Simply Wall St DCF Valuation €462

Secret Sauce DCF Valuation = €453

Metrics (as of June 2025)

Market Cap = €237.79B

EV = €265.41

FCF = €13.37B

Price / Sales = 2.80

P/FCF = 17.78

FCF Yield = 5.62%

Debt / Equity = 0.34

EBIT = €19.30B

EV/EBIT = 13.75

Topline Summary

Formed in 1987 from the merger of Moët Hennessy and Louis Vuitton.

Bernard Arnault became the leading shareholder and CEO in 1989.

At the 76 year old remains the CEO and chairman.

Combination of 75 heritage fashion houses and brands.

Generated a group revenue of €84.68B euros for 2024 (down 2% YoY).

Introduction

With over 75 maisons (brands) in the company portfolio, LVMH is the world’s largest and most diversified luxury goods conglomerate, with positions across multiple businesses, including fashion, leather goods, jewellery and specialist retail.

The group was founded in 1987 through the merger of Louis Vuitton and Moët Hennessy and has grown into one of the Europe’s largest companies.

The chairman and CEO, Bernard Arnault, has been the architect behind the group since 1989 and owns approximately 48.6% of LVMH through his holdings in Dior.

Headquartered in Paris, the company’s brands are globally recognised. The decentralised structure of the business has allowed each of the masions to maximise performance within their own niches, with operating profits being returned to the parent company.

As a result, the masions are able to build close relationships with customers, make fast decisions, remain entrepreneurial, all without requiring sign off from the management.

LVMH has used profits to acquire heritage brands of cultural significance, most of which are hundreds of years old. The oldest brand, Le Clos des Lambrays, dates back to the 14th century. LVMH has repeated and perfected this playbook to become the €240 billion behemoth it is today.

The company balances heritage with innovation, leveraging the global reach of brands like Louis Vuitton, Dior, and Tiffany while continuously acquiring and revitalising others.

This expansive ecosystem allows LVMH to shape trends, access multiple customer segments, and remain diversified in the face of market fluctuations.

The group’s success over the past decades has been helped by several global tailwinds that have fundamentally reshaped the luxury market. One of the most impactful has been the increase in wealth across Asia, with Chinese consumers becoming key customers.

As Chinese consumers have grown richer and more globally connected, their appetite for luxury goods has expanded. This trend has been especially pronounced among upper-middle-class consumers and high-net-worth individuals, who view luxury purchases as symbols of status and identity.

For LVMH, this has translated into increased demand across their flagship brands, particularly Louis Vuitton.

The rise in female purchasing power has dramatically reshaped the customer profile within the luxury industry. Historically, luxury was often marketed toward men or framed as gifts for women. In today’s market, women make purchasing decisions and have higher levels of disposable income. LVMH brands have adapted by adapting products, marketing and experiences that resonate with changing clientele.

Millennials and Gen Z have become a significant customer base, with their outweighed cultural influence throughout the media. LVMH has actively embraced this shift, investing heavily in digital transformation, exclusive collaborations and social media.

These combined approaches have ensured that LVHM has remained at the forefront of luxury almost 40 years.

History

In 1984, Arnault secured an opportunity from the French government's to acquire the bankrupt Boussac Saint-Frères group for $15 million. This acquisition included Christian Dior, which had never fully recovered following the death of the founder in 1957.

Following the acquisition, Arnault divested the majority of the group's assets to focus solely on revitalising the fashion house. Dior transformed from a loss-making entity to a profitable venture, generating over $100 million in free cash flow annually.

LVMH was formed in 1987 through the merger of Louis Vuitton and Moët Hennessy to stave off hostile takeovers. In 1988, Arnault, in partnership with Guinness, acquired a 24% stake in LVMH, eventually gaining majority control of the company a year later.

What is Luxury?

"Luxury is the only sector that deliberately seeks to reduce accessibility in order to increase desirability." - The Luxury Strategy

Before delving into the the LVMH empire, it’s important to understand what exactly is luxury? Luxury, as described in The Luxury Strategy, is not simply about price or status - it is a world built on a dream, created through craftsmanship, vision and time.

Historically, luxury products were exclusively tailored for the aristocracy. Businesses like Hermes and Ferrari, shouldn’t exist at the scale they are at - but globalisation and growing affluence, particularly in China, has allowed luxury companies to thrive and scale like no other point in history.

Based on Bain estimates, the market size for personal luxury goods is around $374 billion, add luxury cars ($500bil), hospitality ($200bil), and other luxury services and that market is closers to $1.5 trillion.

At the core, true luxury has no one single element. Luxury is where art meets commerce, with the skill of the craftsman similar to that of an artist. Products are hand-crafted with both skill and emotion, rather than mass produced.

For consumers, luxury is more than the accumulation of possessions or achieving higher status, it is about experiencing something unique and transcendent. Luxury brands are selling a dream, that has to maintain even after the product is purchased.

Luxury is deeply rooted in centuries of heritage, drawing meaning from history rather than trends. It takes time, with most luxury brands at least 100 years old. Luxury exists in limited supply as scarcity creates demand.

