$ASML Write Up

The Dutch company manufacturing magic 🔬🌈

Author’s Note : Chips and the relating technology are a little bit daunting. If you’re a complete novice to semiconductors this research piece does an excellent job of outlining the technology and industry. If you have more time, Chip War, by Chris Miller is well worth a read. Lastly, this article I published last year, covers TSM 0.00%↑.

Disclaimer: The following article contains my personal opinions and should not replace your own due diligence or be interpreted as investment advice. Please consult with a professional advisor and assess your financial situation before making any investments.

ASML 0.00%↑ Metrics (at time of publication)

Market Cap - €347.81B

EV = €346.64B

FCF = €2.37B

EBIT =€8.42B

Summary Ratios

P/S = 13.4

EV/EBIT = 41.17

FCF Yield = 0.68%

ROIC = 21.97%

5 Year CAGR = 20.3%

Introduction

ASML is Europe’s third largest company, with a market cap over over €370B. Founded in the Netherlands in 1984 as a spinout of Philips, ASML builds and sells specialised machines that semiconductor manufactures rely on to produce chips.

The company is the sole manufacturer of EUV photolithography equipment. The company sells the most expensive mass produced tool ever produced. ASML has carved out what was originally a niche and became world class at it.

The machines utilise extreme ultraviolet light (EUV) which require precise engineering and ultra-clean environments to print transistors on silicon wafers. The revolutionary process has transformed chip manufacturing. Without the equipment the most advanced semiconductors could not be produce and it is unlikely you would be reading this on your current screen.

Each ASML machine contains over 100,000 parts, requires three jumbo jets to transport and 250 engineers to assemble. The next generation of machines will cost around $380 million, roughly double the price of the previous low-NA EUV lithography machines.

ASML has a monopoly on EUV lithography machines, but is heavily reliant on its key customers and an intricate supply chain. TSMC represented 29.3% of 2023 sales, which were down from 38.2% in 2022.

The design of advanced semiconductors is dominated by American tech companies such as Nvidia and Intel. TSMC has a near-monopoly on the actual fabrication of chips, building 92% of the world’s most advanced chips at their fabs (fabrication plants).

In 2023, ASML chief, Peter Wennink announced he would step down as CEO after 10 years.

History

Based in the Dutch down of Veldhoven, far from Silicon Valley, ASML was spun out from Philips in 1984.

Philips had been cornerstone investor in TSMC, which resulted in TSMC fabs being built around Philips manufacturing processes and in turn ASML systems. In 1989, TSMC bought 19 lithography machines from ASML which accelerated the company’s initial growth.

Trade wars between Japan and the US in the 1980’s meant that American companies snubbed Japanese manufacturers, such as Cannon and Nikon, and instead partnered with the Dutch Government.

Japanese companies originally attempted to build everything in house, instead of purchasing specialised components from global suppliers. Due to the high cost of developing EUV technology, the Japanese companies decided not to pursue EUV.

As Intel did not intend to mass produce EUV, ASML received advanced research from the American labs. Andy Grove, the former CEO of Intel invested made $200m investment in ASML the early 90s, as Intel was largest customer. Intel had monopolies in personal computing chips in 1990s.

ASML bought SGV in early 2000s and with it secured all of Americas EUV technology and knowledge.

There was - and remains - considerable collaboration within the semiconductor industry. In 2012, TSMC, Intel and Samsung purchased 15%, 5% and 3% of ASML, respectively. This investment was used to fund the assimilation of EUV technology.

The Chip Industry

If you have the time, I’d suggest watching the following video :-

With increasing costs and specialisation associated with design and fabrication of leading-edge chips, many companies now focus on single steps of the value chain.

Moore’s Law was the observation in 1975 that the number of transistors doubles every two years and has driven the exponential growth in semiconductors for the last 50 years.

The smaller the transistor, the more can be squeezed onto a single chip, ensuring the chip is complex and powerful. Semiconductors, such as memory chips or processors, are the nervous system of almost every piece of hardware on the planet. The most advanced 2nm chip, possesses a density of around 333 million transistors per square millimetre.

Chips are produced in specialised Foundries or Fabrication Plants (fabs), which cost around $20B to build. The largest global producer of semiconductors is Taiwan Semiconductor Manufacturing Company (TSMC).

