Chrome Cracks Under DOJ Pressure 👨⚖️

Antitrust result may force Google to sell the web browser

Author’s Note - Please note that I am a shareholder in Alphabet at the time of writing and publication. I likely possess a bias toward the company however, I aimed to remain impartial throughout this article. Alphabet is the parent company of Google, I use terms interchangeably.

Introduction

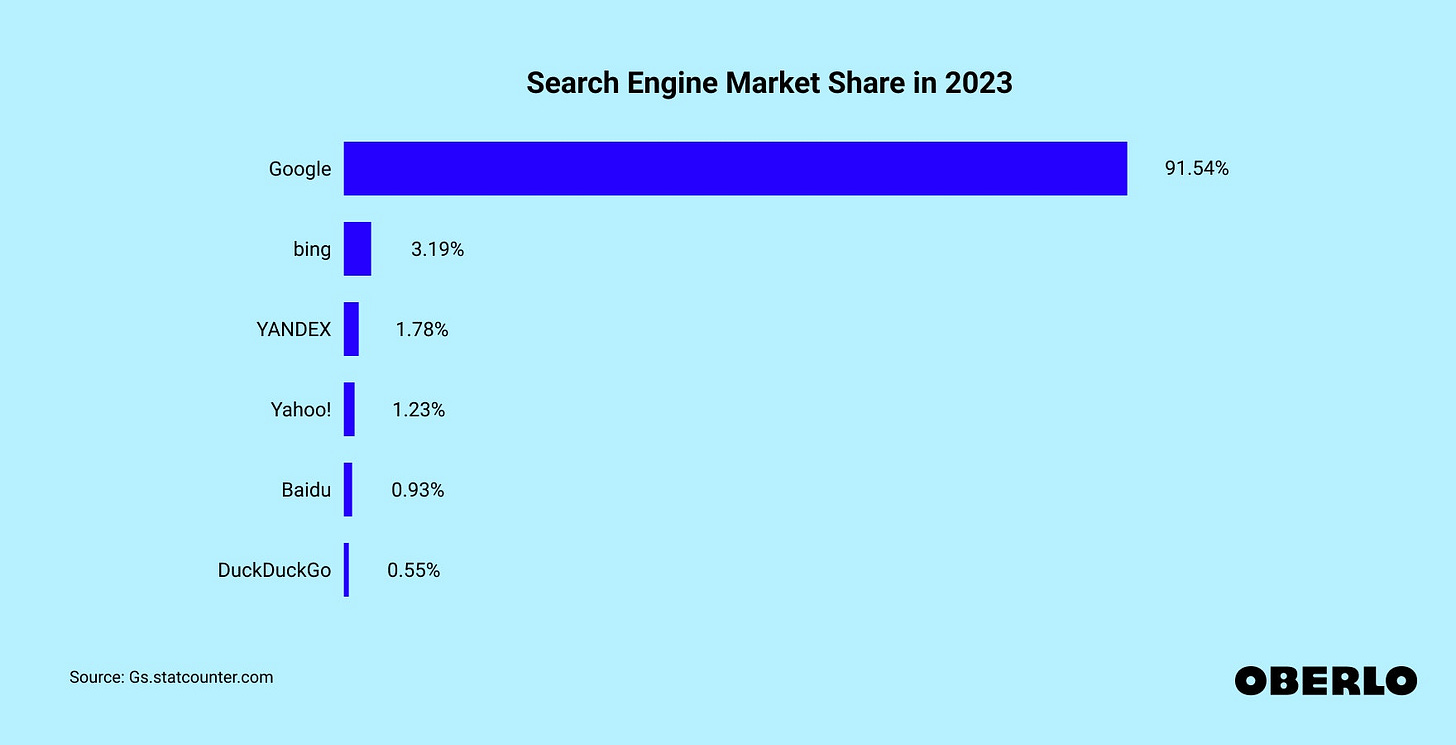

Google is the de-facto player in the search market place. Alphabet, the parent company, has retained 90% of the market for almost two decades. I first wrote about and the company 2 years ago. You can read that here. (↓)

