As of November 2021 -

Market Cap = $65.62B

EV = $60.20B

FCF = $1.65B

FCF Yield = 2.5%

Debt / Equity = 2.7%

EBIT = $1.22B

EV/EBIT = 49.3

Intro

Zoom is a noun. You don’t video call. You don’t Google Meet. You definitely don’t Skype. You Zoom.

Video calls are nothing new. The concept was already mainstream back in the 60s, when George Jetson was regularly harassed by his boss through his TV. MSN messenger allowed a generation of teens to experience pixelated webcam conversations and Skype appeared perfectly placed to corner the market but failed to cross the chasm. It’s incredible it has taken almost three decades for a company to make online video calls as frictionless and accessible.

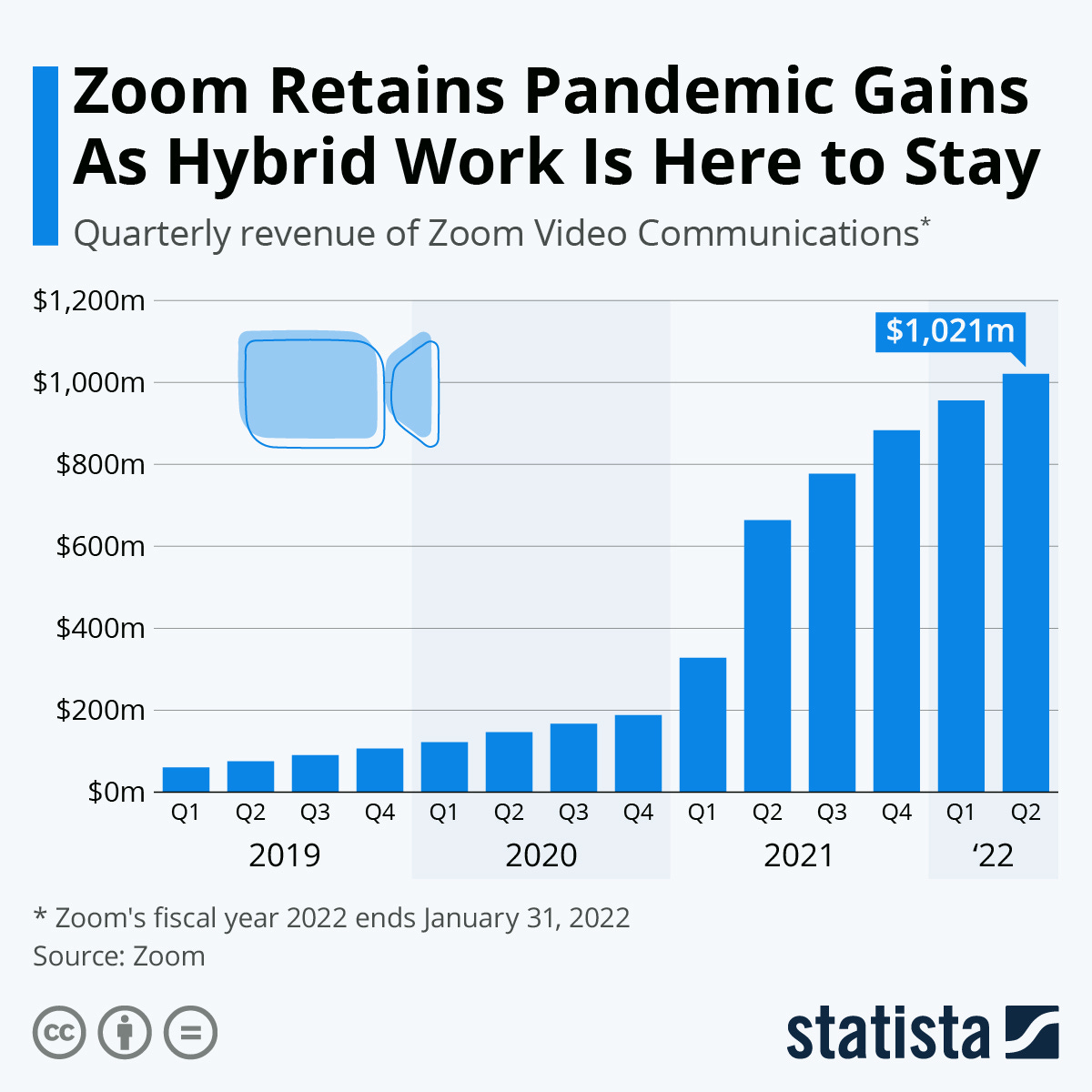

Zoom shot to prominence as the pandemic kicked in, with both the Daily Active Users (DAU) and the share price skyrocketing. The price peaked at a lofty $559, but has since more than halved. Q3’s results wiped 18% off the market cap, despite surpassing earnings targets.

Zoom offers one-click access to video meetings. According to Eric Yuan, the founder and CEO of Zoom, they target business customers, large enterprises, plus education and healthcare organisations.

As we return to schools, offices and places of work, Zoom appears to have had its day in the sun, the market certainly thinks so. Taking a closer look, revenues are still growing and Zoom’s technology is disrupting historic communications infrastructure.

Eric Yuan & Management

Zoom was founded in 2011 by Eric Yuan and launched in 2013. Born and raised in Shandong Province in China, Eric moved to Silicon Valley in 1997 to join the tech boom, despite speaking very little English.

A former Cisco engineer, he pitched a new smartphone-friendly video conferencing system to Cisco management. When the idea was rejected, he left Cisco to build Zoom.

He sums up the company culture in two words; “Deliver happiness….as a CEO my number one priority is to make sure our employees our happy. If our employees are happy then they can make our users and customers happy.”

Yuan has skin in the game, with around 12% ownership. Bain and Company demonstrate founder led companies typically outperform the rest. Founders wage war on industry norms and have a long-term perspective on investments and building a company that lasts. His employees also agree, with a 95% approval rating on Glassdoor, ranking him #63 out of the top 100 CEOs in 2021.

