Disclaimer: The following article contains my personal opinions and should not replace your own due diligence or be interpreted as investment advice. Please consult with a professional advisor and assess your financial situation before making any investments.

SBUX 0.00%↑ Metrics (at time of publication)

Market Cap - $83.92

EV = $105.97

FCF = $3.95B

EBIT = $5.87B

Summary Ratios

P/S = 2.32

EV/EBIT = 18.05

FCF Yield = 4.7%

ROIC = 15.9%

5 Year CAGR = 7.8%

Secret Sauce Business Score = B-

Introduction

Starbucks is world's largest coffee chain. The white cup and green logo is a ubiquitous symbol of Western culture.

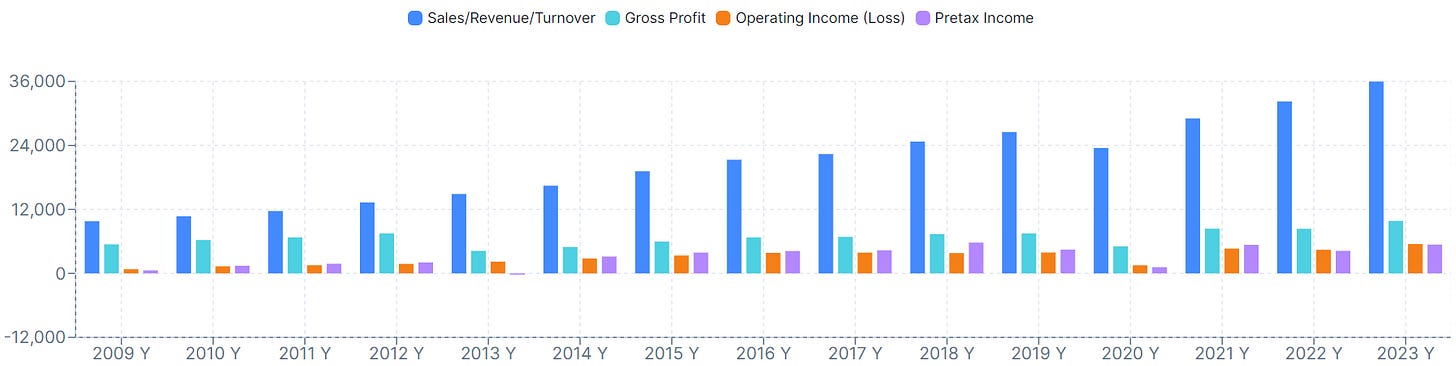

With over 38,000 stores, Starbucks generates $36 billion in annual revenue, $4.1 billion in profit and employs more than 450,000 staff. The share price however has fallen 25% YTD and is down 20% over 5 years.

In the most recent quarter, Starbucks reported total revenue of $8.6 billion, a 1% decline year-over-year, with same store sales down 4%. This was the first sales decrease since the pandemic.

This decline was primarily driven by -3% revenue fall in North America, due to reduced traffic, and a significant 11% drop in China.

To combat the decrease the company has focused on improving efficiency, as it was reported that nearly 15% of mobile orders were not serviced, leading to customer abandonment.

Starbucks remains committed to store expansion, having opened 364 net-new stores in Q2, bringing the total to 38,951. The company is targeting 55,000 locations worldwide by 2030.

History

Starbucks was founded in 1971 by Jerry Baldwin, Zev Siegl, and Gordon Bowker in Seattle, Washington (the HQ is still based there).

There’s little doubt that Howard Schultz has been the driving force behind the global success of the Starbucks. Schultz served as chairman and CEO from 1986 to 2000, then from 2008 to 2017, and briefly as interim between 2022 to 2023.

The company originally operated as a coffee roaster and retailer, focusing on selling coffee beans. The turning point came in 1982 when Schultz, then marketing director, travelled to Italy and was inspired by the coffee culture.

Schultz dreamed of transforming Starbucks into a place where customers could enjoy a unique experience and sense of community. In 1987, Schultz purchased the business from the original founders and began aggressively expanding, building Starbucks into the global chain it is today.

Having laid the foundations of the original business - and despite not being the actual founder - Schultz deserves the same acclaim as CEO/founders such as the Phil Knight and Steve Jobs, amongst others.

The company IPO’d in 1992 with a market cap of $250M - having provided stock options for eligible staff in 1991. Named ‘Bean Stock’, employees were referred to as partners, with those stock options now up 800X.

