Author’s Note - As someone who travels regularly, I use Uber to get around foreign cities. In unknown and potentially dangerous parts of the world, the app provides confidence, reassurance, and offers multi-lingual capacity. You can communicate through the chat function that translates instantly.

Uber not only overcomes historic taxi dilemmas, but has created an entirely new market, allowing ride-hailers to get to locations that were previously inaccessible. Bill Ackman’s investment was announced in early February so I thought it was ample time to do some research.

UBER 0.00%↑ Stats (at time of writing)

Market Cap = $151B

EV = $155.5B

Gross Margin = 39.51%

FCF = $6.895B

FCF Yield = 4.12%

5 Year Rev CAGR = 27.6%

EBIT = $4.64B

EV/EBIT =33.51

ROIC = 7.88%

Secret Sauce DCF share value = $80

Simply Wall St DCF share value = $154

Intro

Long gone are the days where you had to wait in line at a taxi rank to then negotiate with a driver. Historically, there was a lack of sourcing, miscommunication and even a risk of criminal activity.

The Uber app mitigates this by matching a service provider with a customer who has an an immediate need for a service - whether that be for taxis or delivery. The company implements a dynamic pricing model based on supply and demand economics.

Uber was founded in 2009 by Garrett Camp and Travis Kalanick in San Francisco. Since the company went public, it has struggled to shake a history of controversy.

Kalanick, who had previously sold his start-up Red Swoosh, joined as co-founder and helped shape Uber’s aggressive expansion strategy. The company launched as UberCab in 2010, initially offering a premium black car service. It quickly gained popularity and lead to a rebrand as Uber in 2011.

The introduction of UberX in 2012, allowed regular drivers to use their own cars which disrupted the taxi industry and fuelled Uber’s rapid global expansion. Despite the success, Uber continues to face regulatory challenges, lawsuits and controversies, particularly around the treatment of drivers, surge pricing and it’s workplace culture. Kalanick was forced to resign as CEO in 2017, following scandals related to his behaviour and legal issues.

He was replaced by Dara Khosrowshahi, who focused on improving Uber’s reputation and pushing for profitability. Today, Uber has expanded beyond ride-hailing taxis and into food delivery (Uber Eats), freight and autonomous vehicle research. It remains one of the most globally recognised tech companies, despite ongoing challenges with driver rights and competition.

Uber currently generates $177B in annually bookings and is active across 71 countries. The company first achieved profitably in 2023, earing $0.93 per share.

Managing partner of Bill Ackman Pershing Square Capital announced in early February that his firm had purchased approximately $2 billion worth of Uber share, around 1% of the market cap.

“Remarkably, it can still be purchased at a massive discount to its intrinsic value. This favourable combination of attributes is extremely rare, particularly for a large-cap company.” - Bill Ackman

Marketplace

Since 2017, Uber’s market share in the US has been around 75%, with Lyft accounting for the remaining quarter.

Notable competitors in the global ride-hailing industry include China's DiDi, which has a significant presence in its home country and has expanded internationally. Southeast Asia's Grab operates across countries like Singapore, Malaysia and Indonesia.

Business Model

Uber connects customers with drivers for both ride hailing and deliveries through the app. Uber allows drivers to connect with minimum friction, only requiring a smartphone and data to access the Uber Driver app.

To grow revenue Uber can pull on two core leavers; increasing the number of users and increasing the number of trips. In the most recent quarter, users increased by 14% on a YoY and QoQ basis. In the same time period, revenue grew by 20% YoY to $12.0 billion, whilst trips increased by 18%, to 3.1 billion, or 33 million average trips per day.

Demand for Uber’s services varies across the year, with Spring and December making up the busiest periods.

“We hit another important milestone this quarter, delivering over $1 billion in GAAP operating income for the first time in our company's history, and are on track to deliver 20% Gross Bookings growth on a constant currency basis for the full year," said Prashanth Mahendra-Rajah, CFO

Uber achieved profitability for the first time ever in 2023, after years of heavy losses. The company reported a net income of $1.1 billion, driven by strong growth in Mobility and Delivery, paired with efficiency and cost management.