TSMC manufactures chips designed by customers only and does not produce their own branded products, ensuring they do not compete. TSMC manufactures nearly all the world’s advanced processor chips, including Apple’s iPhone processors. Chris Miller’s Chip War estimates that chips from Taiwan provide 37% of the world’s new computing power.

Most of the largest semiconductor businesses today are ‘fabless’, meaning they design chips and outsource production. The largest fabless companies include Apple, Nvidia, AMD and Qualcom.

Where does ASML fit into this?

Lithography

Lithography enables the ability to etch the silicon with such intricate circuits and add more components which, in turn, ensures that electronic devices have more processing power and memory while remaining the same size.

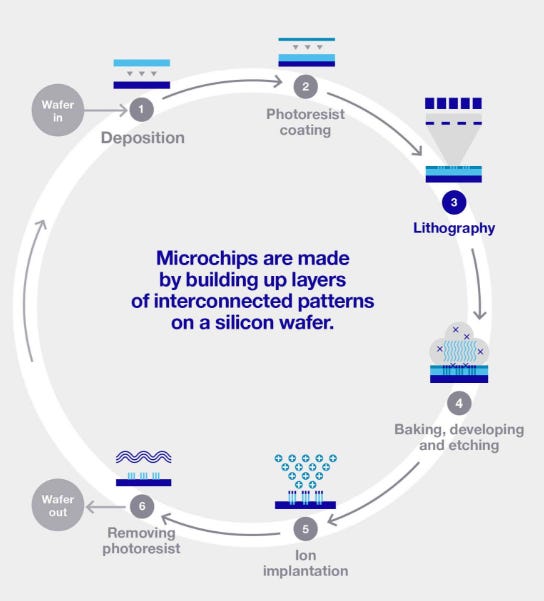

Microchips are made by building complex patterns of transistors, layer by layer, on a silicon wafer. ASML lithography systems print those patterns by projecting ultraviolet light onto a blueprint of the pattern (known as a ‘reticle’ or ‘mask’) by shrinking and focusing the light onto a photosensitive silicon wafer.

The wafer is coated with a “photoresist”, a light-sensitive chemical. A “mask” is then placed on the wafer, which acts as a stencil for the integrated circuit pattern.

The mask is around four times larger than the intended pattern on the chip. UV light travels through the lithography machine, where a series of specialised lenses shrink the light and focus the pattern onto the wafer.

The lithography process is repeated to build layers of a chip. Modern chips can accommodate more than 100 layers, all of which need to be aligned with nanometric precision. EUV systems are used to print the most intricate layers, with the remainder printed using deep ultraviolet (DUV) systems.

This results in a die, a rectangular pattern on a wafer containing circuitry to perform a specific functions. ASML's technology is pivotal to semiconductor production because lithography is the only stage where the wafer is processed die by die.

Lithography has a greater impact on performance, including the yield, than any other stage in the chip manufacturing process.

ASML likens it to using pens with different tips "Because of the small wavelength, that means that you basically are using a fine liner to draw these lines of integrated circuitry - instead of older generation machines which use maybe a marker pen."

Hardware

EUV lithography is a technology unique to ASML and gives the company considerable competitive advantage. EUV stands for Extreme Ultraviolet Lithography and uses EUV light to create intricate patterns on silicon wafers.

As semiconductors get smaller, EUV has enabled the scaling down of intricate patterns on wafers. The technology is required for next-generation applications, including AI and 5G.

ASML shipped the first EUV tool in 2010 to TSMC but didn’t start high volume manufacturing on EUV until 2019, after almost a decade of testing in TSMC’s fabs.

Chipmakers will continue to use EUV technology for 7nm and 5nm chips. As chips reduce further to 3nm & 2nm, chipmakers will be forced to move towards next generation high-NA EUV machines.

EUV lithography makes use of light with a wavelength of only 13.5 nm, which is a reduction of almost 14 times the wavelength of the other lithography techniques. In comparison, Deep Ultraviolet lithography, uses 193nm light.

