GOOG 0.00%↑ stats

Market Cap = $1.72 T

EV = $1.6T

FCF = $65.66B

FCF Yield = 3.54%

EBIT = $85.30B

EV/EBIT = 18.75

ROIC = 24.6%

Reinvestment Rate = 68.63%

ROIC * Reinvestment Rate = 16.88%

Introduction

There might not be blood in the streets, but there’s certainly fear. Google is down 15% from recent highs. Time for a deepdive.

Google (Alphabet), is a name that needs no introduction. It’s synonymous with the internet and feels like it has been around just as long. So what’s the purpose in focusing on a $1.7 trillion dollar company?

Despite a 58% annual gain in 2021 share price, Google is trading at a EV/EBIT of 18.75, likely 18 forward.

At a P/E relative to S&P500 of 0.9 (historically above 1) and several under reported assets, can Google still be considered cheap?

The Business

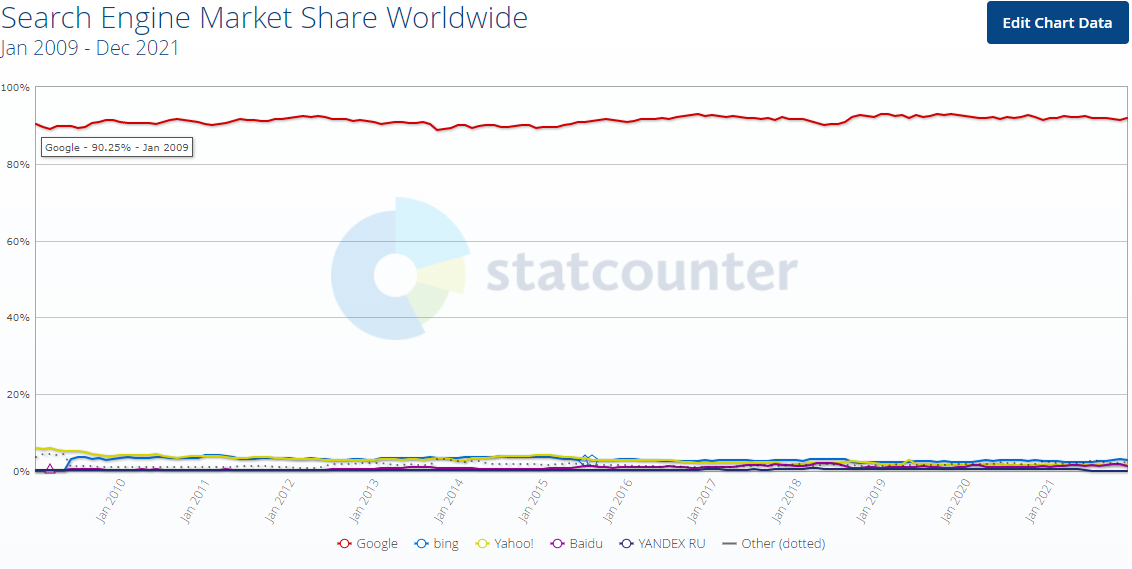

Google dominates the internet. I am writing this on Google Docs, via Chrome and sourcing information through Google Search. There’s no doubting their moat. Google Search owns 90% of the marketplace.