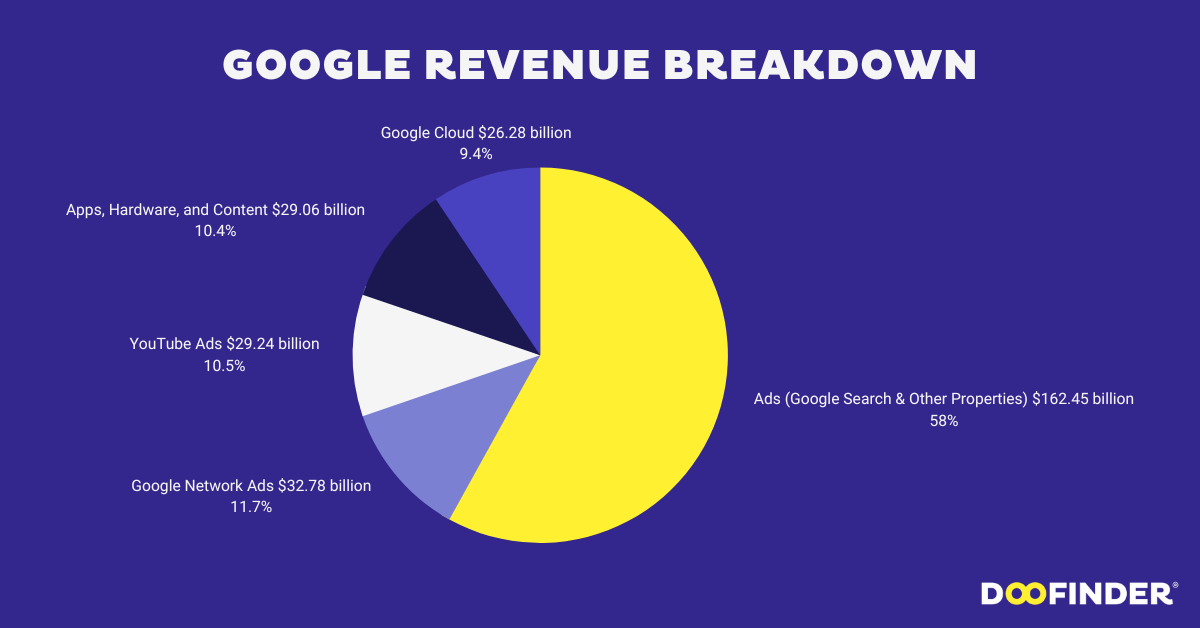

Search is the reason the company has grown from a Stanford start-up to the 5th largest company in the world today by market cap in 26 years. As of the most recent Google earnings update (Q3 2024), Search revenues made up 75% of advertising, and 49% of total revenue.

Two-thirds of the world's web browsing is done on Chrome. The browser is the lynchpin that supports the rest of the advertising ecosystem.

Chrome is currently installed by default on Android phones and captures around 60 percent of the US browser market.

Google is a gateway to the internet for consumers, with 15 products that have more than 500 million users. As one witness stated during the trial, it is no longer the open web, but the Google web, or as Scott Galloway once said, “Google is God.”

On the 24rd of January, 2023, the United States Department of Justice (DOJ) brought a suit against Google of ‘illegally monopolizing the advertising technology’ through Search functionality.

This lawsuit is considered one of the most significant challenges to the tech industry’s dominance since the DOJ sued Microsoft in 1998 for control of the personal computer market. In that case, the trial court ruled that Microsoft had unlawfully attempted to hinder the rival browser Netscape Navigator. Microsoft eventually reached a settlement that didn’t split up the company. A breakup of a monopoly hasn’t happened since AT&T in the 1980s.

Despite the DOJ win, Kent Walker, Google's president of global affairs, said the company intended to appeal the judge's findings.