EUV technology had to be specially designed as extreme UV light is extremely difficult to produce and reflect because of the wavelength. Most materials absorb it. EUV light is produced when a tiny ball of tin is shot in a vacuum with a carbon dioxide laser of 20% light and 80% heat, with industrial diamonds used for lasers exiting the chamber.

Molten droplets of tin, around 25 microns in diameter, are ejected from a generator at 70 meters per second. As they fall, the droplets are hit first by a low-intensity laser pulse that flattens them into a pancake shape. A more powerful laser pulse vaporises the flattened droplet to create a plasma that emits EUV light. This process is repeated 50,000 times every second.

To control the variables and deliver sub-nanometre accuracy, the machine contains hundreds of sensors, actuators and control loops. The EUV illuminator repositions 4,000 mirrors to 20 microradian accuracy, 250 times a second. The cooling system regulates the machine’s internal temperature to within 10 millikelvin. This entire process happens in vacuum with equipment controlled by the paired software.

Next Generation Hardware

High NA EUV is the next step in ASML’s pursuit of Moore’s Law. High-NA extreme ultraviolet (EUV) chipmaking tools, such as the High-NA Twinscan EXE:5000, will cost around $380 million each. This is more than double existing Low-NA EUV lithography systems, which cost around $183 million.

After a decade of R&D, ASML shipped the first modules of the High NA EUV lithography system to Intel in December 2023.

The company has taken between 10-20 initial orders from the likes of Intel and SK Hynix and plans to manufacture twenty High-NA systems annually by 2028.

The first chips made using the EXE:5000 will be 2nm node logic chips. These chips will combine the features with leading-edge architectures to power the technology of the future including robotics, artificial intelligence and beyond.

High NA EUV machines have the capability to deliver a significant increase in productivity with output of up to 220 wafers per hour, a 37% improvement over the previous generation. The new systems have exposure fields half the size of the predecessors meaning it can make twice as many exposures to pattern a single wafer.

‘NA’ in the name refers to numerical aperture – a measure of the ability of an optical system to collect and focus light. High NA EUV ensures the NA increases from 0.33 in the earlier systems to 0.55 in EXE. The higher NA is what gives the new machines better resolution. The High EUV 0.55 NA system provides finer resolution enabling an almost 3 times increase in transistor density.

The Twinscan EXE:5000 can print more than 185 wafers per hour, with ASML aiming to increase that to 220 wafers per hour in 2025. Productivity is key to ensuring that chip manufacturers purchase the next generation of High NA EUV machines.

Software & Servicing

Due to the dimensions of the chips it would be impossible for lithography systems to manufacture chips without software being developed alongside it.

Largely considered a hardware company, ASML software coordinates the behaviour of the modules inside lithography machines.

The software helps to measure and adjust for nanoscopic inaccuracies that can arise due to material imperfections, temperature or atmospheric pressure interference and instructs the hardware to correct for issues.

In addition, ASML has application software (off-machine software), which allows customers to optimize production, calibration and automation through a user interface.

Company Overview

ASML offers customers machines with four wavelengths of light; I-line (365nm), KrF (248nm), ArF (193nm), and EUV (13.5nm).

ASML controls about 90% of the lithography market, creating a bottleneck in the semiconductor industry and a considerable moat. Top customers include the world's main foundries; TSMC, Intel and Samsung.

Due to the significant upfront cost there are only a small number of companies in the industry with the budget and knowledge to purchase EUV Lithography machines.

In most recent quarter ASML sales were driven by 63% logic chip producing customers and 37% coming from memory chips.

Business Model

75% of ASML sales are driven by new hardware sales with the remainder of revenue derived from servicing, maintenance and upgrades. Upgrades can significantly improve the output of each machine.

EUV machines cost around $100M+, with the newest model at up to $380m. Intel was the first customer of the Twinscan EXE: 5000 High NA EUV machine, which is about the same size as a double-decker bus. It arrived in Intel’s R&D facility in late 2023, with ASML engineers methodically piecing it together ever since then.

In 2023, the company delivered a 30.2% increase in net revenue, securing sales for 449 lithography systems (in units), up from 345 in 2022. In the past six months, the company had orders of almost €13B. At the end of Q1 2024, it finished with a backlog of around €38B in future orders.

