NKE 0.00%↑ Metrics

Market Cap = $147.28B

EV = $148.74B

FCF = $4.88B

FCF Yield = 3.31%

ROIC = 17.76%

EBIT = $5.92B

EV/EBIT = 25.13

Introduction

Founded in 1964 by Phil Knight in Oregon, Nike was originally called Blue Ribbon Sports. What started as a company focused on the distribution of running goods, the brand has gone on to consume the entire sportswear market.

Nike holds a near monopoly over the athletic, sport and leisurewear. It generates over double the revenue of nearest competitor, Adidas. After some weak quarters, the share price has pulled back to 2019 levels.

The branded athletic shoe market is reported to be worth $130 billion, with 16 billion serviceable feet in the world. Nike has a presence in almost every sport including Basketball, Football, Soccer, Baseball, Golf, Tennis, Athletics and Skateboarding to name a few.

The company is in the process of making an almost decade long shift to direct-to-consumer. This is enhancing margins and improving customer engagement.

History

In 1964, Knight began as a distributor and importer of Tiger Shoes (now Asics) from Japan. His co-founder, Bill Bowerman, was a renowned track coach for Oregon State University. He trained sixteen sub-4-minute-mile athletes and was known to be eccentric. Bowerman famously poured polyurethane into a waffle iron (the waffle iron remains on display today), to prototype the first Nike waffle shoe.

“If you have a body, you are an athlete.” - Bill Bowerman

Knight and Bowerman originally split the shares in the company 51% / 49%. Bowerman would sell the majority of his shares back to Knight prior to the IPO.

Running and fitness were on a huge uptrend in the US when Blue Ribbon Sports entered the market. Bowerman quite literally wrote the book on running, aptly titled Jogging.

Nike's first ever shoe was a soccer cleat, released in 1971. This led to a fallout with Tiger Shoes and ended up in court. The split led to the creation of the first sneakers, the Waffle Racer and Cortez, in 1972.

Following the split with Tiger, Blue Ribbon Sports rebranded itself as Nike. Phil Knight initially wanted to call the company "Dimension 6," but Jeff Johnson, got the inspiration for Nike after seeing the Greek goddess of victory's name in a dream. The name was only meant to act as a stop gap for the launch of the first cleats, but it stuck.

The “Nike Principles” were famously written by Rob Strasser and posted around the office in 1977.

In 1979 Nike introduced patented "Air" technology with the Tailwind shoe. The company went public in 1980 with a market cap of $400m.

Most Recent Earnings

Nike’s fourth quarter and full year ended May 31, 2023. Annual revenues were $51.2 billion, up 10% compared to prior year and up 16% on a currency-neutral basis.

• Fourth quarter reported revenues were $12.8B, up 5% compared to prior year.

• Nike Direct reported revenues were $5.5B, up 15% YoY.

• Wholesale reported revenues for the fourth quarter were $6.7B, down 2% YoY.

• Gross margin for the fourth quarter was a decrease of 140 basis points to 43.6%.

• Diluted earnings per share was $0.66 for the fourth quarter compared to down 27% compared to prior year.

The Business - Nike Inc.

Today, Nike Inc is the largest sports apparel company on the planet, third in the fashion sector to only LVMH and Hermes. As of 2023, Nike Inc generated $51B of annual revenue, an increase of 10% YoY.

The business is segmented into the three brands; Nike, Jordan and Converse. The Nike brand was responsible for 82%, Jordan for 13% and Converse for the remaining 5%.

Nike is in the midst of a decade-long transformation, shifting towards a direct-to-consumer model. Currently, more than 40% of sales are direct, while the rest are generated by wholesale and retail channels.

Footwear is the driving force behind Nike's business, contributing to 68% of revenue, followed by 28% from apparel and less than 4% from equipment. Given that shoes wear-out faster than clothes, the focus on footwear is well-founded.

In 2017, Nike unveiled its "Consumer Direct Offense" strategy, although its roots trace back almost a decade. With 1,048 stores globally (Statista), Nike gains the ability to gather customer data, capture margin and shape the narrative.