For 2024 it is worth drawing attention to the fact that the annual earnings included a $6.4b benefit (pre-tax) due to the revaluation of Uber’s equity investments. The FCF is a better indicator at $1.7B for 2024 - at metric that was still up 122% YoY.

Revenue Segments

As of the latest earnings, Uber had has 171 million Monthly Active Platform Consumers (MAPCs). These are customers who used Uber's services at least once in the previous month using either ride-sharing and delivery.

Uber separates revenue into three segments - Mobility / Delivery / Freight.

The company takes a gross payment from the customer, with about 30% retained by the company and 70% distributed to the driver. Less than 20% of the payment is retained from delivery (Uber Eats) with over 80% split between the driver and restaurant.

MPACs were up 14% YoY with drivers and couriers earning an $20.0 billion (including tips) during the most recent quarter.

Mobility (Ride-Hailing)

Uber's mobility segment describes the ride-hailing and taxi services that connects customers with drivers. Ride hailing makes up 51.5% of company revenue and is the most profitable, with a margin of 30.3%.

Uber’s Mobility segment continues to show growth, with revenue increasing 18% year-over-year and 25% quarter-over-quarter, reaching $22.79b for the year and $6.91b for the quarter.

This growth was driven by a 24% increase in Gross Bookings, supported by a 26% YoY increase in active drivers, a metric that ensures strong supply to meet demand. Uber’s ride-hailing options are diverse and include UberX, UberX Share, Uber Comfort, Uber Black and Uber WAV (wheelchairs access), with additional options including scooters and motorcycles in select countries.

The company is expanding Uber Shuttle as a low-cost group transport option in the U.S, with new routes to LaGuardia Airport. Uber plans to expand this service to further airports in 2025.

Uber Teens launched in 2023 to provide a service for teenagers to ride independently with parental oversight. The teen focused service continues to gain traction, offering families greater flexibility and safety features.

Uber One

Launched in 2021, Uber One is a paid membership that offers savings on Uber and Uber Eats. It is the equivalent of Amazon Prime or Netflix without ads.

Growing at 60% YoY, there are now over 30 million Uber One members, generating around $300M annually.

The up-sell is available in 34 countries and provides customers with discounts on trips and free delivery through Uber Eats. Uber One costs $9.99 per month or $99.99 annually. This allows repeat users to make regular savings.

Delivery

Uber’s Delivery segment generated $20.13B in revenue in the most recent quarter, making up 45.5% of total revenue, with a margin of 18.7%.

Gross Bookings grew 18% YoY, surpassing the $20 billion mark for the first time in a single quarter.

Primarily driven by Uber Eats, the Delivery segment has expanded significantly since launching in 2014 and moved beyond fast food deliveries. It now includes groceries, alcohol and convenience goods.

The Covid pandemic significantly accelerated growth, leading Uber to acquire Postmates (2020) and Drizly (2021) to strengthen market share and add alcohol delivery. Uber has expanded further into non-food deliveries, including prescriptions and retail items.

In pursuit of autonomous vehicle deliver, Ubers has undertaken testing with partners including Motional and Nuro to test delivery options.

The company remains focused on scaling its delivery network, despite competition from DoorDash and Instacart and a lower overall margin in comparison to mobility.

Freight

The freight segment generates 2.8% of total revenue but operates at a loss. Freight lost -$22m in the most recent quarter. Revenue was flat YoY and decreased 3% QoQ.

This reduction was due to a decrease in revenue per load as a result of the macro-economic climate and ongoing return to the norm after the inflated prices during the pandemic. This was partially offset by an increase in volume.

Uber’s Freight segment launched in 2017 and operates as a digital logistics platform to connect shippers with truckers, similar to how Uber matches riders with drivers.

It aims to streamline freight shipping by using technology to match loads with available carriers, improving efficiency and reducing costs. Uber expanded this business with the $2.25 billion acquisition of Transplace in 2021, strengthening end-to-end logistics capabilities.