Starbucks has acquired several companies. The Coffee Connection was purchased in 1994, whilst Seattle's Best Coffee merged in 2003 for $72 million and was later sold to Nestle in 2022.

The Coffee Connection acquisition brought with it the rights to use, make, market, and sell the "Frappuccino" beverage. The beverage was introduced under the Starbucks brand in 1995.

The company purchased Teavana in 2012 for $620 million to enter the premium tea market. This diversified the beverage portfolio and tapped into the growing demand for tea products.

In 2014, Starbucks acquired La Boulange, a San Francisco-based bakery, for $100 million, with the goal of improving food offerings and enhancing the overall customer experience in its stores.

The company purchased 50% East China the joint venture in 2018 for $1.3 billion. This move highlighted Starbuck’s commitment to expansion in China, a key growth market.

In the same year, Starbucks acquired the coffee technology company Clover, which introduced the Clover brewing system. The technology was a key innovation to make the brewing process was more efficient.

The acquisitions have broadened Starbuck’s product range and enhanced the company’s market presence, maintaining a competitive advantage in the global coffee and beverage industry.

Business Overview

Starbucks reported $35.94 billion in revenue for fiscal year 2023, up 11.5% YoY. Starbucks has built a company-operated store approach, unlike a McDonald’s style franchise business. The total number of company-operated stores is approximately 19,592, with the other 18,446 operated by global licensing partners, a split of 52% / 48%.

Starbucks stores in the U.S. generated average revenue of around $945k per outlet in 2023, compared to $900k in 2022.

Starbucks made 60% of revenue in 2023 from beverages, followed by 22% from what the company classes as Other (single-serve coffees and teas, royalties and licensing fees, ingredients and ready-to-drink beverages). Food accounted for the remaining 18% of revenue.

In an effort to turn around declining sales, Starbucks has outlined three key strategies;

Strengthening digital capabilities.

Elevate the brand.

Expand globally.

The company aims to enhance efficiency and reinvigorate partner culture, referred to as the “two pumps” of its strategic plan.

Brand

Very few things in Western culture are as distinctive as the white takeaway cup the with green logo. According to Brand Value Starbucks was the world’s most valuable restaurant brand for the eighth year running in 2024, and was rated as the world’s 48th best brand, according to Interbrand.

Starbucks’ mission is to provide the so-called Starbucks Experience, consisting of “superior customer service and a seamless digital experience as well as clean and well-maintained stores that reflect the personalities of the communities in which they operate, thereby building a high degree of customer loyalty.“

The Starbucks brand is seen as an ‘achievable luxury,’ allowing the company to charge premium prices but remain accessible to a broad audience. By offering quality coffee, paired with an inviting shop atmosphere, Starbucks creates a unique value proposition. This perception has created a sense of community and loyalty, driving frequent visits and regular purchases.

Customers can access quality coffee across the globe, with customer experience similar worldwide, regardless of location. The experience lies at the core of Starbuck’s brand identity. Starbuck’s instore design maintains a consistent aesthetic that is characterised by a consistent décor, floor plan and furniture, all of which aims to create a welcoming atmosphere.

In 1989, sociologist Ray Oldenburg coined the term “third place,” to describe a venue beyond home and work where people could gather, relax and talk. Developed and patented in 2014, the in-store unique look and feel has allowed Starbucks to maintain a unique atmosphere for consumers. This experience results in the most loyal customers spending hours on the premises, with extended visits increasing transactions.

Coffee Houses

At the end of Q2, Starbucks stores in the U.S. and China represented 61% of the company's global portfolio, with 16,600 locations in the U.S. and 7,093 in China. The presence in these two markets highlights the strategic focus in regions with high consumer demand.

Starbucks added 3,000 more stores in 2023 and aims expand to 45,000 stores by the end of 2025 and approximately 55,000 by 2030. This would achieve growth of approximately 7% a year between 2023 and 2030.

In the United States the majority of stores are being converted to include drive-thru options, to cater for a faster service and increased transactions. In the U.S, drive-thru services contribute to 50% of sales with mobile orders representing 33%.

Starbucks has integrated patented technology in store, such as the Clover Vertica, which brews a cup of coffee in 30 seconds to reduce serving times.

This shift towards convenience, technological improvements and digital engagement has allowed the company to enhance operational efficiency and ultimately increase the volume of transactions.

Global Partners

Starbucks operates two primary types of stores, company-operated and partner-operated stores. The company maintains control over the brand, customer experience and operational standards across the globe. Company-operated stores are wholly owned and managed by Starbucks.