Nike's D2C approach is yielding positive results. In the latest earnings report, direct revenues reached $5.5 billion, a 15% increase compared to the previous year. This growth is propelled by a 24% increase in Nike-owned stores and a 14% expansion in Nike Brand Digital.

Nike does not own the production facilities, contracting factories to the manufacture apparel, equipment and footwear. Outsourcing production ensures that cap-ex and investment remains low.

Nike products are manufactured across 41 countries, with the help of 533 factories and 1.1 million workers. Most of Nike's factories are based in Asia, due to the low cost of wages and the ability to produce high quality products for a fraction of the cost of that in North America or Europe. As of November 2022, 155 of these manufactures were based in Vietnam.

Historically, the working conditions of ‘sweat-shops’ got the company into trouble, in particular for employing child labour. Since the early 2000’s the company has installed stricter guidelines with the aim of becoming more transparent and ethical. The company oversees factories, ensuring stringent quality checks, which in turn leads to substantial cost savings. Nike's Air Manufacturing Innovation facility is the only production based in the US.

Post pandemic, Nike experienced significant inventory backlog. As of FY23, Nike has $8.9B worth of inventory due to “higher product input costs and elevated freight costs.” This is down from the $9.7B of inventory reported in 2022.

Nike Brand

Revenues for the Nike Brand were $12.2 billion, up 5 percent on a reported basis and up 8 percent on a currency-neutral basis, with growth across all brands, channels and geographies.

The essence of the Nike brand is embodied by the iconic swoosh adorning each pair of footwear or apparel. The orange shoe boxes are instantly distinguishable from any other sneakers.

Standout shoes include the Nike Air Force One, Tailwind, and the Blazer. It’s notable how older Nike models, which are decades old, remain relevant today.

The following are still top sellers; the Cortez, released in 1972 costs £90 today. The Blazer, released in 1977, today the high top version is around £100. The Air Force 1, released in 1982 as a basketball shoe, retails for £135.

Nike remains at the forefront of innovation with the introduction of ground-breaking athletic shoe releases, including those designed for marathon running.

In 2019, two-time Olympic gold medallist Eliud Kipchoge accomplished the feat of completing a marathon in 1:59:40, breaking the elusive two-hour barrier. He achieved this wearing a prototype of the Nike Air Zoom Alphafly.

Today, Nike defines basketball and is in turn defined by it. The company holds a near monopoly on basket ball shoe market. Management are confident that the brand’s dominance in the sport will only increase and refer to their roster of athletes as ‘the game's greatest.’

Basketball holds profound influence within the US. The game is almost universally accessible and can be played on any street corner. The iconic shoes worn by athletes are aspirational for any fan or amateur. The design of a basketball shoe enables it to transition into fashionable apparel.

2023 was the first time in which all three company brands were represented in the All-NBA first team. With Luca and Jason from Jordan, Giannis from Nike, and Shai Gilgeous-Alexander wearing Converse.

While football (soccer) claims the title of the world's most popular sport, the players wear studded boots/cleats, a design that's trickier to integrate into casual wear. According to Statista, Nike Football is responsible for around 4% of revenue, similar to that of Nike Basketball (excluding Jordan). In 2023 Nike Football grew 25%, almost doubling growth from the prior year. For the Woman’s 2023 World Cup, Nike partnered with more federations in the tournament than any other brand.

The Jordan Brand

In 1984, Nike gave Michael Jordan his own signature line of shoes and apparel, a move that was pivotal in securing his signature. Jordan takes a 5% revenue-share on any goods sold under the brand. Over his lifetime, Jordan stands to make around $5-10 billion from the deal, especially at the current growth rate.

The structure of the deal was revolutionary, with the company creating a shoe around Jordan. Nike had refused to evolve with the aerobics movement of the early 80’s in the US, losing the top selling shoe spot to Reebok.

The Jordan launch catapulted the company back to the top spot. Nike expected to sell $3 million of product over 3 years, but sold $126M in year 1 alone!

