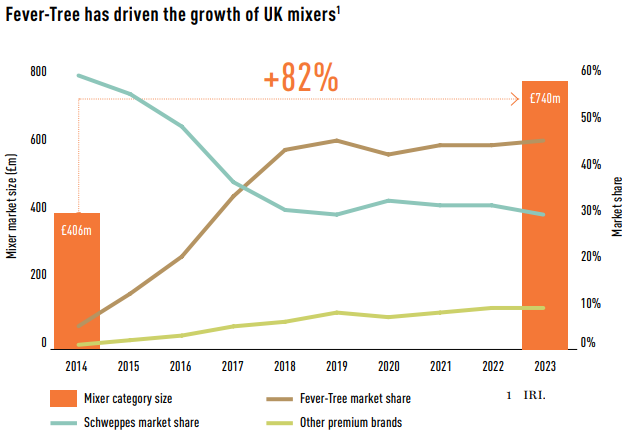

Despite challenges in the UK and Europe, the brand has made significant strides to drive the global mixer category forward, growing the market share from 5% in 2014 to over 44% in 2023. This expansion has nearly doubled the value of the overall mixer category in the same period, solidifying the brand's global position as the leader in premium mixers.

Operations

Fever-Tree made operational improvements in the first half of 2024, with the company’s gross profit margin increasing by 520 basis points to 35.9%.

These improvements were driven by improved glass bottle pricing, better trans-Atlantic freight rates and price increases in key markets. This positions the company to deliver margin gains into 2025, based on reduced inflationary rates.

Fever-Tree operates on an asset-light, outsourced business model, partnering with third-party bottlers, canners, logistics providers and distributors. This approach allows the company to minimise capital outlays and expand into new markets when opportunities arise. This model creates substantial barriers for smaller competitors in for pricing and flavour offerings.

Despite the global expansion, Fever-Tree’s capex requirements remain low, at £9.8 million during 2023 or 2.7% of revenue. The company continues to invest in brand growth, expecting to spend around £90 million on overheads for the full year.

To safeguard against supply disruptions, Fever-Tree holds buffer stocks of key ingredients, such as quinine and fresh green ginger, for which there are a limited number of suppliers. This strategy helps mitigate risks in the supply chain and ensures ongoing de-risked production.

In Australia, the company has established a new subsidiary, creating capacity across key channels in the country. The combined operational improvements have positioned the brand to return improved growth margins, following the shock of the pandemic.

Brand & Advertising

The Fever-Tree brand is positioned as an affordable premium mixer with a diverse customer base and a strong presence across various channels and regions. For the 10th consecutive year, the brand was voted ‘Number One Top Selling Mixer’ and ‘Number One Top Trending Mixer,’ highlighting the dominance in the mixer category.

Fever-Tree continues to expand global marketing efforts, with the aim of enhancing visibility and engagement. Marketing spend was 9.6% of revenue in the first half of 2024, equating to £16.6M.

Key initiatives include partnerships with high-profile events, such as the PGA Tour alongside bar takeovers. The business expanded their presence in retail, with branded fridges in convenience stores, petrol stations and airports.

Fever-Tree’s association with prestigious sporting events across tennis, golf and horse racing has strengthened the brand’s image and allowed the products to connect with an affluent demographic.

The opening of the first standalone Fever-Tree bar at Edinburgh Airport provided a platform to showcase the brand, allowing travellers to experience the products first-hand.

This approach to marketing and advertising ensures that the brand remains relevant whilst offering achievable luxury. This strategy ensures that the company continues to shut out smaller competition who simply cannot afford to advertise on the same scale.

Market

Fever-Tree operates in a marketplace that has seen significant shifts over the past two decades, with consumers steadily moving away from beer and wine in favour of spirits.

This trend has accelerated in recent years, particularly in the US (Fever-Tree's largest market), driven by a surge in craft spirits. Premium spirits continue to drive growth in the category, aligning with Fever-Tree's brand positioning.

Between 2000 and 2023, spirits share of the alcohol market grew from 28.7% to 42.2%, surpassing beer, which holds a 41.9% share.

The company's strong relationships with global spirits producers creates opportunities to expand distribution, particularly as premium spirits become more dominant in mature markets such as the US and UK.

In the UK, the gin boom played a pivotal role in the growth of the tonic market. The G&T remains the most popular spirit-and-mixer combination. However, the gin category has experienced pullbacks in recent years, as many smaller distillers in the UK, such as Boe Gin, the British Honey Company and McQueen Gin, entered administration.