Starbucks does not franchise in the traditional sense, instead creating joint ventures in the Middle East (Muhammad Alai), Latin and Central America, Italy (Percassi family), in the EU and in India (Tata Group).

Every country is different depending on the economics, political issues and laws. Some countries operate as 80/20 split—Starbucks owns 80%, the partner owning 20% - with others at 50/50.

Company-operated stores are primarily located in the United States and other developed markets where Starbucks has a strong presence. Company-operated stores account for approximately 82% of total sales in 2023. The remaining revenue came from partner-stores and other sources.

Company owned stores have higher operational costs and upfront costs compared to partner stores. However, company-operated stores provide Starbucks with direct revenue and higher profit margins. Partner stores offer a cost effective way to enter new markets, especially in countries where regulatory challenges or differing cultures could hinder operations and execution.

Despite being a lower revenue generator, partner stores offer improved global reach in difficult to access countries, building the brand and locking out competition. Partnering allows Starbucks to leverage local knowledge and resources of the selected partner.

By utilising both models, Starbucks achieves a balance of growth and control, ensuring that the brand continues to expand whilst maintaining high standards and service.

Roastery and Reserve Stores

Howard Schultz describes Starbucks Reserve stores as “dynamic, entertaining vehicle(s) of theatre, romance, seduction” which offer the “experience of a lifetime”.

The roasteries act as flagship stores with an almost theme park like set up which offer immersive experiences. There are six roastery locations in Seattle, Chicago, New York, Tokyo, Shanghai and Milan.

The company opened the first 30,000 square foot store in Seattle in 2014. The stores offer a Willy Wonka style experience for coffee lovers. The Chicago Roastery spans five floors and 35,000-square-feet making it the company’s largest retail experience. In these locations customers can enjoy boutique bakeries or mixologist-made cocktails.

The locations have allowed the company to elevate the ubiquitous brand and create pilgrimage like experiences for the most loyal fans.

Products

Starbucks are the world’s leader in coffee and maintain a coffee-focused approach. Starbucks offers a wide range of products across several categories, appealing to various consumer preferences. Customers have an abundance of customisation options to chose from.

63% of beverage sales in the most recent quarter were cold, up 1% YoY. During the summer, nearly 80% of the drinks are cold.

The Starbuck’s menu includes a range of beverages, food and retail products. The following is a breakdown of revenue contributions and percentage of total revenue across 2023.

Beverages:

Revenue: Approximately $22 billion

Percentage of Total Revenue: 61%

This category includes espresso beverages, brewed coffee, teas and other specialty drinks such as Frappuccino’s. Aside from the coffee experience, the Frappuccino is arguably Starbucks most recognised drink and the product that made the company as famous.

Starbucks features a variety of brewed coffees, including the popular Pike Place Roast, blonde roast and dark roast blends. The espresso drinks menu includes lattes, cappuccinos, macchiatos and flat whites, with popular variations such as the caramel macchiato and vanilla latte.

Cold brew options are also available, such as the traditional cold brew, salted caramel cream cold brew and nitro cold brew - which is infused with nitrogen.

The Frappuccino line includes a range of blended beverages, both coffee-based and cream-based. Examples include the Caramel Frappuccino, Mocha Frappuccino, Vanilla Bean Frappuccino and Strawberry Cream Frappuccino.

Under the Teavana brand, Starbucks offers hot teas, iced teas and tea lattes including the Chai Tea Latte and Matcha Green Tea Latte.

Refreshers are lightly caffeinated, fruity beverages such as the Strawberry Acai Refresher, Mango Dragonfruit Refresher and Very Berry Hibiscus Refresher.

Seasonal beverages include the famous Pumpkin Spice Latte during the Autumn and Peppermint Mocha in the winter.

Food

Revenue: Approximately $6 billion

Percentage of Total Revenue: 22%

Starbuck’s food menu includes breakfast options such as the Bacon, Gouda & Egg Sandwich and Spinach, Feta & Egg White Wrap plus with pastries and bagels. For lunch, choices include sandwiches, salads and protein boxes, such as the Turkey & Pesto Panini and Chicken & Quinoa Protein Bowl. The bakery section features muffins, scones, croissants, cookies and cakes.

Packaged snacks include nuts, dried fruit, chips and popcorn, while sweets include cake pops and brownies through to bars and biscotti.

