Nvidia $NVDA Company Analysis

Powering the next stage of computing

NVDA 0.00%↑ Key Stats

Market Cap = $434B

EV = $432B

FCF = $8.13B

FCF Yield = 1.87%

ROIC = 19.8%

EBIT = $10.07B

EV/EBIT = 40.37

5 Year Rev CAGR =23%

10 Year Rev CAGR =20%

Intro

Nvidia is the thirteenth largest company in the world by market cap. The company was founded in 1993 by Jensen Huang, Curtis Priem and Chris Malachowsky and is headquartered in California. Haung still owns 3.1% of the company and has held the position of CEO since the company's inception.

The 2021 share price high made it a hundred bagger in less than a decade!

Nvidia is a company that designs semiconductors - specifically GPUs (graphics processing units). GPUs are the chips housed within graphics cards. Nvidia retails GPUs for gaming, cryptocurrency mining, vehicles, robotics, professional visualisation and data centres.

The chips are manufactured by fabricators, predominantly Taiwan Semiconductor. Nvidia combines hardware with software tools, allowing developers to design software for the GPU.

Historically, Nvidia’s business has been focused on gaming. The architecture of the GPU chip means that in recent years it has been adopted for Artificial Intelligence and Deep Learning.

What is a GPU?

To understand Nvidia, you need to understand GPUs.

The term graphics processing unit (GPU) refers to a chip or circuit that renders graphics on an electronic device. Over the past decade, graphical displays have become ubiquitous across all devices, making the GPU an essential part of any handset.

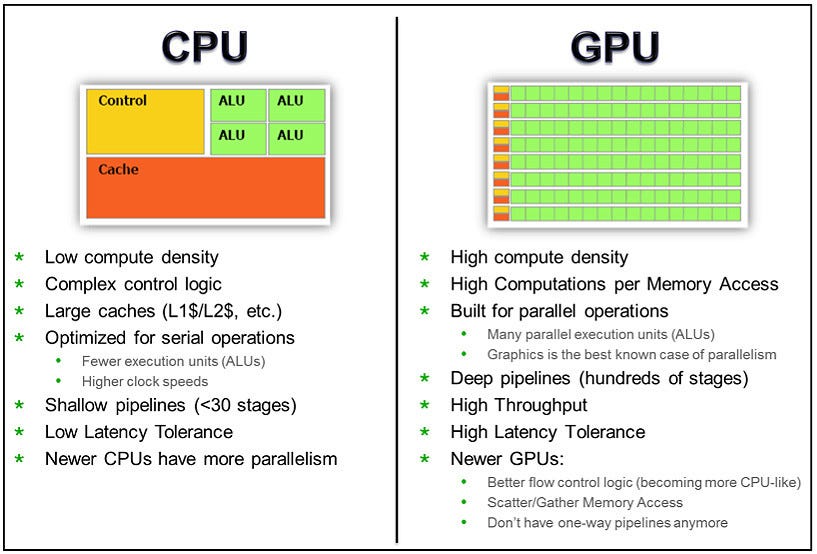

GPU chips are designed to process massive parallel workloads. 3D graphics are one of the best examples of high parallel processing. GPUs can process billions of pixels every second. The basic structure of a GPU provides better memory and more capability than a Central Processing Unit (CPU).

To summarise, the CPU is a general processing unit, able to undertake a wide variety of tasks. The GPU is a specialised processing unit capable of performing a large number of specific tasks. GPUs perform the necessary computations faster than a CPU by performing them in parallel.

Nvidia sells GPUs to consumers under the GeForce brand name. The company launches an updated GPU architecture every year or two. Each architecture is named after a famed scientist, such as Maxwell, Turing, Tesla and Ampere. The latest releases are Hopper (focused on the Data Centre segment) and Lovelace (Ampere’s successor for retail GPUs).

Business Model

Nvidia separates the business into five segments, Data Centre, Gaming, Professional Visualisation, Automotive and OEM & Other.

Historically, Gaming was the focus for Nvidia. Gaming remains a key linchpin for the company but the drop off in Q2 FY23 resulted in the Data Centre becoming the largest revenue generator. The Data Centre segment has 10X’d in 5 years, with a CAGR of 58%!

Nvidia’s 2020 acquisition of Mellanox for $7 billion was pivotal to supercharging Data Centre revenue. Nvidia has been reliant on Gaming since the company was founded, however, the growth and opportunity of the Data Centre has investors excited.

Gaming - 46% of Revenue FY22 Revenue

Nvidia is the market leader in the Gaming GPU space with over 80%+ market share. An estimated 200 million gamers are using the GeForce graphics cards.

Computer games were originally CPU-based, but the maths processor was not powerful enough. In 1999, Nvidia released their first GeForce card and changed the history of gaming. The architecture of the first GPU was responsible for a considerable leap in the quality of graphics.