Yuan is likable and you want him to win. He’s a Chinese immigrant who joined the ranks of silicon valley billionaires, he epitomises the American Dream .

It’s not all skin in the game at Zoom. It’s worth drawing attention to the fact that Kelly Steckelberg, Zoom’s CFO, exercised options in October to purchase $1.8m of stock before immediately selling. This leaves her with only $0.5m of Zoom shares. Since 2019 Steckelberg has sold over $61m in options. When your CFO is selling every stock option they receive, it’s a big red flag.

The Business

Even as we return to the office, Zoom revenues are still growing. Total revenue for the third quarter was $1.05bil, up 35% year over year. Zoom has achieved a net customer retention rate (customers with 10+ employees) of 130% for 14 consecutive quarters. This is not a company that is slowing down!

Microsoft wants you to use Teams, Google Meet needs you to be signed into Gmail, and I’ll ignore Facebook Workplace entirely. Zoom employs a no-walled-garden approach, utilising an open ecosystem to ensure users can meet on the browser of their choosing. Their one-click meeting creates a viral mechanism as users share invites with new users who then create and share their own meetings.

Current Revenue Streams

Zoom’s current services are; Zoom Meetings, the service you are likely familiar with, and Zoom Rooms, a video conference room software predominantly used in classrooms and workspaces.

Zoom employs a freemium model. Meeting users able to host up to a 100 attendees for 40 minutes, free of charge. Rooms start at $39 per month whilst the Meetings Pro package is $11.99 per month.

Zoom are not forthcoming about daily active users, but do state that they have 2,507 customers contributing more than $100,000, meaning that their largest customers are generating around $250m of revenue, or 6-7%. They are not solely reliant on their high rollers and are well diversified amongst smaller customers.

In November, Zoom announced it would be introducing advertising to free users on the browser page after they end a meeting. It’s safe to say that advertising will be rolled out as part of Zoom’s revenue model. It appears to be a no-brainer, as long as they do not compromise their core product. To borrow a quote from Twitter user Modest Proposal, ‘on a long enough timeline everyone sells ads.’