Despite facing challenges from macroeconomic conditions and fluctuating freight demand, Uber Freight aims to grow by leveraging AI-driven load matching, automation and partnerships with major supply chain players. The segment remains a key part of Uber’s diversification strategy beyond Mobility and Delivery.

Advertising

“On a long enough timeline, everyone sells ads.” @modestproposal1 on Twitter, June 2018

This is not the first time I’ve included this ModestProposal quote and I doubt it will be the last. In 2022, Uber launched an advertising platform to create an additional revenue stream.

By leveraging the extensive user base and data insights, Uber launched advertising across its platforms. These include in-app ads on Uber and Uber Eats, as well as external displays on cartops and in-car tablet advertisements.

Uber Eats advertising has similar features to Amazon Ads, a system that allows sellers to sponsor products to reach more views, whilst restaurants can sponsor posts. Uber’s ride-hailing advertising in closer to Meta’s, targeting users with specific products or brands they may be interested in.

Uber's advertising business achieved an annual revenue run rate of over $1 billion in mid-2024. The $1 billion of revenue was more than double two years prior.

The company's first-party data allows for precise targeting, enhancing the effectiveness of campaigns and attracting a growing number of advertisers. As Uber continues to build out this platform, the advertising model could become a significant contributor of high margin profits. .

Balance Sheet

Uber’s balance sheet has significantly improved in recent years, reflecting stronger profitability and better financial discipline. The company has focused on reducing costs, improving cash flow, and strengthening its liquidity position. As of its latest earnings report, Uber holds a healthy cash balance, allowing it to fund operations and strategic initiatives without excessive reliance on debt.

However, Uber still carries a significant debt load, primarily from past investments and acquisitions. The company has has been actively managing and refinancing its obligations to maintain financial flexibility.

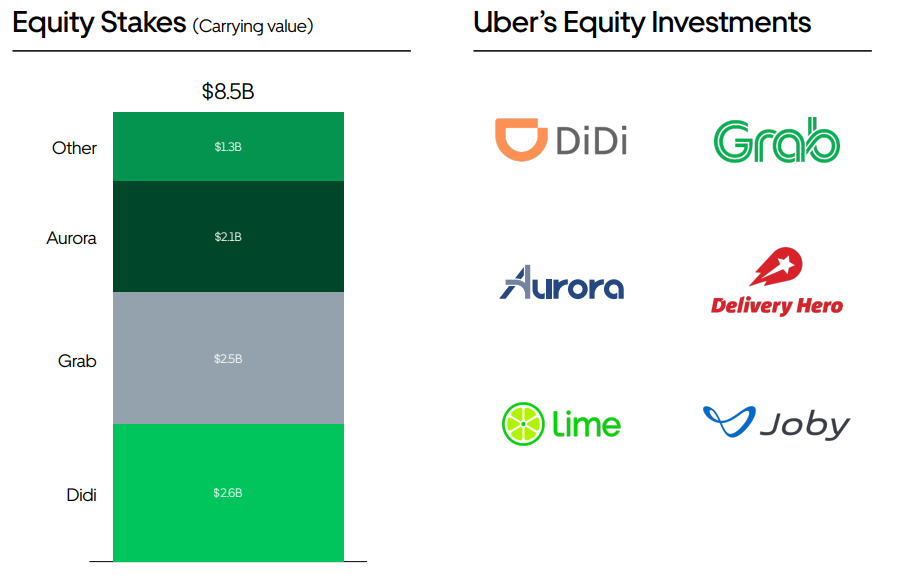

Beyond its core operations, Uber holds equity stakes in several companies, providing both strategic value and financial upside. These include Didi (China), Grab (Southeast Asia), and Aurora (autonomous trucking), stemming from past market exits and partnerships.

While these holdings have fluctuated in value due to market conditions, they represent billions in unrealized gains and potential liquidity sources for Uber. The company has also monetised some of these stakes over time, selling portions of its holdings in Didi and Grab to generate cash. These equity investments not only diversify Uber’s financial portfolio but also position it to benefit from the long-term growth of global mobility and logistics markets - even if that it through its compeition.