Fast forward to 2023, the 4000 series, is Nvidia’s most powerful card to date. The RTX 4090 retails for a hefty $1,599 USD / £1,679.00. The average PC gamer can spend thousands to put together custom hardware. During the most recent crypto bubble, gaming GPUs were also used for crypto currency mining.

The introduction of ray tracing technology, by the NVIDIA in 2018, allowed real-time, cinematic-quality graphics for gamers. Ray tracing is a method of rendering that simulates the physical behaviour of light to achieve greater realism. The Nvidia RTX was the first ever real-time ray tracing GPU.

Nvidia also designs the Tegra system-on-chip processor. This chip is aimed at smaller devices such as tablets and mobiles. The Tegra X1, is used in the Nintendo Switch console.

In the most recent quarter, Gaming revenue was down 51% year-over-year and 23% on the previous quarter. As the lockdown ended, Nvidia's gaming segment was hardest hit from the slowdown in consumer PC demand. 2021’s crypto bubble burst, also affected purchases for crypto mining.

Nvidia blamed the slow down in gaming hardware on macroeconomic conditions, with retailers over-stocked on inventory of the previous RTX models. 2023 is expected to bring further challenges to Nvidia's gaming segment.

Customers are facing harsher economic conditions and tightening their purse strings. Nvidia planned to launch the RTX 4080 at $899, but after initial backlash, decided to re-launch it with a $799 price point, renaming it the RTX 4070 Ti. Customers still appear divided, with some calling it a rip off.

With PC gamers returning to the office and cost rising, it’s unclear how Gaming segment can repeat the past 5 years of unprecedented growth.

Data Centre - 40% of FY22 revenue

GPU graphic rendering poses a similar challenge to artificial intelligence and deep learning. Each pixel on screen is unique, therefore runs parallel computing in the same way to AI and deep learning by processing massive amounts of data.

Despite being responsible for over $10 billion of revenue, the Data Centre segment is still a relatively new addition. Nvidia GPUs have become the gold standard for accelerating workloads like analytics, artificial intelligence, and scientific computing.

The Data Centre segment of the business is providing the hardware to accelerate deep learning, machine learning and high-performance computing. Revenue has grown exponentially over the past 5 years.

Nvidia retails the GPUs to data centres. A data centre allows organisations to assemble resources and infrastructure on independent servers.

Nvidia’s Data Centre customers include -

Cloud Computing Data Centre - Centres owned by Cloud Service providers including AWS, Azure and GCP.

Supercomputing Data Centre - Offers higher computational power to undertake tasks including quantum mechanics, weather forecasting and oil exploration.

Enterprise Data Centre - Typically provides servers and devices necessary for various industries such as e-commerce, web applications, financial services and healthcare.

Nvidia’s Data Centre customer base includes several thousand organisations working on AI and High Performance Computing.

Notable customers include Amazon, Alphabet, IBM, Microsoft and Oracle, plus enterprises and start-ups seeking to implement AI and accelerate processing across multiple industries.

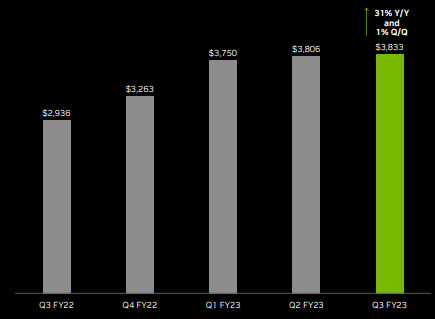

In the most recent quarter, Nvidia saw Data Centre revenues stagnate. Up an impressive 31%, year-on-year, growth slowed to only 1% in the most recent quarter.

The company remains optimistic that headwinds will be short-lived. They are in the process of rolling out the newest architecture, Hopper, along with the launch of the H100 chip. The H100 is the most powerful AI-focused GPU Nvidia has ever designed. The H100 packs 80 billion transistors and has recently retailed for a whopping 4,745,950 yen (around $36,900).

The Data Centre segment includes various products;

NVIDIA HGX A100 - an accelerated server platform for Deep Learning, Machine Learning and High Performance Computing

NVIDIA DGX Systems - Purpose built for supercomputers

NVIDIA AI Enterprise - Runs AI with software supported by NVIDIA

NVIDIA Virtual GPU Software - enables the delivery of virtual desktops and workstations accelerated by Nvidia Data Centre GPUs

Mellanox Acquisition

Nvidia acquired Mellanox in 2019 for $7 billion. The acquisition allowed them to accelerate the growth of the Data Centre segment.

Mellanox specialises in DPUs (data processing units) chips. The DPUs offload tasks from server CPUs, which allows Nvidia's GPU processors to benefit from boosted performance and efficiency.

