MANU 0.00%↑ Key Metrics

Market Cap = $3.10B

EV = $4.7B

FCF = $(34)m

ROIC = (8.3)%

EBIT = $(121.2)M

P/S = 5.3

Introduction

Football (soccer) is the world’s most popular sport. No longer viewed as a poor man’s game, players are paid millions and billionaires are flocking to purchase clubs.

The 21/22 season revenue for the 20 English Premier League clubs was £5.5 billion, up from £3.35B just 8 years ago.

Owning a top-flight football club in Europe is like owning a piece of art. Typically, only the super rich can afford it and it’s not entirely obvious how much the asset is worth. Any purchase risks a greater fool approach.

Football teams are notoriously unprofitable and success on the pitch is never guaranteed. This has not stopped several clubs from becoming listed on global exchanges.

Few teams command more global presence than Manchester United. The club has hordes of loyal fans, with Old Trafford’s 75,000 capacity sold out weekly.

Man Utd are the forth highest earning football team in the world, with 21/22 season revenues of £583.2m.

United are listed on NYSE with a $3.5B market cap. Since listing, the price has barely budged in a decade. The Glazer family own 69% majority.

In 2022, Roman Abramovich completed the sale of Chelsea Football Club to a group led by American businessman Todd Boehly, for a reported £2.5B. This was arguably a distressed sale due to Abramovich’s assets, as Russian national, being frozen. Since the Chelsea acquisition, Man Utd have been put up for sale.

The Glazer family purchased Manchester UTD in 2005 for £790, utilising a leverage buyout. The family are seeking at least £6 billion. On the 28th of April, it was reported that the final offers had been received after a third round of bidding.

The Club

Manchester United was founded in 1878, originally called Newton Heath. The club is one of the most successful in English football and the fans expect trophies.

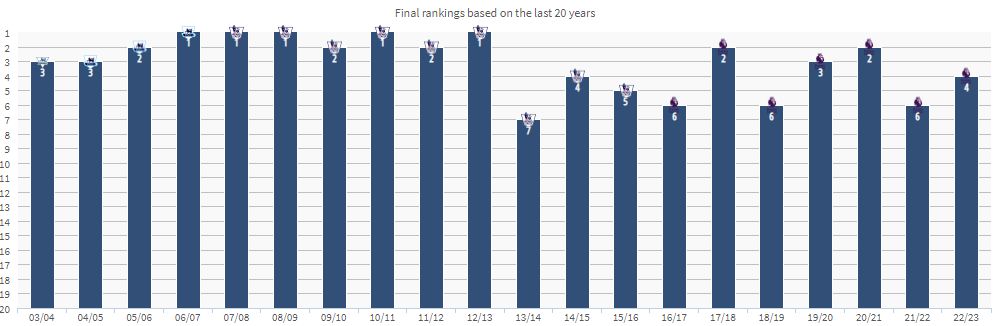

This century’s achievements can largely be attributed to Alex Ferguson, the manger of 26 years who won 38 trophies. Since Ferguson retired in 2013 the club’s success has dwindled.

The club have failed to qualify for the Champions League on five occasions since 2013, resulting in reduced revenues. A fundamental requirement for any new owner is a top four finish. Without it the club will miss out on lucrative European income, reduced sponsorship (in the case of Adidas) and inability to attract top talent.

The poor results on the pitch are not a reflection on the teams expenditure on players or wages.

Net player spend over past 5 seasons was a combined £-(540.23). Man Utd has the 2nd highest transfer deficit in the Premier League.

22/23: £-203.26m (2nd)

21/22: £-99.5m (6th)

20/21: £-56.45m (2nd)

19/20: £-134.87m (3rd)

18/19: £-45.8m (6th)

The club also posted the second highest wage bill in the league (just behind Chelsea) of approximately £384m for 21/22.

Poor investments in players and a regular churn of managers looking to rebuild the squad in their style, have led to poor results on and off the pitch. Since Ferguson retired the club has dismissed 5 permanent managers and 3 temporary. This is not conducive to building long term success.

Local rivals Manchester City appointed current manager Pep Guardiola in 2016. City have been rewarded with 9 trophies under Guardiola. The Abu Dhabi owners have made significant investment since 2012 and the club has achieved dominance in England. In contrast to United, City are the world’s top earning football club with £619.1m in revenue, the 10th highest net player spend £-(224.97)m and £354m wage bill.

Not all plaudits may be justified, with City charged with breaking financial fair play rules around 100 times over a nine-year period, between 2009 and 2018.

If United had achieved success on the pitch during the Glazer’s tenure, it’s unlikely protests would have been as hostile. However, mediocre planning and recruitment have resulted in a mismatch of high expenditure with poor results.