Grab-and-go choices have been expanded to include more vegan, vegetarian and gluten-free options

Packaged and Single-Serve Coffees and Teas:

Revenue: Approximately $4 billion

Percentage of Total Revenue: 11%

Starbucks and Nestle established the Global Coffee Alliance in 2018 to bring Starbucks branded products to market. Nestle obtained the rights to market, sell and distribute packaged beverage goods including Starbucks Reserve, Teavana, Starbucks VIA and Torrefazione Italia. Nestlé agreed to pay Starbucks $7.15 billion, with Starbucks retaining a stake as licensor and supplier of roast and ground products.

Products include Starbucks capsules for the Nespresso systems, whole bean, roast, ground and premium instant coffees. Other products include the K-Cup pods and creamers in the at-home category and foodservice channels.

The company also offers Teavana-branded teas in both bagged and single-serve formats.

These products and Nestle’s infrastructure have ensured that the brand can reach beyond the stores and into the customers homes.

Ready-to-Drink Beverages:

Revenue: Approximately $2 billion

Percentage of Total Revenue: 6%

Starbuck’s ready-to-drink (RTD) beverages include a range of iced coffees, cold brews, energy drinks and bottled teas. These beverages are normally available in retail stores and supermarkets.

These products cater to consumers looking for on-the-go options when a coffee house is not accessible. The RTD segment generated approximately $2 billion in revenue in 2023, around 6% of total revenue.

The success of the RTD beverages has been built on the long-standing partnership with Pepsi. The companies established the North American Coffee Partnership (NACP) in 1994. This collaboration combines Starbuck’s beverage expertise with Pepsi’s distribution and marketing capabilities. Through the NACP, Starbucks RTD products are widely available in USA and Europe.

This partnership has driven product innovation, such as the introduction of Nitro Cold Brew cans and new flavours in the bottled Frappuccino and Doubleshot lines.

The NACP has allowed Starbucks to reach markets not available through hot beverages or coffee houses.

Others (Merchandise, Licensing, etc.):

Starbucks sells drinkware such as tumblers and mugs, often featuring seasonal and limited-edition designs, along with brewing equipment like coffee makers and grinders.

Revenue: Approximately $2 billion

Percentage of Total Revenue: 5%

Marketplace

The global coffee market was valued at approximately $425 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. This growth is fuelled by increasing global coffee consumption, with a diverse range of products including instant, roasted and specialty coffee driving demand.

