TSM 0.00%↑ Stats

Market Cap = $395.28B

EV = $378.51B

Gross Margin = 49.7%

5 Year Rev CAGR =10%

10 Year Rev CAGR =12%

FCF = $9.13B

FCF Yield = 2.3%

EBIT = $21.48B

EV/EBIT = 18.4

ROIC = 21.2%

Introduction

Semiconductors, such as memory chips or processors, are the nervous system of almost every piece of hardware on the planet. The world would grind to a halt without them.

It has been said that semiconductors are the closest thing to magic we have on the planet. We are dealing in the micro-realms, one-hundred-millionth of a metre. The most cutting edge, the 3nm chip, possesses almost 300 million transistors per square millimetre.

Chips are produced in specialised Foundries or Fabrication Plants (fabs). Most of the largest semiconductor businesses today are ‘fabless’, meaning they design chips and outsource production. The largest fabless companies include Apple, Nvidia, AMD and Qualcom.

With increasing costs and the specialisation associated with design and fabrication of leading-edge chips, many companies now specialise in single steps of the value chain.

The largest global producer of semiconductors is Taiwan Semiconductor Manufacturing Company (TSMC). Most people (outside of Fintwit) have never heard of it, but it’s the twelfth largest company on the planet. On a market cap / public awareness ratio, they are surely one of the highest.

TSMC manufactures chips designed by customers. They do not design, produce or sell branded products, ensuring they do not compete. TSMC accounted for 54% of total foundry revenue in 2021, with over 90% high-spec chip revenue.

Semiconductor stocks skyrocketed as the pandemic resulted in bottle-necks and demand. After a lofty 200% share price gain in 2020, TSMC stock has since pulled back by 46%. Time of a deep dive.

History

Morris Chang was born in Ningbo, China in 1931. Having escaped 3 wars, he went to Harvard, aged 18, before transferring to MIT. After spending the majority of his career at Texas Instruments, he was recruited to Taiwan in 1987 to start TSMC.

Originally, Integrated Device Manufacturers (IDMs), such as IBM and Samsung conducted every manufacturing step in-house. The rise of the fabless industry was a long way off.

TSCM had to survive on the scraps of the IDMs, until the smaller companies, such as Nvidia and Qualcomm, began to design chips and outsource the manufacturing.

In 1997, TSCM became the first Taiwanese company listed on the New York Stock Exchange.

In the early 2000s, after decades of investment, TSMC caught up with the 22 companies at the leading edge of chip manufacturing.

Over the past 20 years, the market has increasingly concentrated, due to the cost and intensity of maintaining pace. There are only two current producers of the 5 nanometre chips, TSMC and Samsung.

Today, they employ over 65,000 people. TSMC estimates that the cost of their next 3nm fab to be $20 billion.

A (brief) background on the Semiconductor Value Chain

Silicon is a metalloid. It has some properties that make it like a metal (a conductor) and some properties that make it non-conductive. The nickname ‘Silicon Valley' is a reference to early chip producers.

An Integrated Circuit (IC) chip is a set of electronic circuits on a small flat piece of semiconductor material, predominantly silicon. Digital ICs operate with 0s and 1s. Integrated Circuits include memory, logic, micro, analogue, optoelectronics, discrete and sensor chips. ICs make up 80% of semiconductor sales.

The smaller the transistor, the more can be squeezed onto a single chip, ensuring the chip more complex and powerful. The latest processor, the 5-nanometer that TSMC produces, consists of 11.8 billion transistors.

The production process for semiconductors, in particular ICs, consists of three distinct steps; design, fabrication and assembly.

Most of the largest semiconductor businesses are ‘fabless’, meaning they design semiconductor chips whilst outsourcing fabrication. Fabless companies work closely with fabricators, such as TMSC, to manufacture their chips.

Design software, which is used by chip designers, is known as Electronic Design Automation (EDA). EDA companies produce software for the chip designers include; Cadence Design Systems, Synopsys and Mentor.

Dutch-based ASML manufactures the machines the foundries use to produce the chips. After the chip has been fabricated by the foundry, it is tested, assembled and packaged to protect it from damage.

Operating a fab successfully requires deep knowledge of a very complex process. Wafer fabrication involves hundreds of process steps, spread over dozens of different types of equipment.

This final step is done either by the foundry itself or by outsourced semiconductor assembly and test (OSAT).

The Business

TSMC focuses on the leading edge. 23% of last year’s revenue was attributed to 5nm chips. 7nm and smaller chips accounted for 50% of total revenue.

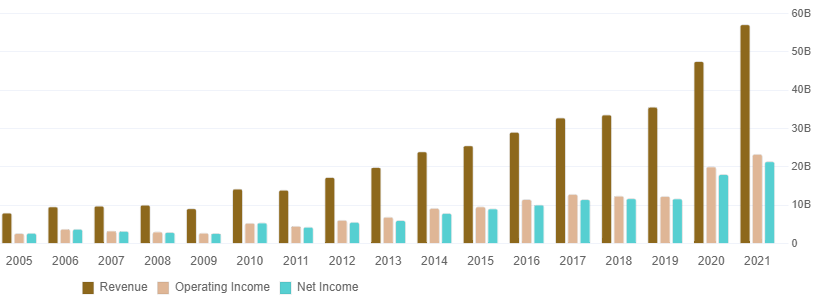

Over the past 20 years, TSMC has generated a revenue CAGR of 12%. In 2021, the $57 billion in annual revenue delivered a 50% gross margin.