Previous Legal Troubles

Google faces an ongoing list of legal challenges beyond the DOJ’s antitrust case. Between 2017 and 2019, the European Commission found that Google had violated European competition law, imposing fines of €2.4 billion ($2.7 billion), €4.3 billion ($5.1 billion), and €1.5 billion ($1.7 billion) across three separate rulings.

In 2021, the French competition authority imposed a €220 million fine, while the European Commission and the UK's Competition and Markets Authority (CMA) launched investigations into whether the company’s adtech practices unfairly advantaged the company over competitors and advertisers.

In September 2022, the General Court reduced the €4.3 billion fine imposed in 2018 to €4.1 billion. Google filed an appeal to the European Court of Justice, although it had already recognized a $5.1 billion charge for the original fine in 2018, later reduced by $217 million.

Around the same time, reports emerged that Alphabet could face damages of up to €25 billion ($25.4 billion) in two lawsuits, set to be filed in British and Dutch courts on behalf of publishers.

In June 2022, both the Australian Competition and Consumer Commission (ACCC) and the UK’s CMA opened separate investigations into Google’s search distribution practices, adding to the global regulatory scrutiny.

The Allegations

On the 24th of January 2023, the US DOJ raised a complaint that Google monopolised key digital advertising technologies through serial acquisitions and anticompetitive auction manipulation, allowing Google to exclude competition.

“Today’s complaint alleges that Google has used anticompetitive, exclusionary, and unlawful conduct to eliminate or severely diminish any threat to its dominance over digital advertising technologies,”

Overseen by a judge Amit Mehta in Washington D.C, the antitrust trial sought to address the company’s market control. The trial was a culmination of years of political pressure and investigation from the Federal and state government, plus Congress and global enforcers.

“If the competitors are largely able to influence price but not ultimately win the competition, is that really a competitive market?” - Judge Mehta

The U.S. and state allies were not pursing a fine; instead they wanted an order to stop Google from unfair practices. The results of the trial carry implications that could put an end to Google’s Ad Tech monopoly.

The Outcome

On the 5th of August, Judge Mehta ruled that Google illegally monopolised the search engine market. Despite his ruling, the share price barely flinched. Mehta ruled that Google has a monopoly on Search and broke the law over online searches and related ads.

Google has an ecosystem it taxes, and the government is seeking a resolution to allow rivals to compete fairly.

This marks the US DOJ’s first victory against a monopoly in over 20 years, the last significant victory in a monopoly case was the well publicised Microsoft antitrust suit, which was resolved in 2001.

On the 20th of November, the DOJ Antitrust Division published their proposal to counter Google’s unlawful behaviour. The DOJ’s suggestions include a forced a sale Chrome and a more tentative divestment of the Android operating system.

The DOJ proposed four broad changes. First, Google cannot keep distribution deals with larger hardware players including Apple and Samsung. This would force Google to remove default pre-instillation agreements, along with other revenue-sharing arrangements related to search and search-related products.

There would be some flexibly around smaller details, but the big agreements would be brought to a stop. Alphabet may have to spinoff Chrome, Play or Android, or face significant restrictions because, as Mehta put it, Google’s control “significantly narrows the available channels of distribution and thus disincentivizes the emergence of new competition.”

In their retort, Google highlighted that the DOJ’s proposal would “literally require us to install not one but two separate choice screens before you could access Google Search on a Pixel phone you bought”.

Secondly, Google could be forced to share data or license any data secured by illegal methods for a 10 year period, including “indexes, data, feeds, and models used for Google Search, including those used in AI-assisted search features.” This could include search results, features, ads and ranking signals.

Google would be forced to open their system to enable rivals to compete effectively. To counter Google’s entrenched advantages, rivals must be given equal access to Google’s search index, data and ad feeds at marginal cost. Forcing Google to share data at a marginal cost will allow competitors (Microsoft’s Bing or DuckDuckGo) to quickly improve their products. In addition, Google must allow competitors to syndicate search and ad feeds for ten years, without restrictions on usage.