Zoom Phone

Zoom Phone is conference call software that employs the Zoom platform mechanics. As a cloud phone solution it is combining new software with legacy technology, integrating into office landlines and conference calls. Zoom Phone is one of their fastest growing products quarter over quarter. Used in over 40 countries, Zoom phone has reached sales of more than 2 million users. Starting at up to $8 per month (with some options as low as $4), per user, it is conservative to estimate that they are now generating at least $100m annually from Zoom Phone.

There was not a single mention of the Metaverse (looking at you Zuck) in Zoom’s Q3 earnings release, but Zoom Phone does offer VR functionality through Oculus, to allow teams to collaborate as if they were in person. Despite no management metaverse narrative, Zoom offers real optionality on the future of hybrid working and may act as a bridge between the virtual and in-person office.

App store

The Zoom App Marketplace allows users to add integrations on top meetings and calls. Initially introduced as Zapps (before Zapier sued them) they enable third-party developers to create and build for the Zoom platform.

Whether it’s Survey Monkey, Heads Up or Virtual Backgrounds, apps allow users to increase collaboration and personalise engagement. This minimises switching between applications and keeps users on Zoom longer.

Despite launching 12 months ago, the Zoom App Marketplace houses only 1,500 apps (there are roughly 2.22 million available apps for iOS).

The Zoom App Marketplace is another example of Zoom’s open garden approach. Unlike Apple and Google's exuberant 30% commission on all sales, Zoom Marketplace is free for companies. This is another example of Zoom upselling customers, it means developers have to purchase a pro package, whilst end users spend more time on the software.

There is a question whether users and developers spend enough time on the platform to make the App Marketplace a success? For work related apps, such as Asana or Dropbox, it’s a quick win to acquire more users. For social apps, where we spend most of our time, it makes little sense to build on a competing platform. The small number of existing apps on the Marketplace appears to confirm this.