Premium means pay more, get more in functional benefits. Luxury is elsewhere: it signals the capacity of the buyer to transcend needs, functions, or objective benefits. The Luxury Strategy

The perceived value of luxury goods is higher than the actual value of the product or service. In fashion terms, luxury sits above the mass market and includes high-end ready-to-wear and accessories.

The power of luxury also often stems from the presence of one uncompromising, visionary or genius at the helm—someone who imposes a singular artistic or cultural vision on the brand. Bernard Arnault recognised this when he empowered the genius of designers including Marc Jacobs, John Galliano and Alexander McQueen.

On the occasions when licensing does happen, is tightly controlled. If it is not, the brand’s prestige is threated and risks damaging the luxury element. Licensed products are often used as ‘entry level’ products for consumers who wish to be associate with the brand but are not yet affluent enough to purchase a core product.

Overall, LVMH is a dominant company in the global luxury industry but second largest, behind Hermès. Hermès, focuses on exclusivity, with a single brand and narrower product range.

Business Segments

LVMH leverages the deep history, tradition, and craftsmanship of its brands to attract luxury consumers. The group invests heavily in innovation, particularly in marketing, digital transformation, and sustainability.

The group has expanded its reach globally, particularly in emerging markets like China and India, which are key drivers for future luxury consumption.

As of the end of 2024, LVMH operated a global retail network of over 6,300 stores, reflecting a strategic expansion across various markets and brands.

LVMH controls around 60 subsidiaries that manage the 75 luxury houses. In addition to Louis Vuitton and Moët Hennessy, the portfolio includes Christian Dior, Givenchy, Fendi, Celine, Kenzo, Tiffany, Bulgari, Loewe, TAG Heuer, Marc Jacobs, Stella McCartney, Sephora and Loro Piana.

In 2024, group generated gross and operating margins of 67% and 23.1% respectively.

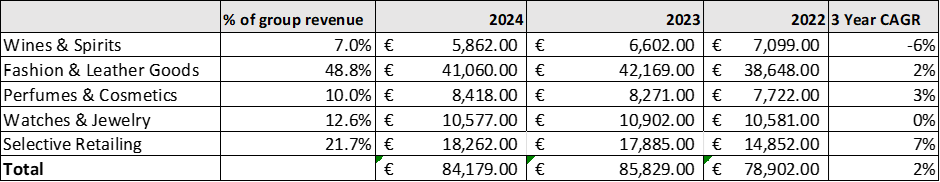

The business is segmented into five core areas -

Selective Retailing

Fashion & Leather Goods

Wines & Spirits

Perfumes & Cosmetics

Watches & Jewellery

These combined segments generated over €84 billion in total revenue in 2024, with Fashion & Leather Goods accounting for nearly half of LVMH's entire business.

LVMH does not publicly disclose revenue figures for individual brands. However, it's widely recognized that Louis Vuitton is the group's most significant revenue driver.

Fashion and Leather Goods - 49.8% of sales -77.8% of total operating income.

This is LVMH’s largest and most profitable division and includes Louis Vuitton, Dior, Fendi, Loewe, and Celine. It dominates the group’s performance and income. Fashion and leather goods remain the largest segment (49%) for the groups and contribute 77% of profitability.

LVMH holds a group of brands that are primarily French, but also include Italian, Spanish, British, German and American companies.

The Louis Vuitton leather goods collections are exclusively produced in workshops located in France, Spain, Italy and the United States, with footwear and ready-to-wear production undertaken in France and Italy.

Louis Vuitton, in particular, remains a significant revenue driver, with its handbags and accessories in high demand globally. The operating margin for this segment is notably high, reflecting the pricing power and brand equity.

The Louis Vuitton brand

In 2022, Bernard Arnault stated that the the LV brand’s annual revenue had surpassed €20 billion, with industry estimates in the region of €22-25B for 2024. With an operating margin of approximately 37%, the LV brand generates conservative operating income of approximately €8.5B or 43% of the group’s total operating income.

Handbags create a higher frequency of use, which enables LV to cross-sell multiple designs to individual customers - generating repeat busienss.

A decade ago, LV saw the risk of overwhelming the market with canvas handbags and opted to push bag prices higher, reducing demand, while offering entry-level consumers lower-priced products in small leather goods and newly introduced fragrances, including eyewear and beauty products.

First launched in 2007, the Neverfull was an immediate hit, and remains one of the most popular LV items. According to Vestiaire Collective, the style remains Louis Vuitton’s second most popular bag, after the Pochette. The Pochette retails for £1,230, with the Neverfull coming in at £1,430.

Dior - Christian Dior Couture encompasses the fashion, accessories, and haute couture divisions—generated approximately €8.5 billion in revenue in 2024. This represents a decline from €9.5 billion in 2023, a peak achieved under the creative direction of Maria Grazia Chiuri .

The Dior shoes and ready-to-wear collections are produced in France and in Italy, with watches manufactured exclusively in Switzerland.

