Global Spirits Company Overview 🥃🍸

A look at publicly traded alcohol producers.

Introduction

Alcohol and spirits have been intrinsically linked throughout human history. There’s evidence of alcohol production in China from around 7000 BC. Distillation is the process of producing spirits from fermented liquid, concentrating the alcohol.

Modern spirit brands often boast centuries of heritage with many able to trace their origins back hundreds of years. The Dutch company, Lucas Bols, is the world's oldest spirits producer, founded in 1575. The oldest working whisky distillery in Scotland is The Glenturret Distillery, which was established in 1775.

This history is testament to spirits staying power. Many alcohol producers are traded on international stock exchanges.

The fact that spirits do not spoil and can be stored for several decades ensures that bottles can gain significant value as they age and become highly sought after. The most expensive bottle ever sold was a Macallan 1926 Valerio Adami version for $2.7 million (USD) at a Sotheby's auction in November 2023.

The global alcohol market disappointed in 2024 as key global markets underperformed - with total volumes dipping nearly 1% globally. Despite this, spirits (excluding national spirits) and RTDs were the only categories to achieve growth, with beer volumes -2% lower and wine declining by -21%.

In a challenging macro climate and with economic weakness in China, customers have become more price conscious, causing producers to rethink the recent shift to focus on premium.

In 2024, U.S, spirits sales fell by 1.1% to $37.2 billion, whilst volumes rose by 1.1% to 312.2 million nine‑litre cases. This move demonstrates that US consumers are paying less, but drinking (slightly) more.

American whiskey volumes dropped 4% following a post-pandemic return to the norm alongside tariff threats in key export markets.

These declines have been potentially caused by the higher cost of living, cannabis competition, Gen Z’s sobriety, alongside appetite suppression caused by GPL1 weight-loss drugs.

Despite the spirits brand strength, the market has stagnated. Growth has been difficult to achieve, even for staple products. As sales have slowed or declined, so too have the spirit company share prices.

The industry has undergone a dramatic cycle over the past five years. Having been rocked by the Covid pandemic, a post-lockdown premiumisation boom was followed by a more challenging macro environment.

2020–2021: Shock and Pivot

The pandemic caused on-trade hospitality sales to collapse globally. At home, demand surged for both retail and ecommerce sales, with consumers experimenting with cocktails and generally having more disposable income and time to indulge.

Customers also ‘traded up’ to premium equivalents, purchasing more expensive bottles of their go to brand. In emerging markets such as India and China, state restrictions impacted volumes more severely, but recovered as those restrictions eased.

2022–2023: Premiumisation and Expansion

Consumers returned to on-trade premises resulting in a global rebound. Companies focused on premium and super-premium offerings, with brands like Aperol, Hennessy and Don Julio achieving record sales.

Notable acquisitions included Becle’s purchase of Connor McGregor's Proper No. Twelve brand, whilst US and European conglomerates targeted the Asian consumer to achieve further revenue, particularly in China, India and Southeast Asia.

2024 Onwards: Correction and Transition

The spirits sector slowed in 2024, with rising interest rates, trade barriers (especially between the US and EU), and inflation pushing consumers to reduce spending. Growth was particularly noticeable in the US and China, the two largest markets.

Lifestyle moderation changes have also began to impact behaviours. Gen Z consumed less whilst a rise in GLP-1 weight loss drugs suppressed demand and impacted volumes. Diageo and Brown‑Forman issued cautious guidance, while Kweichow Moutai and Campari focused on margin preservation over volume growth.

Digital sales remained sticky post-pandemic with ready-to-drink spirits, non-alcoholic alternatives and sustainable brands growing as the exception.