The relationship was not always plain sailing. Jordan tried to leave in the 3rd year, after the launch of the poorly received Jordan 2. The improvements on the Jordan 3, the introduction of the ‘Jumpman’ logo on the tongue plus the commercials directed by Spike Lee ensure the relationship was salvaged.

As of 2023 the Jordan brand generates more than $6B in annual revenue, a record total for the brand. Jordan grew over 30% in FY23 with growth across men's, women's, and kids, footwear and apparel and in both North America and International. Jordan is well on its way to becoming the second largest footwear brand in North America.

Based on how Nike reports direct revenue, it’s likely that Jordan brand sales were considerably higher than the $6.6B reported.

Several star athletes are represented by the Jordan brand in their own right. They include Luka Dončić, Jayson Tatum and Zion Williamson. A number have their own signature shoe. Doncic has Jordan Luka 1, Chris Paul the CP3.13 and Russell Westbrook the Why Not? Zer0.4.

Converse

Revenues for Converse were $586 million, down 1% on a reported basis and up 1% on a currency-neutral basis, led by double-digit growth in Asia, offset by declines in Europe.

Founded in 1908, Converse has been a subsidiary of Nike Inc. since 2003. After decades of competing with them, Nike acquired Converse for $309 million.

Today, the company's portfolio include products under the Converse, Cons, Chuck Taylor All-Star, Jack Purcell, One Star and Star Chevron trademarks. Converse also frequently collaborates on special edition product releases with other brands such as John Varvatos.

Converse athletes include basketball players Draymond Green, Kelly Oubre Jr and Shai Gilgeous-Alexander. Between 2015 - 2020 Converse’s growth largely stagnated. Converse is a poor imitation of Nike, trying to borrow from the same endorsement playbook by converting engagement into leisure-wear sales.

Historically a basketball brand, Converse now appeals more to an alternative market, and could be better promoted through other forms of media.

Nike is known for spinning off brands. With Converse’s slowing growth and lack of identity, might the parent company it may look to sell the brand?

Branding

According to Interbrand, Nike is the world's 10th most valuable brand, ahead of the likes McDonald's and Facebook.

Nike has mastered the art of building exceptional brands. Their advertising taglines “Bo Knows,” “Just Do It,” and “There Is No Finish Line” are now part of everyday culture.

The Nike logo is a globally recognized design. The Swoosh has remained almost identical since its inception. In 1971, design student Carolyn Davis, from Portland State University was tasked with designing a logo. Despite initial reservations, Phil Knight ultimately settled on the swoosh design, remarking, "I don't love it, but maybe it will grow on me." Davis was only paid $2 per hour during her tenure at Blue Ribbon Sport and received a total of $35 for creating the logo. Davis did later receive stock at the IPO, reported to be worth around $4m in 2023.

Advertising & Marketing

Phil Knight was once asked if Nike was a product or marketing agency.

The most important thing we do is market the product. We’ve come around to saying that Nike is a marketing-oriented company, and the product is our most important marketing tool. - Phil Knight

Nike, renowned for its innovative products and iconic advertising, has redefined how companies approach marketing. Authenticity is at the core of the company’s adverting campaigns.

A Nike campaign is instantly distinguishable, adverts stir inspiration, motivation, and emotions. They spotlight real athletes, conveying the journeys and stories in ways that inspire the audience. The adverts encourage customers to buy the products and become part of something bigger.

Colin Kaepernick's "Dream Crazy" advertisement is one of the most culturally iconic of the past decade. In the wake of George Floyd's killing and the subsequent anti-racism protests, Nike reimagined their renowned slogan into the "Don't Do It," campaign compelling consumers to confront racism head-on.

Nike's ads are rooted in concepts accessible to all. Their motivation isn't merely about selling sportswear, it's about instilling inspiration.

Nike VS Adidas

Nike’s story is not complete without Adidas. The two brands have been going head to head for 60 years. Their parallel trajectories of innovation and competition have shaped the sportswear landscape.

Compared to fashion industry, which is much more diverse and competitive, Nike and Adidas are less like fashion brands and closer in comparison to Coke and Pepsi. The two dominant players hold an oligopoly over the industry.

