Author’s Note - This write up was inspired by a queue I walked past at 8AM outside my local Swatch retailer. Customers camped overnight to secure a NEW MOON MoonSwatch, a collaboration between Omega and sister brand Swatch.

Metrics (at time of publication)

Market Cap - 10.08B CHF

EV = 8.11B CHF

FCF = 722M CHF

EBIT =1.057B CHF

Summary Ratios

P/S = 1.28

EV/EBIT = 7.67

FCF Yield = 7.03%

Debt/Equity = 0.63%

Return on Equity = 7.27%

5 Year CAGR = 6.13%

Introduction

The Swatch Group (Swatch) is a Swiss a manufacturer of 17 watch brands including Omega, Tissot, Longines and Swatch, amongst others. The company has over 150 manufacturing plants in Switzerland.

Longines and Tissot are Swatch Group’s second and third biggest brands after Omega. In 2023 the Swatch Group generated revenues of 7.88B Swiss Francs, or $8.71B.

History

Prior to the 1970s, the Swiss watch industry had 50% of the global market share. Through the 70s and 80s the introduction of cheap quartz models from Japanese and US manufactures decimated the industry. The Swiss watch industry, which had 1,600 producers in 1970, declined to 600.

In the early 1980s, Nicolas Hayek, oversaw the liquidation of ASUAG and SSIH, two Swiss watch-making firms that were on the brink of collapse. The restructuring produced the early Swatch Group.

The Swatch Group has grown through the acquisition of numerous luxury watchmaking companies, including Blancpain S. A. (founded 1735, acquired in 1992), Breguet S. A. (founded 1775, purchase in 1999), and Glashütte Original (acquired in 2000). The company acquired Harry Winston, a jeweller and luxury watch producer, in 2013 for around $750 million.

Watch Mechanics

Regulating a watch means changing the rate at which the balance wheel is oscillating back and forth. This is typically done by changing the "active length" of the hairspring, which changes how much the balance wheel, which is attached to the hairspring can rotate before the power of the spring pulls it back in the other direction.

Omega introduced its Si14 silicon hairspring in 2008, as other manufacturers also transitioned to silicon for the benefits compared to traditional alloys like Nivarox. Since then, Omega has relied on free-sprung regulation of its hairsprings.

Market Place

Watches of Switzerland estimates global retail sales of luxury watches were around £44.1 billion in 2022.

Luxury watch producers have continued to increase prices annually, with the average selling price of Swiss watch exports generating a 22-year CAGR of +5.4% (2022 vs 2000).