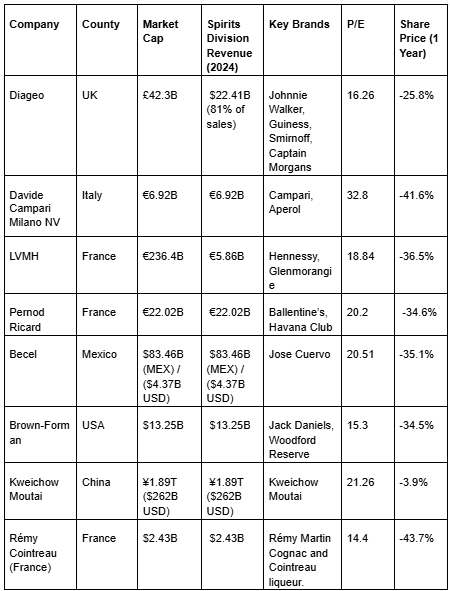

Public Spirits Companies

The following is a list of spirit companies that are traded on global stock exchanges. These listings ensure that data is easier to come by in comparison to private companies (such as Bacardi or Beam Suntory).

Share prices:

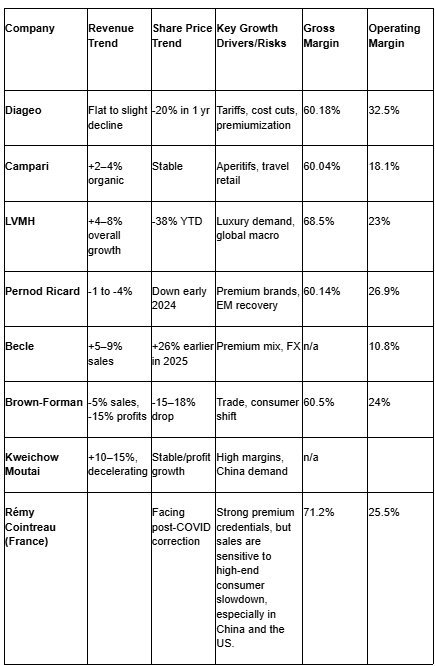

Margin Trends

Diageo (UK)

I’ve previously written about Diageo. You can read that atricle in full here-

Johnnie Walker remains the global Scotch whisky powerhouse. Other strong company brands include Guinness, Smirnoff, Captain Morgan and premium Tequilas like Don Julio.

2024 revenue was flat at $20.27 billion, down slightly from 2023.

The most recent quarter saw organic net sales improve by 5.9%, supported by North and Latin America growth.

The stock has dropped approximately 25% in the past year and over 50% since 2022 highs.

Trade tariffs pose a $150 million annual profit risk; with management poised to cut $500 million in costs through to 2028.

The company has shelved medium‑term growth targets due to macro uncertainty and shuttered the likes of Distil Ventures - its investment arm for start up brands.

With a market cap of £43 billion, Diageo remains one of the largest and diversified spirits companies. The company’s top-selling brand is Johnnie Walker, a globally dominant Scotch whisky with a strong presence across Asia, Europe and North America. Johnnie Walker ranges from Red Label to Blue Label and caters to both entry-level and premium consumers.

Diageo also owns the beer brand Guinness alongside Smirnoff, the world’s best-selling vodka and Captain Morgan, a leading spiced rum brand.

Diageo’s breadth across categories has helped to maintain solid margins, despite of the current macro challenges.

Davide Campari Milano NV (Italy)

Signature Italian aperitifs—Campari and Aperol. The Aperol brand is behind the global Aperol Spritz boom.

2024 sales hit €3.07 billion with double-digit growth in travel retail.

Q1 2025 marked a slowdown, prompting a more cautious outlook by the company.

Management emphasised a focus on travel retail and emerging markets for the Aperol and Campari brands.

The Milan based company has a market cap of €7.4 billion and is best known for the iconic aperitif brands, Campari and Aperol. Aperol, in particular, has become a breakout global success in the past decade due to the rise in popularity of the Aperol Spritz.

Campari holds strong association with Italian lifestyle and cocktail culture, giving the brand significant resonance in Europe and emerging lifestyle markets.

LVMH (France)

I’ve previously written about LVMH here -

Spirits remains only a small part of LVMH’s portfolio (less than 7% of revenue).

The Hennessy house includes Hennessy Cognac with the revenue segment also including champagne brands Moet & Chandon and Dom Pérignon.