Remaining at the cutting edge is costly. TSMC’s capex accounted for over over 50% of revenue, up 63% between 2020 and 21’. The business expects to invest up to $44 billion in capex in 2022 and $100 billion combined over the next three years.

In August 21’ the company announced they planned to increase prices by 10% for the most advanced chips and 20% for the remainder.

Despite a significant profit margin of 37%, TSMC has to constantly re-invest cash flow to build new fabs. The company has to maintain that investment in both capex and R&D. Similar to a Netflix style model, TSMC is investing today, to generate tomorrow’s revenue.

TSMC’s investment makes it very difficult for competitors to keep pace. This ensures scale advantages and has created an oligopoly. Currently, TSMC and Samsung are the only foundries capable of manufacturing the most advanced 5-nanometer chips. Samsung began producing the 3nm chip in June this year, beating TSCM to the punch.

Due to the constant technological advancement in chips, Rock's Law (named after Arthur Rock), highlights that the cost of a fabrication plant doubles every four years. The cost of a plant in 2015 was around $14 billion. TSCM expects the cost of their 2mn plant to surpass $33 billion, demonstrating Rock’s Law in action.

Bear Case

Geopolitics - The elephant in the room. Almost all TSCM manufacturing is located in Taiwan. It's in a geopolitically challenging location which also experiences earthquakes.

On the Compounding Curiosity podcast Asianometry highlighted that ‘There’s no discount you can apply to the stock that codifies the risk of invasion.’ As we have witnessed with the invasion of Ukraine, people are dying and families are being destroyed. The risk is real. However, the entire world (including China) relies on TSMC for chip production. This reason should be off-putting enough for China to launch an invasion and provoke the western world.

Heavy reliance on ASML - ASML (or ASM Lithography) manufactures the photolithography machines which allow TSCM to mass produce their chips. They produce photolithography equipment, which is required to transfer a circuit pattern onto a silicon wafer.

TSMC is responsible for 44% of ASML sales. ASML’s technology ensures their machines are the only business capable of manufacturing the machines required to produce the highest spec chips.

Reliance on a single supplier is risky at best. Supply bottlenecks, ASML’s factory fire in Berlin or political tensions could all lead to future disruptions.

Reinvesting to stay ahead - For almost two decades, TSCM has been at the front of the pack. In the prior 20 years Intel led the market. Intel is now viewed as a has been, despite looking to bring a 3nm chip to market (using TSCM’s fabs, of course).

TSMC has re-invested aggressively, but this comes at a cost. Their model is similar to Netflix, who invest today to produce tomorrow’s content. TSMC’s FCF has only grown by 2% over the past 5 years.

Every generation of chip has to be perfect, or it could result in billions of dollars of wasted investment.

Stagnation of technology - It’s been reported that ‘Moore’s Law is dead’ for a number of years. At some point, the constant reduction in chip size will become a limiting factor.

There are 5 silicon atoms in a nanometre. Either the Silicon changes, or the innovation does. TSMC has been at the cutting edge of this micro-arms race, but innovation may come from outside of Taiwan. If that’s the case, how much of TSMC’s infrastructure remains relevant?

Bull Case

Near Impossible to catch - Between them, TSMC and Samsung have an oligopoly on the most advanced chip sizes. The sheer scale of TSCM means they have over 50% of the market for foundries and 90% market share on the current generation (5nm). TSMC’s advanced process technology leads the world, and it is an indispensable supplier for many large technology manufacturers.

It’s taken over three decades of learning and engineering to reach this point. Only a small number of individuals can operate this technology, meaning, even with $30billion of funding, it’s impossible to build a fab and replicate TSMC’s process.

Supported by an entire country - TSMC’s nickname translates to ‘Sacred Mountain of protecting the country’. Generations of Taiwanese have purchased shares and never sold them.

TSMC’s current annual revenue is about 5% of Taiwan’s overall GDP. It was reported in 2020 that the business was responsible for 20% of private investing in Taiwan. The country has become dangerously dependent on one single enterprise and will do whatever they can to protect it.

Conclusion

Competitors are struggling to catch TSCM. Samsung is keeping pace but cannot match the scale of production. Decades of engineering and specialist-knowledge ensures that investment alone cannot build a leading edge fabrication plant. This ensures that the foundry landscape is unlikely to change significantly in the next 5 to 10 years.

TSMC faces significant geopolitical risk, but it can be argued that a Chinese annex would be reckless due to TSMC's importance in the global supply chain. The investment in an Arizona plant looks to migrate risk, but in terms of output, the US based plant is a drop in the ocean.

TSMC is in chicken-and-egg style arms race. Constant investment in capex and R&D grows revenue, but limits FCF. If TSCM can consolidate the market, they can raise prices for customers who have no choice but to pay them.

Through all implausibility, Taiwan’s Sacred Mountain has surpassed Morris Chang’s wildest dreams. The company has defied all expectations over the course of the past three decades to become the world’s go-to semiconductor manufacturer.

Useful reading and references

https://www.stiftung-nv.de/sites/default/files/the_global_semiconductor_value_chain.pdf