Autonomous Driving

Uber anticipates that Autonomous Driving (AD) is a $1T+ opportunity in the US alone. The technology and opportunity have become a large part of the company’s focus, with the Autonomous Vehicles Spotlight presented in the more recent earnings release.

“The key takeaway is that while AV technology is advancing, commercialization will take significantly longer, and we have conviction that Uber will be the indispensable go-to-market partner for AV players” - Dara Khosrowshahi, Uber, Q4 2024 Earnings Call, 05.02.25.

Despite AD being touted as shiny new opportunity for investors, the reality is that it is years, or even decades away.

Most autonomous vehicle companies, including Waymo, Cruise, Tesla and Mobileye, only operate between Level 2 to Level 4 autonomy, where human supervision is still required in some capacity. Waymo and Cruise have launched robotaxi services in select cities, but scaling remains difficult due to regulatory, safety and technological challenges.

In the near term (2025-2030), autonomous driving is expected within controlled environments, such as highway trucking, with robotaxis in geofenced areas and for delivery bots. Fully autonomous cars that can replace human drivers are a long way from mainstream adoption.

Full Level 5 autonomy, where a vehicle operates without any human intervention, is likely many years away.

Uber launched the Autonomous Technology Group (ATG) in 2015, investing heavily in self-driving technology and partnering with Carnegie Mellon University. The company began testing autonomous vehicles in cities like Pittsburgh, Arizona and San Francisco.

In 2018, an Uber self-driving car was involved in a fatal accident in Arizona, leading to regulatory scrutiny and a temporary testing. Uber faced a lawsuit from Waymo, Google's self-driving unit, over alleged stolen trade secrets, which resulted in a $245 million settlement.

Following these challenges, Uber shifted strategy and in 2020 sold ATG to Aurora Innovation, a self-driving tech startup, in exchange for a 26% stake in the company. Instead of developing in-house own autonomous technology, Uber id now focused on partnerships, such as integrating Waymo’s autonomous ride-hailing service into the platform.

The company also collaborates with Motional, a Hyundai-Aptiv joint venture, to deploy robotaxis in select cities. Uber remains invested in the future of self-driving technology but has transitioned from in-house development to external partnerships - with the aim of becoming the app layer on top of the technology.

During the most recent quarter, Uber launched autonomous ride-hailing in Abu Dhabi in partnership with WeRide, marking the first time autonomous Uber vehicles have been available outside of the US.