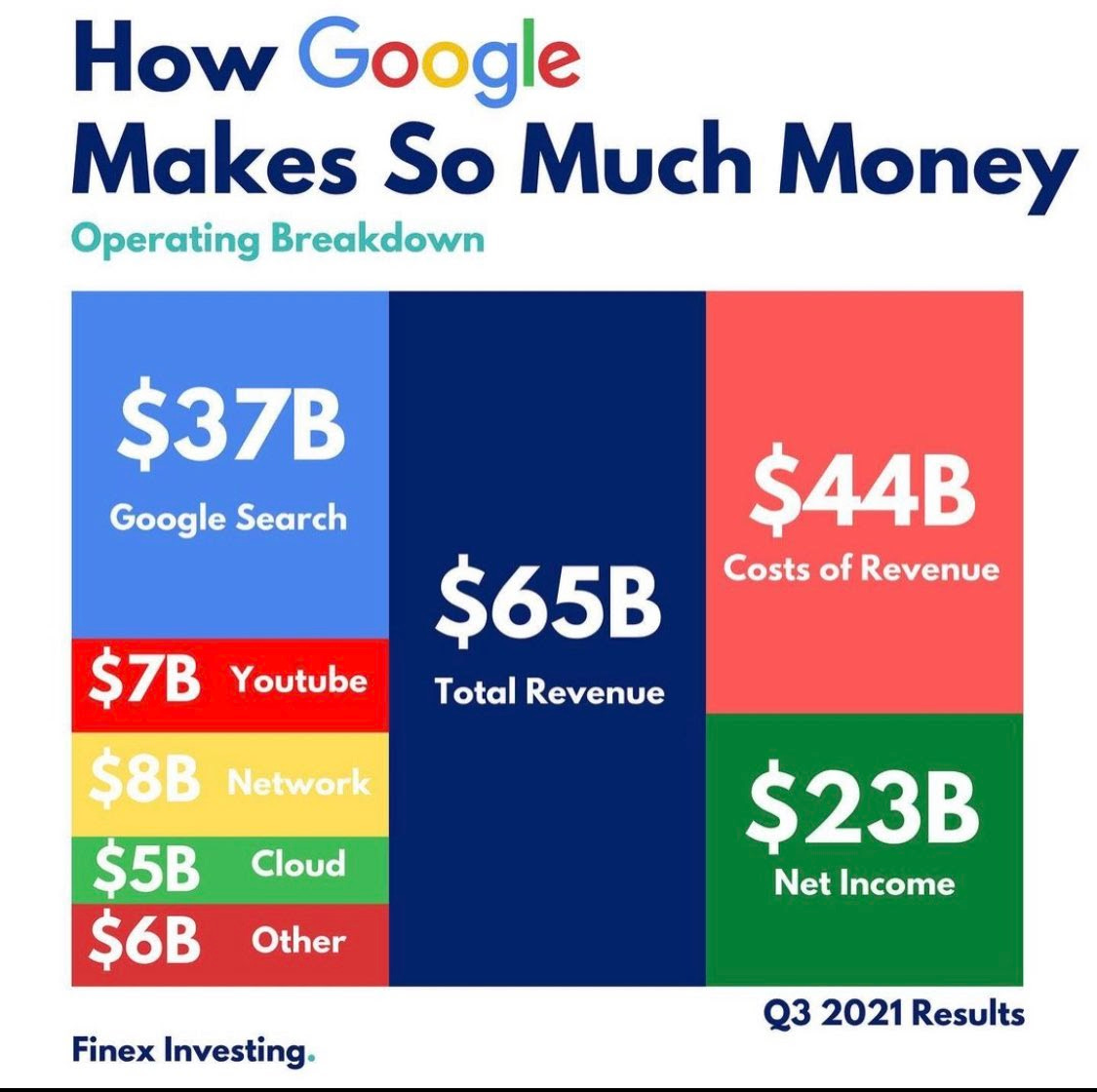

Google segments their income into three key sections; Google Services, Google Cloud and Other Bets. Both Google Cloud and Other Bets achieved cumulative losses of over $10 billion.

In 2021 Google saw revenue grow by 45% to $182 billion. Google Search contributed to nearly 60% of total revenue. Significant growth was recorded in YouTube ads (57%) and Google Cloud (48%) segments. Google’s enormous size doesn’t appear to be slowing it down.

Google Services

Google Services consists of Google’s core business; Google Search, Youtube, Ads, Play and so on. Google Services revenue grew by 11% in 2020 to $168.64 billion.

Over 71% of Google's advertising revenues came in through its Search business in 2021. Moreover, Google Search accounted for roughly 58% of the company's total revenues last quarter.