Both brands are rooted in athletics, but Nike positions itself as a sportswear brand while Adidas appears to centre around a streetwear and lifestyle approach.

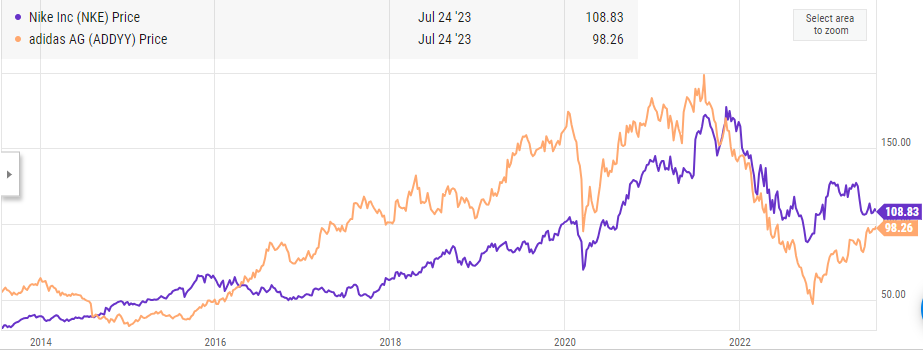

As the above chart shows, Adidas and Nike’s share price returns tend to fluctuate depending on which company is more on tend. The popularity of the brand drives revenue and in turn investor optimism. In recent years, Adidas has struggled to match Nike’s pace. Since 2013 Nike shares have grown by 330%, whilst Adidas have grown 226%.

Adidas was founded in 1949 by Adolf Dassler in Herzogenaurach, Germany. Adidas' origins trace back to Germany, when brothers Adi and Rudolf Dassler established Gebrüder Dassler Schuhfabrik (Dassler Brothers Shoe Factory) in 1924. Pioneering spiked running shoes, they earned acclaim from Olympic athletes including Lina Radke and Jesse Owens. A disagreement between the siblings, lead to the founding of Adidas and Puma. Adi Dassler founded his eponymous brand, which would dominate the running shoe sector for nearly two decades.

Today, Adidas partners with stars outside of traditional sports including musicians, artists and creators. In the 1980s, this was a novel concept. The Adidas Superstar shoe crossed into fashion when hip-hop group Run-D.M.C. began sporting the shoes as part of their signature look. The sneaker was immortalised with their song “My Adidas.” Michael Jordan famously asked Adidas to match Nike’s sponsorship offer as he was so enamoured with the company.

Adidas has affiliations with influencers like Beyonce, Pharrell Williams, plus brand crossovers with the likes of Prada and Gucci. These relationships led Adidas to partner with Kanye West. Although initially fruitful, the association has since turned sour after .

Adidas is currently struggling with a significant downturn due to fallout with Kanye. Formerly signed to Nike until 2015, Kanye West left the brand due to creative control issues. The Adidas Yeezy inventory write-down in 2023 resulted in a staggering $500 million loss for Adidas.

For incumbent players like Nike and Adidas, the challenge isn't about doing more or pursuing the latest trends it's about finding ways stay relevant with the consumer.

Endorsements

Nike acquires new customers through brand exposure and sponsorship on a global scale. Smaller brands simply cannot afford the same athlete endorsement deals. Nike wants athletes who can create emotion and be at the top of their sport for decades.

Athletes are hero like figures - modern day gladiators and demigods. Children hang posters on their walls, advertisers post billboards around cities. This engages customers and creates aspirational demand. The customer participates in the brand story by purchasing an athletic apparel for lifestyle purposes. Every view is a brand impression.

Nike calls their endorsements ‘Demand Creation.’ Demand creation expense was $4.1 billion in 2023, up 5% compared to prior year. Contracts provide bonuses upon specific achievements in an athlete’s sports, such as winning a trophy.

Romanian tennis player, Ilie Nastase was the first athlete to be endorsed Nike when he signed in 1972. Outside of Jordan, the biggest beneficiaries have been Tiger Woods, Kobe Bryant and Lebron James, who signed for Nike in the early stages of their career.