In 2017, LVMH completed a restructuring that brought the Christian Dior fashion house—referred to as Dior Couture—fully under the LVMH umbrella. Prior to that, Dior Couture was owned separately by Christian Dior SE (the Arnault family holding company). Following the deal, LVMH now owns 100 percent of the Christian Dior brand's operating business, including the fashion, leather goods, and accessories.

Wine and Spirits: - 7.0% of sales - 6.7% of total operating income.

Over the past decade this division has suffered a noticeable decline in revenue, with a pull back from €7.10B in 2022. 2024 marked consecutive year of decline. 2023 it saw revenue for its wine and spirits business down to €6.60B from the €7.09B in 2022.

Profits were also the hardest hit in 2024 in comparison to all other divisions, falling from €2.10B in 2023 to €1.35B 2024 – a 36% decline.

Representing 7% of LVMH's total revenue, this division includes brands like Moët & Chandon, Veuve Clicquot, and Hennessy. Diageo owns a 34% stake of this segment - a remnant of the original acquisition.

LVMH’s market share of the champagne market amounted to 22.6% in 2024. The Company is the world leader in cognac, with particularly strong positions in the United States and China.

Hennessy cognac stands out as a top-selling product, particularly in markets like the United States and China. This segment includes single malt distilleries such as Glenmorangie and Ardbeg.

Perfumes and Cosmetics - 10.7% of sales - 3.3 % total operating income.

Driven by brands including Parfums Christian Dior, Guerlain, Acqua di Parma, and Fenty Beauty, this segment leverages strong crossover with fashion and digital retail. It has benefited from celebrity partnerships, social media, and a growing demand in beauty.

As of December 31, 2024, there were over 700 directly operated Perfumes and Cosmetics outlets.

Watches and Jewellery - 12.4% of sales - 14.6 % operating margin

Contributing over 12% to LVMH's revenue, this segment includes brands Bulgari, TAG Heuer, Hublot, and Tiffany & Co. (acquired in 2021). Tiffany has been a major growth driver post-acquisition, delivering close to $1 billion in income whilst targeting a younger and global audience.

Bulgari's high jewellery collections and TAG Heuer's timepieces are among the top-selling products.

Selective Retailing - 20.6% sales - 6.9% of total operating income.

The Selective Retailing segment includes Sephora, a leading selective beauty retailer; Le Bon Marché, a Paris department store and travel retailer Duty Free Shoppers (DFS), which caters specifically to international travellers.

This area of the business makes up approximately 20% of LVMH's total revenue. Sephora, in particular, achieved significant growth in 2023, with a 20% increase in sales to €17.9 billion. While the operating margin is lower compared to other sections, the volume and global reach provide substantial cash flow and future opportunities.

Sephora has more than 3,000 stores in 35 countries worldwide with 52,000 employees. Since opening the first US store in New York’s SoHo neighbourhood in 1998 the brand has grown to over 500 stores across the Americas.

Other Activities

The loss from “Other Activities” was €617 million in 2024, compared to €409 million in 2023.

This segment includes Groupe Les Echos, which publishes leading French news titles, and Royal Van Lent, a builder of high-end yachts sold under the Feadship brand and the Belmond Hotel group.

LVMH acquired Belmond for $3.2 billion in 2018 to strengthen its presence in luxury hospitality. The Belmond group owns several landmark properties, including the Hotel Cipriani in Venice and the iconic Orient Express train. This acquisition complemented LVMH’s existing hotel portfolio, which includes Cheval Blanc in Courchevel and Bvlgari Hotels.

Regional Distribution

In 2024, LVMH's revenue distribution by geographic region of delivery was as follows:

Asia (excluding Japan): €23.25 billion (27.5%)

United States: €21.55 billion (25.4%)

Europe (excluding France): €14.54 billion (17.2%)

Japan: €7.48 billion (8.8%)

France: €7.01 billion (8.3%)

Other countries: €10.86 billion (12.8%)

While Asia (excluding Japan) remained the largest contributor to LVMH's revenue, its share decreased from 31% in 2023 to 28% in 2024, primarily due to weakened consumer spending in China.

Japan's contribution increased by 2 percentage points to 9%, and "Other markets" rose to 13%. The United States, Europe and France remained stable at 25%, 17%, and 8%, respectively.

Supply Chain & Distribution

LVMH's store count has grown consistently in an effort to secure further customers in new markets. While exact regional store counts are not specifically publicised, LVMH's increasing number of stores highlights the strategy to capture market share and meet consumer demand across global geographies.

This expansion is evident the Selective Retailing segment of the business, notably through Sephora, which has been a significant driver of store openings. Sephora alone operates approximately 3,000 stores worldwide, contributing substantially to LVMH's retail footprint.

In addition to Sephora, LVMH has focused on expanding presence in key markets through flagship stores and innovative retail concepts. For example, the 2023 reopening of Tiffany & Co.'s "The Landmark" was not just a store re-launch but a hub of architecture, service, art and design.