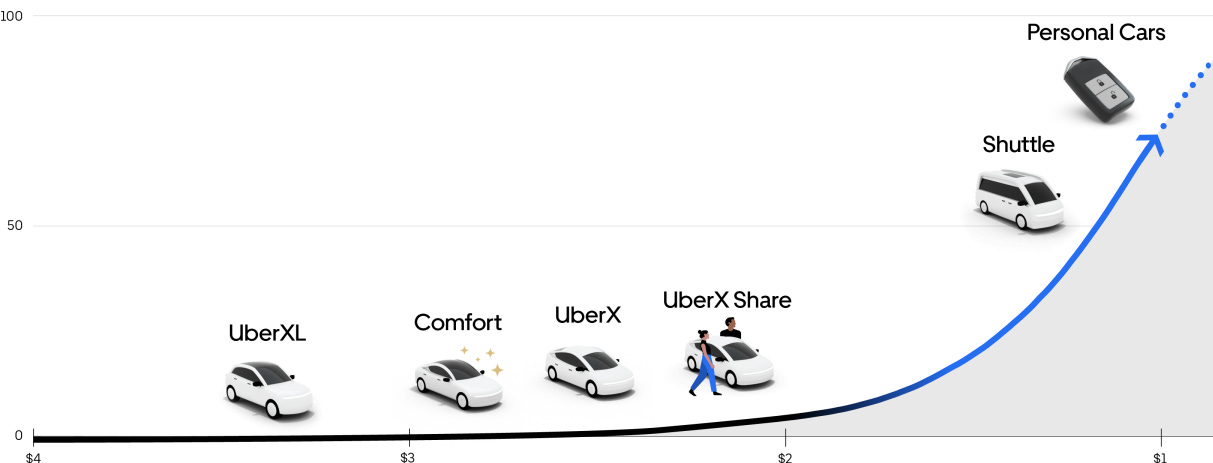

Uber is one of the few companies who can absorb the cost of integrating autonomy - with the scale to role it out. $2 per mile is the cost of a human driver in the US today. Autonomy will unlock a significant addressable market when costs drop below human-driven rides and lead to massive cost savings. Despite the financial opportunity, there remains the moral question of the obligation Uber has to it’s 8.2 million drivers who rely on the service for their livelihoods.

Bear Case 🐻

Geographic Competition

Uber is often viewed as global behemoth attempting to takes on a local businesses - an image than leads global scrutiny and for governments to favour home-grown services. This can often make it difficult to establish a presence in new markets.

Uber does not operate in China, instead Didi is the dominant app. Didi is China's leading ride-hailing service. Uber pulled out of China in 2016 after burning through more than a billion dollars a year due to a price war with Didi. It eventually sold its China operations to Didi in exchange for an 18% stake in the company - Uber still owns a reported 12.8% of Didi.

Didi has been exploring international expansion, moving into markets in Latin America, Australia and Africa, where it competes directly with Uber.

In India, Uber faces competition from Ola, a homegrown ride-hailing app that dominates key markets with localised offerings including auto-rickshaws and cash payments.

Bolt and Free Now provide competition in Europe, particularly in Germany, France, and Spain, where stricter regulations and strong taxi unions limit Uber’s expansion.

In Latin America, Uber faces competition 99 (Brazil) and Cabify (Spain-based, operating in LATAM and Europe), both of which leverage local market knowledge and regulatory compliance to compete effectively.

In Southeast Asia, Uber was forced to sell its business to Grab in 2018, conceding the market after struggling against strong competition and regulatory challenges. Gojek, another Southeast Asian giant, continues to dominate in Indonesia with its super-app model, which includes ride-hailing, food delivery and financial services.

In the delivery space, Uber Eats faces intense competition from DoorDash in the US, Deliveroo in the UK, Zomato in India and Rappi in Latin America.

Despite these challenges, Uber remains the dominant global player by expanding partnerships, acquiring rivals (like Postmates in the U.S.), and diversifying into freight and autonomous technology to maintain its global presence.

Regulation

Uber faces regulatory challenges worldwide, often clashing with governments over labour laws, licensing and competition rules.

In the UK, Uber was forced to classify drivers as workers after a ruling entitled them to minimum wage and benefits. The UK Supreme Court case of Uber BV v Aslam (2021) ruled that Uber drivers are workers, not independent contractors. This case established that Uber drivers are entitled to paid holidays, minimum wage and rest breaks. Additionally, it was also ruled that Uber fares should be subjected to VAT. This lead to approximately $622 million cash outflow related to payments of HMRC VAT in the year ending December 31, 2023.

In California, Uber fought against AB5, a law requiring gig workers to be classified as employees, but later backed Prop 22, which granted drivers some benefits while maintaining contractor status. In Germany and Spain, Uber has faced bans and strict regulations favouring traditional taxis which as lead to operational adjustments.

India and Brazil have imposed stringent safety and fare regulations, while China forced Uber to sell its businessDidi due to intense regulatory pressure.

Uber often adapts by lobbying for new laws, adjusting business models, or partnering with local governments to comply with regulations.

Lack of insider ownership

Uber’s lack of insider ownership is a notable contrast to other tech giants where founders have maintained significant stakes and long-term influence. Travis Kalanick, Uber’s co-founder and former CEO, sold nearly all of his shares between November and December 2019, severing his financial ties with the company.

While Uber has grown into a profitable and globally dominant platform, it lacks the kind of strong founder-led vision seen at companies like Meta (Mark Zuckerberg), Amazon (Jeff Bezos), and Nvidia (Jensen Huang)—leaders who have guided their businesses through multiple phases of growth while retaining significant ownership stakes.