Nike’s roster of athletes is far superior to their competitors. In the most recent earnings call, John Donahoe, referred to their basketball athletes are “the game's greatest.”

Nike have a core-roster of superstars which includes Tiger Woods, Lebron James, Cristiano Ronaldo, Kobe Bryant (posthumously), Giannis Antetokounmpo and Rafal Nadal.

LeBron James signed a 7-year, $87 million deal with Nike in 2003, straight out of high school. 2023 marked 20 years of LeBron’s signature shoe. In 2015, James signed a historic lifetime contract with Nike worth approximately $1 billion.

Kobe famously left Adidas - buying out his contract - to join Nike. According to The Wall Street Journal, Bryant paid $8 million to get out of the remainder of his Adidas contract. Interestingly, Bryant was a free agent during the 2002-03 NBA season. Over the course of 82 games, Bryant wore 65 pairs of Air Jordans, mixed in And1, Converse, Nike, and Reebok shoes.

In football, Nike’s talisman is Cristiano Ronaldo. He signed a $1 billion lifetime contract in 2016, similar to that of LeBron’s. CR7 is Ronaldo’s Nike footballing line.

Focusing on the next generation of greats, Nike secured the signature of Victor Wembanyama, the 19 year old first draft pick in 2023. Is was rumoured his contract was worth around $100m.

Outside of basketball, Nike have secured likely future football greats. Nike have been the official partner of Mbappe since 2006, when he was only 8. Haaland re-signed with Nike after his previous agreement expired in January 2022. The Man City striker will earn over $200m across 10 years.

Nike’s roster is so dominant, it’s surprising when they do not sponsor a world-class player. Messi (Adidas), Steph Curry (Under Armour) and Tom Brady (Under Armour) are the obvious exceptions. Back in 2006, Messi was signed to Nike. However, Adidas offered the then teenager over $1M a year. It was said that his father, and also agent, fell out with Nike after not being supplied with a tracksuit.

During a meeting with Steph Curry, one executive apparently referred to Curry as “Steph-on” and left a ‘Kevin Durant’ slide in the Power Point.

Two things are obvious analysing the roster, the lack of females and the dominance of basketball. Based on Nike’s financials it’s obvious they are under-servicing the women’s market.

However, that approach appears to be shifting. Since 2020 Nike have been dropping high profile male athletes to focus on woman’s football. Nike is the most active brand in terms of this year’s Women’s World Cup endorsements, with 42. Adidas follows with 36.

Interestingly if you consider endorsements in athletes as ‘cap ex’ rather than advertising, Nike’s investments are more similar to an SVOD than a clothing brand. Athletes are the story, quite literally in the case of documentaries such Full Swing and Break Point.

Athletes generate organic engagements across their own social media and time on the pitch. Ronaldo has 600M Instagram followers, LeBron has 158M.

Even if an athlete has retired, they are still signed to Nike in lifetime deals, ensuring their image can be promoted by the company indefinity.

Outside of athletes, Nike sponsors the NBA, NFL & MLB. As part of the arrangement, Nike will continue to supply all 32 NFL teams with uniform and apparel until 2028. The 8 year deal with the NBA is believed to be have cost Nike $1 billion.

According to the New York Post, the 10-year agreement between Nike, MLB and Fanatics is valued at over $1 billion.

Nike do not produce the replica jerseys, this is outsourced to Fanatics. Fanatics produces Nike-branded shirts, whilst Nike focuses on its in-game products for the players.

Nike is also the Official Ball Supplier to the Premier League and has been since the 2000/01 season.

Bull Case 🐂

Unparalleled Scale

Smaller brands cannot compete with Nike using the same playbook. The nearest competition has to double down on a handful of big stars or offer out equity. Nike generates more income and in turn is able to sign the starts of tomorrow. This is leading to growing separation from the competition.

If one superstar has a bad year, (the Adidas Yeezy write-off exemplifies this) a whole product line might have to be scrapped. Nike’s diversified roster insulates them against any public meltdowns or career ending injuries. Arguably, even the Jordan brand has become so much more than the individual.