OnZoom

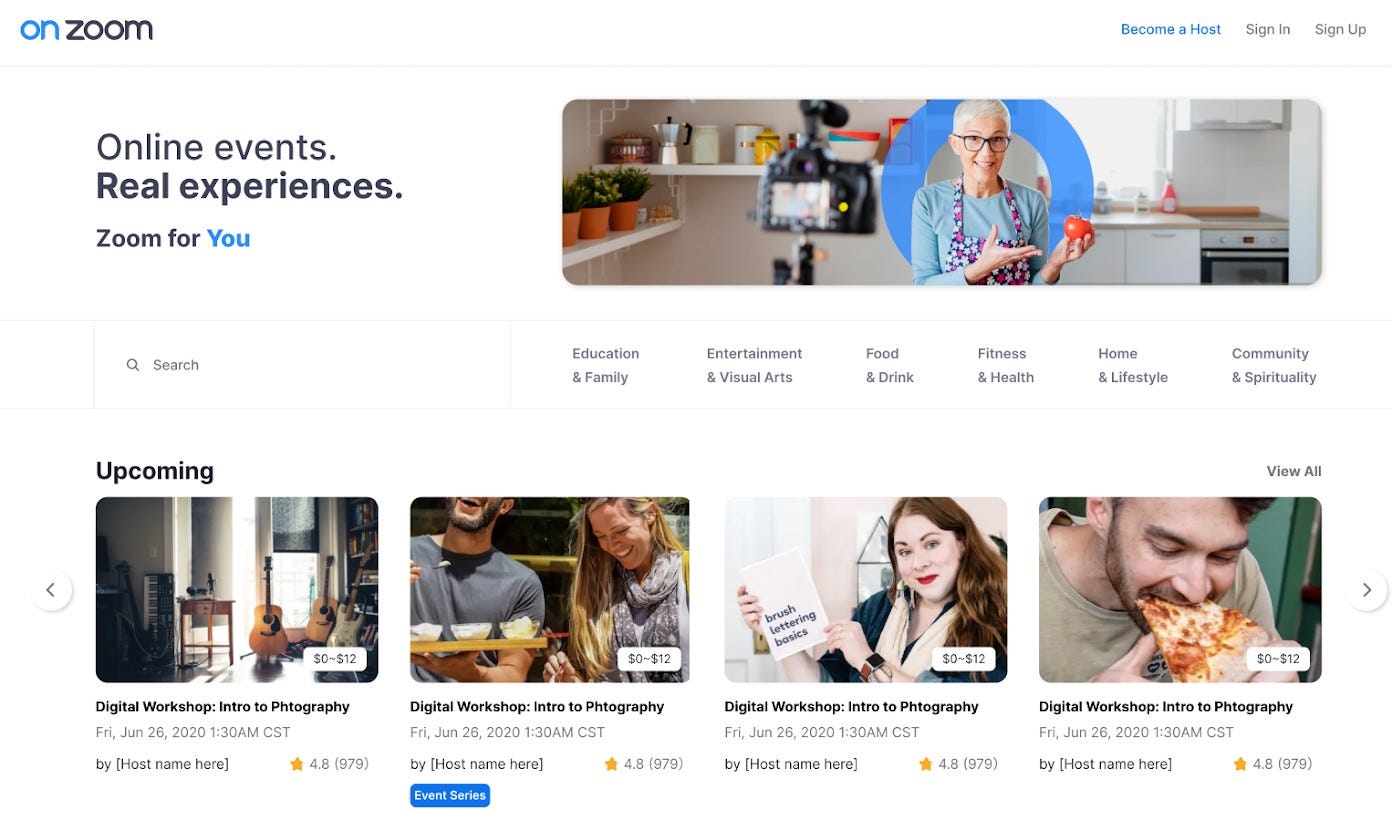

How many fitness classes or quizzes did you attend during the first lockdown? A Thursday night Yoga class was my weekly staple.

Think AirBnB Experiences meets Youtube (or a PC Only Fans). OnZoom is a marketplace for immersive experiences.

Whether it’s a Yoga class, Music lesson or House Flipping Course, OnZoom allows business owners and entrepreneurs to create, host, and monetize events for up to 1,000 attendees. Users pay prior to the event, removing the friction of paying third-party vendors or making a direct bank transfer.

If successful, OnZoom will become a clever way to upsell Zoom services, remove user payment friction and charge a commission on any payments enabled by the platform.

Zoom Video Engagement Centre (VEC)

Using the same technology that powers Zoom Meetings, Zoom VEC was announced at Zoomtopia 2021. A customer service video chat, this service will allow businesses to create personalised and immediate engagement with their customers. Launching in 2022, VEC could help enterprises phase out call centres and allow more employees to work from home.

Hardware

Zoom Home’s DTEN ME device is the company’s first foray into hardware. In collaboration with DTEN, the device launched in 2020. Retailing for $599, it received mostly negative reviews and it is not clear how many units shipped. The Zoom for Home landing page lists Portal from Facebook, Amazon Echo Show and Google Nest, revealing they may intend to move away from hardware going forward.

Moat? / Competitors

The trillion dollar question is whether Zoom has a moat? Zoom faces stiff competition from the majority of the FAAMGs for one reason or another. Despite a $60 billion market cap, it is still not clear.

It can be argued that Zoom’s software is superior, whilst their open garden approach will maintain user growth, but how long will this keep them out in front? Zoom has become synonymous with video calls and conferencing. Meeting organisers first port of call is Zoom. The Zoom brand was ranked as the 52nd by Interbrand for world’s best brands 2021, with a value of $5.5 billion.

Facebook’s Metaverse might eat Zoom’s lunch. Microsoft Teams has nearly 250 million monthly active users, but the real concern may be from more disruptive players like Discord. Not Boring provided an enjoyable deep dive on Discord which is well worth a read.

Discord initially became popular with gamers and has went on to gain massive traction with Crypto fans and NFT drops. The target audience of Zoom is early adopters, they are open-minded and intelligent, seeking new opportunities. This overlaps directly with Discord users. Discord is hot on Zoom’s heels with a planned IPO.

The Numbers - Unlocking Value?

At a PE of 60 and Price/Sales of 17, Zoom is expensive by traditional measurements. Unlike the normal overhyped growth story, they are profitable and growing.