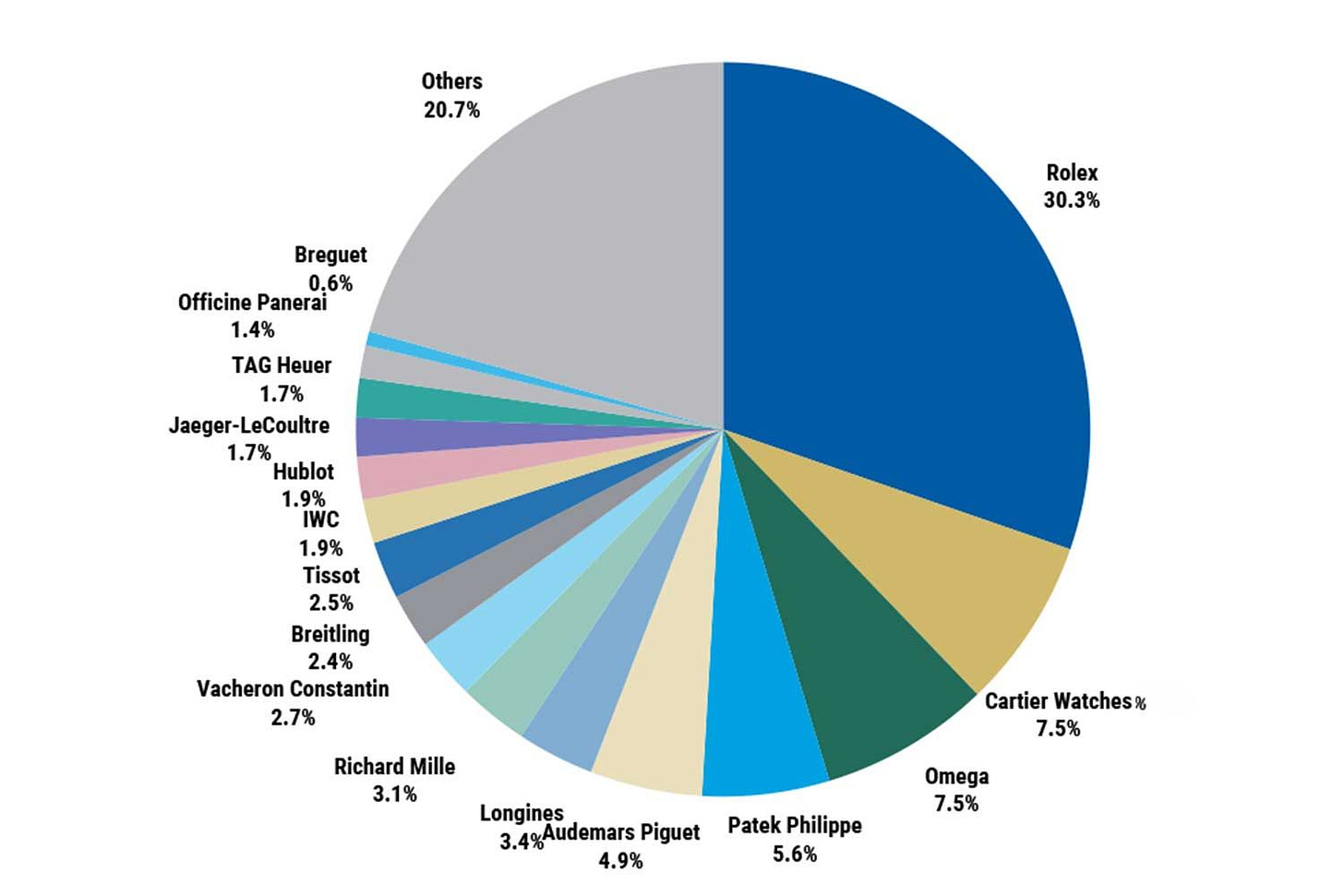

The market is concentrated, with only a few large players. The top ten producers made up 86.64% of the total market in 2021.

Premium watches priced over CHF 25,000 ($28,000) drove 69% of the market’s growth in 2023 and constituted 44% of the total value of Swiss watch exports. Despite the significant value contribution, the segment represents only 2.5% of the total volume of units sold.

Swiss watchmakers brands turnover in 2023 :-

Rolex: CHF 10.1 billion

Cartier watches: CHF 3.1 billion

Omega: CHF 2.6 billion

Audemars Piguet: CHF 2.35 billion

Patek Philippe: CHF 2.05 billion

Richard Mille: CHF 1.54 billion

Longines: CHF 1.11 billion

Vacheron Constantin: CHF 1.1 billion

Marketshare per brand: -

Business Model

Swatch's luxury brands target the high-end customer market with retail prices ranging for $10,000 to over $100,000. A range of brands focus the mid-to-upper range and the "fashion watches" are aimed at the entry level market.

The Group offers basic watches (Swatch & Flik Flak) through to prestige & luxury (Omega, Breguet, Harry Winston). 60% of the Swatch Group operating profit was generated from Omega in 2022, according to Morgan Stanley estimates.

Export growth of 4.6% in 2022 meant that the Group lagged the industry average of 11.6% of Swiss watch exports.

In 2023, the group achieved double-digit growth across Asia. Europe delivered single-digit sales growth, though Switzerland grew by 30%. The group reported that sales would have been up 25% if not for a slowdown in China.

Sales for 2023 were considerably affected by the strengthening of the Swiss Franc against other major currencies. At constant exchange rates, Group sales for the were up 12.6% above the previous year, but only 5.2% at a real rate.

Brands

With a diverse set of brands, the Swatch Group can target customers in almost all segments of the market. The luxury brands allow the business to achieve the highest margin with Omega, Blancpain and Breguet brands selling group’s most expensive watches.