Prior to the launch of the latest model, the two main products is the portfolio were:

Twinscan NXE: 3600D - ASML’s most advanced lithography system that produces 5nm and 3nm logic chips and leading-edge DRAM chips

Twinscan NXE: 3400C - produces the 7nm and 5nm chips.

The EUV Lithography Market size is estimated to be worth $10.34B in 2024 and is expected to reach $17.81B by 2029, growing at a CAGR of 11.5% during the next 5 years.

Supply Chain

AMSL sources parts from almost 5,000 suppliers. The company is the endpoint in complex chain.

Brooks Automation: Supplies ASML with advanced robotics for precise wafer handling, vacuum handling solutions, cryogenic cooling systems and environmental control systems.

Carl Zeiss SMT: ASML has shared a strategic partnership with Zeiss, the lens company, since 1997. ASML owns 24.9% of Zeiss subsidiary, Carl Zeiss SMT. Carl Zeiss SMT provides the optical components, such as lenses and mirrors, used in ASML's photolithography systems. The precision and quality of these optical elements are vital for the performance of ASML's machines. The lenses manufactured by Zeiss are some of most uniform lenses designed in history.

Trumpf: Supplies the CO2 lasers used in ASML's EUV light source. The lasers are essential for shooting the tin droplets to produce extreme UV.

Cymer: San Diego-based Cymer was acquired by ASML in 2013 and is the provider of the EUV light source. In addition to EUV light sources, Cymer also produces deep ultraviolet (DUV) light sources.

MKS Instruments: MKS provides various critical components, including gas delivery systems, vacuum technology plus pressure and flow measurement instruments.

Edwards Vacuum: Edwards supplies vacuum and abatement solutions necessary for the high-vacuum environment required in ASML's lithography machines.

Rudolph Technologies: Rudolph Technologies supplies process control metrology and inspection systems that help ensure the precision and quality of the photolithography process.

Most recent quarter - Q1 2024

ASML reported the most recent quarterly earnings on 17th of April, 2024.

The order book of Q1 net system bookings were €3.6 billion, which was made up of €656M for EUV bookings and €2.9B for non-EUV bookings. Net system bookings in the quarter were driven by memory chip machines at 59% and 41% for logic machines.

The company ended Q1 with negative free cash flow, driven by lower down payments and higher inventory relative to previous quarter. ASML customers are in the process of returning to profitability after a challenging year. The higher inventory was a result of the increased material intake, including High NA parts, as part of planned ramp up of capacity for the next generation of machines in 2025.

In the past six months the company had orders of almost €13 billion.

Bear Case🐻

Impossible Supplier Infrastructure

ASML’s strength lies in sourcing from 5,000 suppliers and bringing all the parts together into a single machine. However, suppliers have to keep up with the pace of ASML’s technological advancements.

When suppliers do not maintain pace or mis-behave, ASML will purchase or invest in the manufacturer. This has worked for Zeiss and Cymer but cannot work indefinitely.

ASML faced difficulties during the pandemic due to a breakdown in global supply chains, which demonstrated the fragility of the network.

Cyclicality of the Industry

The semiconductor industry has a history of cyclicality driven by the capital intensive nature and demand of the end consumer products. Reduction in consumer spending on electronics - such as phones and tablets - during economic downturns translates to the chip manufacturer sales.

As economic pressures worsened in 2023, consumer spending reduced and left high inventories of chips. This reduced demand from chip manufacturers and left them less willing to invest in new manufacturing capacity. Several of ASML's largest customers, including TSMC, SK Hynix and Micron Technology cut capex in 2023 due to elevated chip inventory.

ASML customers have to make capital intensive investments to produce the next generation of chips. TSMC has so far delayed on purchasing the $350M High NA machine.

The lithography industry is becoming less cyclical as high end capacity has accrued to ASML. However, the chip industry remains cyclical and ASML will undoubtedly be affected during downturns.

Constant pursuit of R&D

ASML's investment in research and development is the cornerstone of the strategy to maintain an industry moat. The company allocates a significant portion of its revenue to R&D, €4.3B in 2023, around 15.6% of revenue. This was 22.3% increase in R&D on previous year.

ASML had more than 14,000 R&D employees from a total of 37,643 global employees at the end of 2022. The substantial investment supports the ongoing improvement of technology but means the company is constantly investing.