Search

Google owns 90% of the global market share search across all devices. This figure has barely shifted in a decade. Search is so utterly dominant that competitors seem to have given up on attempting to disrupt the market (famous last words).

Whilst Search continues to dominate, Google will print money that can be used to invest in other areas of the business.

It’s worth drawing attention to the fact Google reportedly paid Apple $15 Billion in 2021 to remain the default search engine on Safari. This payment ensured Google was not outbid by Microsoft’s Bing. Google is beholden to Apple. As payments shift closer to $20 billion it’s possible that Google will revisit this strategy or be challenged by regulatory action.

Chrome, Google’s internet browser (you’re likely using it to read this), is reported to have over 3.2 billion users and a dominant market share of 65%! Chrome saves Google from paying royalty fees to other browsers, whilst funnelling users towards Search.

Google’s Search business is, in its most basic form, a cost-per-click business. Search’s revenue can be broken down to volume of clicks multiplied by the average cost per click.

On a recent Invest Like the Best episode, Sridhar Ramasway, highlighted that Google has essentially maximised the number of search queries and price per click. Ironically, Ramasway, could be a genuine disruptor of the Search monopoly. He’s the founder of Neeva, an ad-free, private search platform.

As global device users begin to stagnate the only way to increase revenue is to increase ad load, a move that could be detrimental for the long term. For this reason, Google’s investments in moonshots may create new platforms that will increase the user ad load and drive revenue.

Youtube

Having acquired Youtube for $1.65 billion in 2006, the platform is now on track to generate $30 billion annually. According to Interbrand, Youtube has a brand value of over $20 billion, ranking it as the 26th most valuable in the world.

For any regular Youtube user it’s obvious that Google is maximising the platform with ads. Saber Captial’s John Huber believes that viewing so many ads in Youtube is due to overstuffing the platform which could result in the alienation of users.

It’s no secret that Youtube is pushing a premium subscription. In 2021, YouTube surpassed 50 million music and premium subscribers, paying around $10 a month. With $6 billion in annual revenue, it would be fair to assume that Youtube views their long term strategy as a subscription business rather than ads platform.

Android

Android now boasts an enormous 3 billion active devices. Android is a mobile operating system that Google purchased for around $50 million dollars in 2005. Android powers all Samsung devices alongside Xiaomi and Google’s own pixel.

In 2021 Samsung devices made up 20% of global smartphone share, with Xiaomi holding 13%. This allowed Android to maintain its comfortable lead over Apple, with their 1.65 billion active iOS and macOS devices

The biggest advantage of operating 3 billion devices is that they also own the app store, Google Play. This results in Google taking a 15% (reduced from 30% in 2021) of all in-app sales.

It’s not entirely clear how much revenue Google generates from Android. In 2016, in a court dispute with Oracle, it was reported that Android generated $31 billion in revenue and $22 billion in profit.

Google Play generated gross revenues of approximately 48 billion U.S. dollars, an annual increase of about 23 percent, compared to the previous year. Still, this figure trails the $85 billion Apple generate through their App Store.

Google Cloud

Google was late to the party with Cloud, a rare misstep. Cloud revenues increased by $4,141 million from $8,918 billion in 2019 to $13,059 in 2020. That’s a 46% increase. However, Google Cloud made a loss of $5,607 billion in 2020. Some analysts claim that Cloud is not even priced into Google’s market cap.

Cloud generated $13,059 billion of revenue in 2020, 7.1% of total revenue, but a 46% increase since the prior year. Cloud is a minnow in comparison to AWS & Azure (both around the $50 billion mark in 2020), and based on this appears to be largely ignored. Q3’s reporting demonstrated that Cloud narrowed its quarterly loss to $644 million, versus $1.21 billion in the prior year.

