2024 Performance

Secret Sauce Portfolio 2024 - +27.60%

FTSE 100 2024- +5.55%

S&P 500 2024- +25.18%

NASDAQ 100 2024- +29.79%

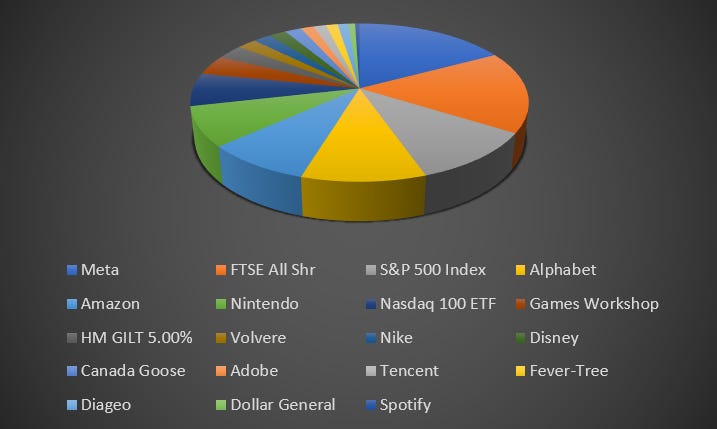

Portfolio Composition (left to right)

Happy new year! I hope that you and your loved ones enjoyed a wonderful festive period.

This is my annual review of the the Secret Sauce Portfolio. 2024 has largely been a quiet year for buying and selling. The portfolio returned 27.6%, slightly above the returns of the S&P 500 and marginally below the NASDAQ 100.

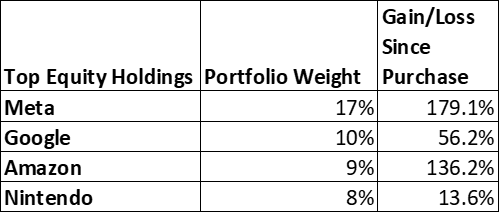

As per 2023, META 0.00%↑ remained my largest equity holding and contributed considerable gains, having increased in value by 73% in 2024. Meta is now 17% of the portfolio, up from 14% last year.

There were no sales, despite pull backs in Dollar General, which has lost -43% of share value throughout 2024. Adobe was the second largest faller, with a loss of -24.2%. Despite the pull-backs, I remain happy to keep both in my portfolio. Each holds respective weight of less than 2%. With a current EV/EBIT of 21.8, Adobe appears to be a potentially attractive buy.

In regards to bonds, I added a UK Treasury GILT at 5.00%. As interest rates begin to dip, I have no immediate plans to purchase any further bonds.

The gains in the portfolio over the past two years have materialised through a concentration in tech stocks. When a NASDAQ drawdown occurs, it will potentially suffer more than the all world index and I will have to adjust accordingly.

Buys

I made two equity purchases during 2024, Nike - NKE 0.00%↑ and Canada Goose, along with a top up of Fever-Tree. I had previous written about the respective apparel companies and believe each offered opportunistic entry points. In the articles I discussed why each company presented a potentially attractive investment.

I added to my position in Fever-Tree and have followed the share price of the Mixer Brand with interest, with a drop of 32% across 2024. I would be open to topping up my other holdings if the opportunity allows.

Watch List

Outside of my existing portfolio, my watchlist includes several companies I have previously written about, including;

$LVMH - (link to

’s article)

I considered purchasing both Hershey and Starbucks during the year, having researched both. I opted against each purchase based on what I perceived as a lack of margin of safety, shortfall in growth opportunities and the large debt holdings of each company. Hershey has a debt/equity ratio 1.24 and Starbucks -2.09 (due to negative equity).

Closing Thoughts

I have been less active than I would have liked on Substack and with my investing portfolio during 2024. Responsibilities in my work-life meant that I had less time to focus on writing and turning over rocks to seek out investment opportunities. Share prices throughout my watchlist and portfolio have either risen of remained largely flat during the year, which offered no immediate incentive to purchase or sell.

As we enter 2025 I will continue to publish company write-ups and assess my holdings. If Mr Market throws a tantrum at any point in 2025, I will be waiting to take advantage.

Reading

Out of the 31 books I’ve finished this year, below are my top five in order of preference.

Endurance - Covers Shakelton’s arduous 497 day Antarctic expedition.

Born to Run - Rekindled my love of running. Christopher McDougall shares the story of the Mexican tribe of super-runners, the Tarahumara.

Stephen King On Writing - Part memoir part instruction on King’s life and writing.

Alchemy - Rory Sutherland’s guide to counter intuitive thinking and ideas.

Open - Andrew Agassi’s fascinating memoir.

In an effort to achieve a Munger-like approach, I have set myself the challenge of reading 50 books in the year ahead. My current reading list (so far) includes the following;

4 x Mental Models - Shane Parrish

Fluid - Ashish Jaiswal

Kitchen Confidential - Anthony Bourdain

The Creative Act - Rick Rubin

Nuclear War - Annie Jacobsen

Educated - Tara Westover

Nothing to Envy - Barbara Demick

Super Forecasting - Dan Gardner and Philip E. Tetlock

Greenlights - Matthew McConaughey

Skin in the Game - Nicholas Taleb

Team of Rivals - Doris Kearns Goodwin

The Beginning of Infinity - David Deutsch

Perhaps I will be able to share some knowledge gleaned from my reading list.

Wishing you success and all the best for 2025!

-Sonny

Happy New Year Sonny! Thanks for mentioning our LVMH article.