The spirit segment has incurred three consecutive years of drawdowns, from €7.10B in 2022 to €5.8B in 2024.

Diageo owns a 34% stake of this segment - a remnant of the original 1980’s acquisition.

Spirits are a smaller slice of the total, but have a 23.1% operating margin (the group’s second strongest behind Leather Goods at 37.1%).

The share price is down 38% YTD, and at one point was as low as €435, but has since rebounded slightly - with a P/E of around 19.

Better known for its fashion and luxury products, LVMH's spirits division (Moet Hennessy) includes dominant brand such as Hennessy Cognac, Moet & Chandon, and Dom Perignon.

Hennessy, in particular, is a top seller in the global cognac market, especially in the U.S. and China. The group’s spirits brands benefit from a strong luxury positioning and cross-support with the fashion and leather goods houses. With a market cap of €236.4 billion and a P/E of 19, LVMH's spirits division contributes to its premium valuation thanks to heritage, scale and brand power - with the company currently trading at a potential discount.

Pernod Ricard (France)

The second global largest spirits producer, behind Diageo.

Ballantine’s blended Scotch and Havana Club rum lead sales, with the portfolio also including Ricard pastis, Jameson Whiskey and Absolut Vodka.

FY2024 revenue fell 4.4% to €11.6 billion, with 2025 H1 down 13% .

Organic net sales declined 1% in 2024, beating forecasts but recurring operating profit grew 1.5%.

Pernod Ricard boasts a broad portfolio with standout brands including Ballantine’s Scotch Whisky, one of the best-selling blended whisky brands and Havana Club, a dominant product in the global rum market. While not as luxury as LVMH, Pernod Ricard maintains strong market share through consistent performance across regions.

Becle (Mexico)

I’ve previously written about Becle here -

Traded on the Mexican stock exchange - making shares harder to transact.

Jose Cuervo tequila accounts for ~35% of Q4 24 volume, though volumes dropped 6.5% YoY.

Q1 25 sales rose 9.9% for flagship brands whilst volumes dipped.

Becel is the Mexican producer of Jose Cuervo—the world’s best-selling tequila. The company has market cap of $4.22 billion USD. Jose Cuervo dominates the tequila category globally, especially in North America, and has benefited from rising demand for agave-based spirits over the past decade.

The brand spans across price tiers, from the accessible Especial to the high-end Reserva de la Familia. With a P/E of 19.22, the company offers growth potential with tequila’s growing popularity but is harder to invest in due to its Mexican listing.

Brown-Forman (USA)

Jack Daniel’s Tennessee Whiskey is the dominant brand and supported by the more premium Woodford Reserve alongside RTD extensions.

FY2025 net sales $4 billion, down 5%; Q4 sales fell 7% to $894 million, missing forecasts.

FY 25 net income dropped 15% whilst Q4 profit plunged. The share price plummeted 20% in June 2025, the steepest single-day drop since 2008 and worst session since Sep 2013.

The share price has lost over 55% over the past 5 years.

The company has introduced product lines including Jack Daniel’s Tennessee Blackberry RTD, and paired it with cost-cutting (12% workforce reduction, with plant closures) to save $70–80 million annually.

Based in the U.S. and valued at $13.25 billion, Brown-Forman’s standout brand is Jack Daniel’s, the top-selling American whiskey worldwide.

Woodford Reserve, a more premium bourbon appeals to craft and connoisseur markets. Brown-Forman’s focus on American whiskey gives it a unique niche with strong brand loyalty and export strength.

Kweichow Moutai (China)

Moutai baijiu is China’s cultural liquor of choice.

2024 revenue of CNY 173 billion ($24.2 billion) and net profit CNY 86.2 billion (+15%).

Growth is slowing, with 10–11% annual revenue targets .

Consumer sentiment is cooling, with rural demand falling. The brand is reliant on the Moutai province which is facing financial strain.

Analysts expect earnings and revenue growth 8–9% annually.