Approximately 95% of LVMH sales come through direct retail, with only 5% through wholesale. LVMH was at the forefront of of building a own store network without wholesale, with a focus on controlling the entire value chain. This is a core strategic priority has allowed the group to retain high retail margins, and guarantees strict control of the brand image, sales reception and environment that the brands are sold.

At the end of 2024 LVMH had 6,307 stores. The venues are always in prime locations, and many are a designed in styles closer to art galleries rather clothing outlets.

As of 2024, Louis Vuitton has twenty‑nine leather goods workshops – eighteen in France, four in Spain, four in the United States and three in Italy. The tanneries manufacture most of the Maison’s leather goods.

Louis Vuitton’s supply chain is a curated ecosystem that reflects the broader strategy of vertically integrating production across the portfolio. Since the early 2000’s, LVMH has responded to increased competition in the luxury sector by acquiring suppliers. This strategy has allowed to the business to ensure consistent quality, provide access to scarce materials, and offers protection against supply disruptions.

The Louis Vuitton brand has steadily acquired key partners and subcontractors into its own chain, rather than relying on third-party producers. This began with the creation of a joint venture with Masure Tannery in 2009—an established leather supplier since the late 1980s. In 2012, LVMH acquired Tanneries Roux, one of France’s last heritage calfskin tanneries, which added another layer of control to Louis Vuitton’s operations, reflecting an ongoing shift from outsourcing to ownership.

The control extends beyond leather. In the watch segment, LVMH strengthened it’s production capabilities by acquiring two manufacturers of cases and dials in 2011, reinforcing a foothold in the high-stakes Swiss watch industry.

Crocodilian leather, a hallmark of exclusive Louis Vuitton items, is sourced through LVMH’s involvement in Heng Long tannery, a Singaporean enterprise the group joined in 2011 and which has become one of the world's leaders in this niche.

Even hardware components have been brought in-house, as evidenced by LVMH’s 2021 investment in Jade Group, a metal parts manufacturer with sites in France and Portugal.

These strategic investments and acquisitions ensure that the business maintains not just creative direction, but control of the supply chain— a critical element in the luxury market where exclusivity and traceability are essential.

Acquisitions

LVMH has achieved consistent growth both organically and through acquisitions. Growth through M&A is typically unsuccessful, with 70-90% of acquisitions ending in failure.

LVMH has a track record of acquiring heritage brands and optimising them by leveraging the group’s combined knowledge in marketing, distribution and retail. The LVMH management team are experts in the growth and optimisation of luxury brands.

This playbook has been repeated to create a flywheel effect - with successful acquisitions being optimised and scaled, with profits being returned to headquarters to be re-invested further.

The approach ensures value from acquisitions is realised efficiently, as evidenced by their largest acquisition of Tiffany & Co (Tiffany).

The $15.8B Tiffany Acquisition

LVMH's largest acquisition to date was the 2020 public buyout of Tiffany – the almost two-centuries-old American jewellery maker known for iconic turquoise boxes. In late 2019, the French luxury giant offered Tiffany’s shareholders $135 per share in cash.

After lowered bids, lawsuits, and the pandemic fallout, the deal finally closed at $131.5 per share, or $15.8 billion, at the end of 2020– saving LVMH around half a billion dollars.

During the Q4 2022 earnings call, Arnault revealed that Tiffany’s profit had doubled in the two years since the acquisition, to around $1 billion in earnings. Profit was $541.1m in 2020 - suggesting it was over $1B in 2022, or 5% of the group’s profits. In 2022, Tiffany's revenue was approximately $5.6 billion, with 2025 revenue is projected to be $7.4 billion. This suggests a compound annual growth rate of approximately 9.7% between 2022 to 2025.

Marketing and Branding

LVMH positions its products through emotions that are tied to heritage and craftsmanship. The campaigns rarely push products directly; instead, they create aspirational worlds through storytelling, cinematic visuals, and cultural references.

Each brand touchpoint is curated to evoke elegance and prestige, reinforcing the strategy that luxury is not bought for utility but for meaning.

The group maintains a careful balance between exclusivity and scale. While brands are globally accessible in high-end retail locations, LVMH deliberately limits product availability, avoids discounts, and tightly controls distribution.

Marketing budgets are substantial, but rather than mass-market media, the group invests in selective placements, high-end fashion shows, and content that builds mythology—like short films, archival storytelling, and brand museums. This strategy ensures each label retains its own identity and prestige.

According to Interbrand, the Louis Vuitton brand was valued at $50.9B in 2024, with Tiffany ($7.3B) and Sephora ($7.2B) also making the top 100 list.

In addition, the Louis Vuitton was ranked as the world’s most valuable luxury brand by Kantar BrandZ Most Valuable Global Brands. The leather goods brand has held this position since the Kantar BrandZ global rankings first launched, with an estimated brand value of $124.8B.