The Glazer Family

Malcom Glazer, the patriarch of the family, made his fortune through business acquisitions and mergers. He purchased the Tampa Bay Buccaneers in 1995. Following his death in 2014, his 69% holding was split between six children.

The Glazers have concentrated voting power through a separate class of share. Class A shares are sold to the public whilst Class B shares are held by the Glazers. The Glazer shares count for 10 votes per 1 listed share. Through ownership of the Class B shares, the Glazers represent 97% of the total voting rights.

Before the Glazer ownership, United had been debt-free since 1931. That changed with the 2005 takeover.

Between 2003 and 2005, Glazer bought out various shareholders to complete a leveraged acquisition. The debt was secured against the club.

An initial debt of around £550m was loaded onto the club, peaking at more than £700m in 2010. Around the time supporters launched the first “green and gold” protests - a throw back to the original “Newton Heath” colours of the club.

The fans have regularly condemned Glazer ownership, with to annual interest repayments of £30-40 million, plus regular dividend payments since 2016. No other football club is known to pay out dividends. During the ownership, the club’s stadium and training facilities have fallen into a state of disrepair.

It’s been estimated that to enhance the stadium and Carrington training facility would cost £1B to £1.5B.

This investment is required to remain competitive with recently improved facilities of Manchester City and Tottenham Hotspur.

Income

The difference with Man Utd and other clubs is they mostly operate at a profit. The club has been profitable 8 of the last 10 years.

Premier League clubs generate income through ticket revenue, broadcasting rights, direct sponsorship and licensing. The more successful the team is on the pitch, the higher the revenue generated. 21/22’s revenue was £583.2m.

21/22 Premier League income :-

League position: 6th

Equal share: £79m

Facility fees: £25.4m

Merit payment: £39.8m

Commercial revenue: £5.6m

Total: £149.8m

Matchday ticket revenue is essentially guaranteed. Old Trafford’s capacity is 74,310 and matchday revenue equates to approximately £4m per match. A record 2.3 million tickets were sold for the 22/23 season. Manchester United boast a waiting list for over 135,000 season tickets.

An increase in the stadium capacity from 75,000 to 100,000 could generate an additional £30m per season.

Player registrations are recognized as intangible assets. When a player is sold, this is recognised as profit on an intangible asset. United are typically a ‘buying club’, who make little from player sales.

Commercial revenue generated £257.8m in 2022. The club signed a 10 year sponsorship deal with Adidas in 2015 worth £75m per year. Front of shirt sponsor, TeamViewer spend a reported £47m per season.

One area United have excelled is licensing and partnerships. On their website the club boasts almost 50 commercial sponsors.

Outgoings

United held the second highest wage bill in the league. In the past decade the club has paid players such as Cristiano Ronaldo and Alexis Sanchez up to £500k per week.

Due to failings on the pitch, the club is attempting to cap weekly wages at £200,000 per week to ensure all members of the first team are paid more equally. Goalkeeper, David DeGea is reportedly having to take a wage cut on a potential new contract.

Man Utd spent a reported £215m on transfers in the summer of 22/23, second only to Chelsea FC.

A transfer fee is amortised over the course of the players contract. Most clubs tend to use forms of creative accountancy to ensure they are not in breach of Financial Fair Play regulations.

The majority of the £384m of employee expenses can be attributed to the players and management staff.

The club encountered exceptional items for 2022, with £24.7 million compensating the departure of managers Ole Gunnar Solskjaer and Ralf Rangnick. During the most recent earnings report, CFO Cliff Baty stated that “club wages which were up 19.1%, in line with expectations following significant play investments made last summer.” Wage increases were likely linked to Cristiano Ronaldo’s salary.

In 2022 the club saw increased operating expenses as fans returned to the stadium after the pandemic.

Man Utd made a considerable loss in 2022, but have have been profitable 3 years out of the past 5 years. A structured wage cap, reduction in interest payments and increase in stadium capacity could lead to recurring profitability, a draw for any potential buyer.

Potential Buyers

With a £6 billon price tag, there are only a handful of individuals who can match a lofty valuation. There appears to be two serious public bids with a third option of offered by hedge fund Elliot Management.

It’s not clear if the £6 billion asking price is for the club or only the Glazer’s stake. If the £6 billion equates the Glazer’s stake, the total value of the club is £8.7B!

In April 23’ the Glazer’s pushed for a third round of bidding. Rival bidders have been asked by Raine Group, the firm handling the sale, to submit their final offers by the end of the month.

Finnish entrepreneur Thomas Zilliacus, dropped out of the bidding, highlighting the continued delays would make it difficult for a new owner to build a winning team during the summer.

Sir Jim Ratcliffe

The founder of the petrochemicals company Ineos, Ratcliffe was born in Failsworth, Greater Manchester. He’s worth a reported £10 - 25 billion, depending on the source and has been hailed as the UK’s richest man on a number of occasions.