It’s unfortunate that Kalanick was unable to see Uber through to its current state, as he might have joined the ranks of great owner-operators in the tech industry. Instead, Uber has transitioned into a corporate-led structure, with leadership driven more by executives and institutional shareholders than by a founder with personal investment.

While this shift has helped professionalise the company and improve governance, it also means Uber may lack the founder-driven, long-term strategic vision that has propelled some of the FANNGAMs to become some of the largest companies in the world.

Reputational Fall Out

Uber is still haunted by it’s past. Regardless of the bad rep that Facebook or X get for rigging elections or misappropriating user data, neither can physically harm the user.

With Uber ride-hailing you are getting into a stranger’s car - no matter how well reviewed the driver is, this goes against human nature.

Uber has faced significant reputation damage over the years, stemming from issues like safety concerns, corporate scandals and legal battles.

The 2017 #DeleteUber movement, triggered by its response to a U.S. travel ban protest, led to mass customer boycotts. Sexual assault incidents involving both drivers and riders have further damaged trust, prompting Uber to release safety reports and implement measures like ride recording and in-app emergency features.

While Uber has worked to address these fears through background checks, real-time tracking, and safety alerts, overcoming this fundamental psychological barrier remains an ongoing challenge, requiring continuous improvements in trust, security, and reputation management.

Missing the Musk Opportunity?

You’ll notice that Uber does not list Tesla as an AD partner or there website, but is segmented into the Other Player/Potential Partner section.

Uber CEO Dara Khosrowshahi has advised that he wants to work with Tesla CEO Elon Musk rather than compete with the EV company as it prepares to launch its own robo-taxi service.

Tesla’s Cybercab, was announced in October and reportedly will be used on roads in Texas in June 2025 as part of a trial rollout. The autonomous taxi service could directly compete with Uber’s AV services and partners like Waymo and Wayve.

Khosrowshahi suggested that Tesla and Uber could have a similar relationship to McDonald’s and Uber Eats. (On a side note, I was surprised when McDonald’s outsourced to Uber Eats. I had anticipated that McDeliverys would be implemented similar to Dominos approach- with McDonalds attempting to own the tech stack).

Musk is not in the fast food business, he builds technology companies - which is why I would be sceptical he would hand over the Robotaxi app layer to Uber.

As of February 2025, there were about 5 million Tesla cars worldwide - around 0.33% of the total 1.5 billion global cars. Elon Musk should clearly never be underestimated, but Tesla does not have the current infrastructure to mount a serious challenge.