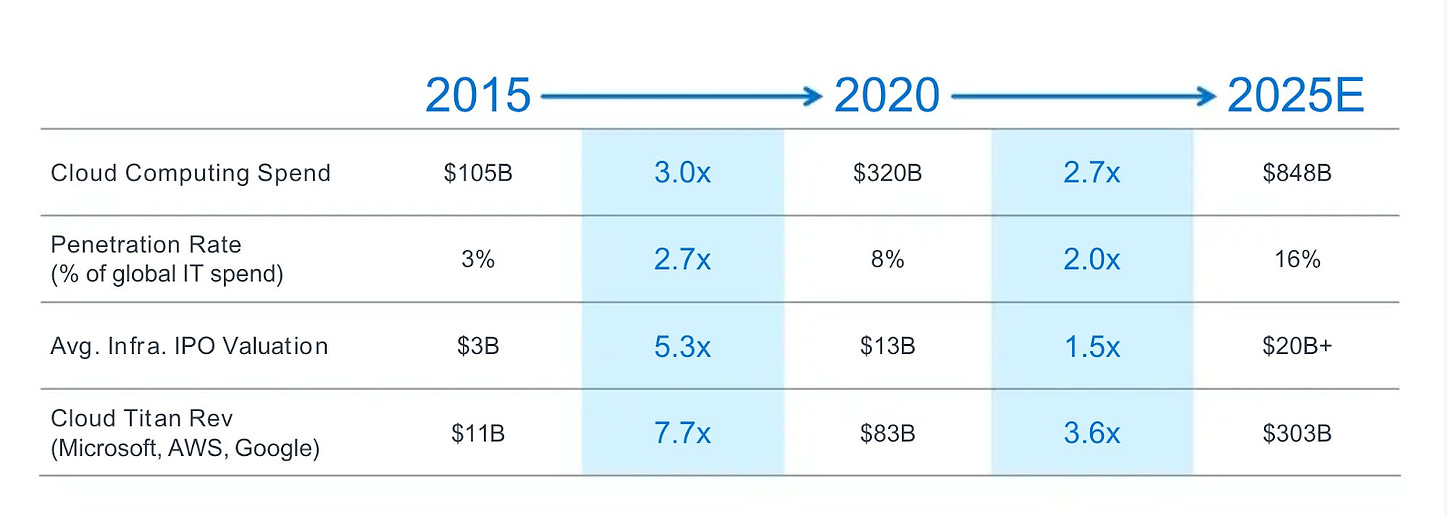

Growth in cloud could be an ace in the hole for Google. Some forecasts anticipate that global cloud services will surpass $1.3 trillion in revenue by 2025 while sustaining a compound annual growth rate (CAGR) of 16.9%.

In 2020, the largest cloud providers (AWS, Azure, Google) generated revenues of approximately $83 billion, whilst the entire industry generated around $320 billion. A 4x growth in revenue could see Google’s Cloud revenue shift to $80+ billion, assuming they maintain their market share. Ambitious, but not unreasonable.

Other Bets

The section of the business Alphabet described as ‘Other Bets’ generated only 0.6% of total revenue and made a loss of $4,476 billion in 2020.

Other Bets has allowed Alphabet to spin off, create or invest in companies under their umbrella.

Alphabet invests in start-ups through GV (formerly Google Ventures), and in later-stage and pre-IPO companies through CapitalG.

In the first-quarter earnings report of 2021, Alphabet reported a net gain on equity investments of $4.75 billion, representing 22% of Alphabet’s pre-tax income. Using a very crude calculation, the S&P 500 grew by approximately 7% in the first quarter of 2021. If Google’s investment portfolio tracked similar growth, there’s a possibility that it could be worth approximately $65 billion.

Under-reported, Intangible Value

In his Counterpoint Global Insights article ‘One Job’, Michael Mauboussin demonstrates how intangible investments, such as R&D, are incorrectly expensed because of outdated accounting practises. This, in turn, leads to operating income being understated.