Despite 70% gross margins and 100%+ revenue growth, Zoom needs to grow revenue and earnings to justify their price tag. They can achieve this by acquiring more users and increasing the revenue per user (RPU). With approximately 300-350 million daily active users (DAU) and $3.6 billion in annual revenue, they are generating $7-9 per user. Building out their software stack will increase revenue per user, but it’s difficult to determine by exactly how much.

If, and it is a big if, they can shift closer to the likes of FAANGS (Facebook’s $30 per user), there is massive value unlock to be had. Zoom’s business is more similar to Microsoft and Google, delivering one service and building a full stack around it. Unfortunately, neither of these businesses are open with their RPU, making it hard to compare directly.

It’s easy to draw comparisons to the FAANGS, but there’s a reason they generate the revenue they do, they are the winners. Zoom has several iterations to go through before they are even close. It is clear that they have a road map with significant upside to be had… if they can unlock it.

Bull Case

Continued growth in video communications across the globe - Software and technology are eating the world, that much is clear. As we move to Web 3 or some form of the Metaverse, Zoom has firmly staked their flag to become the leader in the next generation of video communications. Their partnership with Oculus could springboard this transition.

Shift to hybrid working - The pandemic has accelerated a movement that may or may not be permanent. It’s clear that the majority of employees do not want to return to an hourly commute, whilst some employers want them chained back to their desks. Google told its employees that at least 60% need to return to the office. Hybrid working is the future in one form or another and Zoom could be a big potential winner.

Unlock of value with engaged costumes and diversification of revenue streams - Building out their software stack and revenue channels will allow Zoom to see what sticks and scale it. Azure and AWS were never obvious evolutions for Microsoft and Amazon, but if Zoom continue doing what they do well, I’m optimistic they’ll unlock customer revenue generation.

Eric Yuan - Yuan is a founder with skin in the game and incentives to grow the company with shareholders in mind. With a 95% approval rating on Glassdoor he appears to be the type of CEO you want leading your company.

Loyal customer base - With consecutive 130% quarterly growth, Zoom is giving customers what they want. They have the best product in the market and customers are sticking with it.

Bear Case

Pandemic reopening - The world is opening back up. Zoom was a massive Covid winner but the market thinks it has had its time. The numbers don’t yet show it, but a pandemic free world could stagnate user acquisition and reduce video hours.

No discernible moat? - Zoom went viral 18 months ago because of their one-click-meeting and open garden approach. As competition materializes from the FAAMGs and Discord, a lack of lock-in could be more of a hindrance than a help.

Spreading themselves thin - Zoom is building out their software stack to diversify and enhance their core offering. Zoom Phone targets a different customer than OnZoom. The question is whether the investments and diversification will pay off? The negative reviews of Zoom Home’s DTEN ME device may be an indicator of what is to come when they don’t hit the mark.

Lack of user time on the platform - Do users spend enough hours on Zoom for management execute their full stack of services? Less time spent by users will result in less development time and, in-turn, less apps. It’s a negative feedback loop that Zoom will have to plug by increasing user time on the platform.

Management selling down stock - CFO Kelly Steckelbeg has sold over $61m in stock since 2019, leaving with only $0.5m invested. Yuan transferred 40% of his holding, around $6 billion, in March 2021 as gifts to unspecified beneficiaries.

Conclusion

Zoom is building a full software stack with the seemingly unanimous goal of encouraging users to spend more time on the platform and upgrade their package. They have excellent customer retention and the best product on the market. They can build a very sticky ecosystem, becoming the future of hybrid working and unlock some easy to routes to profits.

Wall Street has re-rated the share price as if the revenue is shrinking and they are losing customers. Despite a 63% pullback from peak, Zoom is still priced for growth. Zoom was one of the clear pandemic winners, but as the world has reopened the market has dumped them like a loser. Their growing revenue and user metrics tell a different story. I am optimistic Zoom has a promising future, but the volatility ahead may not be one for the faint hearted.

Disclosure - I am long Zoom, with a small percentage of my portfolio invested, ~2%.

Thanks for reading Dough Capital! Searching for the secret sauce beneath the crust.