Bull Case 🐂

Brand Value

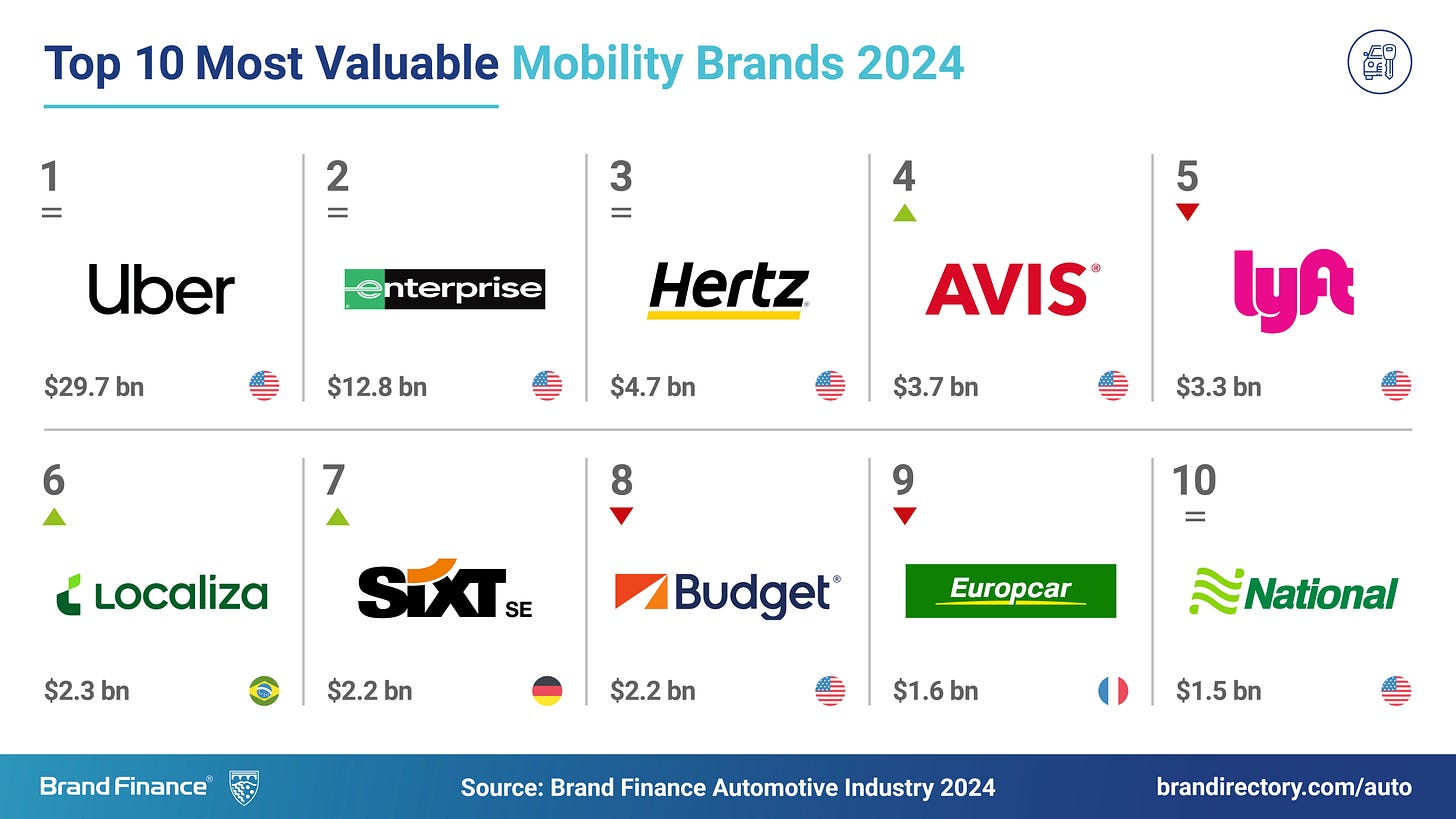

According to Interbrand, Uber was the 78th best global brand of 2024, valued at $9.2B.

Brand Finance valued Uber’s brand at more than three times that, with a worth of $29.7B - making it the world's most valuable mobility brand and 9X larger than US competitor, Lyft.

The Uber app is the the number one travel App in the Apple App Store.

Regardless of the valuation, what is apparent is that Uber’s brand is the most recognised in the space, an advantage that will lead to easier adoption when entering new markets and retaining exiting customers.

Network Effect & Scale Advantage

As of March 2024, Uber commanded a 76% share of the U.S. rideshare market, solidifying its position as the dominant player. This market leadership is reinforced by Uber’s network effects and scale advantage, which are fundamentally interconnected and two sides of the same coin.

As a two-sided marketplace, Uber must continually attract both riders and drivers to maintain dominance. With 33 million trips per day and 8.2 million drivers, the platform’s ability to efficiently match supply with demand is critical.

The benefits of scale include higher trip volumes, greater cost efficiencies, and better pricing leverage, all of which enhances Uber’s competitive edge. Larger platforms benefit from cost savings, spreading fixed costs over more transactions, leading to improved margins, better incentives for drivers and a superior experience for riders.

Diversified Revenue Base

Uber started as a ride-hailing service for black limousines and has since expanded into Uber Eats and Freight, diversifying its business model. In recent years, it has introduced Uber One, a subscription service, and advertising, leveraging the platform to drive additional revenue.