To prevent Google from using privacy as a pretext to shield the data, the ruling seeks to “prohibit Google from using or retaining data that cannot be effectively shared with others on the basis of privacy concerns.”

Third, the DOJ wants to make sure that Google doesn’t leverage its market power in search to get market power in AI-powered search, generative AI of what’s known as “retrieval-augmented-generation-based tools.”

Solutions would include allowing publishers to opt out of having their content used for Google’s AI training and display purposes. Google routinely instructs publishers who want to achieve improved search results they must concede to being part of some of AI training. This level of cohesion would come to an end.

Finally, the DOJ is seeking to address Google’s scale and control of advertising demand. Millions of companies use Google search ads, giving Google considerable discretion on where to direct revenue.

Remedies here include licensing of Google’s ad feed “independent of its search results,” and more power for advertisers over the placement of their ads.

A "choice screen" would be mandated on devices like Pixel phones, requiring users to select their preferred search engine twice before accessing Google Search. This means Google could not make Gemini AI product mandatory on Android devices or degrade the quality of rival products on Android. Android would no longer be allowed to favour their own search engine

The government wants Google to syndicate the very data its search engine is built upon — disrupting a self-reinforcing cycle that helps Google stay on top. If that happens, search engines’ competitive edge would likely centre more around the additional product features they offer — anything from privacy to user interface details.

The Pushback

Despite the trial’s outcome, Alphabet is one of richest companies in history, and unlikely to accept the DOJ’s instructions without a fight. The company warns that the proposed remedies would create collateral damage, harming consumers, innovation and the U.S.'s competitive edge in global technology markets.

Google has said the DOJ demands would harm consumers and businesses if they are forced to sell Chrome. In response to the filing in October, Google said "splitting off" parts of its business, including Chrome and Android would "break them".

Kent Walker, Google’s Chief Legal Officer, penned a blog post noting “we’re still at the early stages of a long process,” while calling the DOJ proposal a “radical interventionist agenda” that would break Google products and destroy American investment in AI.

Google has pushed back strongly against the DOJ’s proposed remedies, characterising them as extreme and harmful to innovation, consumers and the broader economy.

The company suggests that mandating structural changes, like spinning off Chrome, Play, or Android, would disrupt the integration of the ecosystem which benefits users.

Google argued that the DOJ suggestions would negatively impact user experience. Using the example of the “choice screens” requiring users to select their preferred search engine twice could confuse or frustrate customers, detracting the standards they are familiar with.

In addition, Walker contends that the DOJ’s approach would "destroy American investment in AI," citing that Google’s leadership in AI and generative technologies relies on the scale and data the company has built over decades.

By forcing Google to share proprietary data and tools with competitors or restricting its ability to use such data, Google argues that it would reduce incentives for further innovation and slow AI advancements. In turn this would give foreign competitors a chance to overtake U.S. companies. Google argues that the DOJ is attempting to pre-empt competition concerns in the still evolving AI sector.

It views the ten-year syndication of search and ad feeds as an unjustified penalty that unfairly benefits competitors who failed to innovate or invest at Google’s scale.

Google has pushed back on the proposed forced data-sharing arrangements, arguing that they undermine both privacy and security. It suggests that rivals would gain access to sensitive user data without bearing the same responsibility for safeguarding it.

The company maintains that agreements with partners (like Apple) and product integrations, such as Android and Google Search, are standard industry practices that drive innovation and competition, by offering the best products.

The Google - Apple Relationship

The relationship between Apple and Google was at the heart of the trial and eventual result. District Judge Amit Mehta agreed with the US Department of Justice (DOJ) that Google broke the law by paying to ensure it was the default search engine on Apple smartphones and browsers. During the trial it was revealed that Google paid approximately $26.3 billion in 2021 to be the default search engine across all of its search distribution channels

As part of the trial Google CEO Sundar Pichai confirmed that the company pays Apple 36% of its Safari search revenue. This suggests Google’s total revenue from the Apple agreement (if 36% is based on gross revenue) is between $50-$56B.