Shift to Digital

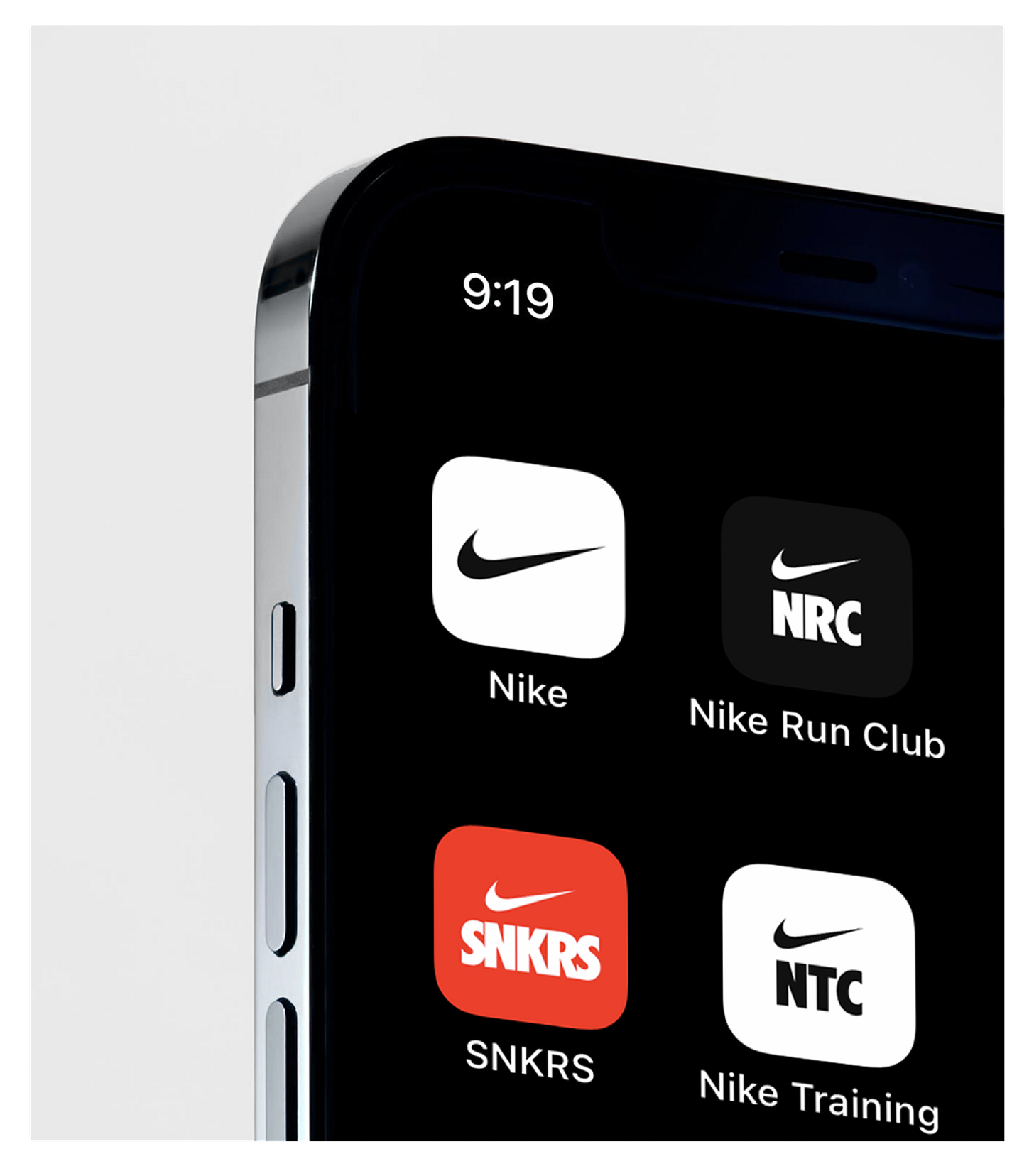

Nike is undertaking a shift to digital, focusing on how it engages with consumers. In 2023 the company experienced robust digital growth of 24%. This trajectory is projected to increase as digital continues to spearhead expansion. The advancement is largely driven by the membership-focused strategy.