LVMH has embraced e-commerce and social media while maintaining control over the online messaging. The groups creates immersive digital experiences that aligns with each brand's ethos. Dior’s hosts virtual fashion shows, Louis Vuitton’s collaborates with digital artists, and TAG Heuer’s has experimented with Web3. The content remains high-end, intentional, and never too ‘available,’ preserving the aura that defines true luxury.

Celebrity partnerships play a crucial role in LVMH's brand marketing, despite most luxury brands tending to avoid celebrity endorsements.

LVMH has learned to leverage these partnerships to align their brands with global trendsetters and influencers. The business focuses on long-term, curated collaborations to delivery brand alignment. Rihanna’s partnership with LVMH resulted in the launch of Fenty Maison, the first new house created by LVMH in decades.

Pharrell Williams’ was appointed as Creative Director for Louis Vuitton Menswear in 2023, as move that blurred the lines between artist, celebrity, and designer. William’s first show was a cultural event featured Beyoncé and Jay-Z, and was attended by celebrities including Naomi Campbell, Kim Kardashian, and Rihanna.

Management and Owners

Bernard Arnault

Since 1989, Bernard Arnault has been the architect behind the growth of LVMH.

Arnault's strategy is reminiscent of Warren Buffett's investment philosophy, focusing on acquiring undervalued assets with strong brand equity. He recognised the potential in luxury brands that had lost prestige.

His strategy has been to implement a model that emphasised brand autonomy, craftsmanship, and exclusivity. This approach allowed each brand under umbrella to maintain a unique identity while benefiting from the group's resources and management. .

His strategy has involved bold acquisitions, often aggressive acquisitions - LVMH was the first in a long line - talent management (securing the very best designers), whilst maintaining exclusivity and quality.

Despite criticism for his aggressive and occasional ruthless approach, under Arnault's leadership LVMH has delivered an average total shareholder return of 13% per year, significantly outpacing the STOXX 600 index's 3% return since 1989.

In 2023, Arnault extended the company’s CEO age limit to 85, signalling his intent to remain at the helm for another potential decade.

The Arnault family

The five Arnault children—Delphine, Antoine, Alexandre, Frédéric, and Jean—have been placed strategically across LVMH’s portfolio. Delphine Arnault is now CEO of Christian Dior Couture, Antoine oversees communications and is CEO of Berluti, while Alexandre, Frédéric, and Jean have been part of Tiffany, TAG Heuer, and other group companies. This hands-on approach may be viewed as nepotism, but will allow the Arnault family to retain control and stewardship of the business long after the current CEO has moved on.

This succession plan is structured less like a handover and more like a dynasty (play the Succession theme tune here). Bernard is yet to announce a clear successor, but he has set up a system where performance, loyalty, and alignment with LVMH’s core values will likely determine who ultimately leads.

Delphine Arnault has been the Chairman and CEO of Christian Dior Couture since February 2023. She was previously the Executive Vice President at Louis Vuitton and Deputy Managing Director at Dior. She sits on the board of LVMH and is known for launching the LVMH Prize to support emerging designers.

Antoine Arnault is the Head of Communications, Image and Environment at LVMH, Chairman and CEO of Christian Dior SE (the holding company for the Arnault family's LVMH stake), and Chairman of Loro Piana. He was formerly CEO of Berluti and led communications at Louis Vuitton. He created the ‘Les Journées Particulières’ event to showcase LVMH’s craftsmanship to the public.

Alexandre Arnault is Deputy CEO of Moët Hennessy as of 2025, and oversees product and communications at Tiffany & Co. He was previously Executive Vice President of Product and Communications at Tiffany & Co and CEO of Rimowa, where he led a major brand revamp.

Frédéric Arnault will become CEO of Loro Piana in June 2025. He was previously CEO of TAG Heuer and later CEO of LVMH Watches, where he played a key role in repositioning TAG Heuer as a tech-forward, luxury watch brand.

Jean Arnault, the youngest, is Director of Watches at Louis Vuitton. He has led the revival of Louis Vuitton’s watchmaking unit, pushing into high-end horology. He studied at Imperial College London and MIT, and also worked briefly at Morgan Stanley before joining LVMH.

Groupe Arnault owns about 97% of Christian Dior SE, which in-turn owns approximately 41% of LVMH's share capital and 57% of voting rights. Additionally, the Arnault family holds an additional 7% of LVMH's shares. This, effectively means that LVMH is controlled by the Dior group, including the Arnault family.

Christian Dior SE still exists as an independelty listed company on the Euronext Paris stock exchange. In essence, it's a holding company where value and income are derived from its ownership of LVMH shares. It does not separately report revenue from selling luxury goods, because it no longer owns the fashion house. The profits that Christian Dior SE reports largely come from the dividends it receives from LVMH and the capital gains associated with its holding.

Investor’s have the opportunity to purchase shares in Christian Dior SE as a discounted bet on LVMH, with the same exposure but through a different vehicle.