Google’s argument is that Apple is ultimately better off outsourcing their search needs to Google whilst being paid for it.

In 2020, Google estimated it would cost Apple approximately $20B to create and maintain a search ecosystem that could compete with Google. Google further estimated that, if Apple needed only half of Google’s infrastructure to produce a competitive search engine, it would have to spend $10 billion to get it off the ground, plus $4 billion annually in technical infrastructure.

In addition, if Apple could sustain a business with only one third of Google’s engineering and product management costs, it would cost Apple $7 billion annually.

The DOJ ruling means that these payments must stop, ending Google’s $20 billion payments to Apple. The will be a considerable loss from the latter’s income. Without getting paid to have Google as the default search engine for the iPhone, what will Apple do? The DOJ expects them to enter the search market.

The AI Gateway?

Regardless of the case brought by the DOJ, there’s a chance that LLM AIs, including Open AI, could be on the verge of genuinely disrupting Search. ChatGPT has already become a similar verb to ‘Googling’ a query.

The irony is that Chrome and Android may be even more valuable than Search. Each has the ability to bring Gemini, Alphabet’s own AI-powered assistant and the company’s answer to ChatGPT, to the consumer. Type a query into the search bar on Chrome and Gemini pops up with an answer prior to any result.

Google has a massive head start on rivals when entering any new technology field, particularly when LLMs are trained on data. Alphabet has more data than tech rivals, with a powerful web index and globally recognised brand. Regardless of OpenAI’s head start, there’s no doubt that Gemini is a serious competitor.

Without Chrome or Android, Google faces a real challenge in getting AIs onto users devices. According to Google’s blog post retort, the enhancement of the suit would “Chill our investment in artificial intelligence, perhaps the most important innovation of our time, where Google plays a leading role.”

Selling off Chrome or Android - Sum of It’s Parts

Alphabet's market cap is around at the time of writing is around $2.3T - the fifth largest globally. Over the past 12 months, Google generated $328B in sales and $135B in EBITDA.

Sales are projected to grow by 11% annually and profits by 17%, driven by the Search & Network segment, which alone is estimated to be worth $800 billion.

Google Services revenues increased 13% to $76.5 billion in Q3 of 2024, with the Search segment growing by 12% YoY to $49.39B.

Alphabet do not break down the costs per segment, but the total Google Services segment achieved a net margin of at least 27% (based on the annual report). This implies Search alone contributes roughly $61.5 billion in net income annually.

Other major components of Alphabet's portfolio also generate significant standalone value. Google Cloud, despite lower profitability, is estimated to be worth $300 billion if valued on par to competitors like Azure and AWS.

YouTube’s valuation is estimated at $280 billion, while smaller divisions, including Chrome, Android and Maps are worth approximately $132 billion. DeepMind and Waymo are worth a further $40 billion retrospectively. The company also holds a cash position of $20B plus securities worth $73B.

Analysts estimate Chrome alone could be worth $15-20 billion if spun off. Questions remain about whether it could thrive independently, maintaining an open-source environment or attract sufficient investment.

Finally, there’s the consideration around who could afford Chrome or Android? Would it make sense to have a different tech giant, such as Amazon or Microsoft, integrate the search engine into a browser? Or would Chrome thrive as an independent company.

Conclusion

After years of dominating the market, Google is poorly equipped to compete fairly in once DOJ proposals are implemented. Investors mostly dismiss the "breaking up" big tech, with the last serious antitrust action against Microsoft in 1998, failing to result in a breakup.

Investors typically disregard lawsuits against the FAANGs. Whenever a fresh lawsuit is announced, the market brushes them off. When Microsoft’s deal to acquire Activision was briefly halted, the market barely blinked. When Meta was forced to sell Giphy, it was inconvenient $250M loss, but did little to hinder the overall business. In the cases tech companies are found guilty, they pay a few billion dollars and move on.

However, investors memories are short, which may lead many to underestimate what is at stake. If Alphabet is forced to divest key assets like Chrome or Android, it could significantly weaken the company’s competitive position.