Uber’s scale and infrastructure enable it to add new revenue streams with minimal cost, creating incremental income opportunities without detracting from the existing customer experience. By implementing high-margin services like advertising and subscriptions, Uber continues to enhance profitability while maximising the value from platform. It is likely that Uber One and advertising are only the start of the additional revenue layers.

Technology

Uber operates as a technology layer on top of evolving transportation infrastructure, avoiding the heavy capital expenditure investments required for ventures like Google’s Waymo. Instead of building autonomous hardware of fleets, Uber focuses on software, network effects, and logistics, making it a scalable yet asset-light business.

However, Uber is a unique case in the tech world—it is unable to achieve the viral growth of platforms like Instagram or ChatGPT since physical vehicles are required in each country, alongside drivers and regulatory approvals.

However, once Uber is established in a market, its network effects, scale and brand presence make it incredibly difficult for competitors to dislodge or replicate.

Conclusion

Uber is successfully growing at double-digit rates while achieving profitability, marking a significant turnaround after years of heavy losses. Both the company and its share price still seem to carry a hangover from past controversies, including regulatory battles, leadership turmoil and safety concerns.

Dara Khosrowshahi has largely turned the company around since taking over in 2017. The compnay’s strategy of moving away from autonomous vehicle competition, instead partnering with them and building a layer on top, appears to be a sound one.

A strong bull case has been made around Uber unlocking global autonomous driving and massively reducing their costs.

Khosrowshahi told Thompson the AV market could represent a trillion-dollar-plus opportunity, and Uber views it as “an enormous, enormous long-term opportunity.”

The AV market could be a trillion dollar opportunity in the long term - but it is not clear how far away that is. Whether Uber can successfully integrate autonomous driving into its platform remains uncertain.

What is clear is that removing human drivers could significantly boost Uber’s profitability, allowing it to increase its 33% commission on trips. Currently, drivers earn an estimated $10.53 per trip and with an average trip length of 4.5 miles, that translates to a cost of $2.35 per mile. The true inflection point for autonomous driving will come when the cost per mile of self-driving technology drops below this threshold, making it economically viable to replace human drivers at scale.

The bull case for Uber isn’t solely dependent on the autonomous vehicle (AV) opportunity—the company is already moving toward sustained profitability while expanding high-margin revenue streams through Uber One and advertising. These additional layers enhance the financial model without requiring significant capital investment, making them key opportunities for long-term growth.

Consider Meta’s Family of Apps, which operate with 60% margins. In 2024, Meta generated approximately $48 per user with a 54% margin. Despite not commanding the same level of daily engagement, Uber’s advertising could still achieve meaningful upside.

With 171 million Monthly Platform Active Consumers (MPACs), capturing even 10% of Meta’s per-user revenue ($4.80) at a 50% margin would generate an additional $400 million in income.

Uber is clearly moving in the right direction, with growing revenue and profitability. The trillion-dollar AV opportunity remains a potential long-term upside rather than a necessity for success. Only time will tell if Bill Ackman’s bet pays off.

Closing thoughts - Uber remains a gateway to new destinations, something which was not possible two decades ago - but perhaps we lose a bit of the culture and adventure because of this. Despite this, the app instantly connects you with a driver, regardless of where you are in the world. It’s a service I’ll continue to rely on—especially when traveling abroad, and may even consider investing in.

Sources

https://substack.com/home/post/p-156784020

https://investor.uber.com/news-events/news/press-release-details/2025/Uber-Announces-Results-for-Fourth-Quarter-and-Full-Year-2024/default.aspx

https://www.uber.com/gb/en/autonomous/

https://fortune.com/2025/02/14/ubers-ceo-says-no-one-wants-to-compete-with-tesla-or-elon-musk/

https://asymmetric-investing.beehiiv.com/p/does-bill-ackman-read-asymmetric-investing-1ff8

http://s23.q4cdn.com/407969754/files/doc_financials/2024/q4/uber-q4-24-earnings-call-transcript.pdf

https://digiday.com/marketing/ubers-ad-playbook-for-2025-scaling-innovating-and-staying-the-course/

this is wonderful. thank you for sharing

:D