Other Interests

L Catterton is a private equity firm with a distinct and strategic relationship with LVMH. It was formed through a 2016 partnership between Catterton Partners (a U.S.-based consumer-focused private equity firm), LVMH, and Groupe Arnault . This joint venture created L Catterton, a global consumer investment platform that combines financial firepower with deep luxury expertise, effectively serving as a growth engine and investment arm aligned with LVMH’s broader strategic interests - or a testing bed for future acqusitions.

LVMH and Groupe Arnault together own approximately 40% of L Catterton. This structure allows L Catterton to operate independently while leveraging the insights, brand-building expertise, and global network of LVMH. L Catterton uses LVMH’s consumer intelligence and retail acumen to guide investments, while LVMH gains early exposure to emerging consumer trends and fast-growing brands that may fit into or complement its luxury portfolio.

Over the years, L Catterton has invested in a wide range of premium and lifestyle brands across sectors including beauty, wellness, apparel, food & beverage, and fitness—often targeting companies that aspire to the level of brand equity that LVMH brands command. Notable investments include Birkenstock (which LVMH and L Catterton later helped take public), Peloton, Equinox, Gentle Monster, Ganni, and The Honest Company. These investments reflect a broader strategy: while LVMH itself focuses on timeless, ultra-premium luxury, L Catterton explores the fast-evolving landscape of premium consumer goods—as both a a scouting tool and a growth accelerator.

Moncler: LVMH partnered with Remo Ruffini, CEO of Moncler, by acquiring a 22% stake in Double R, the parent company of Moncler. This investment allows LVMH to appoint board members and supports Ruffini's vision for the brand's future.

Tod's: L Catterton acquired a 36% stake in Tod's, an Italian luxury shoe and bag maker. This investment aims to rejuvenate the brand while allowing the Della Valle family to retain control.

Our Legacy: LVMH Luxury Ventures, the conglomerate's investment fund, acquired a minority stake in Swedish fashion label Our Legacy.

Mykita: LVMH's eyewear division, Thélios, announced a minority investment in German eyewear brand Mykita, known for its innovative designs.

Competitive Landscape

Hermès is the benchmark for luxury. The French leather-goods company has long stood apart from conglomerates. As a monobrand, the business maintains uncompromising craftsmanship, scarcity, and independence. While LVMH operates across a broad luxury spectrum, Hermes occupies the ultra-luxury space almost exclusively.

The iconic Birkin and Kelly bags regularly command five-figure price tags and are rarely available on demand. This reinforces the philosophy of exclusivity rather than scale or visibility. The company’s limited production, and vertical integration has preserved a magic, leading many to view Hermes as the ultimate standard in true luxury.

In many ways, Hermes is the opposite to LVMH - the family fended off a hostile take over attempt by LVMH in 2010. This steadfastness highlights the differences between the two businesses. LVMH views brand expansion and diversification as strategic strengths whilst Hermes priorities exclusivity and generational continuity. Although floated on the French stock exchange, the business remains a family-controlled entity. This ensures that Hermes continues to set itself apart from the rest of the luxury field.

Chanel is another unique force in the luxury landscape, operating as a privately held company under the ownership of the Wertheimer family. This structure gives Chanel the freedom from quarterly earnings pressure, meaning that the company can build for the long term, without satisfying short term shareholder expectations.

The flagship fragrance, Chanel No. 5, and the iconic Chanel 2.55 bag are global symbols of luxury. Chanel remains a monobrand that has made record investments in craftsmanship and boutiques, highlighting commitment to its luxury strategy.

Kering, the French luxury group is best known as the owner of Gucci and operates as a smaller counterpart to LVMH, with a portfolio focused largely on fashion and leather goods. Kering maintains a leaner collection of brands with high-margin, high-visibility labels like Saint Laurent, Balenciaga, and Bottega Veneta. Under François-Henri Pinault's leadership, Kering has embraced a modern and occasionally risk-taking brand strategy, which has led to periods of explosive growth—particularly with Gucci under Alessandro Michele’s tenure.

Kering’s strategy and reliance on Gucci has proven to be volatile, with the brand’s sales pulling back 18% in 2024. Kering’s narrower portfolio allows for agility, but lacks the depth and resilience of LVMH’s diversified luxury masions.

Richemont, the Swiss luxury conglomerate behind Cartier, Van Cleef & Arpels, and watchmaking powerhouses like Jaeger-LeCoultre and IWC, is a specialist in the high-end jewellery and horology segments. While LVMH competes through Bulgari and TAG Heuer, Richemont’s offerings are often higher in price and tradition, with a reputation for craftsmanship that appeals to connoisseurs and collectors. It would be a fair comment that LVMH cannot truly compete on the luxury time-piece stage, against the likes of Richemont or Rolex.

Richemont's heritage brands focus on legacy, precision, and heirloom value. The company dominant the global watch and jewellery market particularly in the the ultra-premium segment.

Richemont has historically avoided fashion apparel, instead building a portfolio of maisons that cater to the world’s elite with a subtle, enduring elegance. The company has also made notable digital investments, including a majority stake in Yoox Net-a-Porter.