Some distillers, including Sipsmith and Chase Distillery, were successfully acquired by larger companies likes of Beam Suntory and Diageo, signalling consolidation in the sector. Although the height of the gin boom appears to have passed, Fever-Tree’s expanding portfolio and market leading position ensures the brand remains the number one tonic choice, as the market shifts to premium spirits.

With a broad distribution network and a presence in both mature and emerging markets, Fever-Tree is well-positioned to take advantage of early-stage markets where the spirits trend is still gaining momentum.

Competition

Whilst Fever-Tree is the global leader in the premium tonic and mixer market, there’s no doubt that challenger brands will target the company’s dominance.

As the spirit market consolidates, so does the tonic market. Start up and smaller brands, including Halewood’s Lamb & Watt and Fentimans, have scaled back or disappeared all together.

The real threat to Fever-Tree comes from brands backed by industry incumbents including Coca-Cola, Pepsi or the beer conglomerates.

Schweppes was the company that for a number of years held the position as dominant tonic producer until Fever-Tree entered the market. Despite the previous market leadership, the brand lacked premium appeal with consumers. Keurig Dr Pepper is the current owner of the Schweppes trademark in Canada and United States, whilst Coca-Cola Company owns the Schweppes brand in 21 European countries.

In a further 22 European countries, the brand is owned by Schweppes International Limited (a subsidiary of Beam Suntory). Despite tie-ins to global incumbents, the ownership and distribution of the brand appears too fractured to offer any real challenge.

Three Cent Soda – a Greek soda brand - was acquired by Coca-Cola for €45 million in 2022. The brand has been well received by the on trade and offers innovative sodas, and could act as a future challenger brand.

Britvic, the UK based producer was recently acquired by Carlsberg. The acquisition will allow the brand to take advantage of the beer conglomorate’s global distribution and economies of scale.

Conclusion

Despite the challenges linked to the recent share price pull back, Fever-Tree appears to be making the right moves to ensure long-term success, delivering on growth and margin recovery. The company continues to lay the groundwork for global bottling infrastructure and direct distribution which will ultimately reduce the need to ship from the UK.

The company is focusing on expanding local production, including the upcoming bottling facility in Australia and plans for a US plant, both of which will reduce shipping costs and increase profitability.

With little debt, improving post-pandemic costs and a broad portfolio range, Fever-Tree can leverage operational efficiency to deliver significant gross margin improvements. Prior to the pandemic the business enjoyed gross margins in excess of 50% - a return to these levels would significantly enhance shareholder returns.

The products have achieved a high degree of customer loyalty, which allows for price increases that do not diminish market share. The fact that Fever-Tree can increase pricing and maintain rate of sale demonstrates the competitive advantage of the product.

The company is well-positioned to maintain growth in the global mixer market by expanding geographic distribution. Despite changing consumer preferences, including the alcohol-free choices of Gen Z, the business can take advantage of the no and low trends that threaten the alcohol market, by acting as a premium alternative.

The UK appears to have reached a saturation point however, opportunities remain in Europe and the rest of the world. Fever-Tree's first-mover advantage, product quality and strong brand presence offer a solid defence against competition.

One point of contention is whether the brand can maintain a premium price point as the products achieve broader distribution. The mixers are now sold in Waitrose (higher-end) as well as Asda (lower end) supermarkets, making the product mass market instead of premium. This could detract from brand image and close the door on premium and luxury opportunities.

Fever-Tree’s unrivalled quality, broad portfolio range and superior rate-of-sale has enabled the company to dominate the mixer market and extend it’s position as the largest premium mixer brand in the US.

Despite the recent share pull back, dampened by UK weather, the underlying metrics appear to be improving. Perhaps, for any investors who enviously eyed the hights of the £40 share price, now may be an opportunity to consider buying.

Sources and Further Reading

https://substack.com/@librariancapital/p-148920490

https://substack.com/@thescienceofhitting/p-149014097

https://fevertree.s3.eu-west-2.amazonaws.com/reports/21e6d8581ac0bbec0d09f9398d42fa86.pdf

https://fevertree.s3.eu-west-2.amazonaws.com/reports/86a6d5d84c344e911e9098f508030f0b.pdf

https://www.telegraph.co.uk/money/investing/stocks-shares/hold-fever-tree-despite-underperformance/

https://newtonprint.co.uk/fever-tree-mixing-with-the-best

https://www.theguardian.com/business/2019/jul/23/fever-tree-loses-its-fizz-as-cool-start-to-summer-knocks-back-sales

https://motelcompany.com/Fever-Tree-We-d-say-T-G

Thank you for listing my Substack as a source.

Any chance you may be interested in doing a write up on celsius? Would be keen to hear your take on prospects