It’s a catch 22, to stay at the forefront of technological innovation, ASML has to spend heavily. It’s a cliched comment for an investing write up, but ASML is not a Buffett style business due to the high R&D investments. ASML will never be Coca-Cola, who can grow revenue through raising prices alone.

EUV disruption

In 2023, Canon announced that it had developed the FPA-1200NZ2C, a machine capable of manufacturing semiconductors using nanoimprint lithography (NIL).

The Japanese company reported the capability to produce 2nm semiconductor chips using advanced NIL technology - a competitor to EUV. Currently, NIL technology can produce 5nm chips.

Canon claims that NIL printers are simpler and cheaper than EUV lithography machines, consuming only 10% of the energy due to the use of optical pattern imprinting technology, instead of lasers for circuit patterning on wafers.

NIL technology has been developed by Canon since 2004, but the yield rate is low when compared EUV, which explains the lower adoption.

Exposure to Geopolitical Risks

During Q1 24, machine revenue from the Taiwan and South Korean markets decreased from the previous quarter’s 13% and 25% to 6% and 19%, respectively. In contrast, revenue from the Chinese market increased significantly from 39% to 49%, with 20% for backlog orders.

2023’s weaker orders from the West were largely offset through sales to China. In 2022, the Biden administration unveiled export controls that prevented American chip designers such, as Nvidia, from sharing their most advanced technology with Chinese manufactures. ASML sits in the middle of any further actions that the US may implement, but plans to continue selling into China.

As a European-based company with limited US technology in our systems, ASML can continue to ship all non-EUV lithography systems to China out of the Netherlands.

The regulations left ASML having to apply for Dutch export licenses for the most advanced DUV and EUV machines, plus US licenses for some mature systems shipping to China.

Chinese customers bought the company's mid-range equipment before new export restrictions came into full effect in 2024. From 2020-2023, China was ASML's third largest market after Taiwan and South Korea, ahead of the United States.

However in 2022, the US Commerce Department announced the CHIPS act and implemented over $20 billion in grants for new fabs for TSMC, Intel and Samsung. This will mean a steady stream of orders for ASML’s equipment. The U.S. CHIPS Act has awarded $12 billion dollars to TSMC and another $6 billion to Samsung, both of whom are building fabs in the U.S.

Failing to keep up with Moore’s Law

In 1965, Gordon Moore of Fairchild Semiconductor and later Intel predicted that the computer power on each chip would double every few years, now famously termed “Moore’s Law”.

ASML customers, and in turn, their customers, only pay considerable amounts to remain on the cutting edge of technology. If ASML - and other leading fabs - cannot maintain the pace of innovation, purchasing will stagnate and customers will seek out alternative solutions.

ASML is heavily reliant on three major customers; TSMC, Samsung and Intel, who reportedly make up 80% of revenue.

High NA machines will cost more than €350 million each, up from €200 million from the previous generation. ASML customers will hold off on investing in these new machines when they can meet current demand using existing machines.

TSMC has notably held off on upgrading so far, with reports suggesting the the Taiwanese company might not make the purchase for several more years or until it moves to 1nm chips around 2030. Samsung is also reportedly still undecided over high-NA adoption.

Bull Case 🐂

Massive tailwinds

ASML is poised to reap huge rewards from the AI boom.

High-end semiconductor manufacturing is the foundation of the technology behind AI development. AI fuels semiconductor demand due to its outsize needs for computing power and memory.

AI continues to drive demand for smaller chips and only ASML's machines will be able to meet such demand .

The companies investing in the AI, such as NVDIA, Microsoft, Apple, are the largest companies in the world have considerable resources to invest.

ASML’s position means that the company is advantageously placed to reap the rewards of this increased investment.

Supply chain

ASML sources parts and materials globally, orchestrating a highly complex network of hardware, software, engineers and suppliers. This results in what could be the world's most intricate supply chain.

ASML only produces about 15% of the materials in house, relying on the network of suppliers for the remaining 85%. ASML has acquired and invested in key suppliers to ensure tight control over the quality and reliability of components used.

The management of this chain is fundamental to ASML's ability to produce advanced photolithography machines, making them a logistics company as much as a hardware business.