Nike is focusing on four mobile apps — SNKRS, the Nike Mobile App, Nike Training, and Nike Run Club. In the past quarter these apps attracted 500 million visitors in the US alone. The emphasis on customization remains a driving factor.

The volume of app users propelled the digital segment of the business to 26% of revenue in FY23, up from only 10% recorded in 2019.

This digital strategy has enabled Nike to provide personalised experiences through data-driven insights. Customers actively engage more frequently, make more purchases and demonstrate higher brand loyalty.

Direct to Consumer

Nike has traditionally utilised several channels, including wholesale and marketplaces to drive sales. Over the past decade, the strategy has shifted to divert more resources to stores, website and apps to control inventory and the narrative.

Nike's direct-to-consumer segment, Nike Direct, generated approximately $21.3B of revenue in the year ended May 31, 2023. The revenue generated from Nike Direct has more than doubled since FY17.

D2C sales are more profitable and allow the company to continue to increase margins and customer engagement. Building new stores for Nike owned brands, which come with their own followings, creates further growth channels.

Nike has experimented with different store formats. Nike Live, piloted in 2018, was smaller and more neighbourhood-driven. Nike Rise launched in 2020, is also locally-focused but on a larger scale and with more data and in store events. Last summer, Nike introduced Nike Style, which features a gender-agnostic product section and a content studio. Nike has three enormous House of Innovation stores in Shanghai, New York and Paris. These stores tower several levels high. The New York store consumes 68,000-square-foot.

Nike also has Converse flagships in Boston and New York City, as well as dozens of Converse outlet locations across 28 U.S. states.

The D2C strategy appears to be delivering, however, Nike’s gross profit margin has remained flat over the last decade.

Growth In Jordan Brand

Jordan Brand was the star performer for Nike’s fiscal year ended May 31, with 29% growth. In FY23 the brand generated 12.9% of Nike’s total revenue. This is up from 8% in FY19. The Jordan brand is a growth company within a blue-chip.

Almost 40 years on from the launch of the Jordan 1, the brand remains extremely relevant and an strong growth vehicle for Nike. It’s been 20 years since Michael Jordan last set foot on a court as a player and can be argued that the brand has now evolved beyond his legacy.

The Jordan brand is not just relevant to men in the US. Since FY20, Jordan Women has tripled, whilst international geographies have grown over 60%.

In the most recent earnings update CEO John Donahoe highlighted that forecasts see Jordan Brand “well on its way to becoming the second largest footwear brand in North America.”

In March this year, Nike opened its first Jordan Brand-only store in Japan, Jordan World of Flight Shibuya. The store, which Nike calls “the pinnacle of Jordan Brand culture at retail”, builds on the DTC strategy whilst providing the Jordan brand with a stand-alone home.

Bear Case 🐻

Challenger Brands

Challenger brands have always been part of the story. The likes of Under Armour have faded as quickly as they have appeared, relative to Nike’s 60 year history. Since the company overtook Adidas in the 1980s, they have never looked back. No company has been able to take considerable market share or threaten the dominance of the Swoosh.

Previous competitor brands such as Converse and Reebok were purchased by Nike (2003) and Adidas (2005) respectively. Reebok was later spun off in 2021.

In 2016, Under Armour's market cap was once 30% of Nike, it is now under 2%. Emerging brands like Hoka, Castore, and Gym Shark are posing less formidable challenges. Castore was labelled as a 'speedboat in a market of oil tankers' by the Athletic. Despite only launching in 2015, Castore has secured deals with multiple sports teams, whilst Lululemon is increasingly venturing into the footwear domain. Nevertheless, Nike has steadfastly maintained its top position, solidifying its dominant stance.

Loss of China

Nike has achieved 300% growth in China over the past decade. Greater China returned to double digit growth in Q4. However, home-grown brands such as Anta and Li-Ning are gaining market share in the region.

In March 2021, Nike and other foreign brands made public statements denouncing the use of cotton produced from western Xinjiang region of China due to human rights violations. This resulted in a backlash from the Chinese population and shift towards national brands.