The Mellanox acquisition made Nvidia’s compute platform more robust, enabling the company to optimise workloads across computing, networking, and storage.

Professional Visualisation - 8% of Revenue FY22 Revenue

The Professional Virtualization segment of Nvidia’s business helps designers and creators run advanced graphics, 3D modelling and image analysis. Nvidia boasts over 90% of the market share in the graphics for workstations, with over 45 million customers.

Nvidia RTX is a computing application that allows artists, architects and designers access to applications from virtual workstations. Users are able to create 3D mock-ups in virtual reality.

The company is anticipating a 37.5% decrease in revenue in the Professional Visualisation in FY23.

Automotive - 2% of Revenue FY22 Revenue

Nvidia supplies chips to car makers including Mercedes, Volvo, Hyundai and many others.

Nvidia’s long term ambition is to provide an out of the box solution for self-driving cars. In the most recent quarterly results, management proposed that this segment remains a $300 billion opportunity.

The solution would allow car manufacturers to integrate Nvidia’s technology and provide self driving functionality. Automakers recognise that it’s easier and cheaper to purchase an out of the box solution than create their own technology from scratch.

The Nvidia DRIVE architecture will be used in the upcoming Volvo EX90 for autonomous driving. In 2021, BMW announced a project using Nvidia Omniverse technology. This allowed engineers to create a 3D version of the factory, review different parts digitally, instead of undertaking testing in the real world.

The Automotive segment of the business has never achieved product market fit and only generates a small percentage of revenue. Nvidia is targeting a $11B revenue pipeline through to FY28. Whether a $300 billion opportunity materialises is yet to be seen.

CUDA Software

In 2004, the company developed CUDA, a platform used for programming GPUs.

CUDA enables developers to build software for Nvidia’s GPUs. This ensures data scientists and researchers can tap into GPUs to accelerate scientific computing and undertake deep learning.

Before CUDA was released, programming a GPU was a challenging process for developers, who had to write low-level machine code. CUDA allowed GPUs to be programmed using high-level languages, such as Java or C++.

Renowned Silicon Valley VC, Marc Andreessen, highlighted in 2016 that "We've been investing in a lot of start-ups applying deep learning to many areas, and every single one effectively comes in building on Nvidia's platform."

In 2020, Nvidia reportedly surpassed 2 millions registered developers on CUDA, with over 438,000 downloads per month. Courses in CUDA are taught in over 200 universities worldwide.

CUDA ensures that the software built for the GPUs, remains exclusive to Nvidia hardware. Once developers tailor their code for Nvidia chips, it is difficult to run it on products from competitors, such as AMD or Intel.

The Numbers

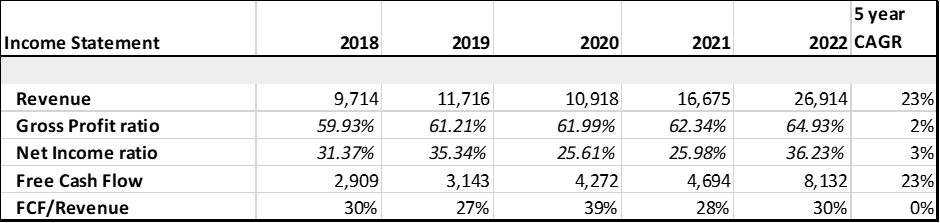

Between 2020 and 2022, Nvidia’s revenue achieved a 146.51% increase!

The share price was mostly flat for almost a decade in the 2000’s, but has followed revenue growth into the stratosphere. Even with the recent 52% pull back, shareholders who purchased in January 2012 are up an astonishing 5,100%. Nvidia is predominately a hardware company and the 2022 operating margin was 37.3% - Apple's was under 30%!

The company is richly valued on a historical and industry basis. The 2022 annual report highlighted how the Peer Group Median for Market Cap/Revenue was 7.14, whilst Nvidia’s was 25.38.

Comparing the company’s share price to the industry, the average PE of a semiconductor company is currently 10.7. Nvidia’s remains a lofty 75.

The company is likely one of the best in the world, but when a share is priced for perfection, the company’s performance has to remain perfect.

Bull Points

Growth in the GPU market

Various reports estimate the GPU market will achieve a CAGR of anywhere between 7% and 33%. These assumptions vary wildly. What is clear is the marketplace is expected to continue growing.

In Q3 2022, Nvidia claimed 86% of the GPU market, dominating competitors. If the company can maintain a 20% CAGR, their revenue will be over $1 trillion by 2028.

Controlling The Stack

Nvidia controls the stack through its closed-source software moat.

Engineers build on CUDA to run their software on the most used GPU. When you are the dominant market player, customer ease of use is king.

does a superb job of highlighting the ‘only way to break the vicious cycle is for the software that runs models on Nvidia GPUs to transfer seamlessly to other hardware with as little effort as possible.’Whilst Nvidia controls the stack, they will do whatever they can to ensure the transfer to a competitor GPU is anything but seamless.