In comparison to LVMH, Richemont employs a precision approach, with less visible to the general public, but instead is strategically focused on high-value clients.

Bull Case 🐂

Own the chain - LVMH is a vertically integrated manufacturer that controls the entire value chain—from production through to distribution and retail. This allows the company to own and tailor the customer experience. This integration ensures complete pricing and margin control, with all products sold at full price through the retail network. This model safeguards brand equity and provides opportunity for controlled strategic expansion.

Brand Equity - The Lindy effect suggests that the longer a brand has existed, the longer it is likely to endure—contributing to both pricing power and sustained demand. Many of LVMH’s brands are centuries old, with Château d'Yquem dating back to 1593 and Moët & Chandon founded in Épernay in 1743. This deep heritage reinforces their perceived value and authenticity. In fast-growing markets like China, where new wealth creation is accelerating, middle-class consumers are naturally drawn to megabrands such as Louis Vuitton and Dior—names they associate with prestige, quality, and cultural cachet. This exposure ensures that LVHM becomes the first mover in many newly wealthy markets.

Scale - In a largely fixed-cost industry like luxury, scale is a powerful driver of profitability. Greater scale allows for higher margins or increased discretionary spending, particularly in areas like marketing, retail and personnel, where the strongest brands can reinforce their dominance through spending.

With more resources at their disposal, LVMH can maximise consumer awareness and market penetration, often becoming the first to enter and establish themselves in new markets. The business’s scale allows the company to achieve greater returns while allocating a smaller proportion of sales to marketing or retail efforts.

Scale offers strategic resilience, with diversified portfolio of brands protected against economic shocks or public backlash in a way that monobands can fall victim to - consider the Adidas fallout from the Kanye West controversy.

Scale also enables access to the best talent and raw materials, further strengthening brand equity. LVMH exemplifies this advantage by attracting and rotating top executives and designers thoughtout the company’s fashion houses. This practice fosters innovation and ensures that each brand remains both independent and relevant.

lastly, LVMH’s established global distribution can be expertly utilised to plug in or accelerate the growth of newly acquired brands.

Family Interest LVMH aspires to be a multigenerational company, with shareholders effectively investing alongside the Arnault family in a long-term vision. This alignment signals stability and deep-rooted commitment, reinforcing the sense of permanence that underpins many of the brands.

However, the family-forward approach also invites scrutiny around governance and succession planning. In 2023, shareholders approved an extension to the age limit for chairman and CEO Bernard Arnault, enabling him to remain in the role until 85. While this decision supports continuity, it stands in contrast to peers like Richemont and Prada, which have taken more deliberate steps to prepare for leadership transitions. Outside the luxury sector, examples like Warren Buffett’s handover to Greg Abel at Berkshire Hathaway highlight the importance of clear succession strategies in sustaining investor confidence over the long term.

Bear Case 🐻

Scale - Due to the sheer scale of LVMH, continued growth risks overexposure and the dilation of brand equity. Brand awareness outpacing sales growth is a key factor of the luxury approach, however, the key question is whether LVMH (Louis Vuitton in particular) can continue to grow whilst remaining a luxury brand.

At what point does luxury shift to the realms of fashion? Louis Vuitton’s best-selling products, the Neverfull and Pochette, are widely available and lack the scarcity that underpins the allure of ultra-luxury items like Hermes’ Birkin or Kelly bags.

If ubiquity replaces aspiration, the brand’s long-term pricing power and prestige could be at risk.

Reliance on the Louis Vuitton - The resilience of the Louis Vuitton brand has been a cornerstone of LVMH’s success, enabling the group to consistently deliver strong revenue and profit growth - reinvesting the profits that the LV brand generates.

Louis Vuitton alone accounts for roughly a quarter of the group’s revenue and an estimated 40–50% of operating income—highlighting the brands outsized contribution. This level of dependence also poses a risk. While Dior carries some of the growth burden, the need for other brands to break out is becoming increasingly clear.

The recent pullback at Gucci—a sales declined during Q1 2024 of 18%—illustrates that no top-tier brand is untouchable.

Reliance on China - LVMH’s heavy reliance on China represents a key vulnerability to the growth strategy, particularly with recent macro challenges and tensions.

Chinese consumers—both domestic and international—account for a significant share of global luxury market, especially for brands like Louis Vuitton and Dior.

While the post-COVID rebound has fuelled strong sales, this dependence creates exposure to macroeconomic volatility, shifting government policy, and rising nationalism.

The recent slowdown in Chinese consumer spending, whether due to economic softness, regulatory pressure or US tariffs, could materially impact LVMH’s growth in the future.

As demand in China weakens, the group may struggle to offset the shortfall elsewhere, particularly given the maturity of Western markets and the slower development of other emerging economies.

Breaking the rules of luxury - LVMH has achieved outstanding growth by pushing the boundaries of traditional luxury and even venturing into brand creation—something that was historically avoided in favour of acquiring established houses with deep heritage.