Future Order Visibly

At the end of Q1 2024, ASML finished with a backlog of around €38 billion is future sales. The backlog spans multiple years, so customers can’t afford to cancel an order or they are pushed to the back of the queue. As a result, revenue is predictable for future quarters.

As customers place deposits, it ensures that future years are less cyclical and increases free cash flow which can be used on R&D.

Specialised Technology

ASML has invested billions of dollars in R&D, specialised knowledge and trained engineers.

The high cost of investment creates a massive barrier to entry for smaller players trying to enter the advanced chip manufacturing market. It would be almost impossible for even well funded entrants to catch up with EUV technology.

EUV is unlikely to change anytime soon, as industry incumbents on all levels have invested billions over the past decade to produce a collaborative supply chain, something that would take decades to unpick.

Conclusion

Back in 2012, Michio Kau predicted that “By 2020, there will be chips everywhere because chips will cost a penny”. 2012 would have been a great point to invest in a basket of semi-conductor stocks. In 12 years since, ASML’s share price has increased almost 20 times.

The technological advantage has accrued to ASML, which is in the process of becoming a full-stack lithography platform for both hardware and software.

ASML is unlikely to ever be disrupted in the short to mid-term by another EUV machine manufacturer. The company is too far ahead in knowledge and investment to ever be caught on the EUV front.

The long-term disruption comes if a competitor can bring another technology, such as Canon’s NIL, to market.

Chipmakers including Intel and Samsung rely on ASML systems to operate 24/7. Every error on a wafer or system downtime has a huge impact for ASML customers. These relationships have been forged over decades and are effectively symbiotic.

If China ever did surpass Taiwan in specialised chip production, the country would still be reliant on ASML technology. The US are actively on-shoring chip manufacturing, with TSMC building three fabs in Arizona and the American government offering $39 billion through the CHIPS act. All of this will drive further revenue to ASML.

ASML will never be a Buffet style Coca-Cola business or achieve Facebook-like viral growth, it will be incremental. The company is at capacity and just can’t produce anymore machines.

The first chips made using the €350M Twinscan EXE:5000 will produce 2nm node Logic chips. These chips will combine the tiniest features with leading-edge architectures to power the technology of the future, including robotics, artificial intelligence, all of which will create a huge wave for ASML to ride.

As long as Moore’s Law continues, ASML will remain the market leader while chip manufacturers increase transistor density. However, if Moore’s Law ever ends — and we are approaching the physical limitations of silicon-based chips — we could move to a technologically stagnant world, or one which does not require EUV technology. In such a scenario, manufacturers would look for cheaper alternatives to produce commoditized chips, rather than relying on ASML’s increasingly expensive machines. Let’s hope this doesn’t play out anytime soon.

Sources and Further Reading

https://roic.ai/quote/ASML:UW/

https://www.techpowerup.com/319071/asml-high-na-euv-twinscan-exe-machines-cost-usd-380-million-10-20-units-already-booked

https://edge.sitecorecloud.io/asmlnetherlaaea-asmlcom-prd-5369/media/project/asmlcom/asmlcom/asml/files/investors/financial-results/a-results/2023/2023-annual-report-based-on-us-gaap-m7rf6.pdf

https://www.marketresearchfuture.com/reports/extreme-ultraviolet-euv-lithography-market-12373

https://www.joincolossus.com/episodes/42699886/reed-asml-competing-with-moores-law?tab=transcript

https://www.bbc.co.uk/news/business-64514573

https://fpt-semiconductor.com/how-will-canons-release-of-lithographic-printers-in-2024-affect-the-us-china-situation/

https://fortune.com/2024/04/18/asml-semiconductor-ai-manufacturing-uev-lithography-chips-act-nvidia-tsmc-wafers/

https://students.tippie.uiowa.edu/sites/students.tippie.uiowa.edu/files/2023-04/s23_ASML.pdf

https://www.fitchratings.com/research/corporate-finance/fitch-affirms-asml-at-a-outlook-stable-05-04-2023

Related Substack Articles

I certainly loved the book “Chip War” by Chris Miller. A must read to understand the geopolitics at stake in chipmaking supply chain !

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e