Gateway to AI & Deep Learning

It’s anticipated that AI is the next stage of modern computing. GPUs will act as the brain of computers, robots and self-driving cars to help them perceive and understand the world.

2023 might be the year that AI enters the public consensus. ChatGPT and Dall-E have dominated social media in recent months. These applications scratch the surface of a potentially seismic shift taking place. What is clear is Nvidia’s tools will be at the forefront of the AI revolution.

In late 2022, the company announced it had partnered with Microsoft to build one of the world’s most powerful AI supercomputers to help enterprises train, deploy and scale AI.

Microsoft Azure will incorporate the Nvidia AI stack, whilst Nvidia will utilise Azure’s virtual machine instances to research and accelerate advances in generative AI.

Microsoft is not the only recognised partner. In January 2022, it was reported that Meta had chosen Nvidia's chips to train AI models in the AI Research SuperCluster (RSC) supercomputer.

The Omniverse

With Zuckerberg laying down the gauntlet for ownership of the Metaverse, Nvidia is quietly building the rails for the Ominiverse.

Nvidia’s Omniverse is a software platform for building and operating metaverse applications. As the adage goes, “during a gold rush, sell shovels.”

This is Nvidia’s first SaaS offering, a diversification away from regular chip design. The Omniverse is still in the early stages, having only launched in 2021, but boasts over 100,000 users.

The Omniverse infrastructure focuses on combining multiple tools, allowing creators, designers and engineers to collaboratively build virtual worlds. At the core of Omniverse is the Universal Scene Description (USD) format, which makes it easy to import assets from a wide variety of separate software, including Unreal Engine, Adobe and Blender.

Bear Points

ARM Write Off

ARM LTD is one of the leading designers of CPUs, whose customers include Apple and Samsung. In 2020, Nvidia attempted to purchase ARM LTD from current owners, Japan’s Softbank.

The deal fell through and Nvidia announced the termination due to regulatory challenges. The cancellation of the deal resulted in a $1.36 billion write off for Nvidia, based on the initial prepayment.

Not only did this equate to 38% of Q1’s expenses, but called into question Nvidia’s ability to make further acquisitions. ARM’s CPU technology would have significantly diversified Nvidia’s product offering, but now leaves them vulnerable to competitors in this space.

TMSC production

Currently, Taiwan Semiconductor manufactures the majority of Nvidia chips. I touched on the problems Apple would face in my previous Write Up.

Nvidia is no different. Most big tech companies would be in trouble if China was to annex Taiwan.

Rich Valuation

Nvidia is richly valued on a historical and industry basis. Until 2015, shares traded below a PE of 20. As revenue growth exploded, the market re-rated the stock and has held it up ever since.

Despite last year's 63% share price drawdown, it remains exuberantly priced. With revenue decreases in Gaming and slowing in Data Centre, it’s a long way down if the company is unable to recapture its exponential growth rate.

Disruption from Big Tech

Nvidia dominates the GPU sector. Big customers include Tesla, Google, Facebook, Amazon and Apple. Facebook recently reported they need 5X more GPUs, just to combat the threat of TikTok.

Based on Nvidia’s high operating margins, customers are paying a premium. The FANGAM companies normally own the stack.

Apple has already introduced their own in-house M1 and M2 GPU chips. However, the M2 GPU is rated at just 3.6 teraflops, less than half the speed of Nvida’s RX 6600 and RTX 3050.

In October, Meta launched a tool that reportedly helped the switching cost between Nvidia and AMD AI chips. The

recent article summarises why ‘OpenAI’s Triton is a very disruptive angle to Nvidia’s closed-source software moat’.The GPU market is plentiful and Big Tech will not remain beholden to Nvidia indefinitely.

Conclusion

Despite 2022’s drawdown, there are many reasons to remain positive regarding Nvidia’s future. They own over 80%+ of the growing GPU market. AI and Deep Learning will further accelerate demand. Jensen Huang has stated that the company has a $1 Trillion revenue opportunity.

With a $400 billion market cap, that revenue has to come from somewhere. Investors remain wowed by recent growth factors, but will the sales slowdown continue?

As consumers face a harsher economic climate, consumer backlash has already led to the RTX 4080 being recalled and re-priced. This raises the question whether the company can maintain pricing power in the Gaming market?

The share price is down 50% from 2021’s highs, offering an opportunity for optimistic buyers. However, with a generous rating in comparison to the semiconductor industry, investors may be wise to hold out for a more reasonable price .… or not.

The Ominverse and next stage of computing are unknowns. Nvidia is undoubtedly building the tools that will empower future technologies. As software companies fight for dominance for the next stage of computing, Nvidia will be in the background providing the shovels.