Kweichow Moutai, with a has a massive valuation of ¥1.89 trillion ($262 billion USD) making it the world’s most valuable spirits company - despite most Westerners having never heard of it. The company’s top-selling product is Moutai, a high-end baijiu spirit deeply embedded in Chinese culture, particularly in official and celebratory events. Moutai’s scarcity, government associations and prestige contribute to its ultra-premium pricing. Despite sales concentration within China, its influence is vast, with strong profitability driven by high margins and domestic demand rather than global expansion.

Rémy Cointreau (France)

Rémy Cointreau, the French spirits house behind Rémy Martin Cognac and Cointreau liqueur, is navigating a post-pandemic correction as demand from high-end consumers, particularly in China and the US, softens. The portfolio remains one of the most premium in the global spirits sector, with a focus on aged Cognac and luxury positioning. The company’s reliance on affluence makes it vulnerable to cyclicality, with the share price down about 73% from 2022 highs.

The long-term appeal remains intact, bolstered by brand equity and growing demand in premium spirits globally. This offers an opportunity to gain exposure to the ultra-premium spirits segment at a relative discount.

Emerging Trends and Considerations

Premiumisation is still the dominant strategic approach for global spirits companies, though many are becoming more selective, targeting margin over volume.

Ready-to-Drink (RTD) formats and non-alcoholic spirits are now significant growth categories.

Consumer behaviour shifts, such health-conscious younger demographics, are displaying interest in experience over quantity and reshaping brand strategies. In some cases Gen Z is moving away from alcohol entirely (more on that below).

Geopolitical risks, such as tariffs and regulatory change, especially between the U.S, EU and China continue to create future uncertainty.

Sustainability and digital engagement are now essential parts of brand proposition and customer expectations.

Bear Case 🐻

1. Gen Z and the Decline of Alcohol Culture

Unlike previous generations, Gen Z is demonstrating a shift away from traditional alcohol consumption. Numerous studies - including those from Berenberg and Gallup - suggest that Gen Z is drinking significantly less than Millennials or Gen X did at the same age. This may be driven by heightened health consciousness, social media accountability or a greater interest in wellness and sobriety.

The rise of ‘sober-curious’ culture, non-alcoholic alternatives, and cannabis use presents a long-term volume risk for legacy spirits brands. In key markets such as the US and UK, surveys had demonstrated that up to 25–30% of Gen Z have abstained from alcohol entirely, a figure far higher than previous generations. If this shift is permanent, long-term demand for core categories such as vodka, whiskey and rum could enter structural decline.

Despite the global narrative that Gen Z is consuming less, there appears to be counter information appearing. The recent survey of 26,000 consumers across 15 key markets found that 73%, aged 21-27 consumed alcohol in the past six months, compared to 66% two years prior — the largest increase of any generation surveyed.

Richard Halstead, head of consumer insights at IWSR, said the survey results suggested lower consumption among young people was driven by the cost of living crisis, rather than fundamental shifts in societal habits. If this is the case, it’s good news for the spirits market.

2. Macroeconomic Pressure and Consumer Downtrading

After years of trading up to premium and luxury spirits, consumers are now facing inflation fatigue. In 2024, rising interest rates, costs and housing pressures led to a decline in discretionary spending. Spirits, particularly premium lines, encountered a pull back. U.S. spirits sales dropped 1.1% in value in 2024, with most volume gains driven largely by RTDs and discount brands.

In Europe, a similar pattern of trading down has emerged, with private label and supermarket branded spirits increasing share at the expense of premium brands. On-trade sales in many regions remain below pre-pandemic levels in real terms. In emerging markets like China and Brazil, economic slowdowns have diminished premium expansion. With global growth stagnating and consumers re-evaluating excess spending, the spirits category faces multiple challenges moving forward, including margin reduction and volume decline.

3. GLP-1 Drugs (Ozempic & Wegovy) Disrupting Consumption Patterns

The increasing use of GLP-1 medications, including Ozempic and Wegovy, for weight loss and diabetes has introduced an unexpected headwind for the spirits sector. These drugs (hormones) reduce appetite and cravings - including for alcohol -by affecting the brain's reward system.