Omega

Omega is the jewel in the Swatch Group crown. The brand is mostly recongnised for the Speedmaster and Seamaster models. Omega sales were estimated to be around CHF 2.6B in 2023, up 4% year-over-year

Originally founded in 1848, Louis Brandt set up a watchmaking business in La Chaux-de-Fonds, Switzerland. In 1929, the brand merged with Tissot to create the SSIH. Buzz Aldrin, known as the second man on the moon, was equipped with a Speedmaster Chronograph, a reference which earned the name ‘Moonwatch’. To this day, the brand remains the only watch officially approved by NASA for manned flights.

Omega has served as the official timekeeper of the Olympic Games since 1932. James Bond has worn an Omega Seamaster in every film since 1995. No Time to Die marked Bond’s 9th film wearing the brand.

Breguet

Breguet watches have been manufactured since 1775 and became part of the Swatch Group in 1999.

Berguet watches are aimed at the hyper luxury market and typically retail for from $15,000 - $50,000+.

The Breguet Sympathique Clock No.128 & 5009 (Duc d'Orléans Breguet Sympathique), is currently the most expensive Breguet timepiece ever sold at auction, fetching $6.8 million in New York in December 2012.

Harry Winston Jewellery

Harry Winston (HW) will surpass one billion in turnover in 2024. The jewellery retailer is Swatch’s answer to Tiffany’s. With boutiques across the world, Harry Winston diamonds are renowned for outstanding quality.

Harry Winston opened The Premier Diamond Company in 1920 before establishing Harry Winston Inc in 1932. The ‘cluster’ or ‘clustering’, now regarded as Harry Winston’s signature technique, originated in the 1940s.

From the 1950s through to the 1970s, Harry Winston serviced royalty and Hollywood stars, including Betsy Bloomingdale, Elizabeth Taylor and the Duke and Duchess of Windsor.

In 2013, the Swatch Group acquired the retail arm of Harry Winston, with Nayla Hayek assuming the role of CEO.

Hayek has continued Winston’s legacy, adding one-of-a-kind diamonds to the Winston collection. This includes the Pink Legacy diamond, a rectangular-cut Fancy Vivid Pink diamond, weighing approximately 18.96 carats. The stone set a price-per-carat world record for a pink diamond when it sold in 2018 at Christie’s in Geneva for CHF 50,38M.

Swatch

The Swatch brand launched in 1983, in direct competition to Japanese quartz models that had decimated the Swiss market.

Swatch watches were disposable and plastic with little chance of repair. The watch had 51 moving parts, almost half that of mechanical watches. Production was mostly automated, which resulted in higher profitability. The Swatch brand was a huge success; in the first two years more than 2.5 million watches were sold.

By the early 1990s, Swatch sold 20 million watches per year. In 2021, sales had dropped to 3.2 million. The 2022 launch of the MoonSwatch completely changed that.

The MoonSwatch sold over 1 million units in 2022. The MoonSwatch is essentially an Omega Moonwatch crossed with a Swatch. Morgan Stanley estimate the watch has a 90% gross margin! The Swatch brand posted record growth of over 60% in 2023 due to the success.

Celebrities such as Ed Sheeran, Ibrahimović and Daniel Craig have sported the $260 timepiece. Swatch sells the models in-store only, leading to queues around the block. This tactic is driving a new generation customers to engage with the company.

In September 2023 Swatch launched a further crossover with sister brand Blancpain, Swatch x Blancpain, debuting the Scuba Fifty Fathoms collection.

Omega vs Rolex

Omega is the most prominent brand within the Swatch group, but sits well below Rolex in the luxury watch pyramid.

Rolex is one of the best known brands in the world and dominates the luxury watch market. Rolex is a privately owned business that was established several years after Omega, in London. The company was originally called Wilsdorf and Davis until 1908. After World War 1, the brand moved operations to Geneva, Switzerland.

In 2018, according to an annual Morgan Stanley report, Rolex’s turnover was around CHF 5 billion, with Omega’s around half that. In 6 years, Rolex has more than doubled revenue, whilst Omega sales have stagnated. Rolex is now larger than the entire Swatch Group.