The market has ignored the DOJ implications, with the share price up almost 20% since the announcement on the 5th of August. It remains unclear whether the DOJ proposal will be soft or have considerable implications. The result is not as inconsequential as the market is treating it.

In September 2023, Crossroads Capital published an article outlining the risk to Google and its shareholders if the DOJ was to win.

The result of the trial means that Google is now an illegal monopolist, and it can never escape that label. The recent outcome brings to mind a quote by Mickey Rouke’s character in Iron Man 2.

“If you could make God bleed, people would cease to believe in him”- Ivan Vanko, Iron Man 2

While the forced sale of Chrome might not immediately dismantle Google Search’s dominance, the cumulative weight of the outstanding cases pose a significant threat. Beyond the trial, Google faces additional antitrust cases over advertising technology and app store practices. Remedies for these cases are likely to intersect, with the judges aiming to collaborate.

The path forward is unclear, with DOJ’s initial recommendations undergoing further refinement. The process includes discovery, additional document disclosures, witness testimonies and a mini-trial to determine specific remedies. Both Google and the DOJ will propose solutions and appeals will follow. Google will hope that higher courts overturn unfavourable rulings.

The remedies the DOJ has put forward will create a different set of challenges for the search engine landscape. Will the market become more diverse or will the forced sale simply shift the power to another tech giant? Microsoft are already a key partner for OpenAi, whilst Apple will require a replacement search tool for the Safari browser. A poorly managed breakup risks creating a new dominant incumbent, while failing to achieve the diversirty the DOJ is aiming for.

The political landscape could also shape the case’s outcome. The DOJ lawsuit was filed during the final months of Donald Trump’s first term, with the President Elect returning to office in January 2025. There are questions whether his administration might adopt a more lenient stance. Trump has expressed scepticism about breaking up Google, citing competition with China. His new administration’s links with Elon Musk could further tie him to big tech, complicating enforcement efforts.

If the situation is similar to Mircosoft’s 1999 trial, a conclusion could be years away. Microsoft appealed the decision and in 2001 the original decision to break the company up was overturned. By the end of 2002 Microsoft had agreed a settlement with the DOJ. It wasn't until 2004 - five years after the original ruling - that the settlement was finalised.

While Microsoft avoided being broken up, the case tarnished their reputation and the aftermath - paired with the bursting of the dot-com bubble - left the company struggling to recover for years. Google has reached a similar crossroads, and while the core assets will ensure the business survives, the company’s reign as the undisputed leader of Search may be coming to an end.

Regardless of how the next decade plays out, if Google is broken up, the tech giant is unlikely to lose its position as a leader in the industry. With assets including YouTube, Android and Google Search, Alphabet’s foundational strength ensure the company remains competitive. Breaking up the company could limit the scale advantages that have historically driven growth and Alphabet shareholders should approach the future with a hint of caution.

Related Articles

References and further reading

https://www.justice.gov/opa/pr/justice-department-sues-google-monopolizing-digital-advertising-technologies#:~:text=In%202020%2C%20the%20Justice%20Department%20filed%20a%20civil,litigation%20is%20scheduled%20for%20trial%20in%20September%202023.

https://storage.courtlistener.com/recap/gov.uscourts.dcd.223205/gov.uscourts.dcd.223205.1033.0_3.pdf

https://assets.website-files.com/5fdcb736a43f592037fbd4b4/64f927a7f3a8d64b1a40ac64_21st%20Century%20Trust%20Busting%20and%20Tail%20Risks.pdf

https://blog.google/outreach-initiatives/public-policy/doj-search-remedies-framework/

https://www.barrons.com/articles/alphabet-google-doj-breakup-6411f164

https://www.theverge.com/2024/11/27/24302415/doj-google-search-antitrust-remedies-chrome-android

https://www.barrons.com/articles/buy-google-alphabet-stock-price-ai-doj-break-up-calls-3ea5d918

https://www.nytimes.com/2024/10/15/us/politics/trump-google-monopoly-china.html