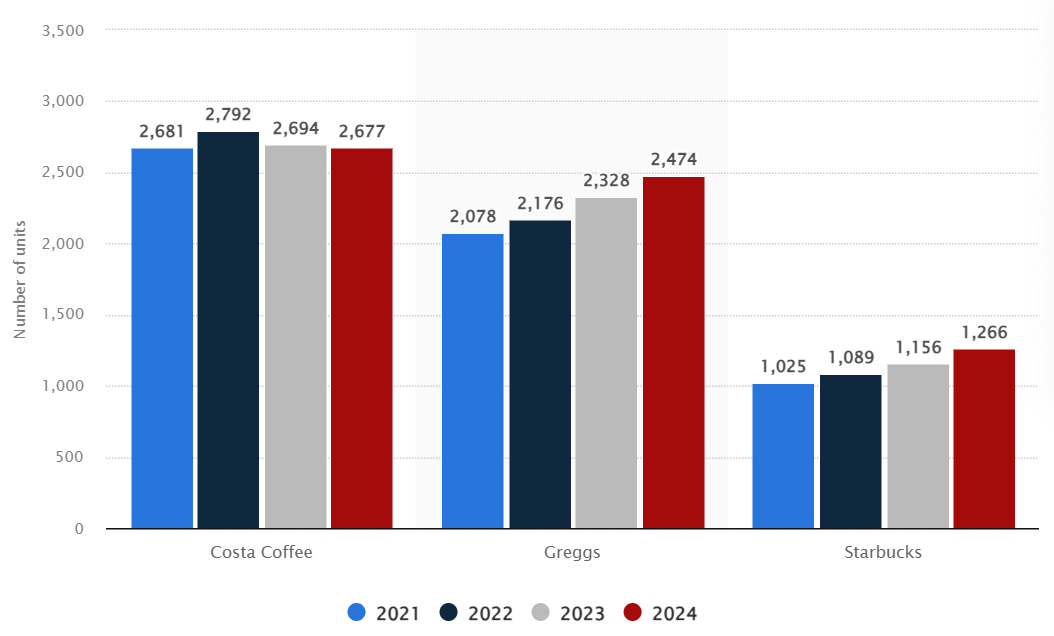

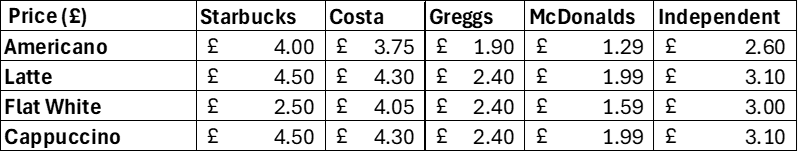

Competitors include Dunkin Brands and Costa Coffee (owned by Coca-Cola) McDonalds introduced McCafe in 1993. Competitors such as Dunkin' Brands, with over 13,000 stores worldwide, emphasise convenience and competitive pricing to attract a broad customer base. Costa Coffee focuses on European and Middle Eastern markets, leveraging its brand heritage and distribution network.

McDonald’s and Starbucks products sit at opposite ends of the price spectrum. McCafe offers low cost coffee options as an add on to meals and burgers.

Greggs (a UK based bakery chain) has an extensive network of 2,400 high street stores, with more outlets than McDonald’s and Subway in the UK. The British bakery offers a substantial range of coffee and beverage options.

Companies like McDonalds & Gregg’s have been able to incentivise regulars to purchase hot beverages by introducing quality coffee. Competitors offer noticeably cheaper coffee options, with customers more likely to visit these outlets for a food and coffee combination.

Technology - Starbucks Rewards App

Starbucks is fast becoming a technology company with a coffee shop base. The App allows customers to order and pay contactlessly in store as well as pre-order to skip queues. One in 10 US adults use the Starbucks Rewards app, with 33% of total orders paid for through the app.

Starbucks Rewards is growing at 14% year-over-year. With 75 million global Rewards members, the company is aiming to double the user base in the next 5 years.

For every $1 spent on the app the customer collects 3 Stars. Customers start at a ‘Green’ basic level. Users that spend more than $150, or 450 stars, within 12 months receive ‘Gold Status’. Gold Status is valid for a year, with customers receiving free shots of espresso, syrups and whipped cream plus a free drink on their birthday.

Repeat visits from Starbucks Rewards members generates 40% of the coffee chain’s UK revenue. More than 60% of morning business in the U.S. comes from Rewards members who overwhelmingly order with a Starbucks app.