He highlights that “Cost of goods sold reflects the direct costs of producing the good or service a company sells. Intangible investments are largely going to be found within selling, general, and administrative (SG&A) costs, which capture costs not directly related to making a good or providing a service”

In 2021, Google spent approximately $33 billion on SGA and $30 billion on R&D. To use a very abbreviated version of MM’s calculation (sorry Michael), Google’s total amortised intangible investment was approximately $7.98 billion. If you add this back into Google’s income of $72 billion, it increases it $80 billion, an increase of almost 10%.

In a 2021 interview with Brown University, Bill Nygen made the following comment - “if you subtract off of Alphabet’s current market price an estimated value for all those non-earning assets and then add back the income statement losses to what they’re earning in search we believe that you get left.”

The Snap Test

David Gardner, co-founder of the Motley Fool, tests companies by exposing them to a Thanos style snap. If, in a "snap," they disappeared, how affected would society be?

Here are a few quick stats for Google’s business: -

There approximately 5.6 billion searches every day

Gmail has over 1.5 billion users (the nearest competitor is Outlook’s 400 million)

Almost 5 billion videos are watched on Youtube on a daily basis

There are 3 billion reported Android users

Google Drive has over 1 billion users

Google Maps has over 1 billion monthly users

Without even getting into Google Cloud, it’s fair to say that society would be in disarray if Google’s services disappeared tomorrow.

Bear Case

Management Spending on Moonshots (and purposely missing) - Terry Smith, of Fundsmith, highlighted that Google has made 235 acquisitions, most of which have failed. Interestingly, he offered the insight that Google may be purposefully closing down these acquisitions to kill future competition. Peter Thiel has also focused on Google’s inabitly to innovate due to their size, whilst using Search and Youtube to stifle competition.

Stuffing the funnel - Both Sridhar Ramasway and John Huber have highlighted Google stuffing their advertising funnels across both Search and Youtube. Without additional channels, Google’s advertising revenue stagnates.

Apple moving into search - Google reportedly pays Apple $15 billion a year to maintain their position as the default search engine across Apple devices. This keeps Bing out but also prevents Apple from building their own Search function. As the FANNGs continue to search for every dollar to maintain their enormous market caps, it is not unrealistic that Apple could being to pursue their own search functionality across their 1.6 billion devices.

Government Regulation - Similarly to Facebook, Google could be at risk of being broken up by the US government. In 2020, Senator Ted Cruz called Google “larger and more powerful than Standard Oil was when it was broken up by the antitrust laws”. Their anti-competition practices and monopolistic relationship with Apple could catalyse this.

Bull Case

Utter dominance - Google is in a duopolay with Facebook. Startups spend almost 40 cents of every VC dollar on Google, Facebook, and Amazon advertising. Google is a tax on the internet. Search, Android, Youtube, Gmail, and Chrome are all market leaders.

Cloud, the secret weapon - Cloud revenues are predicted to grow at a 4x. Although considerably smaller than AWS and Azure, Google Cloud is narrowing it’s losses and growing at a rate of 41% YOY.

Unaccounted for intangible investments - Both Mauboussin and Nygen highlight separate scenarios in whish Google is under-reporting earnings, making Google even cheaper than the current 18.75 EV/EBIT suggests.

Conclusion

Google is one of the most dominant businesses of the this century. Surely growth can only stagnate?

Amazon receives plaudits for deferring earnings by massively overspending on R&D. Amazon’s R&D spend as a percentage of revenue in 2020 was 11%, Google’s was 15% (with a considerably better operating margin). This is not a company that is resting on its laurels. There’s still a lot more growth available.

Google’s P/E relative to the S&P500 is at some of the cheapest levels since the financial crisis (this could be because the S&P500 is in nosebleed territory).

Over the past 10 years, on an annual basis, Google has increased revenues by 19%, cash flow by 18.7% and earnings by 23.5%. How can a $1.7T company continue at those for a further decade? Historically, there is little evidence to suggest that smaller companies outperform larger ones.

Based on a decade of growth, Google may be a safe haven for investors as the market tremors. February's Q4 earnings report, announced on Tuesday (01/02/22), will be decisive.

-DB.

As always, DYOR!