The structure of any acquisition is not clear, with Ratcliffe having stated he will not lumber the club with any fresh leverage, but is unlikely to clear the clubs current debt. He’s aiming to purchase the Glazer’s 69% stake, rather than the club outright.

Ratcliffe is a sports enthusiast who owns owns French Club OGC Nice, Swiss FC Lausanne-Sport and cycling Team Sky, among other ventures.

In more recent developments Ratcliffe has proposed purchasing 51%, with about 20% remaining in the possession of Avram and Joel Glazer.

Sheikh Jassim bin Hamad Al Thani

Little is known about Sheikh Jassim, other than he is the chairman of Qatar Islamic Bank and leads a potential Qatari bid. Jassim has promised to clear any debt whilst further investing in the infrastructure. Sheikh Jassim’s father is Jassim bin Jabr Al Thani Hamad, a former Prime Minister of Qatar who oversaw the country’s $230 billion sovereign wealth fund.

The BBC noted that “the offer from Sheikh Jassim is around £5bn and includes one figure that would go direct to the sellers.”

Although Sheikh Jassim is the face of the bid, it’s likely that this is a state funded purchase. With Saudi’s recent acquisition of Newcastle United and Man City owned by Abu Dhabi, perhaps Qatar are looking to plant a flag in the Premier League?

Concerns have been raised regarding a Qatari owner’s continued investment in the woman’s team. Only founded in 2018, the team is top of the Women’s Super League and on track to win their first top-tier title.

Both public bids hold some level of controversy with Ratcliffe and Qatar being accused of ‘Green Washing’ and ‘Sports Washing’ respectively.

It emerged, after the bidding deadline, that Ratcliffe’s valuation of the club was higher than Sheik Jassim’s, albeit for a majority share rather than 100% ownership.

Partial Sale

A third reported option is a partial sale by the Glazers to raise funds and buy-out disinterested siblings.

US hedge fund Elliot management, who previously owned AC Milan, and the Carlyle Group are reported to be open to supporting a leveraged buyout or purchasing a minority share.

With division among the Glazer siblings, it’s been suggested that only Joel and Avram would remain invested. Kieran Maguire, author of the Price of Football, reported that due to the share structure, if Joel and Avram were to remain they would retain 75.8% of the voting rights, despite only owning 24.8% of the shares. If this result were to come to fruition, fan protests would likely intensify.

Valuation

A £6 billion valuation appears lofty considering Man Utd’s $3.5B market cap and losses over the past 2 years. Buyers are predominantly purchasing intangible assets and optionality, rather than guaranteed future cash flows.

The current market cap highlights a potential arbitrage opportunity, particularly if 100% of the club was sold for £8.7B. That’s a 300% mark up!

With some sensible financial stewardship United can generate consistent profitably. There are several opportunities that could bode well for a potential buyer.

Man Utd has global appeal, the most recent earnings reported 220 million followers, 8.5 billion video views and 2.8 billion engagements across social media, the highest of any global sports team. A new owner has to monetise the audience to make any investment worth while. In a world were IP is more important than ever, are we on the brink of unlocking the true earning potential of football?

UEFA is considering a salary and transfer cap in 2025 that would ensure “clubs spending on transfer fees and salaries must be no more than 70 per cent of their revenue.” This would reduce outgoings whilst ensuring Man Utd remain competitive, based on their high revenue generation.

In the Premier League, 8 of the 20 teams have American owners. Could American owners drive the Premier League in the direction of the NFL to make it more profitable? American owners may be looking to generate cashflow instead of funding a financial black hole. Majority owners could introduce salary caps, redistribute revenues or improve broadcasting.

To draw comparison to the 2022 Walton-Penner acquisition of the Denver Broncos for $4.65 billion. In the 2021 season, the operating income of the Denver Broncos was at $143m, valuing the team at a P/E of 32.5. Not cheap, but by no means frivalous.

What does the future hold?

With most things in football, there are no guarantees. New manager, Erik ten Hag, appears to be steadying the ship and has the support of the fans. In his first season he’s won Man Utd’s first trophy since 2017. With the right backing he could go on to conquer Europe. Alternatively, with overly involved owners, his approach could be hindered.

If Chelsea’s recent acquisition is anything to go by, fans must be comparing their outlays to poor results. Qatar’s Paris Saint Germain owners have spent heavily to bring in the likes of Messi, Neymar and Mbappe but never achieved European success.

Owners who have the financial baking are by no means qualified to run a football club. Jim Ratcliffe is leading the race to acquire the club, with the Glazers maintaining a minority stake. However, United fans continue to push for a full sale only.

Only time will tell how the sale of Manchester United plays out.