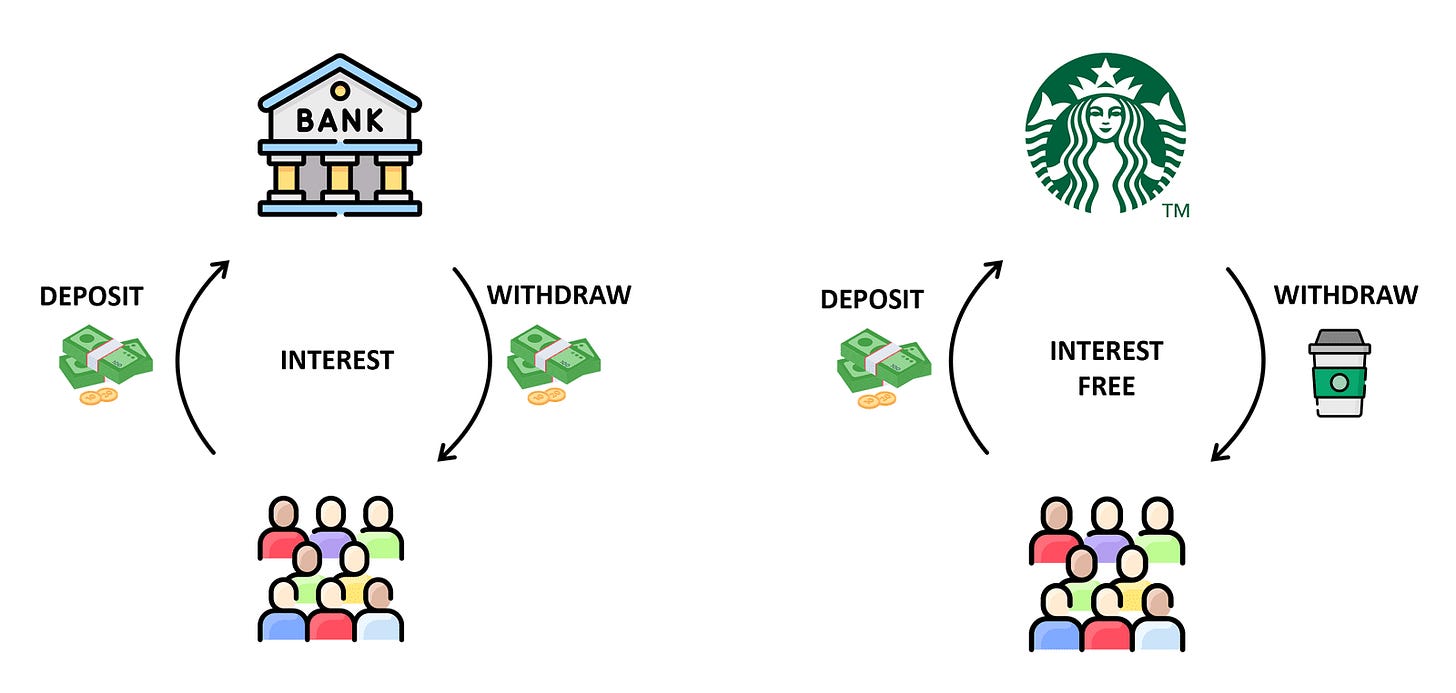

Every time a customer loads money onto their Starbucks account, Starbucks earns an interest-free loan and is unofficially the world's largest unregulated bank. Starbucks holds the funds on the customer account which acts as a financial float. Starbucks doesn’t pay any interest to hold funds for customers. The company is making a profit by having unused money in its system – known as a breakage as customers paid for a service without receiving it.

Starbucks also introduced a subscription service, with customer accounts being automatically topped up each month. By pre-loading funds, Starbucks minimises the commission paid to card providers. If a customer loads $25 dollars, the company only pays Visa or Mastercard once, instead of 5 times over 5 x $5 purchases.

The rewards app only allows customers to top up funds in increments increments of $10. Customers risk reloading excessive amounts because the pre-select is for $25 instead of a lower amount.

Around $14 billion a year reportedly gets loaded onto gift cards. In early 2024 the Washington Consumer Protection Coalition accused Starbucks of claiming nearly $900 million in unspent gift card and app money as corporate revenue over the past 5 years.

Critics have claimed that the app manipulates users into loading more funds resulting in spending more. Customers cannot reload only what they need to cover a one-time purchase, and are instead pushed into making higher deposits, the complaint states. “This Catch-22 traps customers in a cycle that resembles an involuntary subscription,” the complaint reads.

Bear Case🐻

Increased Competition in a Challenging Economic Climate

As Starbucks continues to expand into new markets, the company faces local and regional competition. Competition comes from local chains or independent coffee shops and from global competitors.

Due to the economic slump, consumers are spending less on luxuries like eating out and instead choosing to purchase low-price items instead of high-priced coffee due to shrinking budgets.

Starbucks products are more expensive than large competitors and local coffee shops.

Based on recent macro slump, challenges include intense competition and price sensitivity, Starbucks may no longer be able to charge a premium price point. In a more challenging macro-economic climate, there is no guarantee that ordinary customers will continue to pay a higher price point for a like-for-like beverage. The previous global financial crisis (07-08) made it difficult for the company to exit a low growth phase due to continuous cutback on customer spending, with more than 800 stores were closed in the United States alone over 2008 and 2009.

High Calorie, High Sugar Drinks

Despite being a coffee shop, Starbucks largely serves customers who don’t drink coffee. Instead, consumers are served high-sugar, high-calorie drinks which promote unhealthy dietary habits. These beverages are often marketed as indulgent treats or seasonal specialties but are instead consumed on an almost daily basis.

The irony is that black Italian-style coffee, which originally inspired the chain, contains little calories. The majority of Frappachino’s and Mochas contain around 500 - 600 calories, about a quarter of an adult’s recommended daily intake. These drinks are no longer coffees, they are desserts.

And while these drinks remain popular, Starbucks will continue to market them, Frappachino’s cost around 50% more than an Americcano and therefore drive higher revenue - and that’s before you add any customisations!

Deviation from Core Values

Good coffee and culture are the values that Starbucks has been built on. Due to the scale of the business, technology such as the app to order on demand have become a necessity but detracted from personal service.

It appears counter intuitive that the company plans to renovate stores with drive-thru and delivery-only option. This allows Starbucks to reach varying demographics but goes against Schultz ‘experiential’ vision.