Sales of Rolex watches are believed to have surpassed 10 billion Swiss Francs for the first time in 2023. Omega sales were estimated to be a quarter of this, at CHF 2.6 billion ($2.9 billion). The Rolex group reportedly generated record sales 2023, with a 1.24 million units sold, an implied average retail value of 12,218 CHF. In comparison Omega sold a reported 570,000 units, with an average retail value of 6,573 CHF.

To create demand, Rolex focuses on exclusivity and rarity, restricting the production, instead of flooding the market.

Historically, the Omega brand and design has been the most innovative of the two. The Omega Seamaster was released 6 years before the Rolex Submariner and was the original water-resistant dress-style watch.

An entry level stainless-steel Rolex can retail for over $6,000, with popular professional models ranging from $8,000 - $14,000. Entry level Omega collections cost between $3,000 - $5,000, such as the Seamaster and Speedmaster.

Financials

With highly conservative fiscal management, the Swatch Group maintains a healthy balance sheet and minimal debt, with over $2B of cash on hand. The company generates a gross margin of 77% and operating margin of 17.2%. The group pays an annual dividend of 3.3%.

At constant exchange rates, group sales for the full year of 2023 were 12.6% above the previous year. This negative currency impact affected revenue growth by 7.4%.

Swatch has 5 year ROA, ROE and ROIC of 4.59%, 5.47% and 5.37% respectively. When compared against the returns of Fossil and Richemont, Swatch leads lower end competitors by over 3% in each metric.

Investments of CHF 803 million in 2023 reflects the Group’s long-term strategy to improve distribution and to maximise production.

The Group invested over CHF 300 million in new, innovative production equipment and cutting-edge technologies (e.g. around CHF 20 million was spent on a cleanroom for watches with the Group’s own solar cell technology).

Swatch also invested around CHF 360 million in retail. Of this, over CHF 220 million was allocated to the acquisition of multiple properties in prime locations, securing strategic sites for the Group’s own retail network.

It’s worth highlighting that the real estate of the Swatch Group has a historical acquisition value of around CHF 3 billion and current market value is around CHF 4 billion. The Group has no mortgages, and the net value of these properties stand at just CHF 1.8 billion on the balance sheet, meaning the Group has around CHF 2 billion of unrecorded assets.

Management & Ownership

Nick Hayek is the managing director and son of Lebanese-born Nicolas George Hayek, the late co-founder of the Swatch Group.

His sister, Nayla Hayek, has been chairwoman of the board of directors since the death of her father in June 2010. The community of heirs of Marianne and Nicolas G. Hayek directly controls 42.7% of the group.

Nayla’s son, Marc Alexander Hayek, is a Swatch board member and the CEO of the Blancpain brand.

The management structure means there are multiple CEOs responsible for either a brand, region, or both.

Bear Case 🐻

Reliance on the Swiss Franc

Being based in Switzerland meant that 2023’s revenue was considerably affected by negative exchange effects. Continuous appreciation of the Swiss Franc resulted in the group’s products becoming more expensive abroad.

The rapid erosion of major currencies against the Swiss franc “could not be offset by continuous price adjustments,” the company said in a statement. It’s worth highlighting that this will also have hurt other Swiss manufactures, including Rolex.

Chasing the Incumbent

Rolex is one of the most desirable brands in the world. Rolex is not a public company, it is owned by a foundation which operates as a non-profit. If it was publicly traded it could be worth anywhere between $30B-$100B, up to ten times Swatch’s market cap.

The fact that Rolex is not a publicly traded company is one of the few saving graces. It does not have the same shareholders to appease with aggressive reinvestment or capital allocation. This also allows the group to remain incredibly secretive.

Omega’s sales volumes have stagnated over the past decade. Most Omega watches trade below their retail price on the secondary market whilst Rolex models trade at a premium, according to data from WatchCharts.

Rolex Professional models such as the Submariner, GMT-Master and Daytona often appreciate over time rather than depreciate - selling pre-owned for the same cost or higher than an original retail purchase. Omega’s range exhibits various levels of depreciation, decreasing between 30-50% in the used market.