The launch of SírDavis, a new bourbon developed in partnership with Beyoncé and Moët Hennessy, represents a significant strategic shift aimed at leveraging celebrity influence to tap into new demographics. This follows the commercial success of Fenty Beauty with Rihanna, which expanded LVMH’s reach into younger and more diverse consumer segments.

However, these ventures carry heightened reputational and execution risk. Unlike acquired maisons with centuries of heritage, new creations lack brand equity and must build it from scratch. SírDavis, for example, has so far received mixed reactions, raising questions about authenticity and long-term appeal.

Partnering with celebrities can backfire—recent allegations against P. Diddy, a long-time of Ciroc Vodka - highlight how quickly public perception can turn, with potentially damaging consequences.

In an era of heightened scrutiny, a misinterpreted Tweet or mis-timed photograph in these high-profile partnerships could undermine LVMH’s carefully curated image and expose the group to backlash or boycotts.

Conclusion

There’s debate as to whether LVMH, at its current scale, still embodies ‘true’ or ‘ultra’ luxury. Unlike Hermes, where scarcity and craftsmanship are intertwined to set the benchmark, LVMH has embraced a more accessible model—particularly through brands like Louis Vuitton.

The addressable market for luxury is still expanding, especially in Asia. China remains the cornerstone of growth, accounting for a substantial portion of global luxury consumption. Despite near-term macroeconomic headwinds, the long-term opportunity remains intact.

With just 17% of China’s population considered upper middle class or above as of 2023, the room for growth is significant. India if often dubbed the ‘next China,’ and is gaining traction. Although India’s luxury market is currently a fraction of China’s, it has an increasing middle class who can offer meaningful opportunities in future decades. Africa still lags in terms of luxury, but offers a longer-term frontier. Markets like Nigeria, Kenya, and South Africa are witnessing an increase in wealth, and with the right investment in retail and digital ecosystems, LVMH could be well-placed to capture early demand as the first mover.

LVMH’s unique strength lies in its diversified portfolio, spanning fashion, cosmetics, jewellery, watches, and wines and spirits. This allows the conglomerate to remain resilient even when certain categories, brands or regions face cyclical slowdowns.

The emphasis on heritage, storytelling, and brand equity provides a moat that premium and mass market competitors struggle to replicate. However, the company has reached a scale where organic growth and incremental acquisitions no longer move the needle in the same way.

LVMH now resembles a luxury version of Berkshire Hathaway, with a sprawling portfolio of high-margin, high-brand-equity businesses, but without the same capacity to capture meaningful growth acquisitions. Arnault may require an investment reminiscent to that of Buffet’s 2016 Apple investment.

That is unless the likes of Chanel, Hermes and Richemont ever become genuine acquisition targets. In that scenario, LVMH may be the only buyer to complete the purchase with the scale, capital resource and brand alignment - assuming it is not blocked due to monopoly concerns.

One of the looming questions for investors is what happens when Bernard Arnault steps down. While LVMH is technically a public company, Arnault has been the architect and visionary behind it for the past four decades.

Arnault built the empire himself, carefully guiding each acquisition and brand evolution. Although his children are increasingly involved in the business, it remains to be seen whether they can achieve and execute the same strategic vision their father has delivered for so long. Perhaps long term mangers, such as former CFO, Jean-Jacques Guiony, could be better placed to take the reigns when Arnault eventually does step down.

The transition from founder-led to family leadership will be one of the most critical moments in the company's history. How smoothly that handover occurs could ultimately define whether LVMH continues its reign as a luxury conglomerate or evolves into a different business entirely.

Regardless of near term headwinds and future uncertainty, LVMH shares remain relatively cheap, with a forward PE of only 19 times earnings. Having gained only 17% (excluding dividends) in the past 5 years, this could be as good a time as any join the family on a luxury investment journey.

Sources and Further Reading / Listening

https://www.vanityfair.com/news/1999/07/lvmh-gucci?srsltid=AfmBOorVzJpv4pyYV0nlcOuceN1pLmr57oeC-tXdNcjxgKvPsQWZSWfn

https://www.lvmh.com/jp/investors/investors-and-analysts

https://www.acquired.fm/episodes/lvmh

https://quartr.com/insights/company-research/the-luxury-empire-lvmh-s-most-notable-acquisitions-since-inception

https://www.vanityfair.com/news/1999/07/lvmh-gucci?srsltid=AfmBOorVzJpv4pyYV0nlcOuceN1pLmr57oeC-tXdNcjxgKvPsQWZSWfn

https://elegance-suisse.ch/project/lvmh/

https://www.businessoffashion.com/opinions/luxury/how-lvmh-dominates-the-luxury-business/

https://www.36one.co.za/articles/lvmh-best-in-class-capital-allocation

https://joincolossus.com/episode/billinger-the-wolf-in-cashmeres-maison/

https://lvmh-com.cdn.prismic.io/lvmh-com/Z-PY3HdAxsiBv6wN_UniversalRegistrationDocument2024.pdf

Related Substack Articles

- - -

Valuation is quite nice

Love your work mate! Great write up