The featured drinks on the app currently include an ‘Creme Brulee Iced Brown Sugar Oat Shaken Espresso’ a ‘Dragon Coconut Refresha’ and an ‘Iced Strawberry Matcha Tea Latte’.

This menu is a far cry from the espresso culture Howard Schultz was inspired by in Italy. The increase in complicated, multi-ingredient, sweet drinks coincided with the rise in popularity of the Starbucks app, and was accelerated by the start of the pandemic when many locations could not take walk-in orders.

Workers Unions

Warehouse and roasting plant workers in Seattle were Starbucks first to unionize in 1985. Many historic unions and efforts have folded, in part due to the company's long history of opposing unionisation efforts.

In 2021 workers at a Starbucks store in Buffalo, New York, voted to form a union, making it the first of more than 8,000 US locations to unionise. Starbucks worker’s unions have gained momentum as employees push for better conditions, higher wages and enhanced benefits.

Starbucks response has been mixed. While the company states its commitment to addressing employee concerns, there have been reports of anti-union tactics, including holding mandatory anti-union meetings and closing unionised stores.

Despite challenges, the union movement continues to grow, with ongoing advocacy from over 8,000 workers who have voted in favour of unionising. The outcome of these efforts could significantly impact labour relations within Starbucks and potentially set a precedent.

Reliance on China

18% of Starbucks’s revenue comes from China. U.S. store count is expected to grow by approximately 4% in comparison to 12% in China.

China is a market that Starbucks has strategically targeted for expansion and growth. However, the company is facing competition from local players and emerging premium coffee brands. In China, national brands pose the greatest challenge to Starbucks, with Luckin Coffee at the forefront.

“Many would now buy a 9.9 Renminbi (official currency of the People’s Republic of China) coffee from Cotti or a 12 Renminbi coffee from Luckin instead of a 30 Renminbi coffee from Starbucks - Coffee Intelligence

Funded in 2017, Luckin Coffee is a fast-growing coffee store brand in China. In May 2020, Luckin Coffee had aggressively expanded to 6,912 stores, exceeding the 4,700 Starbucks stores in China. A cup of coffee from Luckin costs 10 to 20 yuan, or about $1.40 to $2.75. Luckin heavy discounts in effort to gain market share. In comparison a cup of coffee from Starbucks is priced at 30 yuan or more - which is around $4.10.

Luckin Coffee is the fastest-growing restaurant brand in the 2024 ranking. Luckin Coffee opened 1,485 new stores in China and entered the Singapore market during 2023.

Luckin offers a different experience to Starbucks. Staff members do not take orders and there is no machine to order from. Instead, everything is done through the Luckin app.

Starbucks future growth is heavily reliant on China. However, Luckin Coffee has surpassed Starbucks operations in China, in both revenue and the number of locations. That is a considerable turnaround from 2020, when Luckin was delisted from the NASDAQ for fabricating over $300 million in sales.

Bull Case 🐂

Infrastructure

Starbucks is the world’s largest coffee chain and operates in more than 84 markets with infrastructure and global footprint that is only surpassed by McDonald’s.

Unlike McDonalds, Starbucks owns the stores or has a direct relationship with their international partners. Starbucks, with its size and scale, has the power to take advantage of supplier relationships and the extensive network.

The chain displays a network effect and can drop more goods per delivery, making logistics cheaper. This ensures perishables are delivered faster, results in less waste and achieves a higher gross margin.

Starbucks is the coffee market incumbent, the larger sale and network ensures the company can secure better access and prices of raw martials with considerable sway over the market.

The network, logistics and buying power will continue to strengthen as more stores are added. Anecdotally, Black Sheep Coffee in the UK are aggressively chasing Starbucks. The company has had to heavily invest in capex and real-estate that Starbucks already has in place - which has resulted in a higher menu prices from Black Sheep Coffee.

Strength of Starbucks Rewards

The Starbucks Rewards app is like the lynchpin and future of the entire business. Competitors can produce similar coffee but are decades away from the digital technology infrastructure (except MacDonald’s). Starbucks App and Rewards are at the centre of the company’s opportunity for the future.

Starbucks Reward members are 5.6 times more likely to visit daily compared to non-members. 71% of Starbucks app users visit a store at least once a week.

Due to the psychology of pre-loaded cards, consumers feel obliged to spend to reach the points needed to redeem a free beverage.