As of January 2022, Anta and Li Ning accounted for 28% of shoe sales, 12% higher than before the Xinjiang outcry. Over the 12 month period ending January 31, domestic Chinese brands saw sales grow by 17%, while foreign brands saw sales decline by 24%.

Nike’s position in China remains uncertain. The weakness coincides with increasing signs of a soft consumer rebound in China, which has been a key growth market for Nike. China’s retail sales growth decelerated to 2.5% in July, worse than the median forecast of 4%.

Lack of Innovation?

At Nike, there has been a move away from a growth mentality, with capital deployed on paying out dividends and re-purchasing shares.

The company has increased dividend payments for 21 consecutive years and purchased 9.4 billion of shares as of August 2022.

Neither dividend payments or buy-backs are ultimately bad, but the investor relations page states that ‘NIKE, INC. IS A GROWTH COMPANY.’ Management actions do not back this statement up.

The Jordan brand is the only segment of the company that is accelerating similar to a growth company. Having expanded a thousand fold since the IPO, it is no longer clear how the company can remain a disruptive innovator when it is the market incumbent.

Conclusion

As a company, Nike has always placed and emphasis on breaking the rules. With a $150B market cap, this is no longer the same company embodied in Rob Strasser’s 1977 principles.

The Swoosh is universally recognised. The company’s major scale has created an almost impenetrable moat and roster of athletes that promote the brand. The steadfastness of the brand is on par with Coca-Cola, McDonalds and Disney. The brand sells aspirations and dreams. The company reaches audiences through today’s heroes, the modern day athlete.

The products used by superstar athletes encourage ordinary customers to buy-in to the brand. 60% of products are purchased by consumers who don’t use it for sport, but instead for leisurewear.

The company has been using the same playbook for 60 years and incredibly so much of the products remain just as relevant today. Considering how much fashion has changed since the company launched, the fact the Blazer or Cortez do not look out of place in 2023 demonstrates the staying power of the brand.

As the market incumbent, Nike has little reason to innovate. Is it only a matter of time before they stop looking over their shoulder?

Further Reading & Source Material

https://www.thestreet.com/lifestyle/history-of-nike-15057083https://www.thestreet.com/lifestyle/history-of-nike-15057083

https://en.wikipedia.org/wiki/List_of_Nike_sponsorships

https://www.complex.com/sneakers/a/matt-welty/nike-facts-you-didnt-know

https://www.highsnobiety.com/p/nike-air-history/

https://www.acquired.fm/episodes/nike

https://docs.google.com/document/d/1lzJ9sZ5z4U4FQOfwXQUTrG5QxSxS6Wiu0IN6_9DjmGc/edit?pli=1

https://www.therichest.com/rich-powerful/the-billion-dollar-swoosh-nikes-10-most-expensive-endorsements-with-athletes/

https://www.hotnewhiphop.com/646142-nikes-largest-athlete-endorsement-deals

https://theathletic.com/4342029/2023/03/26/castore-disruptors-kit/?amp=1

https://fourweekmba.com/nike-business-model/

https://investors.nike.com/investors/news-events-and-reports/investor-news/investor-news-details/2023/NIKE-Inc.-Reports-Fiscal-2023-Fourth-Quarter-and-Full-Year-Results/default.aspx

https://hbr.org/1992/07/high-performance-marketing-an-interview-with-nikes-phil-knight

https://www.askattest.com/blog/articles/the-5-ingredients-of-a-nike-marketing-campaign

https://sourci.com.au/blog/nike-products-are-manufactured-in-over-41-countries/

https://www.cascade.app/studies/how-nike-runs-the-sportswear-game

https://www.modernretail.co/operations/to-grow-its-dtc-business-nike-is-opening-stores-for-jordan-brand/

https://www.marketingdive.com/news/sneaker-supremacy-nike-adidas-brand-rivalry/621712/#:~:text=A%201995%20marketing%20slogan%20nodded,to%20drive%20the%20company%20forward.

Thanks for this write-up !

I'm impressed by Nike's ability to continue to make collabs that are in high demand.

I've also read the book Shoe Dog and it's really good.