When customers can flip a product on the secondary market for more than they paid, manufacturers are leaving value on the table - think of the Hermes Birkin bag or limited edition Nike Jordan’s. When demand is outstripping supply, it maintains the desirability of a luxury brand. If a product is re-sold for less on a secondary market, demand has plateaued or is decreasing.

In addition, Omega lost the 2nd sales spot to Cartier watches in 2020 and is yet to recover it. Cartier’s retail market share surpassed that of Omega, reaching 7.54% compared to Omega’s 7.49%.

Rise of the Smart Watch

There is an argument whether the Apple/Smart Watch will totally consume the watch sector. The Apple Watch now outsells the entire Swiss watch industry but has taken the biggest chunk out of the battery-powered segment, where Swatch operates. To potentially combat this, the company has introduced Swatch Pay.

Smart Watch customers have the option to purchase luxury upgrades - Apple’s recent collaboration with a Hermes watch strap was testament to this.

While the emergence of Smart Watches has undoubtedly resulted in a decrease in the sale of mid-to-lower price watches, luxury dress watches are part of a different category. As a luxury brand, Omega is not affected by the competition from smart watches. Brands such as Rolex and Omega are a status symbols instead of a practical timepieces.

Reliance on Omega

The Swatch Group does not publicly breakdown the performance of individual brands but it is estimated the Group generated a third of sales and around 60% of operating profit from Omega in 2022, according to Morgan Stanley estimates.

Omega recently raised prices by 2% in Switzerland and China, and by 8% in the US, the largest export market for Swiss timepieces.

“The Omega price increase results from weakness rather than strength,” analysts led by Edouard Aubin wrote. “With some of the group’s leading brands (Longines, Tissot, Breguet, etc.) struggling, we estimate that the Swatch Group is increasingly dependent on Omega’s cash flow.”

With the MoonSwatch crossover, the Omega brand name has been leveraged to bail out Swatch brand. The Swatch group undertook a risk with the collaboration that Omega brand name would not be diluted be the cheaper models.

Bull Case 🐂

Intricacies of manufacturing

The group has centuries of manufacturing experience across the numerous brands. Mechanical watches have gradually become luxury goods valued for craftsmanship, aesthetic appeal and design. Mechanical watches are associated with the social status, rather than as timekeeping devices.

Omega launched the new Speedmaster Super Racing in 2023, with enhanced technical innovation, the new Spirate System. The Spirate system is 10 times more efficient than that of the free-sprung balance. Omega highlighted that the technology has been in the works for the past 10 years, emphasising a constant approach to innovation.

Owner Operated

Nick Hayek is the Managing Director whilst his sister, Nayla Hayek is the chairwoman.

Nayla’s son, Marc Alexander Hayek, is the CEO of Breguet. The Hayek family controls 42.7% of the group. The company was nepotistically handed down from father to son. However, this approach mirrors that of the Hermes and LVMH models.

Based on the ownership of the group and the involvement of Marc Alexander Hayek, it is likely that succession plans are already being laid for the next generation to assume control.

Timeless Accessories from a Swiss Stronghold

Humans have been wearing shiny and rare items since the dawn of time to highlight both rank and status. This applies to the collectability of Omega or the prestige of Harry Wilson jewellery.

Swiss watches are largely associated with higher quality and reliability than watches from other nations.

The history and geographic protection means there is limited risk from new entrants. Luxury watches possess a rarity, heritage, craftsmanship. The addition of precious metals further increases the brand value.

Cross Promotion

The launch of the MoonSwatch has been the most exciting product release from the group for the past decade. The MoonSwatch is a genuinely exciting product that doesn’t take itself too seriously. Crowds have quite literally been fighting over the releases.

The MoonSwatches sold accounted for as much as 20% of the group's profit in 2022 and was the best-selling watch release in StockX history. The models are a chance for innovation without heavy investment in R&D and new technology.

In the wake of the MoonSwatch hype, the entire Omega Speedmaster collection also profited from greatly increased interest. Omega Speedmaster Professional sales were reported to have increased by 50% at Omega boutiques after the launch.