Starbucks plans to increase the number of App users to 150 million in 5 years. This will drive further customer loyalty and opportunities whilst adding further customer funded float.

Brand

Customers who shop at Starbucks can be anywhere in the world and receive the same beverage.

The Starbucks brand centres on a global presence, brand loyalty and ongoing innovation. With tens of thousands of stores worldwide, Starbucks enjoys unmatched brand recognition and a market leading position.

The company’s ability to adapt to changing consumer preferences, such as offering plant-based alternatives and expanding digital ordering options, highlight’s agility and responsiveness.

These factors continually contribute to building brand equity that will advantage the company for decades to come.

Customisation

According to Howard Schultz there are over 100,000 beverage combinations a barista may be asked to put together on any given today (theoretically there are over 20 million). Customers can order in store or customise their drink through the app. Consumers have the option to swap out milk, add toppings, whipped creams, syrups, sauces, plus fresh fruit and juices - and more!

This customisation has created what loyal customers refer to as a Secret Menu, which has created an entire community. While not an official menu, the Secret Menu refers to the ways customers create unique drinks.

This recent article by Glamor offers several examples of how customers can experiment with combinations. This customisation makes the drink unique to the customer - who can order the drink at any location - thus creating further loyalty to the coffee chain.

Conclusion

“Focus on being experiential, not transactional,” Schultz wrote in a recent LinkedIn post. However, it feels like Starbucks are squeezing customers a little too much on pricing, or have at least reached the ceiling of what is acceptable to charge.

Regardless of the premium brand, when it comes to coffee Starbucks competes in a high volume, commoditised market. The company runs the risk of becoming an over priced product, losing out to competitors. Customers may turn to local competitors with competitive pricing. Local coffee chains can position themselves as craft and replicate the experience through superior products or focusing on a coffee only approach.

The question remains if the product menu is overly diversified. Has the company fallen into the trap of having to continuously release new products to generate engagement and footfall?

It appears to be counter intuitive that the company plans to renovate stores with drive-thru and delivery-only option. This allows Starbucks to reach varying demographics but goes against Schultz ‘experiential’ vision.

Regardless of the recent downturn, Starbucks can prevail by tapping into several of it’s key strengths.

The brand is a status symbol, the white cup and green logo have become part of the American uniform, with Asian countries desperate to copy the style. Starbucks boasts a customer retention rate of 44%, surpassing the industry average of 25%.

Customers can visit a Starbucks anywhere in the world and enjoy the same style of beverage and décor. There’s a comfort in being able to order a customised drink regardless of the city, state or country.

Starbucks continues to build its brand with Starbucks Reserve Roasteries. With seven global locations, these 'Willy Wonka' style experiences allow customers to fully engage with the brand. Compared to chains like McDonald’s and Subway, Starbucks is measurably ahead, behaving more like a Hershey (Hersheyland) or Nintendo (Super Nintendo World).

The company can overcome competitors with a diverse range of begave options. McCafe and Dunkin can offer Cappuccinos and Americanos, but cannot compete with Starbucks specialised offerings such as Frappuccino’s (it’s a trademarked term), Pumpkin Spiced Latte or customised Secret Menu.

The Rewards App is setting the company up for the future, acting as a lynchpin to tie customers into the ecosystem through reward incentives, drink customisation and queue jumping. With 75 million current users and a goal to double this number within five years, the technology will be crucial to future success. The app has the capacity to act as an unofficial bank, offering additional value to users and providing Starbucks with a financial float.

Unlike in previous times of crisis, the company cannot turn to their normal saviour, Howard Schultz, who has no plans to return for a fourth stint.

It was announced in June that activist investor Elliott Investment Management had reportedly built a sizeable stake in Starbucks, with the share price responding with a 7% jump.

Starbucks has focused in on the Two Pump strategy and has the tools to turn things around. The company is still growing with the intention of increasing their footprint by 44%, to 55,000 locations by 2030.

Sources and Further Reading

https://www.acquired.fm/episodes/starbucks-with-howard-schultz

https://www.fastcompany.com/91004280/complaint-starbucks-app-spending-cycle

https://s203.q4cdn.com/326826266/files/doc_financials/2024/ar/fy23-annual-report.pdf

https://stories.starbucks.com/press/2024/starbucks-introduces-new-ready-to-drink-coffee-line-up-including-refreshed-fan-favorites/

https://www.linkedin.com/pulse/stars-bucks-rewards-real-opportunities-jason-allan-scott-ymc9f/

A great stock