Early consumer data and company comments (including Brown‑Forman and Constellation Brands) have acknowledged noticeable declines in consumption among GLP-1 users.

Analysts at Morgan Stanley and Berenberg have warned that the broader adoption of these drugs could result in a 2–4% hit to total beverage alcohol volumes over the next decade. This could be particularity detrimental for the premium categories where moderation leads to total abstinence rather than switching. If GLP-1 uptake accelerates, or the drugs or efficacy increases this could lead to future declines with the spirits industry's core customer base.

Bull Case 🐂

1. Premiumisation & Brand Heritage Remain Powerful Moats

Despite short-term challenges, the long-term appeal of spirits, particularly premium and super-premium brands, remains robust. Consumers value craftsmanship, heritage and aspirational branding. Brands like Johnnie Walker, Hennessy and Macallan have deep emotional equity and multi-generational loyalty.

As they become more affluent, younger consumers are reverting to the habits of pervious generations. When Gen Z does drink they are focusing on quality over quantity, supporting higher-margin offerings. Global data from IWSR shows that premium spirits grew 3% by volume and 5% by value in 2023, and are forecast to outpace standard and value segments through to 2028. This shift is to ‘less but better’ consumption allows global firms to protect margins, raise prices and build brand depth, even in lower-volume environments.

2. Emerging Markets Create Growth Opportunities

The global middle class is expanding in Asia, India and Latin America, with a growing appetite for premium Western brands and spirits. China remains a key market for imported whiskey and Cognac. India is projected to become the world’s largest whiskey market by volume - with the top four global whiskey brands coming from India.

According to Diageo and Pernod Ricard, India accounts for over 10% of global volume growth in premium spirits, with strong momentum in both urban and tier-2 cities. In Africa, rising incomes and urbanisation are creating new markets, where aspirational branding and social drinking cultures are developing rapidly. These regions also tend to be more spirits-focused (rather than on beer or wine). As economic development progresses, global spirits firms can capture long-term volume and achieve brand dominance in previously untapped territories.

3. Category Innovation - RTDs, No/Low Alcohol, and Direct-to-Consumer

In a stagnating market, the sector has to innovate now more than ever. Ready-to-drink (RTD) products such as canned cocktails, hard seltzers and low-alcohol spritzes are attracting consumers who seek convenience, flavour and moderation. RTD revenues were a reported to be worth $18.81 billion in 2024, with a forecast of $28.76 billion by 2034, growing at a CAGR of 4.3%.

The rise of no/low-alcohol spirits have created a niche, with brands like Seedlip (owned by Diageo) and Lyre’s creating premium offerings with considerably higher margins.

Direct-to-consumer channels are allowing brands to collect first-party data—valuable for product development, price testing and allowing brands to engage on a more personal level with the consumer.

Conclusion

The global spirits industry has proven remarkably resilient for centuries, but it is not immune to macroeconomic headwinds and shifting consumer habits. In a stock market where things feel ‘toppy’ - spirits companies are certainly not that. The segment is feeling the pressure following the slowing growth and the 2025 tariffs.

Investors appear nervous as there is no clear sign of where the next stage of growth will come from. The market is suffering from a lack of innovation and is reliant on increased consumer spending or the opening of new and future markets.

Share prices are down across the board around 25%, with some having fallen more than 50% from 2021-23 highs. The questions remains, are spirits companies undervalued?

Despite the current challenges, these are brands boast centuries of heritage. Spirits are strongly linked to history and culture and that is unlikely to change anytime soon. For investors this could be an ideal time to pick up some bargain booze shares.

Sources and Further Reading / Listening

https://www.msn.com/en-gb/health/other/gen-z-acquires-taste-for-drinking-as-cost-of-living-pressures-ease/ar-AA1HNMLb

https://www.distilledspirits.org/news/distilled-spirits-council-annual-economic-briefing-spirits-industry-holds-steady-in-market-share-amid-economic-challenges-in-2024

https://www.theiwsr.com/insight/iwsr-preliminary-data-release-beverage-alcohol-endures-another-tough-year-in-2024