As an in-store only item, the releases brought more customers into Swatch shops and introduced a new generation to the Omega brand. The crossover has raised the status of the models to collector’s items.

Almost two years on from the first MoonSwatch, there is some evidence that this strategy is working. Omega sales rose by 5% in 2023, according to Morgan Stanley’s estimates.

However, the company has to be careful not to dilute Omega and the other luxury brands. There’s no guarantee that success will be ongoing, but the launch of the Blancpain x Swatch Scuba Fifty Fathoms 'Ocean of Storms', a £350 model, resulted in frenzied shoppers who queued for hours.

Managing director Hayek said sales in Blancpain’s own stores have increased by more than 25% since the Swatch collaboration.

Conclusion

Over the past decade the Swiss watch industry has been decimated by the smart-watch. The sector has faced crisis before with the rise of 1980’s quartz models.

Luxury watches have been insulated from this recent threat, with the high value segments driving growth post-Covid. A Rolex or Omega is a status symbol or dress piece and will always be more valuable than an Apple Watch, regardless of the features and apps. Mechanical watches are intricate and associated with decades of Swiss engineering. These brands are luxury and cannot be replicated with automation or scale.

Regardless, Omega is being greatly outpaced by Rolex. The company was involved in a ‘Speedy Gate Scandal’ in an attempt to artificially inflate the collectability of the brand by bidding up an auction timepiece.

Recent crossover success between Swatch, Omega and Blancpain offer a glimmer of hope for the Group. Swatch participates in a market segment which is not dominated by Rolex. This keeps the brand fun and introduces a younger audience to an entry level product. The Swatch collaboration products generate a 90% gross margin and are only sold in Swatch stores.

Anecdotally, this article was inspired by a queue outside of my local Swatch store in March 2024, two years after the initial launch. The hype shows no sign of abating. There’s a question whether the success of the $250-350 models can truly shift the needle for Swatch, in a market dictated by $10,000 timepieces.

The group must either move Omega even further upmarket to take share from Rolex, or focus on mid-tier offerings with the launc of the Swatch crossover products. The reality is that the Group’s brands are too diverse. The company could be better placed divesting and focusing on a handful of core brands.

Overall, the Swatch Group feels like a safe pair of hands, but is lacking in growth or demand. However, the comapny is extremely well managed by a family with skin in the game. The Hayek family are likely planning decades in advance.

As a final consideration, the Swatch Group (or Omega) must surely be an acquisition target for LVMH. LVMH’s mass market premium offering, the Tag Heuer, falls well below Rolex and Omega in both value and volume. Numerous brands are targeting the watch market. In 2023, Hermès (watches) sales rose by 14% to CHF 593 million. Chanel (watches) increased by 45% to CHF 400 million whilst Louis Vuitton watches generated revenue of only CHF 162. LVMH are used to winning and need a timepiece that dominate competitors. With Rolex unavailable, perhaps Omega could be that brand?

Sources and Further Reading

https://www.watchpro.com/rolex-sales-top-17-billion-but-moonswatch-is-the-big-winner-in-2023/

https://www.wired.com/story/how-the-moonswatch-was-made/

https://www.luxurybazaar.com/grey-market/omega-investment-watches/#:~:text=The%20short%20answer%20to%20the,can%20certainly%20increase%20in%20value.

https://www.fhs.swiss/eng/mechanical-quartz.html

https://hodinkee.com/articles/heres-how-the-new-omega-spirate-system-works

https://en.wikipedia.org/wiki/Quartz_crisis

https://www.bobswatches.com/luxury-watches/omega-vs-rolex

https://www.bloomberg.com/news/articles/2024-01-23/swatch-group-sales-miss-record-as-china-rebound-lags

https://www.visualcapitalist.com/swiss-watches-market-share-by-brand-in-2023/#:~:text=In%202023%2C%20the%20Swiss%20watch,2019%20market%20share%20of%2036.9%25.

https://revolutionwatch.com/morgan-stanley-luxeconsult-2024/

https://www.hodinkee.com/articles/moonswatch-affects-omega-speedmaster-moonwatch-prices

Related Substack Articles